|

市場調查報告書

商品編碼

1913327

過濾市場機會、成長要素、產業趨勢分析及2026年至2035年預測Filtration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

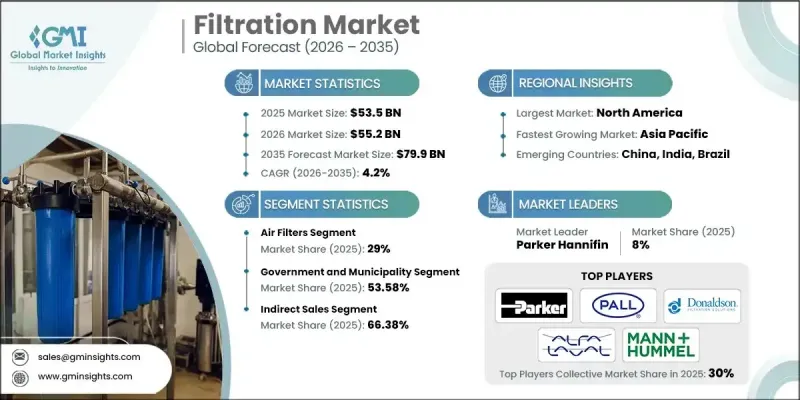

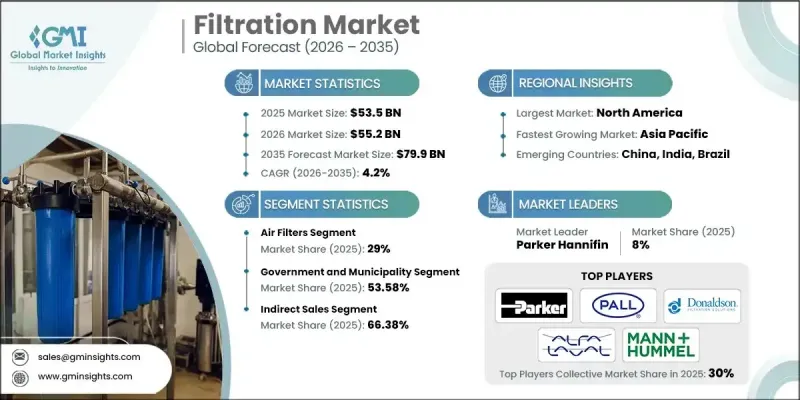

全球過濾市場預計到 2025 年將達到 535 億美元,到 2035 年將達到 799 億美元,年複合成長率為 4.2%。

市場成長受到各行業日益增強的環境責任感和更嚴格的監管合規要求的影響。產業內持續的整合活動正在重塑競爭格局,策略性併購帶來更強大的創新能力、更豐富的技術產品和更強大的全球市場影響力。傳統的廢棄物管理和排放氣體控制方法正逐漸被更先進的過濾解決方案所取代,這些方案能夠提供更佳的環境績效。現代系統旨在透過高效的分離製程去除空氣和水中的污染物,使各行業能夠在滿足合規標準的同時,減少對生態系統的影響。製造業、公共產業和基礎設施建設領域對永續營運的日益重視,持續推動市場的長期擴張。全球工業活動的增加和基礎設施投資的擴大,進一步強化了對能夠提高營運效率和改善環境效益的過濾技術的需求。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 535億美元 |

| 預測金額 | 799億美元 |

| 複合年成長率 | 4.2% |

北美地區的工業擴張和城市發展,以及歐洲部分地區和亞太地區公共服務和環境保護支出的增加,正在推動商業需求的成長。終端用戶越來越傾向於自動化、高效的淨化和處理解決方案,加速了向傳統勞動密集、耗時製程的轉型。

預計到 2025 年,空氣過濾解決方案領域將佔 29% 的市場佔有率。更嚴格的空氣品質標準以及減少工業和商業設施排放的需求正在推動對先進過濾系統的需求,並提高其價值。

預計到 2025 年,間接銷售管道將佔市場佔有率的 66.38%,並將在 2035 年之前保持最高的成長率。由於專業服務網路的重要性,這種流通結構將繼續佔據主導地位,這些網路能夠提供本地專業知識、維護支援和長期服務合約。

預計到 2025 年,北美過濾市場規模將達到 157 億美元,2026 年至 2035 年的複合年成長率將達到 4.3%。強勁的工業活動、大規模的基礎設施建設以及對高性能空氣和水處理解決方案日益成長的需求,將繼續推動該地區的成長。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 快速的都市化和工業發展

- 醫療和製藥業的成長

- 更嚴格的環境永續性和法規

- 產業潛在風險與挑戰

- 初始投資和更換成本高

- 營運複雜性和對熟練勞動力的需求

- 機會

- 智慧技術和物聯網整合

- 替換和售後市場媒體的擴展

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 按類型分類的市場估算與預測,2022-2035年

- 空氣過濾器

- 液體過濾器

- 氣體過濾器

- 水過濾器

- 集塵機

- 其他(磁性濾波器等)

第6章 依過濾器分類的市場估算與預測,2022-2035年

- 高效能空氣過濾器

- 靜電集塵器

- 逆滲透

- 紫外線

- 機械過濾

- 薄膜過濾

- 介質過濾

- 其他(聚合物過濾器等)

7. 2022-2035年過濾介質市場估算與預測

- 活性碳

- 玻璃纖維

- 不織布

- 紙

- 金屬

- 其他

第8章 按應用領域分類的市場估算與預測,2022-2035年

- 產業

- 水泥業

- 用水和污水處理

- 化學過程

- 食品/飲料加工

- 製藥生產

- 車

- 石油和天然氣

- 發電

- 家用電器製造

- 其他(採礦、海運等)

- 政府/市政當局

- 水處理廠

- 空氣品質管理

- 固態廢棄物管理設施

- 污水處理廠

- 其他(公共游泳池等)

9. 2022-2035年按分銷管道分類的市場估算與預測

- 直接地

- 間接

第10章 2022-2035年各地區市場估計與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Vermeer

- 3M Company

- Ahlstrom-Munksjo

- Camfil Group

- Clarcor

- Cummins Filtration

- Donaldson Company, Inc.

- Eaton Corporation

- Koch Filter Corporation

- Lydall, Inc.

- MANN+HUMMEL

- Pall Corporation

- Parker Bioscience Filtration

- Parker Hannifin Corporation

- Pentair

- Porvair Filtration Group

The Global Filtration Market was valued at USD 53.5 billion in 2025 and is estimated to grow at a CAGR of 4.2% to reach USD 79.9 billion by 2035.

Market growth is influenced by rising environmental responsibility and stricter regulatory compliance requirements across industries. Ongoing consolidation activity within the sector is reshaping competition, as strategic mergers and acquisitions enhance innovation capabilities, expand technology offerings, and reinforce global market reach. Traditional approaches to waste management and emission control are gradually being replaced by advanced filtration solutions that deliver improved environmental performance. Modern systems are designed to remove contaminants from air and water through efficient separation processes, enabling industries to reduce their ecological impact while meeting compliance standards. The growing focus on sustainable operations across manufacturing, utilities, and infrastructure development continues to support long-term market expansion. Increased industrial activity and infrastructure investment worldwide further reinforce demand for filtration technologies that improve operational efficiency and environmental outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $53.5 Billion |

| Forecast Value | $79.9 Billion |

| CAGR | 4.2% |

Rising industrial expansion and urban development in North America, along with higher spending on municipal services and environmental protection in Europe and parts of the Asia Pacific region, are strengthening commercial demand. End users increasingly favor automated and efficient purification and treatment solutions, accelerating the transition away from labor-intensive and time-consuming legacy processes.

The air filtration solutions segment held 29% share in 2025. Demand growth is supported by tighter air quality requirements and the need to reduce emissions across industrial and commercial facilities, reinforcing the value of advanced filtration systems.

The indirect sales segment accounted for 66.38% share in 2025 and is expected to maintain the highest growth rate through 2035. This distribution structure remains dominant due to the importance of specialized service networks that provide localized expertise, maintenance support, and long-term servicing agreements.

North America Filtration Market was valued at USD 15.7 billion in 2025 and is forecast to grow at a CAGR of 4.3% from 2026 to 2035. Strong industrial activity, large-scale infrastructure development, and rising demand for high-performance air and water treatment solutions continue to drive regional growth.

Key companies operating in the Global Filtration Market include Donaldson Company, Inc., Pentair, MANN+HUMMEL, Eaton Corporation, 3M Company, Pall Corporation, Camfil Group, Parker Hannifin Corporation, Clarcor, Koch Filter Corporation, Ahlstrom-Munksjo, Porvair Filtration Group, Lydall, Inc., Cummins Filtration, and Parker Bioscience Filtration. Companies in the Filtration Market focus on strategic expansion and technological advancement to strengthen their market position. Leading players invest in product innovation to improve efficiency, durability, and environmental performance. Portfolio diversification allows companies to address a wider range of industrial and municipal applications. Strategic acquisitions and partnerships help expand geographic reach and technical capabilities. Manufacturers also emphasize strengthening distributor networks to improve customer access and service reliability. Investments in automation and advanced materials support cost optimization and performance consistency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Filter

- 2.2.4 Filter Media

- 2.2.5 Application

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid Urbanization & Industrial Development

- 3.2.1.2 Growth in Healthcare & Pharmaceuticals

- 3.2.1.3 Stricter Environmental Sustainability & Regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Investment and Replacement Costs

- 3.2.2.2 Operational Complexity and Need for Skilled Labor

- 3.2.3 Opportunities

- 3.2.3.1 Smart Technology & IoT Integration

- 3.2.3.2 Expansion of the Replacement & Aftermarket Media

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Air Filters

- 5.3 Liquid Filters

- 5.4 Gas Filters

- 5.5 Water Filters

- 5.6 Dust Collectors

- 5.7 Others(Magnetic Filters, etc)

Chapter 6 Market Estimates and Forecast, By Filter, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 HEPA Filters

- 6.3 Electrostatic Precipitators

- 6.4 Reverse Osmosis

- 6.5 Ultraviolet

- 6.6 Mechanical Filtration

- 6.7 Membrane Filtration

- 6.8 Media Filtration

- 6.9 Others(Polymeric Filters, etc)

Chapter 7 Market Estimates and Forecast, By Filter Media, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Activated Carbon

- 7.3 Fiberglass

- 7.4 Nonwoven Fabrics

- 7.5 Paper

- 7.6 Metal

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Cement Industry

- 8.2.2 Water & Wastewater Treatment

- 8.2.3 Chemical Processing

- 8.2.4 Food & Beverage Processing

- 8.2.5 Pharmaceutical Manufacturing

- 8.2.6 Automotive

- 8.2.7 Oil & Gas

- 8.2.8 Power Generation

- 8.2.9 Consumer Appliances Manufacturing

- 8.2.10 Others (Mining, Marine, etc)

- 8.3 Government and Municipality

- 8.3.1 Water Treatment Plants

- 8.3.2 Air Quality Management

- 8.3.3 Solid Waste Management Facilities

- 8.3.4 Sewage Treatment Plants

- 8.3.5 Others (Public Swimming Pools, etc.)

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Vermeer

- 11.2 3M Company

- 11.3 Ahlstrom-Munksjo

- 11.4 Camfil Group

- 11.5 Clarcor

- 11.6 Cummins Filtration

- 11.7 Donaldson Company, Inc.

- 11.8 Eaton Corporation

- 11.9 Koch Filter Corporation

- 11.10 Lydall, Inc.

- 11.11 MANN+HUMMEL

- 11.12 Pall Corporation

- 11.13 Parker Bioscience Filtration

- 11.14 Parker Hannifin Corporation

- 11.15 Pentair

- 11.16 Porvair Filtration Group