|

市場調查報告書

商品編碼

1913313

凍乾水果及蔬菜市場機會、成長要素、產業趨勢分析及2026年至2035年預測Freeze Dried Fruits and Vegetables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

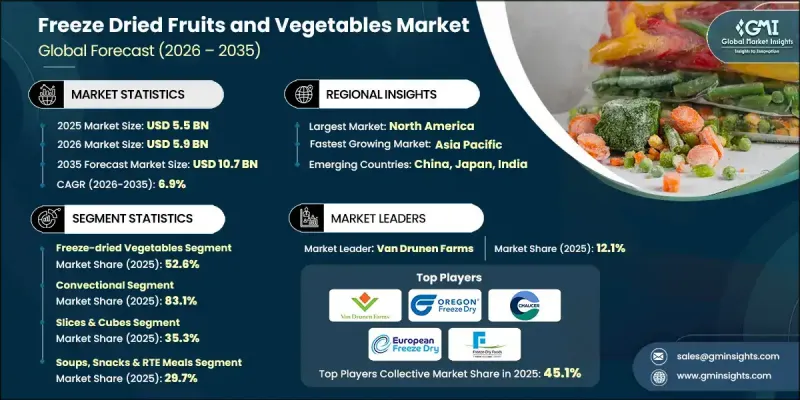

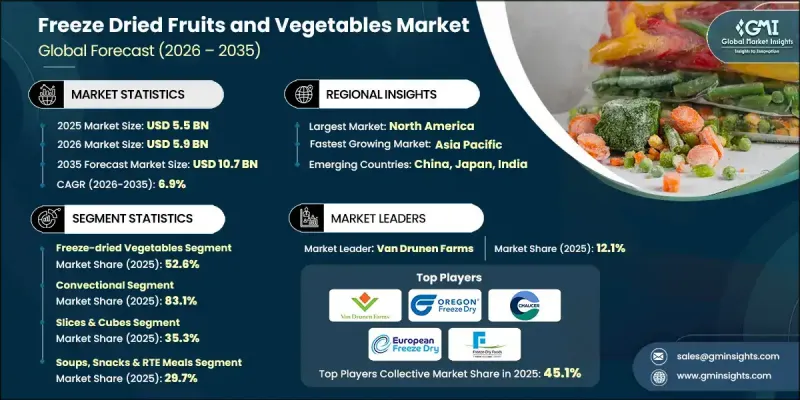

全球凍乾水果和蔬菜市場預計到 2025 年將達到 55 億美元,到 2035 年將達到 107 億美元,年複合成長率為 6.9%。

市場成長主要受以下因素驅動:消費者生活方式向更健康的生活方式轉變,對便捷食品的偏好日益成長,以及對成分潔淨標示乾淨的產品的需求不斷增加。消費者越來越傾向於選擇既能維持營養價值又能兼顧保存期限和易用性的食品。冷凍乾燥技術無需添加人工添加劑即可保留蔬果的天然特性,滿足了消費者的這項偏好。隨著人們對健康飲食和食材來源的意識不斷增強,食品生產商和零售商正在拓展其高階產品線,尤其是在有機和非基因改造食品領域。快節奏的生活方式也影響消費者的購買行為,導致保存期限長、易於烹調的食品消費量增加。因此,冷凍乾燥原料在包裝食品和飲料領域中得到更廣泛的應用,促進了大眾市場和特色食品領域的創新和產品多元化。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 55億美元 |

| 預測金額 | 107億美元 |

| 複合年成長率 | 6.9% |

預計到2034年,冷凍乾燥蔬菜市場將以5.6%的複合年成長率成長,這主要得益於包裝食品製造和餐飲服務業的持續需求。冷凍乾燥蔬菜具有保存期限長、重量輕、易於復水等功能優勢,這些優勢使其作為保鮮食品配料的應用日益廣泛。此外,便利食品品類的不斷拓展以及消費者對產品耐久性提升的需求,也將持續成為推動成長要素。

預計到 2025 年,切碎和切絲的冷凍乾燥水果和蔬菜市場規模將達到 12 億美元。這一成長主要得益於商用廚房和工業食品生產對這類產品的強勁需求,因為與其他形式相比,這類產品烹飪時間更短,處理效率更高。

預計到2025年,北美凍乾蔬果市場規模將達15億美元。該地區的成長得益於即食食品的高消費量、先進的加工技術以及成熟的食品製造生態系統。消費者對健康和潔淨標示產品的日益關注也持續推動該地區的需求。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 對簡便食品的需求不斷成長

- 人們越來越關注健康和營養

- 食品加工業的擴張

- 產業潛在風險與挑戰

- 高昂的生產和設備成本

- 發展中地區消費者意識較低

- 復水後的質地變化

- 市場機遇

- 對有機和天然食品的需求日益成長

- 拓展戶外與太空食品應用

- 包裝和加工技術的創新

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計(HS編碼)(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續努力

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 考慮到碳足跡

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 依產品類型分類的市場估算與預測,2022-2035年

- 凍乾水果

- 冷凍乾燥蔬菜

第6章 2022-2035年依天然來源分類的市場估計與預測

- 傳統的

- 有機耕作

第7章 按類型分類的市場估計與預測,2022-2035年

- 所有的

- 切片和切丁

- 切菜和剁菜

- 粉末/顆粒

第8章 按應用領域分類的市場估算與預測,2022-2035年

- 湯、點心和蒸餾餐

- 穀物

- 飲料和冰沙

- 麵包糖果甜點

- 冰淇淋甜點

- 醬汁、沾醬、調味汁

- 其他

第9章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第10章:公司簡介

- Chaucer Foods Ltd.

- Crispy Green, Inc.

- 歐洲冷凍乾燥有限公司

- Expedition Foods Limited

- Freeze-Dry Foods GmbH

- Harmony House Foods

- Natierra(Sunridge Farms)

- OFD Foods(Oregon Freeze Dry)

- Thrive Freeze Dry/Thrive Life

- Van Drunen Farms

The Global Freeze Dried Fruits and Vegetables Market was valued at USD 5.5 billion in 2025 and is estimated to grow at a CAGR of 6.9% to reach USD 10.7 billion by 2035.

Market momentum is being driven by a strong shift toward healthier lifestyles, increased preference for convenient food options, and growing demand for products with clean labels and transparent ingredient profiles. Consumers are increasingly favoring food products that preserve nutritional value while offering extended shelf stability and ease of use. Freeze drying technology supports these preferences by maintaining the natural characteristics of fruits and vegetables without the need for artificial additives. Rising awareness around wellness-oriented diets and ingredient sourcing is encouraging food manufacturers and retailers to expand premium offerings, particularly within organic and non-GMO categories. Busy lifestyles are also influencing purchasing behavior, leading to higher consumption of shelf-stable and easy-to-prepare foods. As a result, freeze dried ingredients are gaining wider adoption across packaged food and beverage categories, supporting innovation and product diversification across both mass-market and specialized food segments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.5 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 6.9% |

The freeze dried vegetables segment is expected to grow at a CAGR of 5.6% through 2034, supported by sustained demand from processed food manufacturing and foodservice operations. Their functional benefits, including long storage life, low weight, and rehydration efficiency, continue to support adoption as ingredients in shelf-stable food formulations. The ongoing expansion of convenience-focused food categories and the need for extended product durability remain key growth contributors.

The minced and chopped freeze dried fruits and vegetables segment reached USD 1.2 billion in 2025. This growth is supported by strong demand from commercial kitchens and industrial food production due to reduced preparation time and improved handling efficiency compared to other formats.

North America Freeze Dried Fruits and Vegetables Market generated USD 1.5 billion in 2025. Regional growth is supported by high consumption of ready-to-eat foods, advanced processing capabilities, and a well-developed food manufacturing ecosystem. Growing interest in health-focused and clean-label products continues to reinforce regional demand.

Key companies operating in the Global Freeze Dried Fruits and Vegetables Market include Van Drunen Farms, OFD Foods (Oregon Freeze Dry), Chaucer Foods Ltd., Natierra (Sunridge Farms), European Freeze Dry Ltd., Harmony House Foods, Crispy Green, Inc., Thrive Freeze Dry / Thrive Life, Freeze-Dry Foods GmbH, and Expedition Foods Limited. Companies in the Global Freeze Dried Fruits and Vegetables Market are strengthening their market position through product innovation and portfolio expansion focused on organic and clean-label offerings. Many players are investing in advanced freeze-drying technologies to improve nutrient retention, texture, and flavor consistency. Strategic sourcing of raw materials and long-term supplier partnerships are being used to ensure quality and supply stability. Firms are also expanding private-label and foodservice-focused product lines to reach diverse customer segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Nature

- 2.2.4 Form

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for convenience foods

- 3.2.1.2 Growing health and nutrition awareness

- 3.2.1.3 Expansion of food processing industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and equipment costs

- 3.2.2.2 Limited consumer awareness in developing regions

- 3.2.2.3 Texture changes after rehydration

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for organic and natural foods

- 3.2.3.2 Increasing outdoor and space food applications

- 3.2.3.3 Innovation in packaging and processing technology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: The trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Freeze-dried fruits

- 5.3 Freeze-dried vegetables

Chapter 6 Market Estimates and Forecast, By Nature, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conventional

- 6.3 Organic

Chapter 7 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Whole

- 7.3 Slices & cubes

- 7.4 Minced & chopped

- 7.5 Powder & granules

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Soups, snacks & RTE meals

- 8.3 Breakfast cereals

- 8.4 Beverages & smoothies

- 8.5 Bakery & confectionery

- 8.6 Ice cream & desserts

- 8.7 Sauces, dips & dressings

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Chaucer Foods Ltd.

- 10.2 Crispy Green, Inc.

- 10.3 European Freeze Dry Ltd.

- 10.4 Expedition Foods Limited

- 10.5 Freeze-Dry Foods GmbH

- 10.6 Harmony House Foods

- 10.7 Natierra (Sunridge Farms)

- 10.8 OFD Foods (Oregon Freeze Dry)

- 10.9 Thrive Freeze Dry / Thrive Life

- 10.10 Van Drunen Farms