|

市場調查報告書

商品編碼

1913311

移動式心電遙測系統市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Mobile Cardiac Telemetry Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

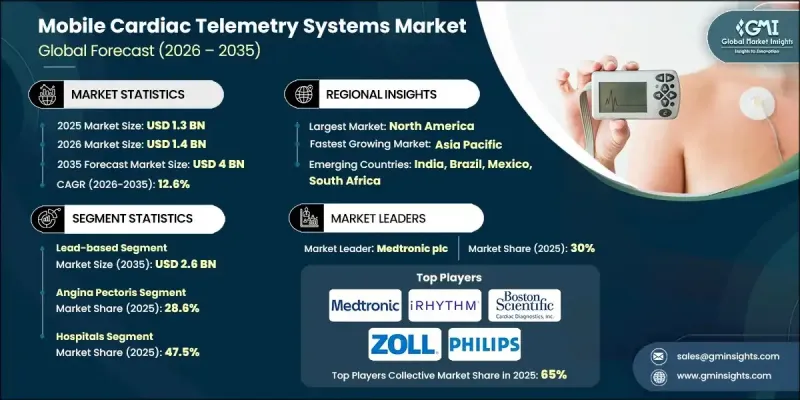

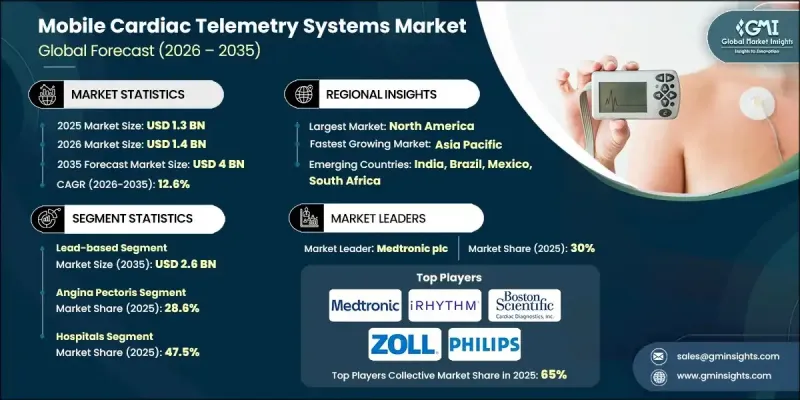

全球行動心電遙測系統市場預計到 2025 年將達到 13 億美元,到 2035 年將達到 40 億美元,年複合成長率為 12.6%。

這一成長反映了心臟相關疾病日益增多的趨勢,推動了公共衛生支持措施的實施、人口老化以及遠端心臟監測技術的不斷創新。行動心電遙測系統使患者能夠在日常生活中無縫追蹤心率活動,為傳統監測方法提供了更柔軟性的替代方案。這些系統利用穿戴式感測器持續擷取心臟訊號,並透過無線連接自動將具有臨床意義的數據傳輸至遠端監測機構。全球心血管疾病負擔的加重推動了對早期診斷和主動疾病管理的需求。持續的遠端監測有助於更快地做出臨床決策、加強護理協調並減少不必要的住院次數。隨著醫療保健系統日益重視預防性護理和數位化健康解決方案,行動心電遙測正成為現代心臟護理服務的重要組成部分,並在臨床和門診環境中都保持著強勁的成長勢頭。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 13億美元 |

| 預測金額 | 40億美元 |

| 複合年成長率 | 12.6% |

預計到2025年,基於導線的產品類型銷售額將達到8.216億美元,到2035年將達到26億美元,複合年成長率(CAGR)為12.8%。這些系統利用多個電極和外部導線提供可靠的心臟數據,有助於臨床醫師進行一致的解讀。它們在醫療機構中久經考驗,並已成功融入常規診斷流程,這持續推動它們在醫院和專科醫療中心的廣泛應用。

預計到2025年,心絞痛應用領域將佔28.6%的市佔率。心絞痛是一種與心肌組織血流減少有關的疾病,通常突發發生,需要持續監測才能有效控制。行動心電遙測系統可在日常活動中進行持續評估,使臨床醫生能夠即時識別異常的心臟模式並進行快速干預。

預計2025年,北美行動心電遙測系統市佔率將達到40.4%。強大的醫療基礎設施、對數位醫療技術的早期應用以及心血管疾病發病率的上升,共同支撐了北美在該地區的市場領先地位。完善的醫療保險報銷機制、意識提升以及對醫療研究的持續投入,進一步推動了美國和加拿大移動心臟遙測系統的應用。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 產業影響因素

- 促進要素

- 心臟病發生率增加

- 有利的政府政策

- 高齡化社會的發展

- 心電遙測系統的技術進步

- 產業潛在風險與挑戰

- 缺乏專門的訓練和教育

- 嚴格的監管政策和品管標準

- 市場機遇

- 轉向以價值為導向的預防性醫療模式

- 新興市場的擴張

- 促進要素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 供應鏈分析

- 救贖方案

- 2024年定價分析

- 未來市場趨勢

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 合作夥伴關係和合資企業

- 新產品發布

- 擴張計劃

第5章 依產品類型分類的市場估算與預測,2022-2035年

- 鉛基

- 基於補丁

第6章 依適應症分類的市場估計與預測,2022-2035年

- 心絞痛

- 冠狀動脈疾病

- 動脈粥狀硬化

- 心臟衰竭

- 中風

- 其他跡象

7. 依最終用途分類的市場估計與預測,2022-2035 年

- 醫院

- 專科診所

- 診斷中心

- 居家醫療環境

- 其他最終用途

第8章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- ACS Diagnostics

- AliveCor

- Baxter International Inc.

- BIOTRICITY INC.

- Biotronik

- Bittium

- Boston Scientific Cardiac Diagnostics Inc.

- Cardiosense

- iRhythm Technologies, Inc.

- Koninklijke Philips NV

- Medicomp Systems

- Medtronic plc

- ScottCare Cardiovascular Solutions

- Telerhythmics LLC

- Zoll Medical Corporation

The Global Mobile Cardiac Telemetry Systems Market was valued at USD 1.3 billion in 2025 and is estimated to grow at a CAGR of 12.6% to reach USD 4 billion by 2035.

This expansion reflects the rising prevalence of heart-related conditions, supportive public health initiatives, an expanding elderly population, and continuous innovation in remote cardiac monitoring technologies. Mobile cardiac telemetry systems enable uninterrupted heart activity tracking while individuals continue their normal routines, offering a more flexible alternative to conventional monitoring methods. These systems rely on wearable sensors that continuously capture cardiac signals and automatically transmit clinically relevant data to off-site monitoring facilities through wireless connectivity. The growing global burden of cardiovascular conditions has intensified the demand for early diagnosis and proactive disease management. Continuous remote monitoring supports faster clinical decision-making, enhances care coordination, and helps limit unnecessary hospital visits. As healthcare systems increasingly prioritize preventive care and digital health solutions, mobile cardiac telemetry is becoming an essential component of modern cardiac care delivery, reinforcing its strong growth trajectory across both clinical and outpatient settings.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 12.6% |

The lead-based product category generated USD 821.6 million during 2025 and is expected to reach USD 2.6 billion by 2035, growing at a CAGR of 12.8%. These systems utilize multiple electrodes and external leads to deliver highly reliable cardiac data, supporting consistent clinical interpretation. Their established use in medical environments and integration into routine diagnostic workflows continue to drive widespread adoption across hospitals and specialized care centers.

The angina pectoris application segment held 28.6% share in 2025. This condition is associated with reduced blood supply to cardiac tissue and often occurs unpredictably, requiring continuous observation for effective management. Mobile cardiac telemetry systems facilitate ongoing assessment during daily activities, allowing clinicians to identify concerning cardiac patterns in real-time and intervene promptly.

North America Mobile Cardiac Telemetry Systems Market accounted for 40.4% share in 2025. Strong healthcare infrastructure, early adoption of digital medical technologies, and a rising incidence of cardiovascular conditions have supported market leadership in the region. Established reimbursement frameworks, increased patient awareness, and sustained investment in medical research further encourage adoption across the U.S. and Canada.

Key companies active in the Global Mobile Cardiac Telemetry Systems Market include Medtronic plc, Koninklijke Philips N.V., iRhythm Technologies, Inc., AliveCor, BIOTRICITY INC., Boston Scientific Cardiac Diagnostics Inc., Zoll Medical Corporation, Biotronik, Baxter International Inc., Medicomp Systems, ScottCare Cardiovascular Solutions, Bittium, Telerhythmics LLC, Cardiosense, and ACS Diagnostics. Companies operating in the Global Mobile Cardiac Telemetry Systems Market are strengthening their market position through technology upgrades, strategic partnerships, and geographic expansion. Many firms are investing in advanced analytics, cloud-based platforms, and artificial intelligence to enhance diagnostic accuracy and data transmission efficiency. Product portfolio diversification and the development of user-friendly wearable designs are being prioritized to improve patient adherence. Strategic collaborations with healthcare providers and payers help expand clinical adoption and reimbursement coverage.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Indication trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of cardiac disorders

- 3.2.1.2 Favorable government policies

- 3.2.1.3 Growing aging population

- 3.2.1.4 Technological advancements in cardiac telemetry systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of professional training & education

- 3.2.2.2 Stringent regulatory policies and quality control standards

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward value-based and preventive care models

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Lead-based

- 5.3 Patch-based

Chapter 6 Market Estimates and Forecast, By Indication, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Angina pectoris

- 6.3 Coronary artery disease

- 6.4 Atherosclerosis

- 6.5 Heart failure

- 6.6 Stroke

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Diagnostic centres

- 7.5 Homecare settings

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ACS Diagnostics

- 9.2 AliveCor

- 9.3 Baxter International Inc.

- 9.4 BIOTRICITY INC.

- 9.5 Biotronik

- 9.6 Bittium

- 9.7 Boston Scientific Cardiac Diagnostics Inc.

- 9.8 Cardiosense

- 9.9 iRhythm Technologies, Inc.

- 9.10 Koninklijke Philips N.V.

- 9.11 Medicomp Systems

- 9.12 Medtronic plc

- 9.13 ScottCare Cardiovascular Solutions

- 9.14 Telerhythmics LLC

- 9.15 Zoll Medical Corporation