|

市場調查報告書

商品編碼

1913297

橡膠加工化學品市場機會、成長要素、產業趨勢分析及2026年至2035年預測Rubber Processing Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

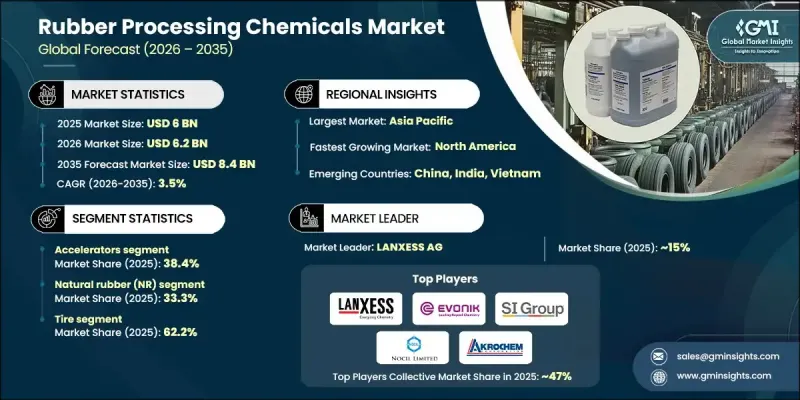

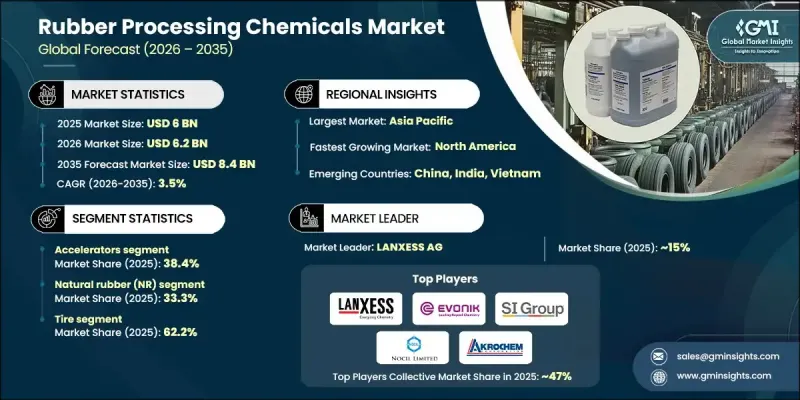

全球橡膠加工化學品市場預計到 2025 年將達到 60 億美元,到 2035 年將達到 84 億美元,年複合成長率為 3.5%。

橡膠加工化學品在橡膠製造中發揮至關重要的作用,它們能夠提升天然橡膠和合成橡膠的耐久性、加工效率和功能性能。這些組合藥物透過提高硫化效率、耐劣化性、黏合性能、阻燃性和整體材料穩定性,為橡膠生產的關鍵階段提供支援。市場成長受到交通運輸、工業生產、基礎設施建設以及永續性驅動型生產實踐的持續變革的影響。製造商越來越重視環保化學解決方案,以符合不斷變化的法規結構和企業永續性目標。因此,市場正穩步轉向先進的清潔化學技術,這些技術在保持性能的同時,也能減少對環境的影響。各種工業應用領域對高品質橡膠產品的需求不斷成長,加上橡膠混合技術的進步,持續增強了長期需求。現代製造系統的擴展以及全球市場對性能一致性的日益成長的期望,進一步推動了橡膠加工化學品的穩定發展。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 60億美元 |

| 預測金額 | 84億美元 |

| 複合年成長率 | 3.5% |

預計到2025年,促進劑市佔率將達到38.4%,並在2035年之前以3.7%的複合年成長率成長。其主導地位歸功於促進劑在控制硫化行為和將生膠轉化為耐用彈性材料方面發揮的關鍵作用。由於促進劑在實現最佳強度、柔軟性和耐熱性方面發揮重要作用,因此在所有橡膠製作流程中都不可或缺。

2025年,天然橡膠市佔率佔比達到33.3%,預計到2035年將以3.8%的複合年成長率成長。其主導地位源自於其固有的機械優勢,能夠滿足嚴苛的性能要求。天然橡膠獨特的分子結構使其在市場波動中仍保持著重要性,確保了對性能要求極高的橡膠應用領域擁有穩定的需求。

美國橡膠加工化學品市場預計2025年將達到10億美元。該國的成長得益於成熟的製造業基礎以及汽車和工業橡膠生產的強勁需求。完善的供應體系和對先進橡膠配方技術的持續投資,共同促成了北美市場穩定的發展趨勢。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 專利趨勢

- 貿易統計(HS編碼)(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續努力

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 考慮到碳足跡

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 依產品類型分類的市場估算與預測,2022-2035年

- 加速器

- 噻唑類

- 磺胺

- Thiram

- 胍類

- 二硫代氨基甲酸

- 硫代磷酸鹽

- 硫脲

- 醛胺

- 劣化

- 抗氧化劑

- 抗臭氧劑

- 蠟

- 矽烷偶合劑

- 乙氧基矽烷

- 甲氧基矽烷

- 巰基矽烷

- 新型耦合系統

- 矽烷替代品

- 加工助劑和塑化劑

- 塑化劑

- 胜肽劑

- 分散劑

- 處理加速器

- 釋放劑

- 潤滑劑

- 生物基加工助劑

- 阻燃劑

- 鹵素阻燃劑

- 磷基阻燃劑

- 礦物填料

- 其他

第6章 依橡膠類型分類的市場估算與預測,2022-2035年

- 天然橡膠(NR)

- SBR(溶液/乳液)

- 丁腈橡膠(NBR)

- EPDM

- 丁基橡膠和鹵化丁基橡膠

- 特種橡膠

第7章 按應用領域分類的市場估算與預測,2022-2035年

- 胎

- 汽車(非輪胎應用)

- 工業產品

- 建造

- 電線電纜

- 醫療保健

- 消費品

- 航太

第8章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第9章:公司簡介

- LANXESS AG

- Evonik Industries

- SI Group

- Nocil Limited

- Akrochem Corporation

- Sennics Co., Ltd.

- RT Vanderbilt

- KUMHO PETROCHEMICAL

- Duslo as

- Struktol Company

- Robinson Brothers

- Sinopec Corp.

- China Sunsine

- Eastman Chemical

- Arkema SA

The Global Rubber Processing Chemicals Market was valued at USD 6 billion in 2025 and is estimated to grow at a CAGR of 3.5% to reach USD 8.4 billion by 2035.

Rubber processing chemicals play a foundational role in rubber manufacturing by enhancing durability, processing efficiency, and functional performance of both natural and synthetic rubber. These formulations support critical stages of rubber production by improving curing efficiency, resistance to degradation, adhesion properties, flame resistance, and overall material stability. Market growth is shaped by ongoing changes in transportation, industrial manufacturing, infrastructure development, and sustainability-driven production practices. Manufacturers are increasingly prioritizing environmentally responsible chemical solutions to align with evolving regulatory frameworks and corporate sustainability goals. As a result, the market is steadily transitioning toward advanced and cleaner chemistries that maintain performance while reducing environmental impact. The growing need for high-quality rubber products across diverse industrial applications, combined with advancements in rubber formulation technologies, continues to reinforce long-term demand. Expansion of modern manufacturing systems and rising expectations for performance consistency across global markets further support the steady evolution of rubber processing chemicals.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 3.5% |

The accelerators segment held a 38.4% share in 2025 and is expected to grow at a CAGR of 3.7% through 2035. This dominance is attributed to their indispensable function in controlling curing behavior and enabling the transformation of raw rubber into durable, elastic materials. Accelerators remain essential across all rubber processing activities due to their role in achieving optimal strength, flexibility, and thermal resistance.

The natural rubber segment accounted for 33.3% share in 2025 and is forecast to grow at a CAGR of 3.8% by 2035. Its leadership stems from inherent mechanical advantages that support demanding performance requirements. The unique molecular structure of natural rubber continues to sustain its relevance despite market fluctuations, ensuring consistent demand across performance-focused rubber applications.

U.S. Rubber Processing Chemicals Market generated USD 1 billion in 2025. Growth in the country is supported by a mature manufacturing base and strong demand from automotive and industrial rubber production. A well-established supply ecosystem and continued investment in advanced rubber formulations contribute to stable market momentum across North America.

Key companies active in the Rubber Processing Chemicals Market include Evonik Industries, LANXESS AG, Eastman Chemical, Arkema S.A., SI Group, China Sunsine, Nocil Limited, KUMHO PETROCHEMICAL, Robinson Brothers, R.T. Vanderbilt, Akrochem Corporation, Duslo a.s., Sennics Co., Ltd., Sinopec Corp., and Struktol Company. Companies operating in the Global Rubber Processing Chemicals Market are reinforcing their market position through innovation-led product development and sustainability-focused strategies. Many players are investing in research to create high-performance formulations that comply with stricter environmental standards while maintaining efficiency and durability. Capacity expansion in emerging manufacturing regions and strengthening distribution networks remain key priorities. Strategic collaborations with rubber producers help companies deliver customized solutions and improve long-term customer engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product Type

- 2.2.2 Rubber Type

- 2.2.3 Application

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Accelerators

- 5.2.1 Thiazoles

- 5.2.2 Sulfenamides

- 5.2.3 Thiurams

- 5.2.4 Guanidines

- 5.2.5 Dithiocarbamates

- 5.2.6 Thiophosphates

- 5.2.7 Thioureas

- 5.2.8 Aldehyde amines

- 5.3 Antidegradants

- 5.3.1 Antioxidants

- 5.3.2 Antiozonants

- 5.3.3 Waxes

- 5.3.4 Silane coupling agents

- 5.4 Ethoxy silanes

- 5.4.1 Methoxy silanes

- 5.4.2 Mercaptosilanes

- 5.4.3 Novel coupling systems

- 5.4.4 Silane alternatives

- 5.5 Processing aids & plasticizers

- 5.5.1 Plasticizers

- 5.5.2 Peptizers

- 5.5.3 Dispersing agents

- 5.5.4 Processing promoters

- 5.5.5 Mold release agents

- 5.5.6 Lubricants

- 5.5.7 Bio-based processing aids

- 5.6 Flame retardants

- 5.6.1 Halogenated flame retardants

- 5.6.2 Phosphorus-based flame retardants

- 5.6.3 Mineral fillers

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Rubber Type, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural rubber (NR)

- 6.3 SBR (solution & emulsion)

- 6.4 Nitrile rubber (NBR)

- 6.5 EPDM

- 6.6 Butyl & halobutyl rubber

- 6.7 Specialty rubbers

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tire

- 7.3 Automotive (non-tire)

- 7.4 Industrial goods

- 7.5 Construction

- 7.6 Wire & cable

- 7.7 Medical & healthcare

- 7.8 Consumer goods

- 7.9 Aerospace

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 LANXESS AG

- 9.2 Evonik Industries

- 9.3 SI Group

- 9.4 Nocil Limited

- 9.5 Akrochem Corporation

- 9.6 Sennics Co., Ltd.

- 9.7 R.T. Vanderbilt

- 9.8 KUMHO PETROCHEMICAL

- 9.9 Duslo a.s.

- 9.10 Struktol Company

- 9.11 Robinson Brothers

- 9.12 Sinopec Corp.

- 9.13 China Sunsine

- 9.14 Eastman Chemical

- 9.15 Arkema S.A.