|

市場調查報告書

商品編碼

1913286

離心式幫浦市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Centrifugal Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

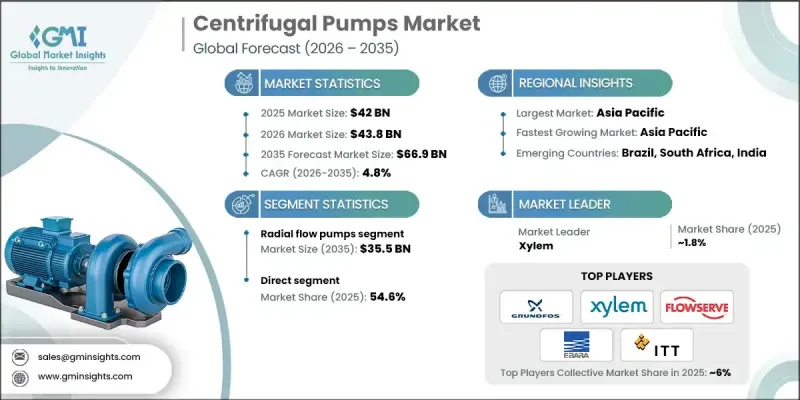

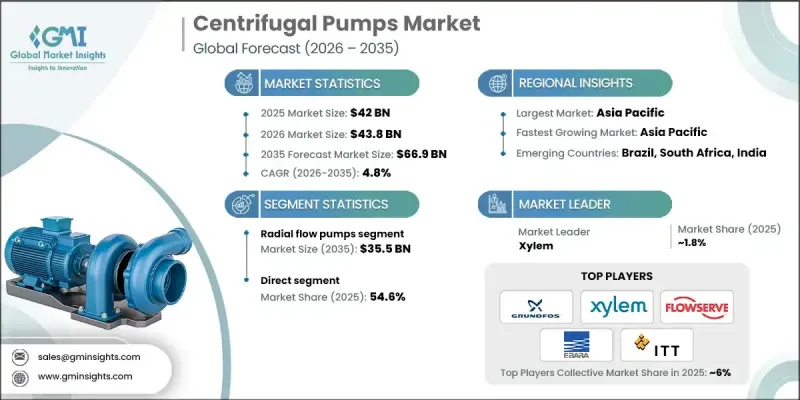

全球離心式幫浦市場預計到 2025 年將達到 420 億美元,到 2035 年將達到 669 億美元,年複合成長率為 4.8%。

全球城市化進程的加速和工業活動的擴張顯著提升了對可靠流體輸送解決方案的需求。全球水資源日益緊張,推動了高效水處理、再利用和淨化系統的發展,而離心式幫浦仍是這些系統的核心部件。監管機構對永續性和資源效率的重視將進一步推動長期需求,因為各行業都在尋求合規且節能的泵送解決方案。同時,能源生產和加工基礎設施的持續成長也維持了對高容量、高可靠性泵送系統的需求。離心式幫浦在採礦、加工和配送等環境中發揮至關重要的作用,為流體輸送作業提供支援。隨著產量的增加和運作的重要性日益凸顯,泵浦的可靠性和效率也變得越來越重要。製造商正受益於持續的資本投資,這些投資旨在升級基礎設施、提高營運韌性並最佳化生命週期性能。這些因素共同創造了一個穩定的需求環境,使離心式幫浦成為全球工業和市政系統中不可或缺的資產。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 420億美元 |

| 預測金額 | 669億美元 |

| 複合年成長率 | 4.8% |

預計到 2025 年,輻流泵市場規模將達到 223 億美元,到 2035 年將達到 355 億美元。徑流泵能夠在可控的流量下提供持續的壓力,因此在需要穩定運行性能的製程中得到廣泛應用。

到2025年,銷售管道將達到230億美元,佔市場佔有率的54.6%。直接參與能夠促進製造商和終端用戶之間的更緊密合作,從而實現系統最佳化、更快解決問題,並透過直接獲取技術專長和原廠配件來改善生命週期管理。

美國離心式幫浦市場預計到 2025 年將達到 82 億美元,從 2026 年到 2035 年的複合年成長率為 4.8%。持續的大規模基礎設施投資和現代化計畫正在推動對先進泵送系統的需求,以支持全國範圍內高效的水資源和公共產業管理。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 價格趨勢

- 按地區和泵浦類型

- 原料成本

- 原料供應中現實與認知之間的差距

- 檢驗供應商價格上漲情況

- 法律規範

- 按地區

- 貿易統計

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 產品系列基準測試

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 按泵浦類型分類的市場估算與預測,2022-2035年

- 軸流泵

- 混流泵

- 輻流泵

第6章 2022-2035年依設計分類的市場估算與預測

- 水平離心式幫浦

- 立式離心式幫浦

第7章 按類型分類的市場估計與預測,2022-2035年

- 可攜式的

- 固定類型

第8章 2022-2035年各階段市場估算與預測

- 單級泵浦

- 多級泵浦

第9章 2022-2035年各細分市場的估計與預測

- 電動幫浦

- 引擎驅動幫浦

第10章 依最終用途產業分類的市場估計與預測,2022-2035年

- 礦業

- 建築/施工

- 石油和天然氣

- 一般工業

- 水和污水處理

- 化學品

- 發電

- 其他(農業等)

第11章 按分銷管道分類的市場估算與預測,2022-2035年

- 直銷

- 間接

第12章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第13章:公司簡介

- Andritz AG

- Ebara Corporation

- Flowserve Corporation

- Grundfos

- ITT Inc.

- Kirloskar Brothers Limited

- KSB Group

- Pentair PLC

- Shakti Pumps(India)Ltd.

- SPX Flow, Inc.

- Sulzer Ltd.

- Torishima Pump Manufacturing Co., Ltd.

- Weir Group PLC

- Wilo SE

- Xylem Inc.

The Global Centrifugal Pumps Market was valued at USD 42 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 66.9 billion by 2035.

Accelerating urban development and expanding industrial activity worldwide significantly increase the demand for reliable fluid movement solutions. Rising pressure on global water resources strengthens the need for efficient water handling, reuse, and treatment systems, where centrifugal pumps remain a core component. Regulatory emphasis on sustainability and resource efficiency further supports long-term demand as industries seek compliant and energy-efficient pumping solutions. In parallel, continued growth in energy production and processing infrastructure sustains the requirement for high-capacity and high-reliability pump systems. Centrifugal pumps play a critical role in supporting fluid transfer operations across extraction, processing, and distribution environments. As production volumes rise and operational uptime becomes increasingly important, pump reliability and efficiency gain strategic importance. Manufacturers benefit from steady capital investments aimed at upgrading infrastructure, improving operational resilience, and optimizing lifecycle performance. These combined factors create a consistent demand environment, positioning centrifugal pumps as essential assets across global industrial and municipal systems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $42 Billion |

| Forecast Value | $66.9 Billion |

| CAGR | 4.8% |

The radial flow pumps segment generated USD 22.3 billion in 2025 and is projected to reach USD 35.5 billion by 2035. Their ability to deliver sustained pressure at controlled flow rates supports widespread adoption in processes that require consistent operational performance.

The direct sales channel reached USD 23 billion in 2025 and holds 54.6% share. Direct engagement enables closer collaboration between manufacturers and end users, supporting system optimization, faster issue resolution, and improved lifecycle management through direct access to technical expertise and original components.

U.S. Centrifugal Pumps Market garnered USD 8.2 billion in 2025 and is expected to grow at a CAGR of 4.8% between 2026 and 2035. Large-scale infrastructure investment and modernization initiatives continue to drive demand for advanced pumping systems that support efficient water and utility management nationwide.

Key companies operating in the Global Centrifugal Pumps Market include Grundfos, Flowserve Corporation, Sulzer Ltd., Xylem Inc., KSB Group, ITT Inc., Ebara Corporation, Andritz AG, Wilo SE, Pentair PLC, SPX Flow, Inc., Weir Group PLC, Kirloskar Brothers Limited, Torishima Pump Manufacturing Co., Ltd., and Shakti Pumps (India) Ltd. Companies strengthen their position through continuous product innovation, energy-efficiency improvements, and expanded service offerings. Many manufacturers invest in digital monitoring, predictive maintenance solutions, and smart pump technologies to enhance operational reliability. Expanding global manufacturing footprints and localized service networks improves responsiveness and reduces downtime for customers. Strategic partnerships and long-term service agreements support customer retention and recurring revenue streams. Firms also focus on material advancements and modular designs to address diverse operating conditions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Pump type trends

- 2.2.3 Design trends

- 2.2.4 Type trends

- 2.2.5 Stage trends

- 2.2.6 Operation trends

- 2.2.7 End use industry trends

- 2.2.8 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Price trends

- 3.5.1 By region and pump type

- 3.5.2 Raw material cost

- 3.5.3 Real vs. perceived capacity constraints in supply of raw materials

- 3.5.4 Supplier price increase validation

- 3.6 Regulatory framework

- 3.6.1 By Region

- 3.7 Trade statistics

- 3.7.1 Major importing countries

- 3.7.2 Major exporting countries

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Pump Type, 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Axial flow pump

- 5.3 Mixed flow pump

- 5.4 Radial flow pump

Chapter 6 Market Estimates & Forecast, By Design, 2022 - 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Horizontal centrifugal pump

- 6.3 Vertical centrifugal pump

Chapter 7 Market Estimates & Forecast, By Type, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Portable

- 7.3 Stationary

Chapter 8 Market Estimates & Forecast, By Stage, 2022 - 2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Single-stage pump

- 8.3 Multi-stage pump

Chapter 9 Market Estimates & Forecast, By Operation, 2022 - 2035 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Electric-driven pump

- 9.3 Engine-driven pump

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2022 - 2035 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Mining

- 10.3 Building & construction

- 10.4 Oil & gas

- 10.5 General industries

- 10.6 Water & wastewater treatment

- 10.7 Chemicals

- 10.8 Power generation

- 10.9 Others (agriculture etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 U.K.

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 Andritz AG

- 13.2 Ebara Corporation

- 13.3 Flowserve Corporation

- 13.4 Grundfos

- 13.5 ITT Inc.

- 13.6 Kirloskar Brothers Limited

- 13.7 KSB Group

- 13.8 Pentair PLC

- 13.9 Shakti Pumps (India) Ltd.

- 13.10 SPX Flow, Inc.

- 13.11 Sulzer Ltd.

- 13.12 Torishima Pump Manufacturing Co., Ltd.

- 13.13 Weir Group PLC

- 13.14 Wilo SE

- 13.15 Xylem Inc.