|

市場調查報告書

商品編碼

1913279

金屬成型設備市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Metal Forming Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

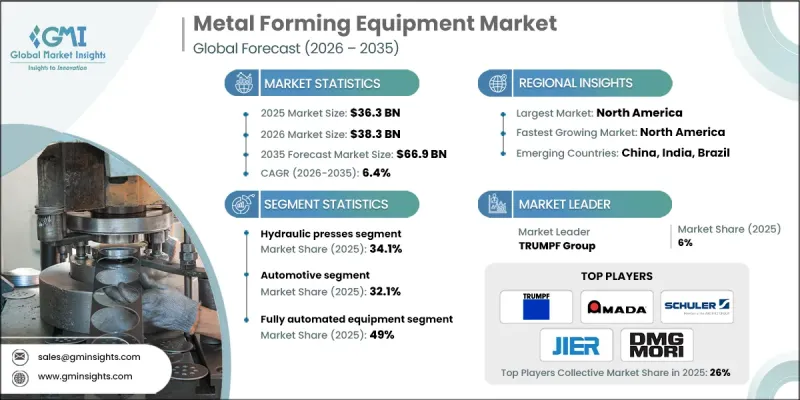

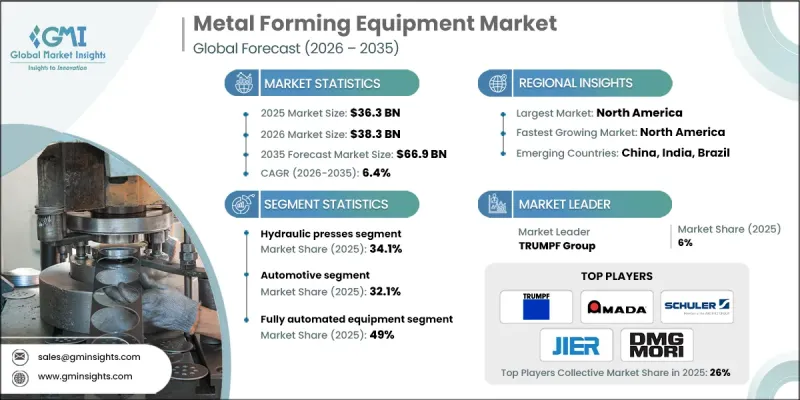

全球金屬成型設備市場預計到 2025 年將達到 363 億美元,到 2035 年將達到 669 億美元,年複合成長率為 6.4%。

隨著製造商採用先進的數位化製造方法和新一代設備架構,整個產業正經歷著翻天覆地的變革。智慧製造框架日益整合基於感測器的監控、即時數據處理和預測性維護,以提高精度、一致性和運作可靠性。數位化生產環境能夠更精確地控制成形參數,進而提高能源效率和產品品質。一場重大的技術變革也在進行中,伺服電動壓力機系統的應用日益廣泛,與傳統方案相比,它具有更卓越的運動控制和更低的能耗。隨著各產業優先考慮輕量材料和複雜幾何形狀,需求模式也不斷演變,推動著成形方法和模具設計的創新。交通運輸和航太製造業的電氣化趨勢正在推動對高精度、高重複性成形解決方案的需求。這些因素共同重塑了資本投資策略,並迫使設備供應商提供更智慧、更柔軟性、更自動化的平台。長期的工業現代化舉措以及全球生產基地對高性能製造設備的持續需求,正使市場受益匪淺。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 363億美元 |

| 預測金額 | 669億美元 |

| 複合年成長率 | 6.4% |

到2035年,汽車產業將以7.3%的複合年成長率成長,鞏固其作為設備創新關鍵驅動力的地位。向電動化移動平台的轉型正在推動對先進成型系統的需求,這些系統能夠處理輕質高強度材料,同時保持精度和結構完整性。

到 2025 年,全自動金屬成型設備市佔率將達到 49% 。人事費用上升、勞動力短缺以及對連續生產日益成長的需求,正促使製造商採用整合機器人、智慧控制和最大限度減少人為干預的自動化技術。

美國金屬成型設備市場佔全球市場佔有率的82.1%,營收達115億美元,年複合成長率達7%。強力的聯邦投資計畫和工業現代化舉措正在推動多個產業對精密成型零件的需求。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 電動車(EV)的興起和輕量化

- 工業4.0和自動化整合

- 全球基礎設施發展與工業化

- 產業潛在風險與挑戰

- 高額資本投入和較長的投資回收期

- 技術純熟勞工和工程師短缺

- 機會

- 新興經濟體尚未開發的市場

- 實體世界與數位世界的融合(STEAM)

- 綠色製造和節能設備

- 將供應鏈遷回鄰近地區

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 按類型分類的市場估算與預測,2022-2035年

- 油壓機

- 機械壓力機

- 軋延

- 其他

第6章 按應用領域分類的市場估算與預測,2022-2035年

- 車

- 航太/國防

- 建造

- 電子設備

- 其他

7. 依自動化程度分類的市場估算與預測,2022-2035 年

- 全自動設備

- 半自動化設備

第8章 按分銷管道分類的市場估算與預測,2022-2035年

- 線上

- 離線

第9章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- TRUMPF Group

- Amada Co., Ltd.

- Schuler AG

- JIER Machine-Tool Group

- DMG Mori

- AIDA Engineering

- Komatsu Ltd.

- Fagor Arrasate

- Haas Automation

- BYSTRONIC

- Mitsubishi HI Machine Tool

- Cincinnati Incorporated

- LVD Group

- MAG IAS

- Bliss-Bret Industries

- WardJet

- Prima Industrie

- Salvagnini

- Ermaksan

- Hyundai Rotem

The Global Metal Forming Equipment Market was valued at USD 36.3 billion in 2025 and is estimated to grow at a CAGR of 6.4% to reach USD 66.9 billion by 2035.

The industry undergoes a structural transformation as manufacturers adopt advanced digital manufacturing practices and next-generation equipment architectures. Smart manufacturing frameworks increasingly integrate sensor-based monitoring, real-time data processing, and predictive maintenance to enhance precision, consistency, and operational reliability. Digitalized production environments allow tighter control over forming parameters while improving energy efficiency and output quality. A major technological transition also takes shape as servo-electric press systems gain wider acceptance due to their superior motion control and reduced energy consumption when compared to legacy alternatives. Demand patterns further evolve as industries prioritize lightweight materials and complex geometries, driving innovation in forming methods and tooling design. Electrification trends across transportation and aerospace manufacturing intensify requirements for highly accurate and repeatable forming solutions. These converging factors reshape capital investment strategies and push equipment suppliers to deliver smarter, more flexible, and automation-ready platforms. The market benefits from long-term industrial modernization initiatives and sustained demand for high-performance manufacturing equipment across global production hubs.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $36.3 Billion |

| Forecast Value | $66.9 Billion |

| CAGR | 6.4% |

The automotive segment will grow at a CAGR of 7.3% through 2035, reinforcing its position as the primary catalyst for equipment innovation. The shift toward electrified mobility platforms increases demand for advanced forming systems capable of handling lightweight and high-strength materials while maintaining precision and structural integrity.

The fully automated metal forming equipment segment accounted for 49% share in 2025. Rising labor costs, workforce shortages, and demand for continuous production encourage manufacturers to deploy automation technologies that integrate robotics, intelligent controls, and minimal human intervention.

U.S. Metal Forming Equipment Market held 82.1% share, generating USD 11.5 billion and achieving a CAGR of 7%. Strong federal investment programs and industrial modernization initiatives drive demand for precision-formed components across multiple sectors.

Key companies operating in the Global Metal Forming Equipment Market include Schuler AG, TRUMPF Group, Amada Co., Ltd., DMG Mori, BYSTRONIC, Komatsu Ltd., Haas Automation, AIDA Engineering, Fagor Arrasate, JIER Machine-Tool Group, Mitsubishi HI Machine Tool, LVD Group, Cincinnati Incorporated, Salvagnini, MAG IAS, Ermaksan, Prima Industrie, WardJet, Bliss-Bret Industries, and Hyundai Rotem. Companies strengthen their position through continuous investment in automation, digital integration, and energy-efficient equipment design. Many manufacturers focus on developing modular systems that offer flexibility across multiple applications while reducing downtime. Strategic partnerships with end users support the co-development of customized solutions aligned with evolving production needs. Expanding service capabilities, including remote monitoring and lifecycle support, improves customer retention and operational reliability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Age group

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise of Electric Vehicles (EVs) & Lightweighting

- 3.2.1.2 Integration of Industry 4.0 & Automation

- 3.2.1.3 Global Infrastructure Development & Industrialization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Capital Investment and Long ROI

- 3.2.2.2 Shortage of Skilled Labor and Technicians

- 3.2.3 Opportunities

- 3.2.3.1 Untapped Markets in Emerging Economies

- 3.2.3.2 Convergence of Physical and Digital Play (STEAM)

- 3.2.3.3 Green Manufacturing & Energy-Efficient Equipment

- 3.2.3.4 Reshoring and Near-shoring of Supply Chains

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Hydraulic Presses

- 5.3 Mechanical Presses

- 5.4 Rolling Machines

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Aerospace & Defense

- 6.4 Construction

- 6.5 Electronics

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Automation level, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Fully Automated Equipment

- 7.3 Semi Automated Equipment

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 TRUMPF Group

- 10.2 Amada Co., Ltd.

- 10.3 Schuler AG

- 10.4 JIER Machine-Tool Group

- 10.5 DMG Mori

- 10.6 AIDA Engineering

- 10.7 Komatsu Ltd.

- 10.8 Fagor Arrasate

- 10.9 Haas Automation

- 10.10 BYSTRONIC

- 10.11 Mitsubishi HI Machine Tool

- 10.12 Cincinnati Incorporated

- 10.13 LVD Group

- 10.14 MAG IAS

- 10.15 Bliss-Bret Industries

- 10.16 WardJet

- 10.17 Prima Industrie

- 10.18 Salvagnini

- 10.19 Ermaksan

- 10.20 Hyundai Rotem