|

市場調查報告書

商品編碼

1892916

穿戴式生物電子皮膚貼片市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Wearable Bioelectronic Skin Patches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

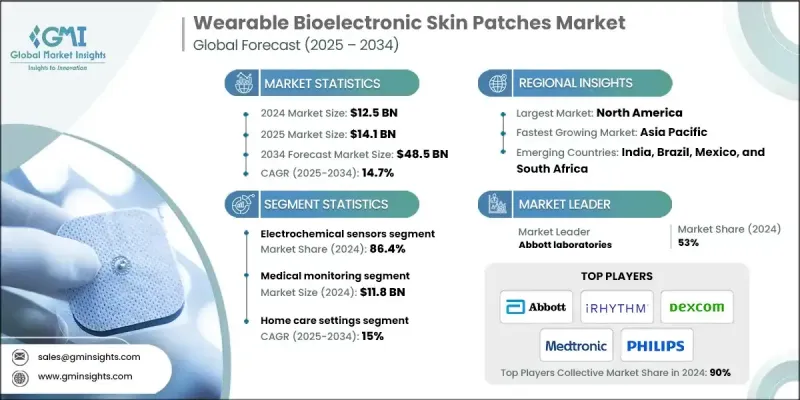

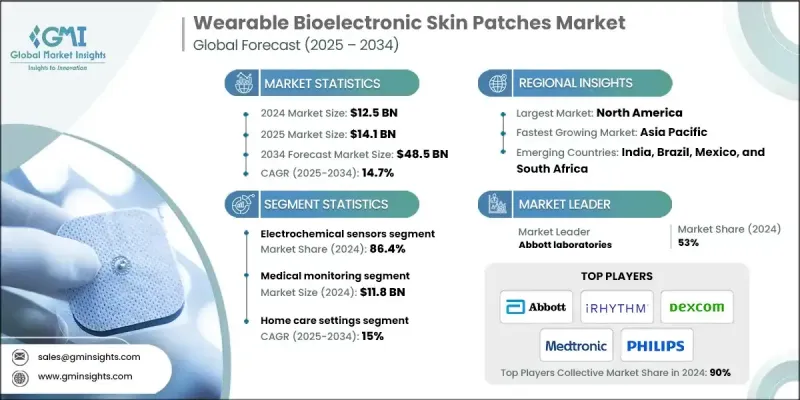

2024 年全球穿戴式生物電子皮膚貼片市場價值為 125 億美元,預計到 2034 年將以 14.7% 的複合年成長率成長至 485 億美元。

市場成長的驅動力來自於即時健康監測的日益普及、慢性病盛行率的上升以及軟性生物感測技術的快速發展。這些新一代貼片整合了多感測器系統、無線連接和人工智慧分析功能,能夠持續提供心血管、代謝和生理參數的數據。隨著醫療保健系統向預防性和遠距醫療模式轉型,穿戴式生物電子貼片在長期監測、早期診斷和個人化治療管理方面變得不可或缺。全球對遠距醫療的日益重視,以及病患對非侵入性解決方案的偏好,進一步加速了市場普及。隨著可拉伸電子裝置和生物相容性材料研發的不斷深入,這些貼片正在發展成為能夠與數位健康生態系統無縫整合的先進平台,從而改善臨床療效並減輕患者負擔。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 125億美元 |

| 預測值 | 485億美元 |

| 複合年成長率 | 14.7% |

市場主要按類型分類,其中電化學感測器細分市場預計在2024年將佔據86.4%的市場佔有率,成為全球市場收入最高的細分市場。電化學感測器之所以佔據主導地位,是因為其在生化監測方面具有極高的精度,尤其是在血糖追蹤、電解質評估和乳酸分析方面。由於其高靈敏度、成本效益以及與軟性基材的兼容性,電化學感測器整合到穿戴式貼片中,可支援從糖尿病管理到運動表現等廣泛的應用。這些感測器將化學反應轉化為電訊號,從而能夠透過汗液和組織液進行精確且連續的監測。

就應用領域而言,醫療監測領域在2024年創造了1,180萬美元的市場規模,使其成為全球最大的應用領域。該領域的成長動力源於對慢性疾病(例如心律不整、糖尿病、高血壓和術後恢復)進行不間斷監測的需求。醫療監測貼片可在臨床環境之外提供持續、高品質的資料,從而減少患者的再次入院率並實現併發症的早期發現。隨著醫療機構擴大採用遠距患者監測平台和混合護理模式,醫療監測貼片的應用正在迅速擴展。隨著醫院和臨床醫生將精準診斷、降低成本和改善患者預後作為優先事項,生物電子皮膚貼片正成為現代化醫療服務的核心。

預計到2024年,北美穿戴式生物電子皮膚貼片市場佔有率將達到44.4%。強大的醫療基礎設施、數位健康工具的高普及率以及遠端監測系統的廣泛應用是推動市場成長的關鍵因素。該地區受益於生物感測器技術快速融入臨床工作流程、慢性病負擔日益加重以及遠端監測設備報銷範圍的擴大。此外,總部位於北美的主要產業參與者,如雅培、德康醫療和iRhythm,持續增加對研發、產品創新和大規模商業化的投入。遠距醫療平台的蓬勃發展,以及消費者對持續健康追蹤意識的不斷提高,使北美成為穿戴式生物電子皮膚貼片領域的長期領導者。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 對非侵入式和即時健康監測解決方案的需求日益成長

- 軟性可拉伸電子技術的進步

- 慢性病盛行率不斷上升

- 提高健康意識和健身意識

- 產業陷阱與挑戰

- 高昂的研發和製造成本

- 對資料隱私和安全的擔憂

- 市場機遇

- 遠端健康監測

- 結合人工智慧和物聯網技術實現個人化醫療

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 亞太地區

- 歐洲

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略儀錶板

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 電化學感測器

- 心電圖感測器

- 溫度感測器

- 肌電感測器

- 其他類型

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 健身與健康

- 醫療監測

- 其他應用

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 醫院和診所

- 家庭護理機構

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 2M Engineering

- Abbott Laboratories

- Biolinq

- Baxter International

- Boston Scientific

- Dexcom

- Epicore Biosystems, Inc.

- GE Healthcare Technologies Inc.

- GENTAG, Inc.

- Insulet Corporation

- iRhythm Technologies, Inc.

- Koninklijke Philips NV

- LifeSignals, Inc.

- Medtronic plc

- Sinocare

- SmartCardia Inc.

- VitalConnect

- VivaLNK, Inc.

The Global Wearable Bioelectronic Skin Patches Market was valued at USD 12.5 billion in 2024 and is estimated to grow at a CAGR of 14.7% to reach USD 48.5 billion by 2034.

Market growth is driven by rising adoption of real-time health monitoring, increasing prevalence of chronic diseases, and rapid advancements in flexible biosensing technologies. These next-generation patches integrate multi-sensor systems, wireless connectivity, and AI-enabled analytics, offering continuous insights into cardiovascular, metabolic, and physiological parameters. As healthcare systems shift toward preventive and remote care models, wearable bioelectronic patches are becoming indispensable for long-term monitoring, early diagnosis, and personalized therapy management. The growing global focus on telehealth, combined with patient preference for non-invasive solutions, further accelerates market uptake. With expanding R&D in stretchable electronics and biocompatible materials, these patches are evolving into advanced platforms that seamlessly integrate with digital health ecosystems, enhancing clinical outcomes and reducing patient burden.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.5 Billion |

| Forecast Value | $48.5 billion |

| CAGR | 14.7% |

The market is primarily segmented by type, with the electrochemical sensors segment holding 86.4% share in 2024, making it the highest revenue segment in the global market. Electrochemical sensors dominate due to their precision in biochemical monitoring, especially in glucose tracking, electrolyte assessment, and lactate analysis. Their integration within wearable patches supports a wide range of applications from diabetes management to sports performance, owing to high sensitivity, cost-effectiveness, and compatibility with flexible substrates. These sensors transform chemical reactions into electrical signals, enabling accurate and continuous monitoring through sweat and interstitial fluids.

In terms of application, the medical monitoring segment generated USD 11.8 million in 2024, making it the dominant application segment globally. This segment is driven by the need for uninterrupted monitoring of chronic conditions such as arrhythmia, diabetes, hypertension, and post-surgical recovery. Medical monitoring patches provide continuous, high-quality data outside clinical environments, reducing hospital readmissions and enabling early detection of complications. Their use is expanding rapidly as healthcare providers increasingly adopt remote patient monitoring platforms and hybrid care models. As hospitals and clinicians prioritize precision diagnostics, cost reduction, and improved patient outcomes, bioelectronic skin patches are becoming central to modernized care delivery.

North America Wearable Bioelectronic Skin Patches Market held 44.4% share in 2024. Strong healthcare infrastructure, high adoption of digital health tools, and widespread use of remote monitoring systems are key growth drivers. The region benefits from rapid integration of biosensor technologies into clinical workflows, rising chronic disease burden, and expanding reimbursement for remote monitoring devices. Additionally, major industry players headquartered in North America, such as Abbott, Dexcom, and iRhythm, continue to invest in R&D, product innovation, and large-scale commercialization. The strong presence of telehealth platforms, combined with increasing consumer awareness of continuous health tracking, positions North America as a long-term leader in wearable bioelectronic skin patches.

Key players in the Global Wearable Bioelectronic Skin Patches Market include 2M Engineering, Abbott Laboratories, Baxter International, Biolinq, Boston Scientific, Dexcom, Epicore Biosystems, GE Healthcare Technologies, GENTAG, Insulet Corporation, iRhythm Technologies, Koninklijke Philips, LifeSignals, Medtronic, Sinocare, SmartCardia, VitalConnect, and VivaLNK Companies. The wearable bioelectronic skin patches market is focusing on multi-layered strategies to strengthen its market foothold. Leading players are investing heavily in R&D to develop flexible, biocompatible materials, advanced electrochemical and ECG sensor platforms, and AI-driven analytics that enhance clinical accuracy and user comfort. Strategic partnerships with hospitals, digital health platforms, and research institutions are accelerating the integration of patches into remote patient monitoring and telehealth ecosystems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Production trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for non-invasive and real-time health monitoring solutions

- 3.2.1.2 Technological advancements in flexible and stretchable electronics

- 3.2.1.3 Growing prevalence of chronic diseases

- 3.2.1.4 Increasing health awareness and fitness consciousness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Concerns regarding data privacy and the security

- 3.2.3 Market opportunities

- 3.2.4 Remote health monitoring

- 3.2.5 Integration with AI and IoT for personalized healthcare

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Asia Pacific

- 3.4.3 Europe

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Electrochemical sensors

- 5.3 ECG sensors

- 5.4 Temperature sensors

- 5.5 EMG sensors

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fitness and wellness

- 6.3 Medical monitoring

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Home care settings

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.3 Germany

- 8.3.4 UK

- 8.3.5 France

- 8.3.6 Spain

- 8.3.7 Italy

- 8.3.8 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 2M Engineering

- 9.2 Abbott Laboratories

- 9.3 Biolinq

- 9.4 Baxter International

- 9.5 Boston Scientific

- 9.6 Dexcom

- 9.7 Epicore Biosystems, Inc.

- 9.8 GE Healthcare Technologies Inc.

- 9.9 GENTAG, Inc.

- 9.10 Insulet Corporation

- 9.11 iRhythm Technologies, Inc.

- 9.12 Koninklijke Philips N.V.

- 9.13 LifeSignals, Inc.

- 9.14 Medtronic plc

- 9.15 Sinocare

- 9.16 SmartCardia Inc.

- 9.17 VitalConnect

- 9.18 VivaLNK, Inc.