|

市場調查報告書

商品編碼

1892912

單相重合器市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Single Phase Recloser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

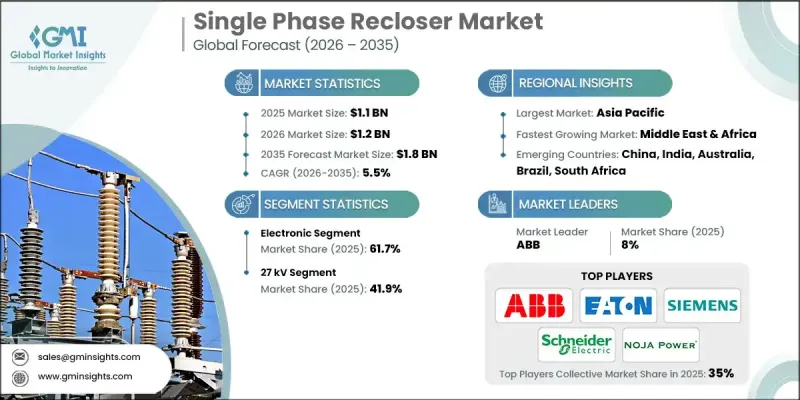

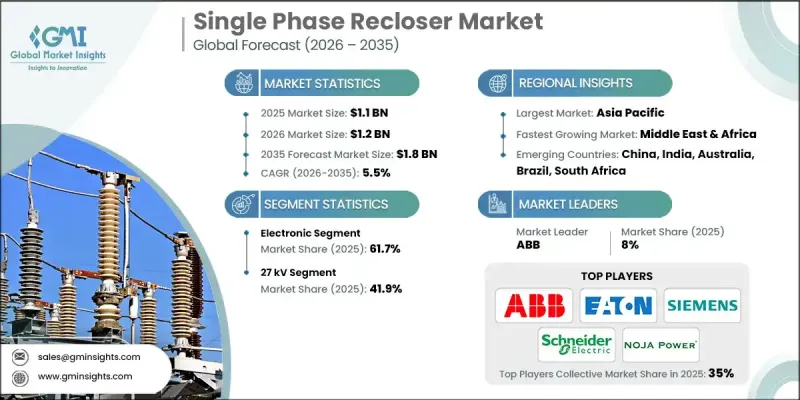

2025 年全球單相重合閘市場價值為 11 億美元,預計到 2035 年將以 5.5% 的複合年成長率成長至 18 億美元。

老舊配電網路的持續現代化改造仍然是推動單相重合器應用的關鍵因素。全球電力公司正在升級現有基礎設施,以提高供電可靠性並縮短停電時間,尤其是在單相饋線廣泛使用的農村和郊區。這些裝置能夠自動隔離故障區段並恢復供電,這對於經常遭受天氣相關干擾的地區至關重要。隨著全球電力產業向更智慧、更具韌性的電網結構轉型,重合器正成為提升運作性能和維持穩定供電的必要組件。再生能源滲透率的不斷提高也增加了電力流動的複雜性,從而增加了對先進保護設備的需求。自動化故障管理、快速復原能力以及與分散式能源的兼容性,增強了單相重合器在半城市和農村地區的實用性。發展中地區電氣化進程的推進進一步支撐了這一需求,因為這些解決方案提供了一種經濟高效的替代方案,可以取代部署成本更高的多相系統,並幫助電力公司在向服務不足地區擴展服務的同時減少維護需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 11億美元 |

| 預測值 | 18億美元 |

| 複合年成長率 | 5.5% |

2025年,電子控制單相重合閘市佔率達到61.7%,預計到2035年將以5.5%的複合年成長率成長。這些數位系統與智慧電網框架和物聯網平台的整合日益增強,從而實現了更高級的監控、自動化和網路安全功能。它們與分析工具和遠端控制功能的兼容性,使其成為採用現代電網架構的電力公司不可或缺的工具。

預計到 2035 年,15 kV 額定電壓等級的電壓等級將以 5% 的複合年成長率成長。非洲和亞太地區部分地區的電氣化進程不斷加快,持續推動對這些設備的需求,尤其是在農村地區,可靠性、簡化的安裝以及與現有饋線的兼容性是電力公司優先考慮的因素。

預計到2025年,美國單相重合閘市場將佔據65%的佔有率,創造1.1億美元的收入。美國和加拿大對電網自動化的大規模投資以及再生能源的擴張仍然是推動市場發展的關鍵因素。在聯邦政府旨在提高電網韌性的資金支持下,該地區的公用事業公司正在優先考慮能夠與SCADA、物聯網和其他先進通訊系統整合的智慧設備。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 策略舉措

- 競爭性標竿分析

- 戰略儀錶板

- 創新與技術格局

第5章:市場規模及預測:依控制方式分類,2022-2035年

- 電子的

- 油壓

第6章:市場規模與預測:依中斷類型分類,2022-2035年

- 油

- 真空

第7章:市場規模及預測:依電壓等級分類,2022-2035年

- 15千伏

- 27千伏

- 38千伏

第8章:市場規模及預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ABB

- ARTECHE

- Eaton Corporation

- ENSTO

- ENTEC Electric & Electronic

- G&W Electric

- Hubbell

- Hughes Power System

- L&R Electric Group

- NOJA Power Switchgear Pty Ltd

- Rockwill

- S&C Electric Company

- Schneider Electric

- Shinsung Industrial Electric

- Siemens

- Tavrida Electric

- Southern States LLC

- Joslyn Hi-Voltage

- Korea ENTEC

- Goto Electrical Co., Ltd.

- Cooper Power Systems

The Global Single Phase Recloser Market was valued at USD 1.1 billion in 2025 and is estimated to grow at a CAGR of 5.5% to reach USD 1.8 billion by 2035.

The ongoing modernization of aging power distribution networks remains a central factor fueling the adoption of single-phase reclosers. Utilities worldwide are upgrading existing infrastructure to enhance service reliability and shorten outage periods, especially in rural and suburban regions where single-phase feeders are widely used. These devices automatically isolate faulted sections and restore service, which is critical in areas that frequently experience weather-related disturbances. As the global power sector moves toward smarter and more resilient grid structures, reclosers are becoming a necessary component for improving operational performance and maintaining consistent electricity delivery. The growing penetration of renewable energy sources is also adding complexity to power flows, increasing the need for advanced protective equipment. Automated fault management, rapid restoration capabilities, and compatibility with distributed energy resources strengthen the utility of single-phase reclosers in semi-urban and rural areas. Expanding electrification efforts in developing regions further support demand, as these solutions offer a cost-effective alternative to deploying more expensive multi-phase systems and help utilities reduce maintenance needs while expanding into underserved areas.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.1 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 5.5% |

The electronically controlled single-phase reclosers segment accounted for a 61.7% share in 2025 and is forecasted to grow at a 5.5% CAGR through 2035. These digital systems increasingly integrate with smart grid frameworks and IoT platforms, enabling advanced forms of monitoring, automation, and cybersecurity. Their compatibility with analytics tools and remote-control functions makes them essential for utilities adopting modern grid architectures.

The 15 kV rating category is projected to grow at a CAGR of 5% by 2035. Rising electrification in parts of Africa and Asia-Pacific continues to boost demand for these devices, especially in rural applications where reliability, simplified installation, and compatibility with existing feeder lines are priorities for utilities.

U.S. Single Phase Recloser Market held a 65% share in 2025, generating USD 110 million. Large-scale investments in grid automation and the expansion of renewable power sources remain key drivers in both the U.S. and Canada. Utilities across the region are prioritizing smart devices capable of integrating with SCADA, IoT, and other advanced communication systems, supported by federal funding targeted at improving grid resilience.

Prominent companies active in the Global Single Phase Recloser Market include ABB, Eaton Corporation, ARTECHE, ENSTO, ENTEC Electric & Electronic, G&W Electric, Hubbell, NOJA Power Switchgear Pty Ltd, Rockwill, Schneider Electric, Siemens, Hughes Power System, S&C Electric Company, L&R Electric Group, Shinsung Industrial Electric, Tavrida Electric, Southern States LLC, Joslyn Hi-Voltage, Goto Electrical Co., Ltd., Korea ENTEC, and Cooper Power Systems. Key strategies adopted by leading companies in the Single Phase Recloser Market focus on improving digital intelligence, strengthening product durability, and enhancing interoperability with modern grid systems. Many manufacturers are prioritizing the development of advanced control platforms that support remote diagnostics, automated operations, and cybersecurity features. Companies are also investing in ruggedized designs suitable for harsh outdoor environments and expanding offerings that integrate seamlessly with smart grid technologies. Partnerships with utilities help accelerate product testing and deployment, while continuous updates to communication protocols ensure compatibility with SCADA, IoT, and DER management systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Control trends

- 2.1.3 Interruption trends

- 2.1.4 Voltage rating trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2025

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Control, 2022 - 2035 (USD Million, Units)

- 5.1 Key trends

- 5.2 Electronic

- 5.3 Hydraulic

Chapter 6 Market Size and Forecast, By Interruption, 2022 - 2035 (USD Million, Units)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Vacuum

Chapter 7 Market Size and Forecast, By Voltage Rating, 2022 - 2035 (USD Million, Units)

- 7.1 Key trends

- 7.2 15 kV

- 7.3 27 kV

- 7.4 38 kV

Chapter 8 Market Size and Forecast, By Region, 2022 - 2035 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 South Africa

- 8.5.3 UAE

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 ARTECHE

- 9.3 Eaton Corporation

- 9.4 ENSTO

- 9.5 ENTEC Electric & Electronic

- 9.6 G&W Electric

- 9.7 Hubbell

- 9.8 Hughes Power System

- 9.9 L&R Electric Group

- 9.10 NOJA Power Switchgear Pty Ltd

- 9.11 Rockwill

- 9.12 S&C Electric Company

- 9.13 Schneider Electric

- 9.14 Shinsung Industrial Electric

- 9.15 Siemens

- 9.16 Tavrida Electric

- 9.17 Southern States LLC

- 9.18 Joslyn Hi-Voltage

- 9.19 Korea ENTEC

- 9.20 Goto Electrical Co., Ltd.

- 9.21 Cooper Power Systems