|

市場調查報告書

商品編碼

1892909

石油及天然氣電動潛水幫浦市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Oil and Gas Electric Submersible Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

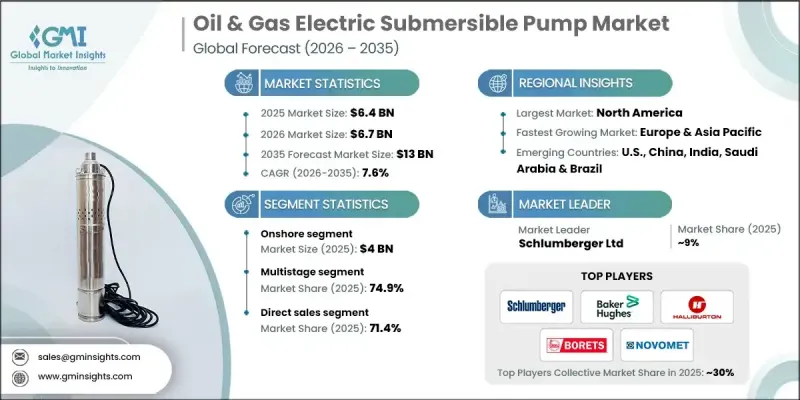

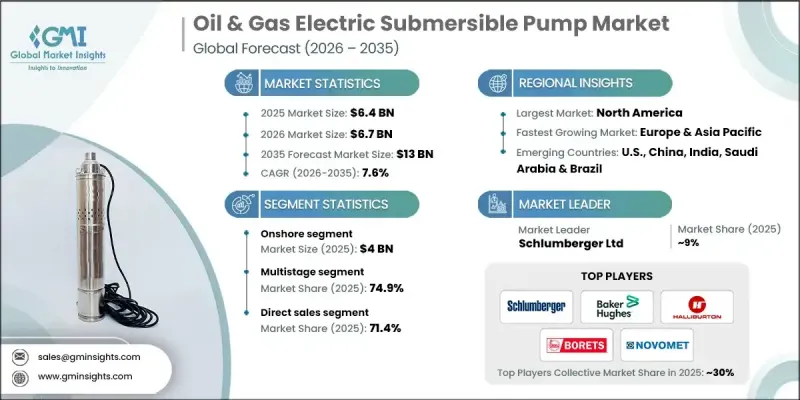

2025年全球油氣用電動潛水幫浦市場價值為64億美元,預計2035年將以7.6%的複合年成長率成長至130億美元。

新興經濟體人口成長和快速工業化正推動前所未有的能源需求,尤其是在成熟市場。能源需求的激增促使油氣產業採用更先進、更有效率的開採技術,其中電潛泵(ESP)發揮關鍵作用。電潛泵被廣泛用於提高老油田的產量,並最佳化大規模作業的開採效率。儘管電潛泵優勢顯著,但高昂的前期成本等挑戰使得小型業者難以採用,尤其是在油價低迷時期。然而,泵浦設計的創新、更耐用材料的運用以及即時監控系統的整合,正使電潛泵的效率、可靠性和成本效益不斷提高,從而在能源需求持續成長的情況下,為全球產量成長提供支持。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 64億美元 |

| 預測值 | 130億美元 |

| 複合年成長率 | 7.6% |

2025年陸上油氣市場規模達40億美元,預計2026年至2035年將以7.7%的複合年成長率成長。成長的主要驅動力是維持成熟陸上油田產量的需求,而人工採油解決方案對於維持這些油田的生產至關重要。陸上作業通常比海上專案更具成本效益,因此對那些希望在控制營運成本的同時最佳化生產效率的營運商來說更具吸引力。不斷成長的油氣需求以及針對老舊油藏的強化採收技術,進一步推動了電潛泵(ESP)在高效流體處理和提高產量方面的應用。

2025年,多級電潛泵市佔率達到74.9%,預計2026年至2035年將以7.3%的複合年成長率成長。多層電潛泵配備多個葉輪,能夠提供必要的提升力,將大量石油、水和天然氣從深層油藏輸送到地面。這些泵浦非常適合高產能、複雜的油井,包括非常規油氣田和海上油氣田。隨著探勘活動向更深、更具挑戰性的油藏推進,多級系統的需求將持續穩定成長。

美國油氣產業電動潛水幫浦市場預計在2025年達到14.1億美元,並有望在2035年之前以8.1%的複合年成長率成長。電動潛水泵技術的進步,例如可靠性的提升、效率的提高以及與數位監控系統的整合,是推動市場成長的主要因素。這些進步使營運商能夠最佳化效能並最大限度地減少停機時間。此外,海上專案的投資以及對提高油井產量成本效益的需求,也是重要的成長動力。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 全球能源需求不斷成長

- ESP技術的進步

- 深水和超深水探勘

- 日益關注減少碳排放

- 產業陷阱與挑戰

- 前期成本高

- 複雜的安裝和維護

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按泵類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依泵浦類型分類,2022-2035年

- 離心式

- 軸流

- 正位移

- 漸進性齲齒

第6章:市場估算與預測:依馬達類型分類,2022-2035年

- 感應電機

- 永磁電機(PMM)

- 高溫電機

第7章:市場估算與預測:依功率等級分類,2022-2035年

- 最高可達 500 匹馬力

- 500-1000馬力

- 1000-2000馬力

- 超過2000馬力

第8章:市場估算與預測:依部署方式分類,2022-2035年

- 傳統鑽井平台部署

- 替代性無鑽井部署

第9章:市場估算與預測:依井深分類,2022-2035年

- 淺井(≤ 1,000 公尺)

- 中級(1,000-2,500公尺)

- 深海(2500-4000公尺)

- 超深(> 4,000 公尺)

第10章:市場估計與預測:依控制系統分類,2022-2035年

- 固定頻率

- 變速

- 數位化最佳化(智慧/物聯網系統)

第11章:市場估價與預測:依部署類型分類,2022-2035年

- 陸上

- 離岸

第12章:市場估算與預測:依營運模式分類,2022-2035年

- 單級

- 多級

第13章:市場估算與預測:依應用領域分類,2022-2035年

- 石油生產

- 天然氣生產

- 水注入

- 人工採油(EOR)

- 熱恢復

第14章:市場估算與預測:依配銷通路分類,2022-2035年

- 直銷

- 間接銷售

第15章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第16章:公司簡介

- Atlas Copco AB

- Baker Hughes

- Borets International Ltd

- Crompton Greaves Consumer Electricals Limited

- EBARA CORPORATION

- Flowserve Corporation

- Gorman-Rupp Pumps

- Grundfos Holding A/S

- Halliburton

- Novomet

- Schlumberger Ltd

- Sulzer Ltd

- Tsurumi Manufacturing Co. Ltd.

- Weatherford

- WILO SE

The Global Oil & Gas Electric Submersible Pump Market was valued at USD 6.4 billion in 2025 and is estimated to grow at a CAGR of 7.6% to reach USD 13 billion by 2035.

The rising population and rapid industrialization in emerging economies are driving an unprecedented demand for energy, especially in well-established markets. This surge in energy requirements is pushing the oil and gas sector to adopt more advanced and efficient extraction technologies, with electric submersible pumps playing a key role. ESPs are widely deployed to enhance production in aging fields and optimize extraction efficiency for large-scale operations. Despite the benefits, challenges such as high upfront costs make ESP adoption difficult for smaller operators, particularly during periods of low oil prices. However, innovations in pump design, more durable materials, and the integration of real-time monitoring systems are making ESPs increasingly efficient, reliable, and cost-effective, supporting global production growth as energy demand continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.4 Billion |

| Forecast Value | $13 Billion |

| CAGR | 7.6% |

The onshore segment accounted for USD 4 billion in 2025 and is expected to grow at a CAGR of 7.7% from 2026 to 2035. Growth is driven by the need to maintain output from mature onshore oilfields, where artificial lift solutions are critical for sustaining production. Onshore operations also tend to be more cost-effective than offshore projects, making them attractive to operators seeking to optimize productivity while controlling operational expenses. Rising hydrocarbon demand and enhanced recovery techniques for aging reservoirs are further boosting ESP adoption for efficient fluid handling and higher production rates.

The multistage segment held a 74.9% share in 2025 and is anticipated to grow at a CAGR of 7.3% from 2026 to 2035. Multistage ESPs, with multiple impellers, provide the necessary lift to transfer significant volumes of oil, water, and gas from deep reservoirs to the surface. These pumps are ideal for high-capacity, complex wells, including unconventional and offshore fields. As exploration moves toward deeper and more challenging reservoirs, the demand for multistage systems continues to rise steadily.

US Oil & Gas Electric Submersible Pump Market is generating USD 1.41 billion in 2025 and is expected to grow at a CAGR of 8.1% through 2035. Adoption is being driven by technological improvements in ESPs, such as enhanced reliability, greater efficiency, and integration with digital monitoring systems, which allow operators to optimize performance and minimize downtime. Investments in offshore projects, coupled with the need for cost-effective methods to maximize output from declining wells, are also significant growth factors.

Key players operating in the Global Oil & Gas Electric Submersible Pump Market include Schlumberger Ltd, Halliburton, Baker Hughes, Atlas Copco AB, Flowserve Corporation, Grundfos Holding A/S, Crompton Greaves Consumer Electricals Limited, EBARA CORPORATION, Gorman-Rupp Pumps, Novomet, Sulzer Ltd, Weatherford, WILO SE, Tsurumi Manufacturing Co. Ltd., and Borets International Ltd. Companies in the Oil & Gas Electric Submersible Pump Market are focusing on innovation, R&D, and digital integration to strengthen their market position. They are developing advanced pump designs with enhanced durability, energy efficiency, and real-time monitoring capabilities to optimize production and minimize downtime. Strategic partnerships with technology providers and digital solution companies allow operators to implement predictive maintenance and automation solutions. Firms are also expanding their geographic presence in emerging oil-producing regions and providing tailored services for onshore and offshore applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Pump type

- 2.2.3 Motor types

- 2.2.4 Power rating

- 2.2.5 Deployment method

- 2.2.6 Well depth

- 2.2.7 Control system

- 2.2.8 Deployment type

- 2.2.9 Operation

- 2.2.10 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global energy demand

- 3.2.1.2 Advancements in ESP technology

- 3.2.1.3 Deepwater and ultra-deepwater exploration

- 3.2.1.4 Rising focus on carbon emission reduction

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Complex installation and maintenance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By pump type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Pump Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Centrifugal

- 5.3 Axial flow

- 5.4 Positive displacement

- 5.5 Progressive cavity

Chapter 6 Market Estimates & Forecast, By Motor Types, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Induction motors

- 6.3 Permanent magnet motors (PMMs)

- 6.4 High-temperature motors

Chapter 7 Market Estimates & Forecast, By Power Rating, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 500 HP

- 7.3 500-1000 HP

- 7.4 1000-2000 HP

- 7.5 Above 2000 HP

Chapter 8 Market Estimates & Forecast, By Deployment Method, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Conventional rig-based deployment

- 8.3 Alternative & rigless deployment

Chapter 9 Market Estimates & Forecast, By Well Depth, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Shallow wells (≤ 1,000 m)

- 9.3 Intermediate (1,000-2,500 m)

- 9.4 Deep (2,500-4,000 m)

- 9.5 Ultra-deep (> 4,000 m)

Chapter 10 Market Estimates & Forecast, By Control system, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Fixed frequency

- 10.3 Variable speed

- 10.4 Digital optimization (Intelligent/IoT-enabled systems)

Chapter 11 Market Estimates & Forecast, By Deployment Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Onshore

- 11.3 Offshore

Chapter 12 Market Estimates & Forecast, By Operation, 2022 - 2035, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Single stage

- 12.3 Multistage

Chapter 13 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Thousand Units)

- 13.1 Key trends

- 13.2 Oil production

- 13.3 Gas production

- 13.4 Water injection

- 13.5 Artificial lift (EOR)

- 13.6 Thermal recovery

Chapter 14 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 14.1 Key trends

- 14.2 Direct sales

- 14.3 Indirect sales

Chapter 15 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 15.1 Key trends

- 15.2 North America

- 15.2.1 U.S.

- 15.2.2 Canada

- 15.3 Europe

- 15.3.1 Germany

- 15.3.2 UK

- 15.3.3 France

- 15.3.4 Italy

- 15.3.5 Spain

- 15.4 Asia Pacific

- 15.4.1 China

- 15.4.2 India

- 15.4.3 Japan

- 15.4.4 South Korea

- 15.4.5 Australia

- 15.4.6 Indonesia

- 15.4.7 Malaysia

- 15.5 Latin America

- 15.5.1 Brazil

- 15.5.2 Mexico

- 15.5.3 Argentina

- 15.6 MEA

- 15.6.1 Saudi Arabia

- 15.6.2 UAE

- 15.6.3 South Africa

Chapter 16 Company Profiles

- 16.1 Atlas Copco AB

- 16.2 Baker Hughes

- 16.3 Borets International Ltd

- 16.4 Crompton Greaves Consumer Electricals Limited

- 16.5 EBARA CORPORATION

- 16.6 Flowserve Corporation

- 16.7 Gorman-Rupp Pumps

- 16.8 Grundfos Holding A/S

- 16.9 Halliburton

- 16.10 Novomet

- 16.11 Schlumberger Ltd

- 16.12 Sulzer Ltd

- 16.13 Tsurumi Manufacturing Co. Ltd.

- 16.14 Weatherford

- 16.15 WILO SE