|

市場調查報告書

商品編碼

1892900

汽車液力變矩器市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Automotive Torque Converter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

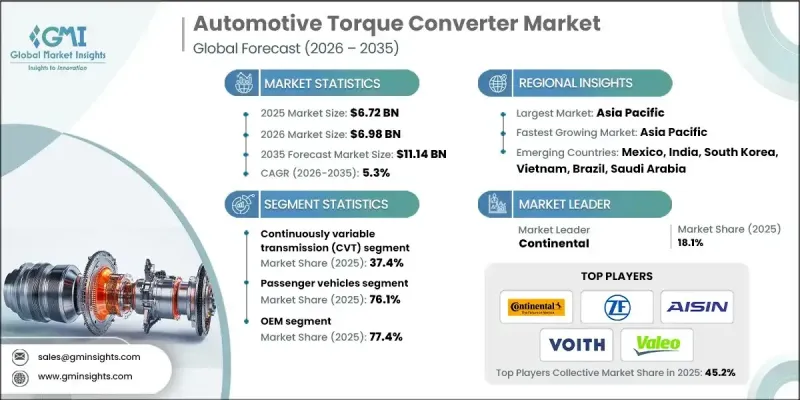

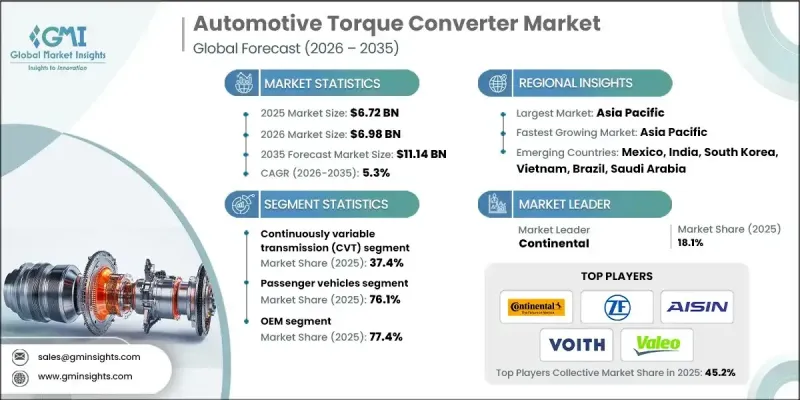

2025 年全球汽車扭力轉換器市場價值為 67.2 億美元,預計到 2035 年將以 5.3% 的複合年成長率成長至 111.4 億美元。

自動變速箱的日益普及推動了市場成長,尤其是在城市地區,自動變速箱能夠提供更平順、更輕鬆的駕駛體驗。液力變矩器透過以液壓系統取代複雜的離合器和齒輪機構,使車輛無需離合器踏板即可行駛,從而改變了傳統車輛的駕駛方式。消費者對乘用車和商用車自動變速箱的偏好不斷增強,進一步推高了市場需求。與手排變速箱相比,液力變矩器還能提高燃油效率,這進一步促進了其普及。美國和英國等自動擋汽車滲透率高的市場,持續為新車生產和售後零件更換創造了巨大的機會。隨著全球城市化進程的推進和混合動力汽車的普及,液力變矩器正成為實現車輛順暢高效運作的關鍵部件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 67.2億美元 |

| 預測值 | 111.4億美元 |

| 複合年成長率 | 5.3% |

由於其卓越的燃油效率和使引擎以最佳轉速運轉的能力,預計到2025年,無段變速箱(CVT)市場佔有率將達到37.4%。 CVT提供平順、無縫的駕駛體驗,在城市環境中越來越受歡迎。

預計到2025年,乘用車市場規模將達到51.1億美元,反映出市場對自動變速箱汽車的強勁需求。混合動力汽車(HEV)的興起以及製造商對先進自動變速箱技術的投入,正在推動該細分市場的成長。

美國汽車扭力轉換器市場規模預計在2025年達到18.2億美元,高於2024年的17.5億美元。技術進步正促使美國汽車製造商採用更有效率的扭力轉換器,以滿足企業平均燃油經濟性(CAFE)標準。雖然純電動車通常不需要扭力轉換器,但混合動力車和插電式混合動力車則依賴先進的緊湊型轉換器來最大限度地提高效率和性能。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 全球自排變速箱普及率不斷提高

- 乘用車產量成長

- 商用車和非公路用車成長

- 售後市場和服務市場成長

- 產業陷阱與挑戰

- 電動車的普及降低了對自動變速箱的需求。

- 在價格敏感型市場中,手排變速箱更受歡迎

- 市場機遇

- 混合動力汽車(HEV)細分市場成長

- 與原始設備製造商 (OEM) 就系統級最佳化開展合作

- 永續性與循環經濟的融合

- 售後性能及賽車領域

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國:美國企業平均燃油經濟性(CAFE)標準

- 加拿大:加拿大聯邦輕型車輛標準

- 歐洲

- 德國:德國道路交通許可條例(StVZO)

- 法國:法國車輛類型認證框架

- 英國:英國車輛認證機構(VCA)

- 亞太地區

- 中國:中國第六期汽車排放標準

- 日本:日本汽車型式認證(JATA)法規

- 印度:Bharat Stage排放標準

- 拉丁美洲

- 巴西:巴西 PROCONVE 車輛排放計劃

- 阿根廷:阿根廷國家汽車安全標準

- 墨西哥:墨西哥NOM車輛排放與安全標準

- 中東和非洲

- 阿拉伯聯合大公國:阿拉伯聯合大公國聯邦車輛安全與排放法規

- 南非:南非國家道路交通法規

- 沙烏地阿拉伯:SASO燃油經濟性和車輛安全標準

- 北美洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 製造成本結構

- 營運成本分析

- 基礎設施成本分析

- 成本最佳化策略

- 專利分析

- 永續性和環境影響

- 液力變矩器生產的碳足跡

- 材料可回收性分析

- 環保生產方式

- 生命週期評估

- 最佳情況

- 未來展望與機遇

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依輸電方式分類,2022-2035年

- 自動手排變速箱(AMT)

- 雙離合器變速箱(DCT)

- 無段變速器(CVT)

- 其他

第6章:市場估算與預測:依轉換器分類,2022-2035年

- 單級

- 多階段

- 鎖

- 其他

第7章:市場估價與預測:依車輛類型分類,2022-2035年

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 低容量性狀

- MCV

- C型肝炎

第8章:市場估算與預測:依銷售管道分類,2022-2035年

- OEM

- 售後市場

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 比荷盧經濟聯盟

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 新加坡

- 馬來西亞

- 印尼

- 越南

- 泰國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球公司

- ZF Friedrichshafen

- Schaeffler

- Valeo

- EXEDY

- Aisin

- BorgWarner

- Yutaka Giken

- Allison Transmission

- JATCO

- Punch Powertrain

- Voith

- Delphi Technologies

- 區域公司

- Zhejiang Torch Auto Parts

- Hubei Aviation Precision Machinery Technology

- Zhejiang Wanliyang

- Transtar Industries

- Florida Torque Converter

- RevMax Converters

- TCI Automotive

- 新興公司

- Circle D Specialties

- Coan Engineering

- Hughes Performance

- Hays Performance (Holley)

- Sonnax Transmission Company

The Global Automotive Torque Converter Market was valued at USD 6.72 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 11.14 billion by 2035.

Growth is driven by the rising adoption of automatic transmissions, which offer a smoother, easier driving experience, particularly in urban areas. Torque converters are transforming traditional vehicles by replacing complex clutch and gear mechanisms with hydraulic fluid-based systems, allowing vehicles to operate without a clutch pedal. Increasing consumer preference for automatic transmission in both passenger cars and commercial fleets is boosting market demand. Torque converters also enhance fuel efficiency compared to manual transmissions, which further encourages adoption. Markets with high penetration of automatic vehicles, including the U.S. and the U.K., continue to create significant opportunities for both new vehicle production and aftermarket component replacement. As global urbanization and hybrid vehicle adoption grow, torque converters are becoming essential for seamless and efficient vehicle operation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.72 Billion |

| Forecast Value | $11.14 Billion |

| CAGR | 5.3% |

The continuously variable transmission (CVT) segment held a 37.4% share in 2025 due to its superior fuel efficiency and ability to allow engines to operate at optimal revolutions per minute. CVTs provide a smooth, seamless driving experience that is increasingly favored in city environments.

The passenger vehicle segment generated USD 5.11 billion in 2025, reflecting high demand for automatic transmission vehicles. The rise of hybrid electric vehicles (HEVs) and manufacturers' push for advanced automatic transmission technology is driving growth in this segment.

United States Automotive Torque Converter Market reached USD 1.82 billion in 2025, up from USD 1.75 billion in 2024. Technological advancements are encouraging U.S.-based OEMs to adopt more efficient torque converters that help meet Corporate Average Fuel Economy (CAFE) standards. While battery-electric vehicles often do not require torque converters, HEVs and plug-in hybrids rely on advanced, compact converters to maximize efficiency and performance.

Key players in the Automotive Torque Converter Market include Schaeffler Technologies, BorgWarner, Exedy, Aisin Seiki, Allison Transmission, Continental, Voith, ZF Friedrichshafen, Valeo, and Delphi Technologies. Companies are strengthening their Automotive Torque Converter Market positions by developing high-efficiency and compact torque converters suitable for hybrid and plug-in hybrid electric vehicles. Strategic R&D investments are focused on improving fuel economy, reducing emissions, and enhancing durability. Leading manufacturers are forming alliances with OEMs to integrate advanced torque converters into next-generation automatic transmissions and continuously variable transmissions (CVTs). Technological innovation, including hydraulic optimization and lightweight materials, is being used to improve performance while lowering costs. Market leaders are also expanding global production capabilities and establishing service and aftermarket networks to ensure long-term customer support.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Transmission

- 2.2.3 Converter

- 2.2.4 Vehicle

- 2.2.5 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing global automatic transmission penetration

- 3.2.1.2 Growth in passenger vehicle production

- 3.2.1.3 Commercial vehicle & off-highway vehicle growth

- 3.2.1.4 Aftermarket & service market growth

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 EV adoption reducing automatic transmission demand

- 3.2.2.2 Manual transmission preference in price-sensitive markets

- 3.2.3 Market opportunities

- 3.2.3.1 Hybrid electric vehicle (HEV) segment growth

- 3.2.3.2 Partnerships with OEMs on system-level optimization

- 3.2.3.3 Sustainability & circular economy integration

- 3.2.3.4 Aftermarket performance & racing segments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: U.S. Corporate Average Fuel Economy (CAFE) Standards

- 3.4.1.2 Canada: Canada's federal light-duty vehicle standards

- 3.4.2 Europe

- 3.4.2.1 Germany: German Road Traffic Licensing Regulations (StVZO)

- 3.4.2.2 France: French Vehicle Type-Approval Framework

- 3.4.2.3 United Kingdom: UK Vehicle Certification Agency (VCA)

- 3.4.3 Asia Pacific

- 3.4.3.1 China: China VI Vehicle Emission Standards

- 3.4.3.2 Japan: Japan Automobile Type Approval (JATA) Regulations

- 3.4.3.3 India: Bharat Stage Emission Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil: Brazilian PROCONVE Vehicle Emission Program

- 3.4.4.2 Argentina: Argentina National Automotive Safety Standards

- 3.4.4.3 Mexico: Mexican NOM Vehicle Emission and Safety Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE: UAE Federal Vehicle Safety & Emission Regulations

- 3.4.5.2 South Africa: South African National Road Traffic Regulations

- 3.4.5.3 Saudi Arabia: SASO Fuel Economy and Vehicle Safety Standards

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing cost structure

- 3.10.2 Operational cost analysis

- 3.10.3 Infrastructure cost analysis

- 3.10.4 Cost optimization strategies

- 3.11 Patent analysis

- 3.12 Sustainability and environmental impact

- 3.12.1 Carbon footprint of torque converter production

- 3.12.2 Material recyclability analysis

- 3.12.3 Eco-friendly manufacturing practices

- 3.12.4 Lifecycle assessment

- 3.13 Best case scenarios

- 3.14 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Transmission, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Automated manual transmission (AMT)

- 5.3 Dual- Clutch transmission (DCT)

- 5.4 Continuously variable transmission (CVT)

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Converter, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Single-stage

- 6.3 Multi-stage

- 6.4 Lockup

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUVs

- 7.3 Commercial Vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.4.10 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 ZF Friedrichshafen

- 10.1.2 Schaeffler

- 10.1.3 Valeo

- 10.1.4 EXEDY

- 10.1.5 Aisin

- 10.1.6 BorgWarner

- 10.1.7 Yutaka Giken

- 10.1.8 Allison Transmission

- 10.1.9 JATCO

- 10.1.10 Punch Powertrain

- 10.1.11 Voith

- 10.1.12 Delphi Technologies

- 10.2 Regional companies

- 10.2.1 Zhejiang Torch Auto Parts

- 10.2.2 Hubei Aviation Precision Machinery Technology

- 10.2.3 Zhejiang Wanliyang

- 10.2.4 Transtar Industries

- 10.2.5 Florida Torque Converter

- 10.2.6 RevMax Converters

- 10.2.7 TCI Automotive

- 10.3 Emerging companies

- 10.3.1 Circle D Specialties

- 10.3.2 Coan Engineering

- 10.3.3 Hughes Performance

- 10.3.4 Hays Performance (Holley)

- 10.3.5 Sonnax Transmission Company