|

市場調查報告書

商品編碼

1892899

生物樣本採集試劑盒市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Biological Sample Collection Kits Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

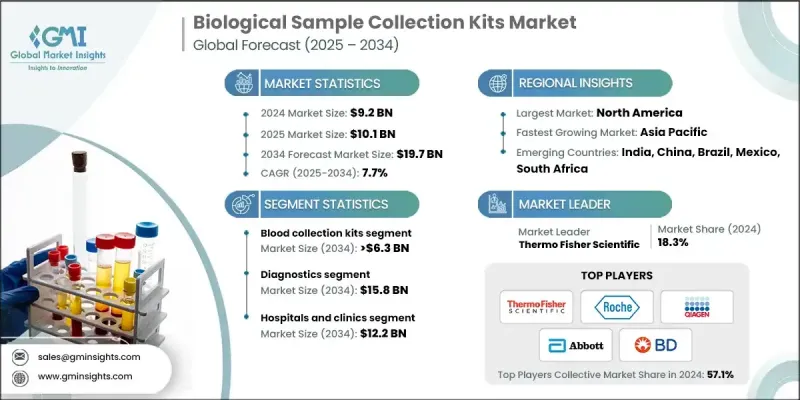

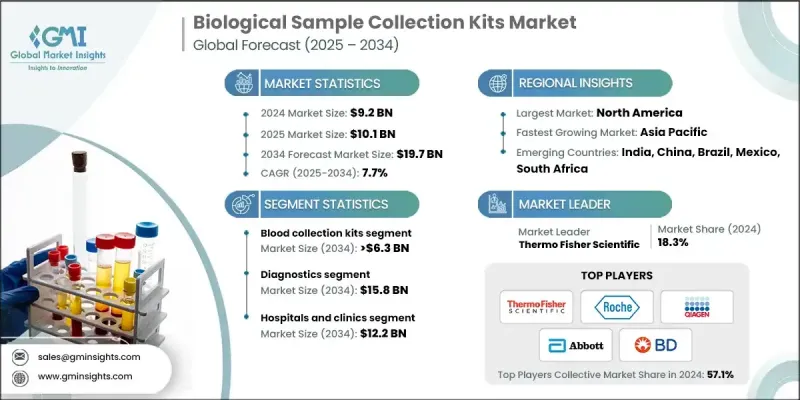

2024 年全球生物樣本採集試劑盒市場價值為 92 億美元,預計到 2034 年將以 7.7% 的複合年成長率成長至 197 億美元。

隨著對診斷檢測、生物樣本庫和個人化醫療等高度依賴精準生物標記分析的項目的需求不斷成長,市場持續擴張。這些試劑盒透過保護樣本品質和確保結果可靠,為實驗室、醫療機構、診斷公司和生物製藥企業提供支援。種類繁多的產品,例如血液和尿液採集試劑盒、病毒轉運培養基、唾液採集系統和自採樣工具,能夠實現安全、穩定、無污染的臨床和科學研究操作。分子診斷(包括新一代定序和基於PCR的檢測)的興起,進一步推動了先進分析平台最佳化的專用試劑盒的需求。遠距醫療的日益普及也加速了居家採集解決方案的推廣,這些方案不僅方便患者,還能減輕臨床機構的負擔。此外,監管機構對樣本安全性和可追溯性的關注,也促進了條碼包裝、防篡改設計和耐溫包裝等方面的創新。實驗室自動化程度的提高以及針對特定樣本類型客製化試劑盒的需求,進一步支撐了市場的長期發展勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 92億美元 |

| 預測值 | 197億美元 |

| 複合年成長率 | 7.7% |

預計到2034年,拭子市場將以7.2%的複合年成長率成長。成長的主要促進因素是傳染病診斷、微生物組研究和快速檢測流程中對非侵入性採樣需求的不斷成長。拭子具有可靠性和廣泛的可用性,使其成為醫院、實驗室和即時檢測環境中不可或缺的工具。

2024年,診斷業務佔據78.9%的市場佔有率,預計2034年將達到158億美元。全球慢性病和傳染病發病率的上升推動了診斷檢測的持續應用,以支持早期發現和治療方案的發展。採集試劑盒是這些工作流程中的關鍵環節,它們能夠保持樣本的完整性,並透過及時的健康評估來幫助降低醫療成本。

預計到2024年,北美生物樣本採集試劑盒市佔率將達到32.4%。強大的醫療基礎設施、先進診斷技術的廣泛應用以及健全的研究生態系統,持續支撐著生物樣本採集試劑盒的高利用率。代謝性疾病、心臟病、腫瘤和傳染病病例的不斷增加,進一步凸顯了該地區對可靠診斷工具的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 實驗室檢測數量不斷增加

- 實驗室檢驗在精準疾病診斷的應用日益廣泛

- 樣品採集技術的研發活動日益增多,技術也不斷進步。

- 生物樣本庫和個人化醫療的擴展

- 產業陷阱與挑戰

- 先進試劑盒價格昂貴,且採樣過程複雜。

- 市場機遇

- 居家和遠端採樣工具包的使用率不斷提高

- 自動化和數位追蹤解決方案的整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 技術格局

- 當前技術趨勢

- 攜帶式和家用生物樣本採集試劑盒的成長

- 支援遠端樣本追蹤的數位健康平台

- 方便患者自行採集且微創的試劑盒

- 新興技術

- 人工智慧驅動的樣品品質監測和預測分析

- 穿戴式和連網的樣本採集設備

- 具備自適應穩定和保存功能的智慧套件

- 當前技術趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 人工智慧、數位醫療和互聯診斷的融合

- 擴大居家自取樣檢測方案

- 新興市場成長,醫療基礎建設得到改善

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 採血包

- 尿液採集套裝

- 拭子

- 鼻咽拭子

- 口咽拭子

- 鼻拭子

- 病毒運輸培養基

- 其他產品

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 診斷

- 研究

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 醫院和診所

- 診斷中心

- 居家照護

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- Altona Diagnostics

- Becton, Dickinson and Company (BD)

- CTK Biotech

- Hardy Diagnostics

- HiMedia Laboratories

- Labcorp

- Lucence Health

- Miraclean Technology

- Puritan Medical

- QIAGEN

- Roche

- Seegene

- Thermo Fisher Scientific

- VIRCELL MEDICAL

The Global Biological Sample Collection Kits Market was valued at USD 9.2 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 19.7 billion by 2034.

The market continues to grow as demand rises for diagnostic testing, biobanking, and personalized medicine initiatives that rely heavily on accurate biomarker analysis. These kits support laboratories, healthcare facilities, diagnostics companies, and biopharmaceutical organizations by preserving sample quality and ensuring dependable results. A wide range of products, such as blood and urine collection kits, viral transport media, saliva-based systems, and self-sampling tools, enable safe, consistent, contamination-free handling for both clinical and research purposes. The shift toward molecular diagnostics, including next-generation sequencing and PCR-based testing, is expanding the need for specialized kits optimized for advanced analytical platforms. Increasing use of telemedicine is also accelerating the adoption of at-home collection solutions that offer patient convenience and reduce the burden on clinical settings. Additionally, regulatory attention on sample security and traceability is encouraging innovation in barcoded packaging, tamper-resistant designs, and temperature-stable formats. Growing automation in laboratories and the push for kits tailored to specific specimen types are further supporting long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 7.7% |

The swabs segment is expected to grow at a CAGR of 7.2% through 2034. Growth is influenced by increasing demand for non-invasive sampling across infectious disease diagnostics, microbiome research, and rapid testing workflows. Their reliability and widespread availability make swabs essential in hospitals, laboratory settings, and point-of-care environments.

The diagnostics segment held a 78.9% share in 2024 and is anticipated to achieve USD 15.8 billion by 2034. Rising rates of chronic and infectious illnesses worldwide are driving consistent use of diagnostic testing to support early detection and treatment planning. Collection kits form a critical part of these workflows by maintaining sample integrity and helping reduce medical costs through timely health assessments.

North America Biological Sample Collection Kits Market accounted for a 32.4% share in 2024. Strong healthcare infrastructure, broad access to advanced diagnostic technologies, and robust research ecosystems continue to support high utilization of biological sampling kits. Increasing case numbers for metabolic, cardiac, oncological, and infectious conditions further reinforce the need for reliable diagnostic tools across the region.

Leading companies active in the Global Biological Sample Collection Kits Market include Abbott, Altona Diagnostics, Becton, Dickinson and Company (BD), CTK Biotech, Hardy Diagnostics, HiMedia Laboratories, Labcorp, Lucence Health, Miraclean Technology, Puritan Medical, QIAGEN, Roche, Seegene, Thermo Fisher Scientific, and VIRCELL MEDICAL. Companies competing in the Biological Sample Collection Kits Market use a variety of strategies to strengthen their presence. Many are expanding product portfolios with specialized kits that support molecular testing, personalized medicine, and at-home diagnostics. Investments in automation-ready systems, tamper-proof designs, and advanced tracking features help improve accuracy and traceability. Firms are enhancing global distribution networks and forming partnerships with laboratories, biotech companies, and healthcare providers to widen market access. Significant focus is placed on compliance with evolving regulatory standards to ensure product reliability across regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of laboratory tests

- 3.2.1.2 Rising usage of lab tests for precise disease diagnosis

- 3.2.1.3 Growing R&D activities and technological advancements in sample collection techniques

- 3.2.1.4 Expansion of biobanking and personalized medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced kits and complexities associated with specimen collection

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of at-home and remote sample collection kits

- 3.2.3.2 Integration of automation and digital tracking solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Growth of portable and home-based biological sample collection kits

- 3.5.1.2 Digital health platforms enabling remote sample tracking

- 3.5.1.3 Patient-friendly self-collection and minimally invasive kits

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-powered sample quality monitoring and predictive analytics

- 3.5.2.2 Wearable and connected sample collection devices

- 3.5.2.3 Smart kits with adaptive stabilization and preservation features

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Integration of AI, digital health, and connected diagnostics

- 3.9.2 Expansion of home-based and self-collection testing solutions

- 3.9.3 Growth in emerging markets with enhanced healthcare infrastructure

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Blood collection kits

- 5.3 Urine collection kits

- 5.4 Swabs

- 5.4.1 Nasopharyngeal (NP) swabs

- 5.4.2 Oropharyngeal (OP) swabs

- 5.4.3 Nasal swabs

- 5.5 Viral transport media

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostics

- 6.3 Research

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Diagnostic centers

- 7.4 Homecare

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Altona Diagnostics

- 9.3 Becton, Dickinson and Company (BD)

- 9.4 CTK Biotech

- 9.5 Hardy Diagnostics

- 9.6 HiMedia Laboratories

- 9.7 Labcorp

- 9.8 Lucence Health

- 9.9 Miraclean Technology

- 9.10 Puritan Medical

- 9.11 QIAGEN

- 9.12 Roche

- 9.13 Seegene

- 9.14 Thermo Fisher Scientific

- 9.15 VIRCELL MEDICAL