|

市場調查報告書

商品編碼

1892898

分析儀器市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Analytical Instrumentation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

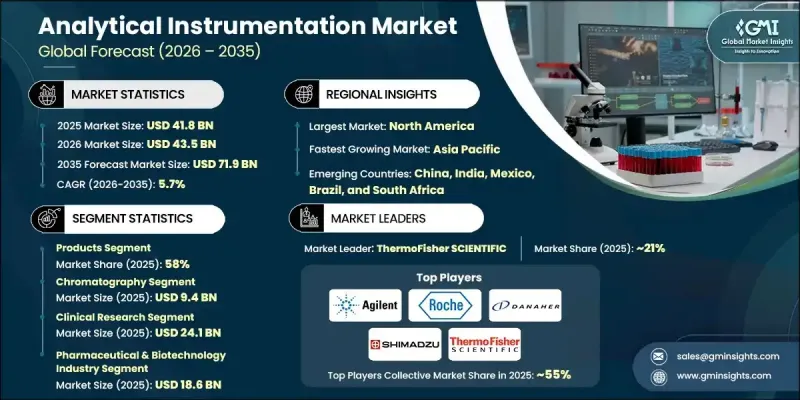

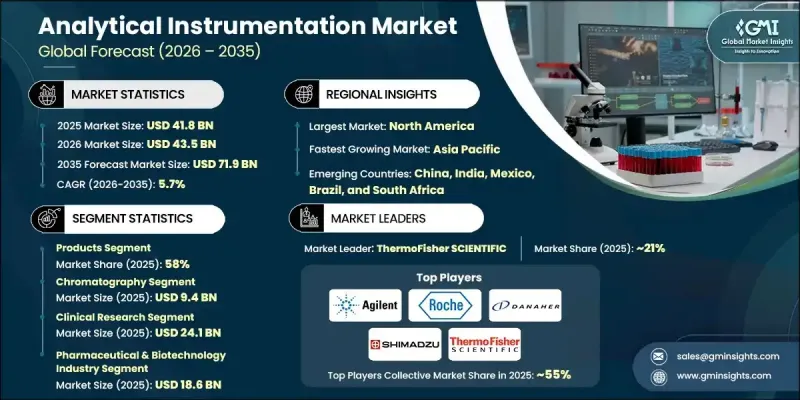

2025年全球分析儀器市場價值為418億美元,預計到2035年將以5.7%的複合年成長率成長至719億美元。

製藥和生物技術領域研發投入的增加、精準醫療分析系統應用的日益普及、慢性病和傳染病的日益流行,以及監管機構對已驗證分析方案的合規性要求,共同推動了分析儀器的發展。分析儀器使實驗室能夠提供高精度測量、即時監測和進階資料分析,從而支持實證臨床決策和最佳化治療策略。臨床、參考和研究實驗室對高通量、高靈敏度檢測的需求不斷成長,進一步加速了這些系統的應用。這些系統對於雜質分析、生物製劑特性、批次放行和穩定性測試至關重要。這些儀器使科學家和臨床醫生能夠以無與倫比的精度分析樣本的化學、物理和分子特性,使其在醫療保健、製藥和工業應用領域發揮關鍵作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 418億美元 |

| 預測值 | 719億美元 |

| 複合年成長率 | 5.7% |

到2025年,產品板塊佔據58%的市場佔有率,這主要得益於醫藥研發、診斷和工業檢測領域對先進儀器的強勁需求。持續的技術創新以及對精準、高通量分析工具日益成長的需求進一步鞏固了這個市場主導地位。

由於色譜技術能夠精確分離、鑑定和定量複雜的化學混合物,預計到2025年,該領域將創造94億美元的產值。實驗室高度依賴色譜技術進行品質控制、配方開發、穩定性測試和雜質分析,這鞏固了其在研發密集型工作流程中的核心地位。

2025年,美國分析儀器市場規模達到146億美元,預計2035年將以5.8%的複合年成長率成長。這一領先地位源於成熟的製藥、生物技術和臨床診斷生態系統、先進的實驗室基礎設施以及嚴格的監管要求。 FDA、USP、CDC和CMS/CLIA等機構對藥物研發、生物製品生產和臨床診斷實施嚴格的分析驗證,從而推動了對高精度儀器的持續需求,包括色譜儀、光譜儀、質譜儀、分子分析平台和顆粒表徵工具等,這些儀器廣泛應用於研究、品質控制和臨床實驗室。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 製藥業和政府研究機構的研發支出不斷增加

- 分析儀器的技術進步

- 分析儀器在精準醫療應用的應用日益廣泛

- 慢性病和傳染病日益普遍,需要準確的檢測。

- 監管合規性推動了經驗證的分析系統的應用

- 分子診斷和基於PCR的早期檢測平台的擴展

- 產業陷阱與挑戰

- 儀器成本高昂

- 缺乏熟練專業人員

- 市場機遇

- 即時檢測的成長

- 藥物發現和開發活動激增

- 成長促進因素

- 成長潛力分析

- 價值鏈分析

- 管道分析

- 2025年各地區定價分析

- 2022-2035年銷售分析

- 未來市場趨勢

- 監管環境

- 技術格局

- 目前技術

- 新興技術

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品與服務分類,2022-2035年

- 產品

- 色譜儀器

- 光譜儀

- 分子分析儀器

- 粒子計數器和分析器

- 電化學分析儀

- 其他產品

- 服務和耗材

第6章:市場估算與預測:依技術分類,2022-2035年

- 色譜法

- 液相層析法

- 氣相層析法

- 離子色譜法

- 光譜學

- 聚合酶鍊式反應

- 顆粒分析

- 其他技術

第7章:市場估計與預測:依應用領域分類,2022-2035年

- 臨床研究

- 臨床診斷

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 製藥和生物技術產業

- 研究和學術機構

- 診斷中心

- 其他最終用途

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 波蘭

- 瑞典

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 泰國

- 印尼

- 菲律賓

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 土耳其

- 伊朗

第10章:公司簡介

- Agilent

- Avantor

- BIO RAD

- BRUKER

- Danaher

- Eppendorf

- HITACHI

- Illumina

- Malvern Panalytical (Spectris)

- METTLER TOLEDO

- Metrohm AG

- Revvity

- Roche

- SARTORIUS

- SHIMADZU

- ThermoFisher SCIENTIFIC

- Waters

- ZEISS

The Global Analytical Instrumentation Market was valued at USD 41.8 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 71.9 billion by 2035.

The growth is fueled by increased R&D investments in the pharmaceutical and biotech sectors, rising adoption of analytical systems for precision medicine, the growing prevalence of chronic and infectious diseases, and regulatory mandates driving compliance with validated analytical protocols. Analytical instrumentation enables laboratories to deliver highly accurate measurements, real-time monitoring, and advanced data analytics, supporting evidence-based clinical decision-making and optimized treatment strategies. The rising demand for high-throughput, sensitive testing in clinical, reference, and research laboratories is further accelerating the adoption of these systems, which are essential for impurity profiling, biologics characterization, batch release, and stability testing. These instruments allow scientists and clinicians to analyze chemical, physical, and molecular properties of samples with unmatched precision, making them critical across healthcare, pharmaceutical, and industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $41.8 Billion |

| Forecast Value | $71.9 Billion |

| CAGR | 5.7% |

The products segment held 58% share in 2025, driven by strong demand for advanced instruments in pharmaceutical R&D, diagnostics, and industrial testing. This dominance is reinforced by continuous technological innovation and the growing need for precise, high-throughput analytical tools.

The chromatography segment generated USD 9.4 billion in 2025, due to its ability to separate, identify, and quantify complex chemical mixtures accurately. Laboratories heavily rely on chromatography for quality control, formulation development, stability testing, and impurity profiling, solidifying its central role in research-intensive workflows.

U.S. Analytical Instrumentation Market reached USD 14.6 billion in 2025 and is expected to grow at a CAGR of 5.8% through 2035. This leadership stems from a mature pharmaceutical, biotechnology, and clinical diagnostics ecosystem, advanced laboratory infrastructure, and stringent regulatory requirements. Agencies such as the FDA, USP, CDC, and CMS/CLIA enforce rigorous analytical validation for drug development, biologics manufacturing, and clinical diagnostics, driving sustained demand for high-precision instruments, including chromatography, spectroscopy, mass spectrometry, molecular analysis platforms, and particle characterization tools across research, quality control, and clinical laboratories.

Key players in the Global Analytical Instrumentation Market include Bruker, Waters, Eppendorf, Agilent, Illumina, Avantor, Revvity, Shimadzu, METTLER TOLEDO, Bio-Rad, Malvern Panalytical (Spectris), Roche, Sartorius, Hitachi, ThermoFisher Scientific, Metrohm AG, Zeiss, and Danaher. To strengthen their Analytical Instrumentation Market position, companies are focusing on product innovation, expanding instrument portfolios, and integrating advanced technologies such as AI, IoT, and automation into their analytical platforms. Strategic collaborations with pharmaceutical, biotech, and research institutions help accelerate the adoption of cutting-edge systems. Firms are investing in digital services, predictive maintenance, and cloud-enabled analytics to improve workflow efficiency and uptime. Global expansion into emerging markets, targeted marketing campaigns, and customized solutions for clinical, industrial, and research applications further reinforce brand presence and foster long-term client relationships.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product & services trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising R&D spending by the pharmaceutical industry and government research organizations

- 3.2.1.2 Technological advancements in analytical instruments

- 3.2.1.3 Increasing adoption of analytical instrumentation for precision medicine applications

- 3.2.1.4 Growing prevalence of chronic and infectious diseases requiring accurate testing

- 3.2.1.5 Regulatory compliance driving adoption of validated analytical systems

- 3.2.1.6 Expansion of molecular diagnostics and PCR-based platforms for early detection

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of instruments

- 3.2.2.2 Lack of skilled professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in point-of-care testing

- 3.2.3.2 Surge in drug discovery and development activities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Value chain analysis

- 3.5 Pipeline analysis

- 3.6 Pricing analysis, by region, 2025

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Volume analysis, 2022 - 2035

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 MEA

- 3.8 Future market trends

- 3.9 Regulatory landscape

- 3.10 Technology landscape

- 3.10.1 Current technologies

- 3.10.2 Emerging technologies

- 3.11 Gap analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product & Services, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Products

- 5.2.1 Chromatography instruments

- 5.2.2 Spectroscopy instruments

- 5.2.3 Molecular analysis instruments

- 5.2.4 Particle counters and analyzers

- 5.2.5 Electrochemical analysis instruments

- 5.2.6 Other products

- 5.3 Services & consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Chromatography

- 6.2.1 Liquid chromatography

- 6.2.2 Gas chromatography

- 6.2.3 Ion chromatography

- 6.3 Spectroscopy

- 6.4 Polymerase chain reaction

- 6.5 Particle analysis

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Clinical research

- 7.3 Clinical diagnostics

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical & biotechnology industry

- 8.3 Research and academic institutes

- 8.4 Diagnostic centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Poland

- 9.3.7 Sweden

- 9.3.8 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Thailand

- 9.4.7 Indonesia

- 9.4.8 Philippines

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.5.5 Chile

- 9.5.6 Peru

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Israel

- 9.6.5 Turkey

- 9.6.6 Iran

Chapter 10 Company Profiles

- 10.1 Agilent

- 10.2 Avantor

- 10.3 BIO RAD

- 10.4 BRUKER

- 10.5 Danaher

- 10.6 Eppendorf

- 10.7 HITACHI

- 10.8 Illumina

- 10.9 Malvern Panalytical (Spectris)

- 10.10 METTLER TOLEDO

- 10.11 Metrohm AG

- 10.12 Revvity

- 10.13 Roche

- 10.14 SARTORIUS

- 10.15 SHIMADZU

- 10.16 ThermoFisher SCIENTIFIC

- 10.17 Waters

- 10.18 ZEISS