|

市場調查報告書

商品編碼

1892896

門診腫瘤輸液市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Outpatient Oncology Infusion Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

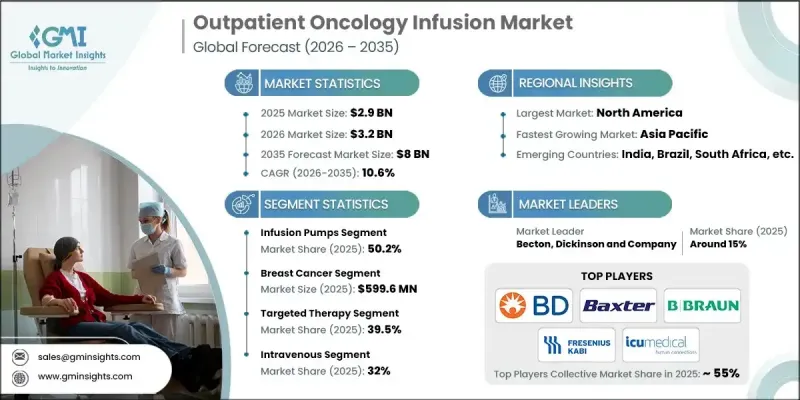

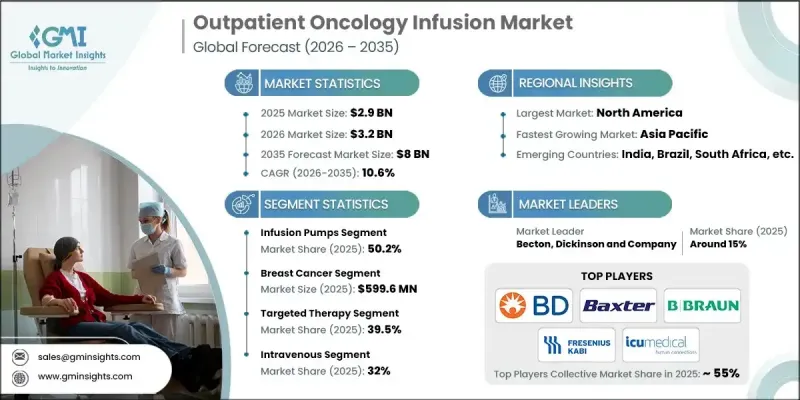

2025 年全球門診腫瘤輸液市場價值為 29 億美元,預計到 2035 年將以 10.6% 的複合年成長率成長至 80 億美元。

市場擴張的促進因素包括:人們對經濟實惠的門診治療的需求日益成長、癌症發病率上升、政府推行癌症宣傳舉措以及輸液技術的進步。標靶治療和免疫療法的日益普及、以價值為導向的醫療模式的轉變以及遠距醫療輔助輸液服務的興起,進一步推動了市場需求。生活方式因素、肥胖和環境影響導致癌症病例不斷增加,加劇了對有效且便捷治療的需求。與住院治療相比,門診輸液中心為患者提供更方便且有效率的治療模式,同時降低整體成本。此外,先進的智慧輸液幫浦整合了自動給藥、錯誤警報和電子健康記錄 (EHR) 相容性等功能,提高了安全性和操作效率,進一步增強了門診腫瘤輸液服務在全球範圍內的吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 29億美元 |

| 預測值 | 80億美元 |

| 複合年成長率 | 10.6% |

到2025年,輸液幫浦市佔率將達到50.2%。這些設備採用攜帶式設計,並整合了智慧系統,能夠提升患者舒適度,實現靈活的給藥方式,並支援精準給藥。輸液幫浦技術的進步是門診輸液服務發展的關鍵。

到2025年,標靶治療市佔率將達到39.5%。這類療法作用於與癌症相關的特定分子通路,並透過可控輸注給藥。門診輸注中心是此類療法的首選給藥地點,因此需要先進的輸注設備和熟練的醫護人員來監測精確的劑量和患者的反應。

北美門診腫瘤輸液市場在2025年佔據43.1%的市場佔有率,預計未來將顯著成長。該地區受益於先進的醫療基礎設施、龐大的癌症患者群體以及創新輸液技術的廣泛應用。全面的保險覆蓋和以價值為導向的醫療模式的轉變,使得患者能夠以比住院治療更低的成本獲得門診癌症治療。智慧輸液幫浦和整合電子病歷系統在門診中心的應用,提高了病患安全性和營運效率,進一步推動了市場成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 全球癌症發生率不斷上升

- 人們越來越傾向選擇經濟實惠的門診服務

- 輸液幫浦的技術進步

- 政府加大力度提高癌症防治意識

- 產業陷阱與挑戰

- 癌症治療費用高昂

- 機會

- 採用具有電子健康記錄互通性的智慧型輸液泵

- 開發生物相似藥以降低治療成本

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價值鏈分析

- 報銷方案

- 政策環境

- 流行病學情景

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 點滴幫浦

- 靜脈輸液裝置

- 靜脈導管

- 無針頭連接器

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 肺癌

- 肝癌

- 乳癌

- 攝護腺癌

- 其他癌症

第7章:市場估計與預測:依療法分類,2021-2034年

- 化療

- 標靶治療

- 免疫療法

- 荷爾蒙療法

第8章:市場估算與預測:依模式分類,2021-2034年

- 肌肉內注射(IM)

- 靜脈注射(IV)

- 皮下

- 其他模式

第9章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

第10章:公司簡介

- B. Braun

- Baxter

- Becton, Dickinson and Company

- Fresenius Kabi

- ICU Medical

- IRADIMED

- Medtronic

- Micrel

- MOOG

- NIPRO

- Penlon

- Teleflex

- Terumo

The Global Outpatient Oncology Infusion Market was valued at USD 2.9 billion in 2025 and is estimated to grow at a CAGR of 10.6% to reach USD 8 billion by 2035.

The market expansion is fueled by increasing preference for cost-efficient outpatient care, rising cancer prevalence, government initiatives promoting cancer awareness, and advancements in infusion technologies. Rising adoption of targeted therapies and immunotherapies, the shift toward value-based care, and telehealth-assisted infusion services are further driving demand. Lifestyle factors, obesity, and environmental influences contribute to the growing number of cancer cases, increasing the need for effective and accessible treatments. Outpatient infusion centers provide patients with a more convenient and efficient treatment model while reducing overall costs compared to hospitalization. Additionally, the integration of advanced smart infusion pumps with automated dosing, error alerts, and electronic health record (EHR) compatibility has enhanced both safety and operational efficiency, strengthening the appeal of outpatient oncology infusion services worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.9 Billion |

| Forecast Value | $8 Billion |

| CAGR | 10.6% |

The infusion pumps segment held a 50.2% share in 2025. These devices, featuring portable designs and smart system integration, enhance patient comfort, allow flexible administration, and support precise dosing. Technological improvements in pumps are central to the growth of outpatient infusion services.

The targeted therapy segment accounted for a 39.5% share in 2025. These therapies act on specific molecular pathways linked to cancer and delivered through controlled infusion. Outpatient infusion centers are preferred for their administration, driving the need for advanced infusion devices and skilled personnel to monitor accurate dosing and patient response.

North America Outpatient Oncology Infusion Market held 43.1% share in 2025 and is expected to grow significantly. The region benefits from advanced healthcare infrastructure, a high number of cancer patients, and strong adoption of innovative infusion technologies. Comprehensive insurance coverage and the shift toward value-based care allow patients to access outpatient cancer treatments more affordably than in hospital settings. Adoption of smart infusion pumps and integrated EHR systems in outpatient centers enhances patient safety and operational workflow, further boosting market growth.

Key companies operating in the Global Outpatient Oncology Infusion Market include B. Braun, Baxter, Fresenius Kabi, Medtronic, MOOG, IRADIMED, Micrel, NIPRO, Teleflex, Terumo, ICU Medical, Penlon, and Becton, Dickinson and Company. Companies in the Global Outpatient Oncology Infusion Market focus on strategies such as continuous product innovation in smart infusion pumps, integration of digital health platforms, and development of user-friendly, portable devices to improve patient outcomes. Expansion into new geographic regions and partnerships with healthcare providers enhance market reach. Firms also invest in training programs for clinical staff to ensure accurate administration of therapies. Additionally, collaborations with telehealth services, EHR integration, and value-based care initiatives strengthen operational efficiency, patient safety, and long-term adoption, helping companies solidify their market foothold and maintain leadership in a competitive environment.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Therapy trends

- 2.2.5 Mode trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cancer across the globe

- 3.2.1.2 Increasing preference for cost-effective outpatient care

- 3.2.1.3 Technological advancements in infusion pumps

- 3.2.1.4 Surging government initiatives for cancer awareness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of cancer therapies

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of smart infusion pumps with EHR interoperability

- 3.2.3.2 Development of biosimilars to reduce treatment costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Reimbursement scenario

- 3.8 Policy landscape

- 3.9 Epidemiology scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

- 3.13 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Infusion pumps

- 5.3 Intravenous sets

- 5.4 IV cannulas

- 5.5 Needleless connectors

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lung cancer

- 6.3 Liver cancer

- 6.4 Breast cancer

- 6.5 Prostate cancer

- 6.6 Other cancers

Chapter 7 Market Estimates and Forecast, By Therapy, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chemotherapy

- 7.3 Targeted therapy

- 7.4 Immunotherapy

- 7.5 Hormonal therapy

Chapter 8 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Intramuscular (IM)

- 8.3 Intravenous (IV)

- 8.4 Subcutaneous

- 8.5 Other modes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Nigeria

- 9.6.5 Egypt

Chapter 10 Company Profiles

- 10.1 B. Braun

- 10.2 Baxter

- 10.3 Becton, Dickinson and Company

- 10.4 Fresenius Kabi

- 10.5 ICU Medical

- 10.6 IRADIMED

- 10.7 Medtronic

- 10.8 Micrel

- 10.9 MOOG

- 10.10 NIPRO

- 10.11 Penlon

- 10.12 Teleflex

- 10.13 Terumo