|

市場調查報告書

商品編碼

1892895

心臟消融市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Cardiac Ablation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

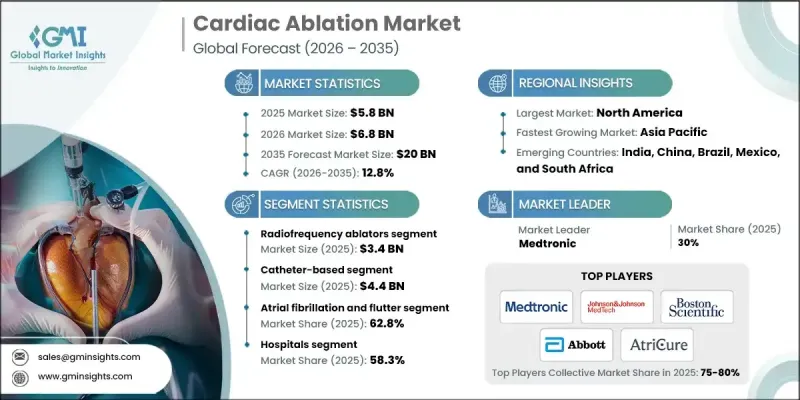

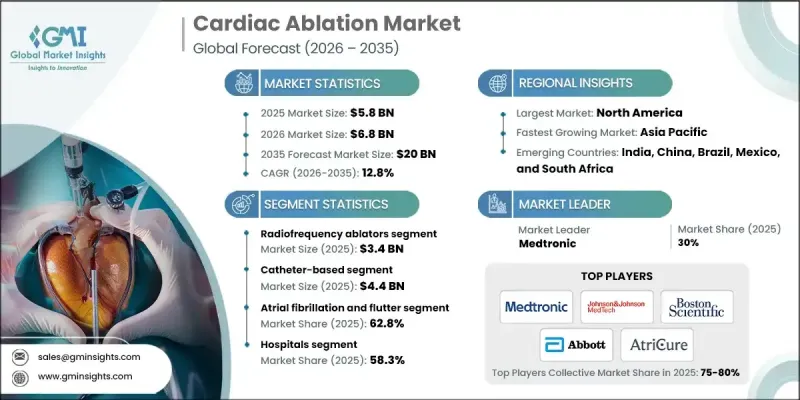

2025 年全球心臟消融市場價值為 58 億美元,預計到 2035 年將以 12.8% 的複合年成長率成長至 200 億美元。

心血管疾病(尤其是心律不整)發生率的上升,以及對微創手術和消融技術創新日益成長的需求,推動了心臟消融市場的擴張。人口老化加劇、生活方式的改變以及糖尿病和高血壓等合併症發病率的上升,都加劇了心律不整病例的激增。患者往往需要傳統藥物治療以外的干涉措施,因此心臟消融術成為至關重要的解決方案。這些手術能夠有效長期控制心律不整,減少住院次數,並提升病患的生活品質。隨著醫療系統致力於降低死亡率和控制慢性心臟疾病,先進的消融技術在全球範圍內廣泛應用,推動了市場的發展。微創手術的普及是推動心臟消融市場發展的重要因素。與傳統開胸手術相比,這些技術能夠減少手術創傷、縮短住院時間、加快康復速度並降低併發症發生率。基於導管的射頻消融和冷凍消融術在提供有效治療的同時,最大限度地減少了患者的不適感,並改善了患者的預後。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 58億美元 |

| 預測值 | 200億美元 |

| 複合年成長率 | 12.8% |

射頻消融器市場預計在2025年達到34億美元,佔58.1%的市場。這類設備透過向心肌組織輸送可控熱量來治療心律不整,形成微小的病灶,阻斷異常電訊號,進而恢復正常心律。由於其臨床療效顯著,射頻消融術被廣泛認為是心律不整治療的黃金標準。

預計到2025年,導管消融術市場規模將達44億美元。導管消融術使用細而柔軟的導管經血管插入心臟,將能量輸送至致心律不整組織。這種微創方法可減少患者創傷、縮短復原時間並減少住院時間。心房顫動盛行率的上升以及患者對微創手術的日益青睞,使得導管消融術成為全球主要的治療方法。

2025年,美國心臟消融市場規模預計將達23億美元,反映了心血管疾病的高發生率。憑藉先進的醫療基礎設施、龐大的手術量以及對創新解決方案的持續投入,美國在消融技術的應用和發展方面處於領先地位。先進的消融系統能夠提供精準的治療、更高的成功率和更低的併發症發生率,進而推動市場成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 患有心血管疾病(包括心律不整)的患者人數不斷增加

- 對微創手術的需求不斷成長

- 心臟消融裝置的技術進步

- 產業陷阱與挑戰

- 心臟消融手術風險較高

- 嚴格的監管環境

- 市場機遇

- 脈衝場消融術的應用日益廣泛

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 2024年定價分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2022-2035年

- 射頻消融器

- 電消融器

- 冷凍消融裝置

- 超音波消融器

- 其他產品

第6章:市場估算與預測:依方法分類,2022-2035年

- 基於導管的

- 開放式/外科手術

第7章:市場估計與預測:依應用領域分類,2022-2035年

- 心房顫動和撲動

- 心跳過速

- 房性心搏過速

- 室性心搏過速

- 其他心跳過速

- 其他應用

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 醫院

- 門診手術中心

- 心臟中心

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott Laboratories

- AngioDynamics

- AtriCure

- Biotronik

- Boston Scientific

- CardioFocus

- Japan Lifeline

- Johnson & Johnson MedTech

- Koninklijke Philips

- Medtronic

- MicroPort Scientific

- Olympus

- Osypka Medical

The Global Cardiac Ablation Market was valued at USD 5.8 billion in 2025 and is estimated to grow at a CAGR of 12.8% to reach USD 20 billion by 2035.

This market expansion is fueled by the rising prevalence of cardiovascular diseases, particularly cardiac arrhythmias, along with the increasing demand for minimally invasive procedures and innovations in ablation technologies. The growing aging population, lifestyle changes, and higher incidence of comorbidities such as diabetes and hypertension are contributing to the surge in arrhythmia cases. Patients often require interventions beyond conventional drug therapies, making cardiac ablation a critical solution. These procedures provide effective long-term management of arrhythmias, reducing hospital admissions and enhancing quality of life. As healthcare systems focus on lowering mortality and managing chronic cardiac conditions, advanced ablation technologies are gaining traction worldwide, driving the market. The adoption of minimally invasive procedures is a significant factor propelling the cardiac ablation market. These techniques offer reduced surgical trauma, shorter hospital stays, faster recovery, and lower complication rates compared to traditional open-heart surgery. Catheter-based radiofrequency and cryoablation procedures provide effective treatment while minimizing discomfort and improving patient outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.8 Billion |

| Forecast Value | $20 Billion |

| CAGR | 12.8% |

The radiofrequency ablators segment accounted for USD 3.4 billion in 2025, holding a 58.1% share. These devices treat arrhythmias by delivering controlled heat to cardiac tissue, creating small lesions that block abnormal electrical signals and restore normal heart rhythm. RF ablation is widely regarded as the gold standard in arrhythmia therapy due to its proven clinical success.

The catheter-based segment reached USD 4.4 billion in 2025. Catheter-based ablation uses thin, flexible tubes inserted through blood vessels to access the heart and deliver energy to arrhythmogenic tissue. This minimally invasive approach reduces patient trauma, shortens recovery, and lowers hospital stays. Rising atrial fibrillation prevalence and growing preference for minimally invasive interventions have made catheter-based ablation the dominant treatment method globally.

U.S. Cardiac Ablation Market was valued at USD 2.3 billion in 2025, reflecting the high prevalence of cardiovascular diseases. The country leads in the adoption and development of ablation technologies due to its advanced healthcare infrastructure, high procedural volumes, and continuous investment in innovative solutions. Advanced ablation systems provide precise treatment, high success rates, and reduced complications, reinforcing market growth.

Key players in the Cardiac Ablation Market include Medtronic, Boston Scientific, Abbott Laboratories, Olympus, Japan Lifeline, AtriCure, Biotronik, Johnson & Johnson MedTech, Koninklijke Philips, MicroPort Scientific, CardioFocus, Osypka Medical, and AngioDynamics. Companies in the Cardiac Ablation Market are adopting multiple strategies to strengthen their market position. They are heavily investing in research and development to introduce innovative and high-precision ablation devices. Strategic partnerships, collaborations, and mergers are being pursued to expand global reach and enhance technology portfolios. Geographic expansion into emerging markets is a key focus to capture rising demand. Firms are also emphasizing product differentiation through advanced catheter designs, energy modalities, and software integration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Approach trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of patients suffering from cardiovascular diseases including cardiac arrhythmias

- 3.2.1.2 Rising demand for minimally invasive procedures

- 3.2.1.3 Technological advancements in cardiac ablation devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk associated with cardiac ablation procedures

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption of pulsed field ablation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Radiofrequency ablators

- 5.3 Electrical ablators

- 5.4 Cryoablation devices

- 5.5 Ultrasound ablators

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Approach, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Catheter-based

- 6.3 Open/Surgical

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Atrial Fibrillation and flutter

- 7.3 Tachycardia

- 7.3.1 Atrial tachycardia

- 7.3.2 Ventricular tachyarrhythmias

- 7.3.3 Other tachycardia

- 7.4 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Cardiac centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 AngioDynamics

- 10.3 AtriCure

- 10.4 Biotronik

- 10.5 Boston Scientific

- 10.6 CardioFocus

- 10.7 Japan Lifeline

- 10.8 Johnson & Johnson MedTech

- 10.9 Koninklijke Philips

- 10.10 Medtronic

- 10.11 MicroPort Scientific

- 10.12 Olympus

- 10.13 Osypka Medical