|

市場調查報告書

商品編碼

1892889

抗菌玻璃市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Antibacterial Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

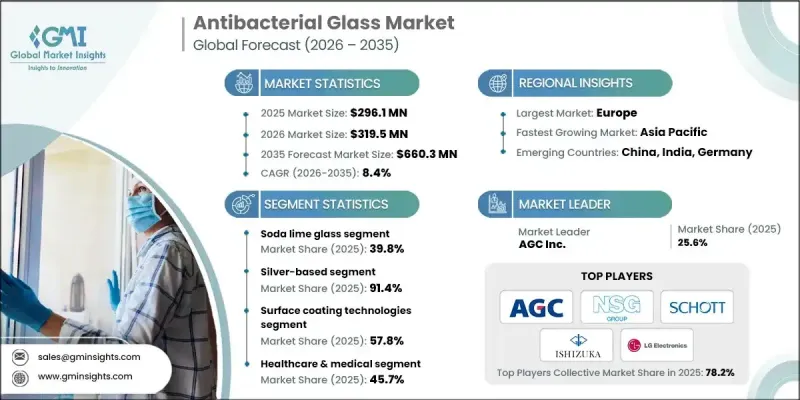

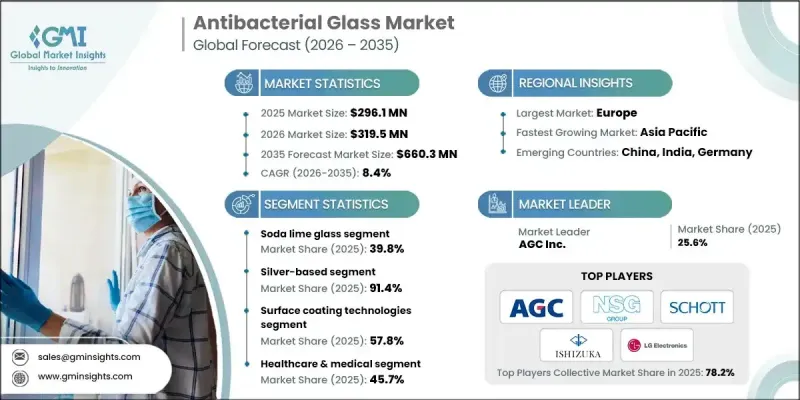

2025 年全球抗菌玻璃市場價值為 2.961 億美元,預計到 2035 年將以 8.4% 的複合年成長率成長至 6.603 億美元。

隨著醫療保健、消費性電子和商業應用等各行業日益重視以衛生為中心的解決方案,市場正經歷強勁成長。各公司正投資創新產品,推動高效能、高附加價值產品的開發。硼矽酸鹽玻璃因其卓越的耐熱性和耐化學性,預計將持續成長,非常適合實驗室和食品接觸應用。銀基抗菌產品因其對多種微生物的有效性和持久的抗菌性能而繼續佔據主導地位。同時,銅基、鋅基和鈦基抗菌產品正作為環保、速效和紫外線活化的替代方案嶄露頭角。北美地區由於醫院和實驗室衛生意識的提高而引領市場應用,而歐洲,尤其是德國,正在將抗菌玻璃應用於建築、交通和工業領域。快速的城市化和不斷成長的醫療保健投資推動了亞太地區的顯著成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 2.961億美元 |

| 預測值 | 6.603億美元 |

| 複合年成長率 | 8.4% |

2025年,鈉鈣玻璃市佔率為39.8%,預計到2035年將以7%的複合年成長率成長。這種玻璃經濟實惠、供應充足,常用於公共場所和家庭應用。硼矽酸鹽玻璃具有更強的耐熱性和耐化學性,正在逐步蠶食先前由鈉鈣玻璃主導的市場,尤其是在實驗室、製藥和食品接觸應用領域。

2025年,銀基抗菌玻璃市佔率達到91.4%,預計到2035年將以8.2%的複合年成長率成長。銀因其能夠去活化多種病原體,仍是應用最廣泛的抗菌劑。它與不同類型的玻璃具有良好的相容性,並廣泛應用於醫院、大型公共設施和電子產品製造領域。

預計到2025年,北美抗菌玻璃市佔率將達到28.1%,這主要得益於醫療基礎設施的進步、日益嚴格的衛生法規以及抗菌技術在醫療、消費性電子和建築領域的應用日益廣泛。醫院、研究實驗室和公共設施擴大使用抗菌玻璃,以最大限度地降低感染風險並確保符合衛生標準。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 醫療保健和公共場所對以衛生為中心的解決方案的需求不斷成長。

- 在消費性電子產品和高頻接觸的家居表面中的應用日益廣泛。

- 提高食品飲料產業對污染風險的認知。

- 產業陷阱與挑戰

- 高昂的製造成本限制了其在價格敏感型市場的普及。

- 在不影響玻璃品質的前提下,將抗菌性能融入玻璃的技術有其限制。

- 不同地區的監管和安全合規要求。

- 市場機遇

- 開發創新塗層和基於奈米技術的抗菌解決方案。

- 隨著新興市場衛生意識的提高,業務正在擴張。

- 汽車、交通運輸和工業應用領域的需求不斷成長。

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按玻璃類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依玻璃類型分類,2022-2035年

- 鈉鈣玻璃

- 硼矽酸鹽玻璃

- 鋁矽酸鹽玻璃

- 玻璃陶瓷

- 生物活性玻璃

- 特殊塗層浮法玻璃

第6章:市場估算與預測:依抗菌劑類型分類,2022-2035年

- 表面塗層技術

- 溶膠-凝膠塗層法

- 噴塗/浸塗法

- 物理氣相沉積(PVD)/化學電鍍

- 高溫嵌入/高溫嵌入

- 光催化在線塗層

- 批量整合技術

- 傳統熔融/添加劑摻入

- 離子交換法

- 化學強化與抗菌劑的融合

- 混合/先進技術

- 玻璃陶瓷形成

- 奈米顆粒/奈米技術整合

第7章:市場估算與預測:依製造技術分類,2022-2035年

- 銀基抗菌玻璃

- 銅基抗菌玻璃

- 鋅基抗菌玻璃

- 鈦基(TiO2/光催化)抗菌玻璃

- 多離子組合抗菌玻璃

第8章:市場估算與預測:依應用領域分類,2022-2035年

- 醫療保健

- 食品和飲料

- 消費性電子產品

- 建築與施工

- 交通運輸與汽車

- 軍事與國防

- 住宅/家庭

- 實驗室與研究

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- AGC Inc.

- AGI Glaspac

- Fuyao Glass Industry Group Co., Ltd.

- HMI Glass

- Ishizuka Glass Co., Ltd.

- LC Corporations

- Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington)

- Saint-Gobain

- Schott AG

- Xinyi Glass Holdings Limited

The Global Antibacterial Glass Market was valued at USD 296.1 million in 2025 and is estimated to grow at a CAGR of 8.4% to reach USD 660.3 million by 2035.

The market is experiencing strong growth as industries increasingly prioritize hygiene-focused solutions across healthcare, consumer electronics, and commercial applications. Companies are investing in innovative offerings, driving the development of high-performance, value-added products. Borosilicate glass is expected to see sustained growth due to its superior thermal and chemical resistance, making it highly suitable for laboratories and food-contact applications. Silver-based antimicrobial products continue to dominate due to their proven effectiveness against a broad spectrum of microorganisms and long-lasting performance. Meanwhile, copper, zinc, and titanium-based antimicrobial products are emerging as eco-friendly, fast-acting, and UV-activated alternatives. North America leads adoption due to heightened hygiene awareness in hospitals and laboratories, while Europe, particularly Germany, is integrating antibacterial glass into construction, transportation, and industrial sectors. Rapid urbanization and growing healthcare investments have driven remarkable growth in the Asia Pacific region.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $296.1 Million |

| Forecast Value | $660.3 Million |

| CAGR | 8.4% |

The soda lime glass segment held a 39.8% share in 2025 and is anticipated to grow at a CAGR of 7% by 2035. This type of glass is cost-effective, widely available, and commonly used for public spaces and household applications. Borosilicate glass, with enhanced thermal and chemical resistance, is gradually capturing markets previously dominated by soda lime glass, particularly in laboratories, pharmaceuticals, and food-contact applications.

The silver-based antibacterial glass segment accounted for a 91.4% share in 2025 and is expected to grow at a CAGR of 8.2% through 2035. Silver remains the most widely used antimicrobial agent due to its ability to inactivate a wide variety of pathogens. It is highly compatible with different glass types and finds extensive use in hospitals, large public facilities, and electronic product manufacturing.

North America Antibacterial Glass Market held a 28.1% share in 2025, driven by advancements in healthcare infrastructure, stringent hygiene regulations, and rising adoption of antimicrobial technology across medical, consumer electronics, and building sectors. Hospitals, research laboratories, and public facilities increasingly use antibacterial glass to minimize infection risks and ensure hygiene compliance.

Leading players in the Global Antibacterial Glass Market include AGC Inc., AGI Glaspac, Fuyao Glass Industry Group Co., Ltd., HMI Glass, Ishizuka Glass Co., Ltd., LC Corporations, Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington), Saint Gobain, Schott AG, and Xinyi Glass Holdings Limited. Companies in the Global Antibacterial Glass Market strengthen their position by focusing on product innovation and R&D to develop high-performance, durable, and eco-friendly glass products. They invest in advanced coating technologies, expand regional manufacturing capabilities, and form strategic partnerships to enhance distribution networks. Regulatory compliance, brand differentiation, and marketing of superior antimicrobial solutions help attract institutional and consumer clients. Firms also adopt cost optimization and sustainability initiatives, while targeting high-growth regions through localized operations to maintain a competitive edge and increase market penetration globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Glass type

- 2.2.3 Antimicrobial agent

- 2.2.4 Manufacturing technology

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for hygiene-focused solutions in healthcare and public spaces.

- 3.2.1.2 Growing use in consumer electronics and high-touch household surfaces.

- 3.2.1.3 Increasing awareness of contamination risks in food and beverage industries.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs limiting adoption in price-sensitive markets.

- 3.2.2.2 Technical limitations in integrating antimicrobial properties without affecting glass quality.

- 3.2.2.3 Regulatory and safety compliance requirements across different regions.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of innovative coatings and nanotechnology-based antimicrobial solutions.

- 3.2.3.2 Expansion in emerging markets with rising hygiene awareness.

- 3.2.3.3 Growing demand in automotive, transportation, and industrial applications.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By glass type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Glass Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soda Lime Glass

- 5.3 Borosilicate Glass

- 5.4 Aluminosilicate Glass

- 5.5 Glass-Ceramic

- 5.6 Bioactive Glass

- 5.7 Specialty Coated Float Glass

Chapter 6 Market Estimates and Forecast, By Antimicrobial Agent, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Surface Coating Technologies

- 6.2.1 Sol-Gel Coating Method

- 6.2.2 Spray/Dip Coating Method

- 6.2.3 Physical Vapor Deposition (PVD)/Chemical Plating

- 6.2.4 Burn-In/High-Temperature Embedding

- 6.2.5 Photocatalytic On-Line Coating

- 6.3 Bulk Integration Technologies

- 6.3.1 Conventional Melting/Additive Incorporation

- 6.3.2 Ion-Exchange Method

- 6.3.3 Chemical Strengthening with Antimicrobial Integration

- 6.4 Hybrid/Advanced Technologies

- 6.4.1 Glass-Ceramic Formation

- 6.4.2 Nanoparticle/Nanotechnology Integration

Chapter 7 Market Estimates and Forecast, By Manufacturing Technology, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Silver-Based Antibacterial Glass

- 7.3 Copper-Based Antibacterial Glass

- 7.4 Zinc-Based Antibacterial Glass

- 7.5 Titanium-Based (TiO2/Photocatalytic) Antibacterial Glass

- 7.6 Multi-Ion Combination Antibacterial Glass

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Healthcare & Medical

- 8.3 Food & Beverage

- 8.4 Consumer Electronics

- 8.5 Building & Construction

- 8.6 Transportation & Automotive

- 8.7 Military & Defense

- 8.8 Residential/Household

- 8.9 Laboratory & Research

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 AGC Inc.

- 10.2 AGI Glaspac

- 10.3 Fuyao Glass Industry Group Co., Ltd.

- 10.4 HMI Glass

- 10.5 Ishizuka Glass Co., Ltd.

- 10.6 LC Corporations

- 10.7 Nippon Sheet Glass Co., Ltd. (NSG Group / Pilkington)

- 10.8 Saint-Gobain

- 10.9 Schott AG

- 10.10 Xinyi Glass Holdings Limited