|

市場調查報告書

商品編碼

1892886

電工鋼市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Electrical Steel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

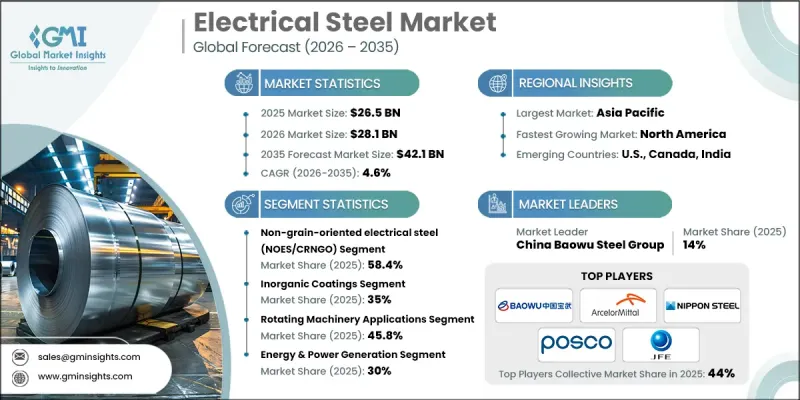

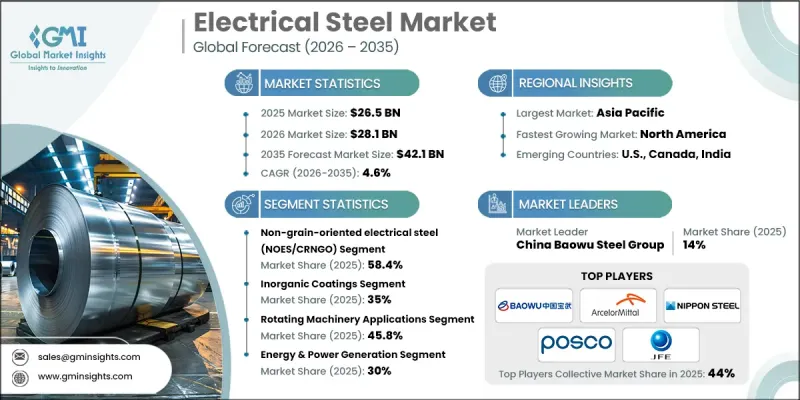

2025年全球電工鋼市場價值為265億美元,預計2035年將以4.6%的複合年成長率成長至421億美元。

電工鋼在提升馬達、變壓器和發電機的效率方面發揮著至關重要的作用,是全球電氣化和工業系統的核心組成部分。它不僅是結構鋼的供應來源,還能在汽車、電力基礎設施和工業自動化等下游領域創造顯著價值,使其成為現代經濟體的戰略材料。隨著電動車的快速普及、電網現代化項目和工業自動化的推進,市場預計將持續成長。儘管原料成本有所波動,但由於對性能的更高要求,優質電工鋼的價格預計將保持強勁。亞洲仍然是主要的需求中心,這得益於其製造中心和基礎設施的擴張;而歐洲和北美則透過電氣化措施和能源效率法規推動成長。隨著薄規格和先進等級產品的競爭優勢日益凸顯,以及對小眾電磁元件的關注度不斷提高,電工鋼市場正朝著性能驅動型生態系統發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 265億美元 |

| 預測值 | 421億美元 |

| 複合年成長率 | 4.6% |

2025年,非取向電工鋼(NOES/CRNGO)市佔率為58.4%,預計到2035年將以4.9%的複合年成長率成長。 NOES非常適合旋轉機械,包括馬達和發電機,因為它在各個方向上都能提供均勻的磁性能,這使其成為電動車和工業自動化領域不可或缺的材料,因為在這些領域,能源效率和運行速度至關重要。

2025年,無機塗料市場佔有率為35%,預計2026年至2035年將以4.6%的複合年成長率成長。無機塗料非常適合高溫絕緣應用,包括變壓器鐵芯和重型電氣設備,可降低極端條件下的層間損耗,並確保電力傳輸的可靠性。

預計到2025年,北美電工鋼市場佔有率將達到12.4%,並憑藉先進的製造能力、健全的監管框架以及對電氣化基礎設施的大量投資,迅速崛起為戰略中心。該地區注重生產節能高效的高性能電工鋼,以滿足日益嚴格的技術和環境要求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 效率法規促進了高等級產品的採用。

- 電動車的普及促進了超薄NOES的需求。

- 電網現代化擴大了對高定向能衛星的需求。

- 產業陷阱與挑戰

- 原料揮發性。

- 薄軌/HiB產能限制。

- 市場機遇

- 自黏合塗層可簡化組裝流程並提高產量。

- 資料中心 UPS/變壓器升級提高了對 GOES 高階產品的需求。

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2022-2035年

- 無取向電工鋼(NOES/CRNGO)

- 取向矽酸鹽水泥(GOES/CRGO)

- 先進軟磁材料

- 非晶態電工鋼

- 奈米晶電工鋼

- 多層複合電工鋼

第6章:市場估算與預測:依塗層類型分類,2022-2035年

- 無機塗層

- C-2 / EC-2(磨粉玻璃 - 矽酸鎂)

- C-4 / EC-4(磷酸鹽或化學處理)

- C-5 / EC-5(無機/陶瓷填充)

- 有機塗層

- C-3 / EC-3(有機清漆/瓷漆)

- C-6 / EC-6(有機物與無機填料)

- 天然氧化物塗層

- 自黏合塗層

第7章:市場估計與預測:依應用領域分類,2022-2035年

- 旋轉機械應用

- 變壓器應用

- 電力變壓器

- 配電變壓器

- 專用變壓器

- 再生能源變壓器

- 電磁元件

- 電感器和電抗器

- 鎮流器和照明

- 無線電力傳輸

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 能源與發電

- 電力公司

- 再生能源

- 傳統發電

- 儲能系統

- 汽車與運輸

- 電動車(純電動車 - BEV)

- 混合動力電動車(HEV/PHEV)

- 汽車輔助系統

- 電動車充電基礎設施

- 軌道運輸和公共交通

- 航太

- 工業製造

- 工業機械及設備

- 機器人與自動化

- 石油和天然氣設備

- 消費性電器及電子產品

- 家用電器

- 電動工具

- 消費性電子產品

- 資料中心和IT基礎設施

- UPS系統

- 資料中心變壓器

- 伺服器冷卻系統

- 暖通空調及建築系統

- 商用暖通空調系統

- 住宅暖通空調

- 電梯和電扶梯

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Nippon Steel Corporation

- JFE Steel Corporation

- ArcelorMittal SA

- POSCO (Pohang Iron & Steel Co.)

- China Baowu Steel Group

- thyssenkrupp Electrical Steel GmbH

- Cleveland-Cliffs Inc. (AK Steel)

- Tata Steel Limited

- Aperam SA

- Waelzholz Group

- Ansteel Group Corporation

- HBIS Group (Hebei Iron & Steel)

- Nucor Corporation

- Metglas Inc. (Hitachi Metals Group)

- Advanced Technology & Materials Co. Ltd. (AT&M)

The Global Electrical Steel Market was valued at USD 26.5 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 42.1 billion by 2035.

Electrical steel plays a vital role in enhancing the efficiency of motors, transformers, and generators, acting as a core component of electrification and industrial systems worldwide. It not only supplies structural steel but also drives significant downstream value in sectors such as automotive, power infrastructure, and industrial automation, positioning it as a strategic material for modern economies. The market is expected to gain momentum due to the rapid adoption of electric vehicles, grid modernization projects, and industrial automation. Premium grades are expected to maintain strong pricing due to performance demands, despite raw material cost fluctuations. Asia remains the primary demand hub, supported by manufacturing centers and infrastructure expansion, while Europe and North America drive growth through electrification initiatives and energy-efficiency regulations. The market is evolving into a performance-driven ecosystem with thin-gauge and advanced-grade products gaining competitive importance, alongside a rising focus on niche electromagnetic components.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $26.5 Billion |

| Forecast Value | $42.1 Billion |

| CAGR | 4.6% |

The non-grain-oriented electrical steel (NOES/CRNGO) segment held 58.4% share in 2025 and is expected to grow at a CAGR of 4.9% through 2035. NOES is ideal for rotating machinery, including motors and generators, as it offers uniform magnetic performance in all directions, making it essential for electric vehicles and industrial automation where energy efficiency and operational speed are critical.

The inorganic coatings segment accounted for a 35% share in 2025 and is expected to grow at a CAGR of 4.6% from 2026 to 2035. Inorganic coatings are highly suitable for high-temperature insulation applications, including transformer cores and heavy-duty electrical equipment, reducing interlaminar losses under extreme conditions and ensuring reliability in power transmission.

North America Electrical Steel Market accounted for a 12.4% share in 2025 and is rapidly emerging as a strategic hub due to advanced manufacturing capabilities, strong regulatory frameworks, and significant investments in electrification infrastructure. The region emphasizes energy-efficient, high-performance grades to meet increasingly stringent technical and environmental requirements.

Major players in the Global Electrical Steel Market include Nippon Steel Corporation, JFE Steel Corporation, ArcelorMittal S.A., POSCO (Pohang Iron & Steel Co.), China Baowu Steel Group, Thyssenkrupp Electrical Steel GmbH, Cleveland-Cliffs Inc. (AK Steel), Tata Steel Limited, Aperam S.A., Waelzholz Group, Ansteel Group Corporation, HBIS Group (Hebei Iron & Steel), Nucor Corporation, Metglas Inc. (Hitachi Metals Group), and Advanced Technology & Materials Co. Ltd. (AT&M). Companies in the Global Electrical Steel Market are strengthening their foothold by investing in R&D for advanced-grade and thin-gauge products, enabling higher efficiency and performance. Strategic partnerships with automotive and industrial manufacturers enhance integration into critical applications. Expanding production capacities in high-demand regions, adopting sustainable manufacturing practices, and leveraging digital technologies for process optimization improve operational efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Coating type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Efficiency regulations lift high-grade adoption.

- 3.2.1.2 EV proliferation boosts ultra-thin NOES demand.

- 3.2.1.3 Grid modernization expands GOES demand.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material volatility.

- 3.2.2.2 Thin gauge/HiB capacity constraints.

- 3.2.3 Market opportunities

- 3.2.3.1 Self-bonding coatings streamline assembly and improve yields.

- 3.2.3.2 Data center UPS/transformer upgrades raise premium GOES pull.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Non-grain-oriented electrical steel (NOES/CRNGO)

- 5.3 Grain-oriented electrical steel (GOES/CRGO)

- 5.4 Advanced soft magnetic materials

- 5.4.1 Amorphous electrical steel

- 5.4.2 Nanocrystalline electrical steel

- 5.4.3 Multilayer & composite electrical steel

Chapter 6 Market Estimates and Forecast, By Coating Type, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Inorganic coatings

- 6.2.1 C-2 / EC-2 (mill glass - magnesium silicate)

- 6.2.2 C-4 / EC-4 (phosphate or chemical treatment)

- 6.2.3 C-5 / EC-5 (inorganic/ceramic filled)

- 6.3 Organic coatings

- 6.3.1 C-3 / EC-3 (organic varnish/enamel)

- 6.3.2 C-6 / EC-6 (organic with inorganic fillers)

- 6.4 Natural oxide coatings

- 6.5 Self-bonding coatings

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Rotating machinery applications

- 7.3 Transformer applications

- 7.3.1 Power transformers

- 7.3.2 Distribution transformers

- 7.3.3 Specialty transformers

- 7.3.4 Renewable energy transformers

- 7.4 Electromagnetic components

- 7.4.1 Inductors & reactors

- 7.4.2 Ballasts & lighting

- 7.4.3 Wireless power transfer

Chapter 8 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Energy & power generation

- 8.2.1 Electric utilities

- 8.2.2 Renewable energy

- 8.2.3 Conventional power generation

- 8.2.4 Energy storage systems

- 8.3 Automotive & transportation

- 8.3.1 Electric vehicles (battery electric vehicles - BEV)

- 8.3.2 Hybrid electric vehicles (HEV/PHEV)

- 8.3.3 Automotive auxiliary systems

- 8.3.4 EV charging infrastructure

- 8.3.5 Rail & mass transit

- 8.3.6 Aerospace

- 8.4 Industrial manufacturing

- 8.4.1 Industrial machinery & equipment

- 8.4.2 Robotics & automation

- 8.4.3 Oil & gas equipment

- 8.5 Consumer appliances & electronics

- 8.5.1 Home appliances

- 8.5.2 Power tools

- 8.5.3 Consumer electronics

- 8.6 Data centers & IT infrastructure

- 8.6.1 UPS systems

- 8.6.2 Data center transformers

- 8.6.3 Server cooling systems

- 8.7 HVAC & building systems

- 8.7.1 Commercial HVAC systems

- 8.7.2 Residential HVAC

- 8.7.3 Elevators & escalators

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Nippon Steel Corporation

- 10.2 JFE Steel Corporation

- 10.3 ArcelorMittal S.A.

- 10.4 POSCO (Pohang Iron & Steel Co.)

- 10.5 China Baowu Steel Group

- 10.6 thyssenkrupp Electrical Steel GmbH

- 10.7 Cleveland-Cliffs Inc. (AK Steel)

- 10.8 Tata Steel Limited

- 10.9 Aperam S.A.

- 10.10 Waelzholz Group

- 10.11 Ansteel Group Corporation

- 10.12 HBIS Group (Hebei Iron & Steel)

- 10.13 Nucor Corporation

- 10.14 Metglas Inc. (Hitachi Metals Group)

- 10.15 Advanced Technology & Materials Co. Ltd. (AT&M)