|

市場調查報告書

商品編碼

1892877

汽車火星塞市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Automotive Spark Plug Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

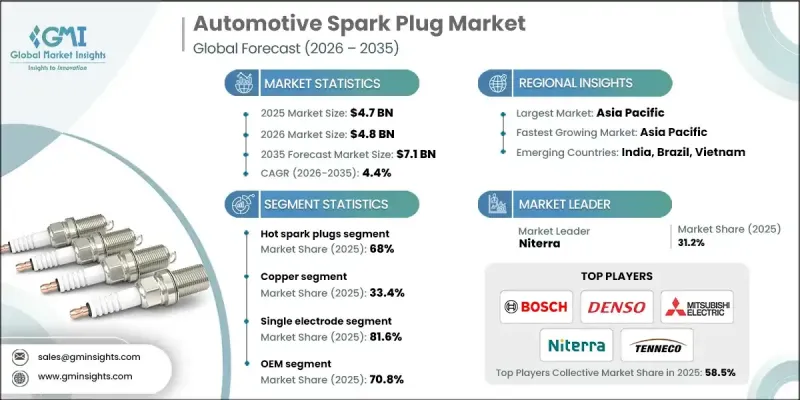

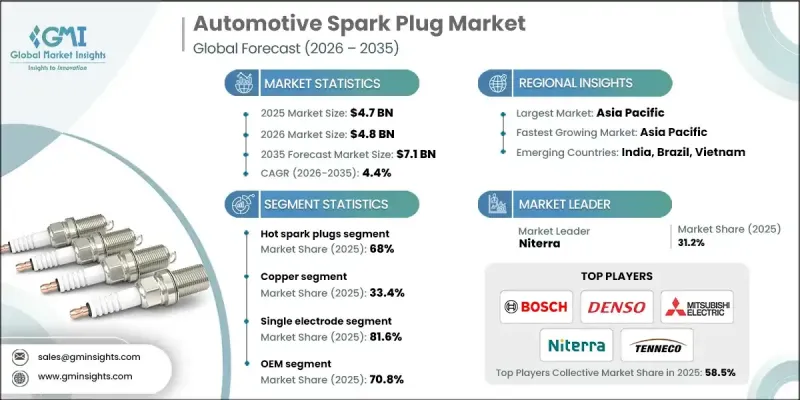

2025年全球汽車火星塞市場價值為47億美元,預計2035年將以4.4%的複合年成長率成長至71億美元。

全球新車產量穩定成長以及消費者對汽油動力車型的持續偏好支撐了市場成長。對更高燃油經濟性的追求也推動了先進火星塞技術的普及,因為新型引擎架構旨在最大限度地提高效率。製造商正在其產品組合中擴大銥金和鉑金等材料的使用,從而提升點火性能的耐用性和效率。現代燃燒系統目前可將燃油效率提高約10%,促使人們更廣泛地使用優質火星塞組件。不斷成長的城市出行趨勢也增加了對採用火星點火系統的緊湊型引擎的需求。售後市場仍是市場的重要動力,尤其是在2024年車輛平均車齡超過12年的情況下,車輛的年度更換週期將會增加。高性能金屬的持續改進也將繼續延長火星塞的使用壽命並提高點火可靠性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 47億美元 |

| 預測值 | 71億美元 |

| 複合年成長率 | 4.4% |

2025年,熱型火星塞市佔率達到68%,預計2026年至2035年間將以4.7%的複合年成長率成長。這類火星塞因其在寬廣的溫度範圍內都能保持可靠的點火性能,仍然是傳統汽油引擎的首選。其獨特的設計有助於有效散熱,從而減少在城市低速行駛(全球主要地區的大都市地區普遍存在)時產生的積碳。

到2025年,單電極火星塞市佔率將達到81.6%。它們仍然是大眾市場乘用車和二輪車的首選,這得益於2024年全球乘用車產量超過7,600萬輛。大多數入門級和中級引擎仍依賴單電極系統,該系統運作穩定可靠,維護成本低廉。這使得它們在老舊車輛保有量大的地區,對售後市場尤其具有吸引力。

預計到2024年,中國汽車火星塞市佔率將達到46.8%,2025年市場規模將達8.244億美元。市場成長主要得益於汽車銷售上升和城市快速擴張,持續推動乘用車產量超過2800萬輛。這加速了主要城市和中小城鎮的整車OEM)需求和換裝週期。兩輪交通仍然是交通運輸領域的重要組成部分,預計到2024年,摩托車和踏板車的產量將達到約700萬輛,其中大部分使用銅芯或鉑金火星塞,因此對火星塞的持續更換需求強勁。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 汽油動力汽車的成長

- 轉向高效引擎

- 售後市場活動日益增多

- 採用貴金屬插頭

- 產業陷阱與挑戰

- 電動車滲透率不斷提高

- 原料成本上漲

- 市場機遇

- 全球售後市場的擴張

- 先進點火系統的開發

- 新興市場二輪車需求成長

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 電極材料演變(從銅到釕)

- 細絲技術發展

- 多電極設計創新

- 預燃室火星塞技術

- 物聯網與智慧診斷整合

- 雷射焊接製造技術的進步

- 熱範圍最佳化技術

- 下一代材料

- 新興技術

- 當前技術趨勢

- 價格趨勢

- OEM與售後市場價格差異

- 區域價格差異

- 原料成本影響

- 進出口價格分析

- 未來價格走勢

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利與智慧財產權分析

- 電極材料的活性專利

- 專利地理分佈

- 主要專利持有人

- 新興技術專利(智慧插頭)

- 專利到期時間表(2024-2034)

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 投資與融資分析

- 製造商研發投資趨勢

- 替代燃料適應性投資

- 製造能力擴張

- 策略夥伴關係與合資企業

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依產品分類,2022-2035年

- 熱火星塞

- 冷火星塞

第6章:市場估算與預測:依材料分類,2022-2035年

- 銅

- 鉑

- 銥

- 其他

第7章:市場估算與預測:依電極類型分類,2022-2035年

- 單電極

- 雙電極

- 多電極

- 表面放電

第8章:市場估算與預測:依銷售管道分類,2022-2035年

- OEM

- 售後市場

第9章:市場估價與預測:依車輛類型分類,2022-2035年

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型

- 中型

- 重負

- 二輪車

- 摩托車

- 小型摩托車

第10章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第11章:公司簡介

- 全球參與者

- ACDelco

- Autolite

- Bosch

- DENSO

- MAHLE

- Mitsubishi Electric

- Niterra

- Tenneco

- Valeo

- 區域玩家

- BorgWarner

- Brisk Spark Plug Company

- E3 Spark Plugs

- Hella

- MAGNETI MARELLI PARTS & SERVICES

- MSD Performance

- Stitt Spark Plug Company

- Zhuzhou Torch Spark Plug

- 新興參與者/顛覆者

- Iskra Spark Plugs

- Nanjing Leidian

- Prenco Progress & Engineering Corporation

- Pulstar

- SMP Automotive

- Weichai Power

The Global Automotive Spark Plug Market was valued at USD 4.7 billion in 2025 and is estimated to grow at a CAGR of 4.4% to reach USD 7.1 billion by 2035.

Growth is supported by the steady rise in new vehicle production worldwide and continued consumer preference for gasoline-powered models. The shift toward better fuel economy is also driving higher adoption of advanced spark plug technologies, as newer engine architectures are built to maximize efficiency. Manufacturers are expanding the use of materials such as iridium and platinum throughout their portfolios, contributing to more durable and efficient ignition performance. Modern combustion systems now deliver around a 10 percent boost in fuel efficiency, which encourages broader use of premium spark plug components. Expanding urban mobility trends are creating more demand for compact engines that rely on spark-ignited systems. The aftermarket remains a strong contributor as well, particularly as the average age of vehicles surpassed 12 years in 2024, increasing annual replacement cycles. Ongoing improvements in high-performance metals also continue to enhance spark plug lifespan and ignition reliability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.7 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 4.4% |

The hot spark plugs segment held a 68% share in 2025, and this category is expected to expand at a CAGR of 4.7% between 2026 and 2035. These plugs remain favored for conventional gasoline engines because they maintain dependable ignition across a wide temperature range. Their design supports effective heat dissipation, helping limit fouling during low-speed driving that is common in metropolitan settings across major global regions.

The single electrode spark plugs segment held 81.6% share in 2025. They remain the primary option for mass-market passenger cars and two-wheel vehicles, supported by more than 76 million units of global passenger car production in 2024. Most entry-level and mid-tier engines still depend on single electrode systems, which offer predictable operation and low maintenance costs. This makes them especially appealing for the aftermarket in regions with a large base of aging vehicles.

China Automotive Spark Plug Market held 46.8% share in 2024 and generated USD 824.4 million in 2025. Growth is tied to rising vehicle sales and rapid urban expansion, which continue to boost passenger car production beyond 28 million units. This accelerates OEM demand and replacement cycles in both major cities and smaller communities. Two-wheel mobility remains a large component of the transportation landscape, with around 7 million motorcycles and scooters produced in 2024, most of which relied on copper or platinum spark plugs, ensuring strong ongoing replacement needs.

Key companies participating in the Automotive Spark Plug Market include ACDelco, Autolite, Bosch, DENSO Corporation, Hyundai Mobis, MAHLE, Mitsubishi Electric, Niterra, Tenneco, and Valeo. Leading Automotive Spark Plug Market is strengthening its presence by expanding advanced material technologies, particularly through wider integration of iridium and platinum to improve durability and ignition precision. Many manufacturers are increasing R&D investments to support next-generation combustion systems and adapt to evolving engine designs. Companies are also focusing on broadening their global manufacturing footprints to reduce costs and improve supply reliability. Strategic collaborations with automakers remain essential for securing long-term OEM contracts, while an enhanced emphasis on aftermarket networks helps capture demand from aging vehicle fleets. In addition, several brands are modernizing their product portfolios with heat-range-optimized designs and cost-efficient options to reach both premium and mass-market customer segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Electrode

- 2.2.5 Sales Channel

- 2.2.6 Vehicle

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growth in gasoline powered vehicles

- 3.2.1.3 Shift toward high efficiency engines

- 3.2.1.4 Increasing aftermarket activity

- 3.2.1.5 Adoption of precious metal plugs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Increasing penetration of electric vehicles

- 3.2.2.2 Rising raw material costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of the global aftermarket

- 3.2.3.2 Development of advanced ignition systems

- 3.2.3.3 Growth in two-wheeler demand in emerging markets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Electrode material evolution (copper to ruthenium)

- 3.7.1.2 Fine wire technology development

- 3.7.1.3 Multi-electrode design innovations

- 3.7.1.4 Pre-chamber spark plug technology

- 3.7.1.5 IoT & smart diagnostics integration

- 3.7.1.6 Laser welding manufacturing advances

- 3.7.1.7 Heat range optimization technologies

- 3.7.1.8 Next-generation materials

- 3.7.2 Emerging technologies

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 OEM vs aftermarket price differential

- 3.8.2 Regional price variations

- 3.8.3 Raw material cost impact

- 3.8.4 Import/export price analysis

- 3.8.5 Future price trajectory

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent & intellectual property analysis

- 3.11.1 Active patents by electrode material

- 3.11.2 Geographic patent distribution

- 3.11.3 Key patent holders

- 3.11.4 Emerging technology patents (smart plugs)

- 3.11.5 Patent expiration timeline (2024-2034)

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & Funding Analysis

- 3.13.1 R&D investment trends by manufacturer

- 3.13.2 Alternative fuel adaptation investments

- 3.13.3 Manufacturing capacity expansion

- 3.13.4 Strategic partnerships & joint ventures

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 2035 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Hot spark plug

- 5.3 Cold spark plug

Chapter 6 Market Estimates & Forecast, By Material, 2022 - 2035 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Copper

- 6.3 Platinum

- 6.4 Iridium

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Electrode, 2022 - 2035 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Single Electrode

- 7.3 Twin Electrode

- 7.4 Multi-Electrode

- 7.5 Surface Discharge

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 (USD Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Vehicle, 2022 - 2035 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Passenger car

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 SUV

- 9.3 Commercial vehicle

- 9.3.1 Light duty

- 9.3.2 Medium duty

- 9.3.3 Heavy duty

- 9.4 Two-wheeler

- 9.4.1 Motorcycle

- 9.4.2 Scooter

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Netherlands

- 10.3.9 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ACDelco

- 11.1.2 Autolite

- 11.1.3 Bosch

- 11.1.4 DENSO

- 11.1.5 MAHLE

- 11.1.6 Mitsubishi Electric

- 11.1.7 Niterra

- 11.1.8 Tenneco

- 11.1.9 Valeo

- 11.2 Regional Players

- 11.2.1 BorgWarner

- 11.2.2 Brisk Spark Plug Company

- 11.2.3 E3 Spark Plugs

- 11.2.4 Hella

- 11.2.5 MAGNETI MARELLI PARTS & SERVICES

- 11.2.6 MSD Performance

- 11.2.7 Stitt Spark Plug Company

- 11.2.8 Zhuzhou Torch Spark Plug

- 11.3 Emerging Players / Disruptors

- 11.3.1 Iskra Spark Plugs

- 11.3.2 Nanjing Leidian

- 11.3.3 Prenco Progress & Engineering Corporation

- 11.3.4 Pulstar

- 11.3.5 SMP Automotive

- 11.3.6 Weichai Power