|

市場調查報告書

商品編碼

1892876

感應加熱系統市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Induction Heating System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

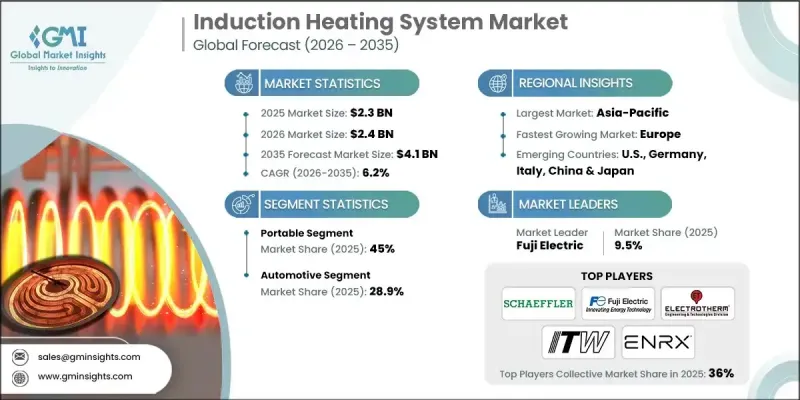

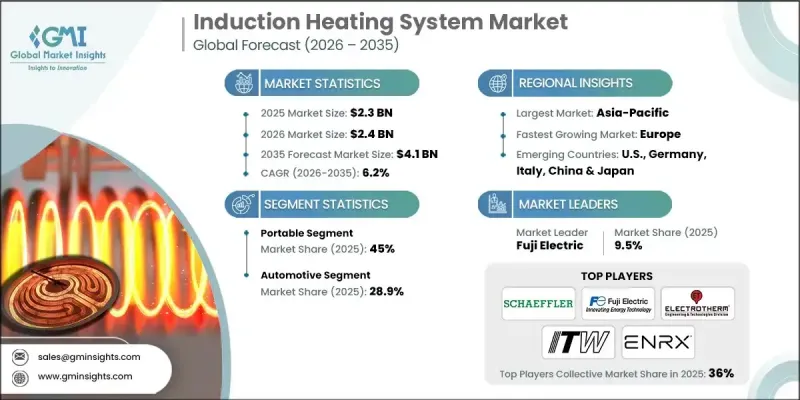

2025 年全球感應加熱系統市場價值為 23 億美元,預計到 2035 年將以 6.2% 的複合年成長率成長至 41 億美元。

多個工業領域對精準、非接觸式和節能加熱技術的轉變,進一步推動了市場成長。汽車、金屬加工、航太和電子產業的應用日益廣泛,製造商尋求能夠最大限度減少能源浪費、縮短生產週期並降低營運成本的解決方案,這持續增強了市場需求。感應加熱系統透過電磁感應而非直接接觸產生熱量,能夠快速、精確地加熱材料(主要是金屬)。政府日益重視促進國內製造業發展,鼓勵建立和改造採用高效熱技術的生產設施,也推動了市場擴張。隨著各行業努力降低排放並淘汰燃燒工藝,感應加熱正成為實現更清潔、更安全、更精確加熱的首選方法。工業自動化技術的持續進步、全球製造業產量的成長以及對永續發展的日益重視,預計將為市場的長期發展提供支撐。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 23億美元 |

| 預測值 | 41億美元 |

| 複合年成長率 | 6.2% |

攜帶式感應加熱系統市場在2025年佔據了45%的市場佔有率,預計到2035年將以超過6%的年成長率成長。該細分市場受益於對用於維護、維修和現場組裝等任務的緊湊型、節能型解決方案的需求。石油天然氣、汽車、航太和一般製造業等產業的採用率持續上升。輕量化結構、數位介面和電力電子技術的改進進一步提升了性能和用戶便利性。

2025年,汽車感應加熱系統市佔率為28.9%,預計到2035年將達到10億美元。隨著製造商在各種生產任務中依賴更快、更清潔的加熱工藝,該行業正在蓬勃發展。感應加熱能夠實現高效的淬火、黏合、釬焊和熱縮裝配,從而滿足日益成長的自動化需求、提高零件品質的需求,並促進與電動車製造和輕量化材料應用相關的產量成長。

預計到2025年,美國感應加熱系統市場將佔據72%的佔有率,創造3.714億美元的收入。美國市場的成長動能主要得益於對清潔、精準的工業加熱系統日益成長的需求,尤其是在汽車和金屬加工行業。此外,美國政府對先進製造業和國內生產措施的大力支持也持續推動市場成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 感應加熱系統的成本結構分析

- 新興機會與趨勢

- 投資分析及未來展望

- 永續發展措施與工業4.0融合

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 重要夥伴關係與合作

- 主要併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭性標竿分析

- 創新與永續發展格局

第5章:市場規模及預測:依產品分類,2022-2035年

- 便攜的

- 文具

第6章:市場規模及預測:依最終用途分類,2022-2035年

- 汽車

- 航太

- 發電

- 造船

- 石油和天然氣

- 其他

第7章:市場規模及預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Abhay Induction Tech Pvt. Ltd.

- Advanced Corporation for Materials & Equipments

- Ambrell Corporation

- Chengdu Jinkezhi Electronic Co., Ltd.

- Da-ichi Kiden Co., Ltd.

- Electrotherm

- Enrx

- Fuji Electric

- Heatrotherm

- Inductotherm Group

- Interpower Induction

- ITW Welding Singapore Pte Ltd.

- KBG Induction

- KITASHIBA ELECTRIC CO., LTD.

- Lu-Chiuan Heating Elements Ind Co., Ltd.

- Microtech Induction Pvt. Ltd.

- Neturen Co. Ltd.

- Radyne Corporation

- Rapid-Heat Systems Ltd.

- Schaeffler (Singapore) Pte. Ltd.

- Solidheat Industries Pte. Ltd.

- Thermo International

- TM Induction Heating

- Uchino Co. Ltd.

- Ultraflex Power Technologies

The Global Induction Heating System Market was valued at USD 2.3 billion in 2025 and is estimated to grow at a CAGR of 6.2% to reach USD 4.1 billion by 2035.

Market growth is reinforced by the shift toward precise, contact-free, and energy-efficient heating technologies across multiple industrial sectors. Rising adoption in automotive, metalworking, aerospace, and electronics environments continues to strengthen demand as manufacturers seek solutions that minimize energy waste, improve cycle times, and reduce operational costs. Induction heating systems operate by generating heat through electromagnetic induction rather than direct contact, allowing materials, primarily metals, to be heated quickly and with controlled accuracy. Increasing government emphasis on boosting domestic manufacturing is also driving expansion by encouraging the establishment and modernization of production facilities that rely on efficient thermal technologies. As industries work to lower emissions and eliminate combustion-based processes, induction heating is becoming a preferred method for achieving cleaner, safer, and more precise heating. Continued advancements in industrial automation, expansions in global manufacturing output, and rising attention to sustainability are expected to support long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 6.2% |

The portable induction heating system segment held a 45% share in 2025 and is forecasted to grow at more than 6% through 2035. This segment benefits from the demand for compact, energy-efficient solutions used for maintenance, repair, and on-site assembly tasks. Adoption continues to rise in sectors such as oil and gas, automotive, aerospace, and general manufacturing. Improvements in lightweight construction, digital interfaces, and power electronics further enhance performance and user convenience.

The automotive induction heating system segment held a 28.9% share in 2025 and is expected to reach USD 1 billion by 2035. The industry is expanding as manufacturers rely on faster and cleaner heating processes for various production tasks. Induction heating enables efficient hardening, bonding, brazing, and shrink-fitting, supporting the growing need for automation, improved component quality, and increasing output tied to electric vehicle manufacturing and lightweight material usage.

U.S. Induction Heating System Market held 72% share in 2025, generating USD 371.4 million in revenue. The country's momentum is driven by rising demand for clean and accurate industrial heating systems, particularly within automotive and metal processing sectors. Strong national support for advanced manufacturing and domestic production initiatives continues to enhance market growth.

Key companies operating in the Global Induction Heating System Market include Inductotherm Group, Ultraflex Power Technologies, Fuji Electric, Radyne Corporation, ENRX, Microtech Induction, Electrotherm, Uchino, Da-ichi Kiden, Interpower Induction, Advanced Corporation for Materials & Equipment, Schaeffler (Singapore), ITW Welding Singapore, Rapid-Heat Systems, Heatrotherm, TM Induction Heating, KBG Induction, KITASHIBA ELECTRIC, Lu-Chiuan Heating Elements Ind, Solidheat Industries, Chengdu Jinkezhi Electronic, Ambrell Corporation, Abhay Induction Tech, Neturen Co., and Thermo International. Companies in the Induction Heating System Market strengthen their competitive standing by prioritizing continuous product innovation, expanding manufacturing capabilities, and developing high-efficiency solutions aligned with sustainability goals. Many firms invest in digital controls, smart monitoring systems, and advanced power electronics to improve precision and energy performance. Strategic partnerships with OEMs and industrial manufacturers help expand application reach, while modular product platforms allow customization for diverse end-use industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Product trends

- 2.1.3 End Use trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of induction heating systems

- 3.8 Emerging opportunities & trends

- 3.9 Investment analysis & future prospects

- 3.10 Sustainability initiatives & industry 4.0 integration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Portable

- 5.3 Stationary

Chapter 6 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Aerospace

- 6.4 Power generation

- 6.5 Shipbuilding

- 6.6 Oil & Gas

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Abhay Induction Tech Pvt. Ltd.

- 8.2 Advanced Corporation for Materials & Equipments

- 8.3 Ambrell Corporation

- 8.4 Chengdu Jinkezhi Electronic Co., Ltd.

- 8.5 Da-ichi Kiden Co., Ltd.

- 8.6 Electrotherm

- 8.7 Enrx

- 8.8 Fuji Electric

- 8.9 Heatrotherm

- 8.10 Inductotherm Group

- 8.11 Interpower Induction

- 8.12 ITW Welding Singapore Pte Ltd.

- 8.13 KBG Induction

- 8.14 KITASHIBA ELECTRIC CO., LTD.

- 8.15 Lu-Chiuan Heating Elements Ind Co., Ltd.

- 8.16 Microtech Induction Pvt. Ltd.

- 8.17 Neturen Co. Ltd.

- 8.18 Radyne Corporation

- 8.19 Rapid-Heat Systems Ltd.

- 8.20 Schaeffler (Singapore) Pte. Ltd.

- 8.21 Solidheat Industries Pte. Ltd.

- 8.22 Thermo International

- 8.23 TM Induction Heating

- 8.24 Uchino Co. Ltd.

- 8.25 Ultraflex Power Technologies