|

市場調查報告書

商品編碼

1892872

家用睡眠呼吸中止症檢測設備市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Home Sleep Apnea Testing Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

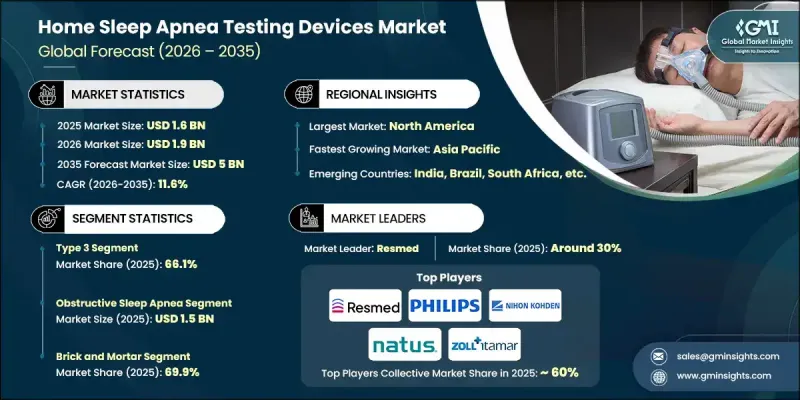

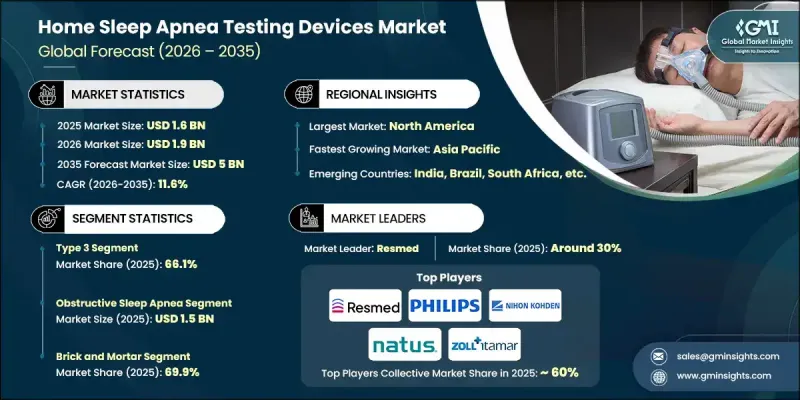

2025 年全球家用睡眠呼吸中止症檢測設備市場價值為 16 億美元,預計到 2035 年將以 11.6% 的複合年成長率成長至 50 億美元。

市場成長主要得益於老年人口的不斷擴大、睡眠呼吸中止症及相關慢性疾病發病率的上升,以及攜帶式和穿戴式診斷技術的快速創新。大眾對睡眠健康以及未確診睡眠障礙相關臨床風險的日益關注,也進一步推動了市場需求。居家檢測方案因其價格實惠、方便快捷,且能夠在傳統臨床環境之外提供可靠的診斷結果,正逐漸受到青睞。遠距醫療和遠距患者監測的日益普及也加速了這一趨勢,因為這些設備能夠輕鬆整合到數位化醫療工作流程中。肥胖、糖尿病和心血管疾病的日益流行,使得早期篩檢和介入的需求日益成長,因為未經治療的睡眠呼吸中止症會顯著增加嚴重併發症的風險。感測器精度、無線資料傳輸和人工智慧技術的進步,使得設備更加小型化、精準化,並簡化了患者獨立操作的流程。這些因素使得居家睡眠呼吸中止症檢測成為全球醫療保健系統中實用的第一線診斷工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 16億美元 |

| 預測值 | 50億美元 |

| 複合年成長率 | 11.6% |

2025年,3型設備市佔率達66.1%。該細分市場的成長得益於對早期診斷和預防性護理的日益重視。這些設備能夠追蹤多種生理訊號,並在臨床可靠性和使用者便利性之間取得平衡,因此適用於識別非複雜病例中的中度至重度阻塞性疾病。

2025 年,阻塞性睡眠呼吸中止症市場規模預計將達到 15 億美元。這種疾病是睡眠呼吸中止症中最常見的類型,並且與代謝和心血管風險密切相關,因此及時診斷和監測至關重要。

預計2025年,北美家用睡眠呼吸中止症檢測設備市場佔有率將達到33.6%,並維持強勁成長。人們對睡眠障礙的高度關注、遠距醫療的廣泛應用、先進的醫療基礎設施以及生活方式相關風險因素的高發生率,將繼續推動該地區的需求成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 睡眠呼吸中止症及其相關併發症的盛行率日益增加

- 提高人們對睡眠健康和居家睡眠呼吸中止症檢測的認知

- 人口老化加劇

- 穿戴式和可攜式HSAT設備的技術進步

- 產業陷阱與挑戰

- 診斷設備需經過嚴格的監管審查。

- 與實驗室多導睡眠圖相比,準確度有限

- 機會

- 開發人工智慧驅動的診斷演算法

- 提供HSAT服務的遠距醫療平台發展迅速

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價值鏈分析

- 報銷方案

- 政策環境

- 消費者行為洞察

- 波特的分析

- PESTEL 分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依測試類型分類,2022-2035年

- 類型 2

- 3型

- 4型

第6章:市場估算與預測:依應用領域分類,2022-2035年

- 阻塞性睡眠呼吸中止症(OSA)

- 中樞性睡眠呼吸中止症

第7章:市場估算與預測:依配銷通路分類,2022-2035年

- 磚瓦

- 電子商務

第8章:市場估算與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- CADWELL

- CleveMed

- COMPUMEDICS

- CONTEC

- natus

- Neurosoft

- NEUROVIRTUAL

- NIHON KOHDEN

- nox MEDICAL

- PHILIPS

- Resmed

- SOMNOmedics

- ZOLL itamar

The Global Home Sleep Apnea Testing Devices Market was valued at USD 1.6 billion in 2025 and is estimated to grow at a CAGR of 11.6% to reach USD 5 billion by 2035.

Market growth is fueled by the expanding elderly population, rising incidence of sleep apnea and related chronic conditions, and rapid innovation in portable and wearable diagnostic technologies. Increasing public awareness of sleep health and the clinical risks associated with undiagnosed sleep disorders is further supporting demand. Home-based testing solutions are gaining preference due to their affordability, convenience, and ability to deliver reliable diagnostic results outside traditional clinical environments. The growing adoption of telemedicine and remote patient monitoring is also accelerating uptake, as these devices integrate easily into digital healthcare workflows. The rising prevalence of obesity, diabetes, and cardiovascular disease is increasing the need for early screening and intervention, since untreated sleep apnea significantly elevates the risk of serious complications. Advances in sensor accuracy, wireless data transmission, and artificial intelligence are enabling devices that are smaller, more precise, and simpler for patients to operate independently. These factors are positioning home sleep apnea testing as a practical frontline diagnostic tool across global healthcare systems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.6 Billion |

| Forecast Value | $5 Billion |

| CAGR | 11.6% |

The type 3 device segment held a 66.1% share in 2025. Growth in this segment is supported by increased emphasis on early diagnosis and preventive care. These devices track multiple physiological signals and offer a balance between clinical reliability and user convenience, making them suitable for identifying moderate to severe obstructive conditions in uncomplicated cases.

The obstructive sleep apnea segment was valued at USD 1.5 billion in 2025. This condition represents the most common form of sleep apnea and is closely associated with metabolic and cardiovascular risks, reinforcing the importance of timely diagnosis and monitoring.

North America Home Sleep Apnea Testing Devices Market accounted for a 33.6% share in 2025 and is expected to maintain strong growth. High awareness of sleep disorders, widespread telehealth adoption, advanced healthcare infrastructure, and elevated prevalence of lifestyle-related risk factors continue to drive regional demand.

Key companies active in the Global Home Sleep Apnea Testing Devices Market include ResMed, Philips, Nox Medical, Compumedics, ZOLL Itamar, Nihon Kohden, Natus, SOMNOmedics, CleveMed, Neurosoft, CADWELL, CONTEC, NEUROVIRTUAL, and Nox Medical. Companies in the Global Home Sleep Apnea Testing Devices Market are strengthening their market position through continuous product innovation, digital integration, and strategic partnerships. Manufacturers focus on improving diagnostic accuracy, comfort, and ease of use through advanced sensors and AI-driven analytics. Integration with telehealth platforms and cloud-based data management systems supports seamless clinical workflows. Many players invest in regulatory approvals and clinical validation to expand adoption across healthcare settings. Geographic expansion into underserved markets and collaboration with sleep clinics and healthcare providers help increase reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Indication trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of sleep apnea and related co-morbidities

- 3.2.1.2 Increasing awareness regarding sleep health and home sleep apnea tests

- 3.2.1.3 Rising aging population

- 3.2.1.4 Technological advancements in wearable and portable HSAT devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approvals for diagnostic devices

- 3.2.2.2 Limited accuracy compared to in-lab polysomnography

- 3.2.3 Opportunities

- 3.2.3.1 Development of AI-powered diagnostic algorithms

- 3.2.3.2 Growth of telehealth platforms offering HSAT services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Reimbursement scenario

- 3.8 Policy landscape

- 3.9 Consumer behavior insights

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Type 2

- 5.3 Type 3

- 5.4 Type 4

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Obstructive sleep apnea (OSA)

- 6.3 Central sleep apnea

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 CADWELL

- 9.2 CleveMed

- 9.3 COMPUMEDICS

- 9.4 CONTEC

- 9.5 natus

- 9.6 Neurosoft

- 9.7 NEUROVIRTUAL

- 9.8 NIHON KOHDEN

- 9.9 nox MEDICAL

- 9.10 PHILIPS

- 9.11 Resmed

- 9.12 SOMNOmedics

- 9.13 ZOLL itamar