|

市場調查報告書

商品編碼

1892869

遠距病人監護(RPM)設備市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Remote Patient Monitoring (RPM) Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

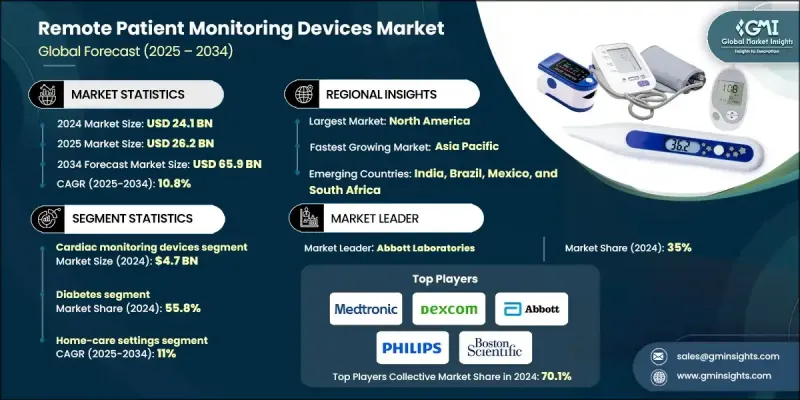

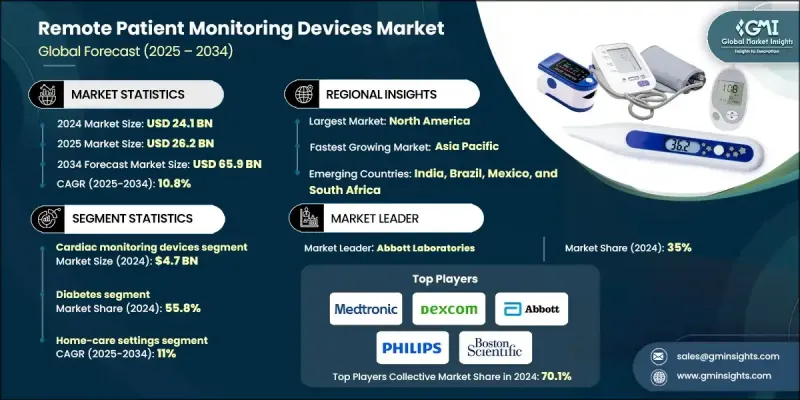

2024 年全球遠距病人監護設備市場價值為 241 億美元,預計到 2034 年將以 10.8% 的複合年成長率成長至 659 億美元。

市場成長的促進因素包括慢性病盛行率的上升、醫療保健的快速數位化以及降低醫院再入院率和整體醫療成本的迫切需求。遠距患者監護 (RPM) 能夠在傳統臨床環境之外持續追蹤患者的生命徵象和健康狀況,使醫生能夠更快地做出數據驅動的決策,並提高患者對治療方案的依從性。智慧型手機、連網醫療設備和雲端平台的日益普及顯著提升了 RPM 解決方案的可用性、準確性和可擴展性。這些技術共同支持更積極主動的預防性醫療模式,減少急診就診次數,減輕醫療基礎設施的負擔。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 241億美元 |

| 預測值 | 659億美元 |

| 複合年成長率 | 10.8% |

全球向價值醫療和居家醫療模式的轉變進一步加速了對遠距病患監測(RPM)設備的需求。支付方和醫療服務提供方日益認知到遠端監測的經濟效益,例如減少住院天數、降低再入院罰款以及更好地管理高風險患者群體。此外,全球人口老化以及糖尿病、心血管疾病和呼吸系統疾病等疾病發生率的上升,也擴大了RPM的目標患者族群。政府推行的促進數位醫療、遠距醫療報銷以及將遠距監測納入標準診療流程的舉措,也在預測期內對提升市場滲透率發揮關鍵作用。

2024年,心臟監測設備市場規模預計將達47億美元。該市場涵蓋心電圖設備、植入式心臟監測器、穿戴式心臟監測器以及用於即時檢測心律不整、心臟衰竭加重和其他心臟異常的事件記錄儀。全球心血管疾病的高發生率,以及對高風險心臟病患者進行持續監測的迫切需求,是推動該市場成長的核心因素。遠距心臟監測能夠減少患者頻繁的面對面就診,及早發現危及生命的事件,並有助於更好地調整藥物劑量。

隨著醫療服務從醫院轉向患者家中,以提高患者舒適度、降低成本並減少再次入院率,預計到2024年,居家護理市場將佔據11%的市場佔有率。在該領域,遠端監測設備,例如生命徵象監測儀、血糖儀、心臟穿戴設備和連網血氧儀,被用於持續或定期監測慢性病患者、術後患者和老年人的健康狀況。居家監測使患者能夠在熟悉的環境中接受醫療專業人員的遠端監督,從而提高治療依從性和生活品質。

2024年,北美遠距患者監護設備市佔率達到42.3%,位居全球最大。該地區的領先地位得益於其完善的醫療基礎設施、高額的醫療支出以及對數位醫療技術的廣泛應用。尤其是在美國,遠距監護服務的優惠報銷政策極大地鼓勵了醫療機構將遠距患者監護納入慢性病管理方案。此外,生活方式相關疾病的高發生率、龐大的老齡人口以及網際網路和智慧型設備的普及,也為遠距監護解決方案的部署創造了理想的環境。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 全球慢性病發生率不斷上升

- 新興國家可支配收入和醫療保健支出不斷成長

- 已開發國家的技術進步

- 遠距病人監護設備的應用日益普及

- 產業陷阱與挑戰

- 設備成本高昂

- 嚴格的監管框架

- 市場機遇

- 人工智慧驅動的預測性監測工具的應用日益普及

- 穿戴式生物感測器的出現,為連續、即時健康追蹤提供了可能

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀錶板

第5章:市場估算與預測:依產品分類,2021-2034年

- 心臟監測設備

- 血壓監測設備

- 神經監測設備

- 呼吸監測設備

- 多參數監測設備

- 血糖監測設備

- 胎兒及新生兒監護設備

- 睡眠監測設備

- 其他產品

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 心血管疾病

- 癌症

- 糖尿病

- 神經系統疾病

- 傳染病

- 呼吸系統疾病

- 其他應用

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 居家照護環境

- 長期照護

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 波蘭

- 瑞士

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 泰國

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 以色列

第9章:公司簡介

- Abbott Laboratories

- Baxter International

- BIOTRONIK

- Boston Scientific

- Dexcom

- F. Hoffmann-La Roche

- GE Healthcare

- Johnson & Johnson

- Koninklijke Philips NV

- Medtronic

- OMRON

- Sotera Wireless

- Vital Connect

The Global Remote Patient Monitoring Devices Market was valued at USD 24.1 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 65.9 billion by 2034.

Market growth is driven by the rising prevalence of chronic diseases, rapid digitalization of healthcare, and the growing need to reduce hospital readmissions and overall care costs. Remote patient monitoring (RPM) enables continuous tracking of patients' vital signs and health status outside traditional clinical settings, empowering physicians to make faster, data-driven decisions and improving patient adherence to treatment plans. Rising adoption of smartphones, connected medical devices, and cloud-based platforms has significantly enhanced the usability, accuracy, and scalability of RPM solutions. These technologies collectively support more proactive and preventive care models, reducing emergency visits and easing the burden on healthcare infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.1 Billion |

| Forecast Value | $65.9 Billion |

| CAGR | 10.8% |

The global shift towards value-based care and home-based healthcare is further accelerating the demand for RPM devices. Payers and providers are increasingly recognizing the economic benefits of remote monitoring, such as reduced inpatient days, lower readmission penalties, and better management of high-risk patient cohorts. Additionally, aging populations worldwide and the rising incidence of conditions like diabetes, cardiovascular diseases, and respiratory disorders are expanding the addressable patient pool for RPM. Government initiatives promoting digital health, telehealth reimbursement, and integration of remote monitoring into standard care pathways are also playing a critical role in enhancing market penetration over the forecast period.

The cardiac monitoring devices segment generated USD 4.7 billion in 2024. This segment includes ECG devices, implantable cardiac monitors, wearable heart monitors, and event recorders used to detect arrhythmias, heart failure exacerbations, and other cardiac abnormalities in real time. The high burden of cardiovascular diseases globally, combined with the critical need for continuous surveillance of high-risk cardiac patients, is a core driver for this segment. Remote cardiac monitoring reduces the need for frequent in-person consultations, enables early identification of life-threatening events, and supports better medication titration.

The home care settings segment held 11% share in 2024 as healthcare delivery shifted from hospitals to patients' homes to improve comfort, reduce costs, and minimize hospital readmissions. In this segment, remote monitoring devices such as vital signs monitors, glucose meters, cardiac wearables, and connected oximeters are used to track patients with chronic conditions, post-operative cases, and elderly individuals on a continuous or scheduled basis. Home-based monitoring enables patients to remain in a familiar environment while still being under the virtual supervision of healthcare professionals, which enhances treatment adherence and quality of life.

North America Remote Patient Monitoring Devices Market held 42.3% share in 2024, accounting for the largest regional share. The region's leadership is supported by a well-established healthcare infrastructure, high healthcare expenditure, and strong adoption of digital health technologies. Favorable reimbursement frameworks for remote monitoring services, particularly in the United States, have significantly encouraged providers to incorporate RPM into chronic disease management programs. Additionally, a high prevalence of lifestyle-related disorders, a large elderly population, and widespread access to the internet and smart devices create an ideal environment for the deployment of remote monitoring solutions.

Key players operating in the Global Remote Patient Monitoring Devices Market include Philips Healthcare, Medtronic plc, GE HealthCare, Abbott Laboratories, Boston Scientific Corporation, Nihon Kohden Corporation, ResMed Inc., Dexcom, Inc., and Masimo Corporation. These companies focus on continuous product innovation, integrating advanced sensors, wireless connectivity, and data analytics into their device portfolios. They are also actively involved in strategic partnerships with hospitals, telehealth platforms, and payers to expand their installed base and enhance recurring revenue streams via monitoring services and software subscriptions. Many of these players are investing in AI-enabled platforms that can automatically flag abnormal readings, support predictive risk scoring, and simplify clinical workflows, making remote monitoring more scalable and effective for large patient populations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic diseases across the globe

- 3.2.1.2 Growing disposable income and healthcare expenditure in emerging countries

- 3.2.1.3 Technological advancement in developed nations

- 3.2.1.4 Growing adoption of remote patient monitoring devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing adoption of AI-powered predictive monitoring tools

- 3.2.3.2 Emergence of wearable biosensors for continuous, real-time health tracking

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac monitoring devices

- 5.3 Blood pressure monitoring devices

- 5.4 Neurological monitoring devices

- 5.5 Respiratory monitoring devices

- 5.6 Multiparameter monitoring devices

- 5.7 Blood glucose monitoring devices

- 5.8 Fetal and neonatal monitoring devices

- 5.9 Sleep monitoring devices

- 5.10 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular diseases

- 6.3 Cancer

- 6.4 Diabetes

- 6.5 Neurological disorders

- 6.6 Infectious diseases

- 6.7 Respiratory diseases

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Home-care settings

- 7.3 Long-term care

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Poland

- 8.3.8 Switzerland

- 8.3.9 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Thailand

- 8.4.7 Indonesia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Colombia

- 8.5.5 Chile

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Israel

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Baxter International

- 9.3 BIOTRONIK

- 9.4 Boston Scientific

- 9.5 Dexcom

- 9.6 F. Hoffmann-La Roche

- 9.7 GE Healthcare

- 9.8 Johnson & Johnson

- 9.9 Koninklijke Philips N.V.

- 9.10 Medtronic

- 9.11 OMRON

- 9.12 Sotera Wireless

- 9.13 Vital Connect