|

市場調查報告書

商品編碼

1892849

等離子切割機市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Plasma Cutting Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

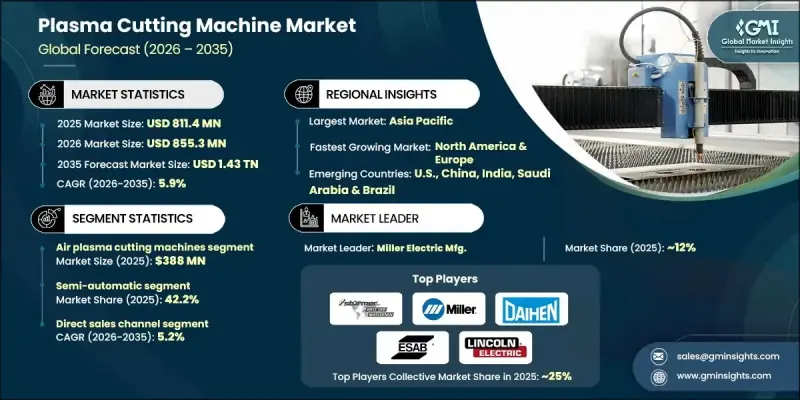

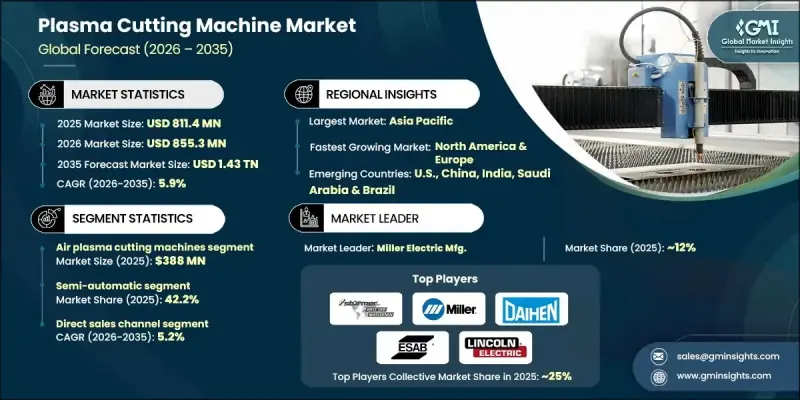

2025 年全球等離子切割機市值為 8.114 億美元,預計到 2035 年將以 5.9% 的複合年成長率成長至 1.43 兆美元。

市場成長主要得益於數控技術和自動化在等離子切割系統中的日益普及。數控技術的整合使製造商能夠持續生產高精度零件,從而減少人為誤差並提高整體生產效率。自動化也支援工業4.0計畫的實施,包括物聯網監控、預測性維護以及製造系統間的無縫連接,進而提升生產效率。航太、汽車和重型工程等產業正是由於這些優勢而高度依賴等離子切割機。此外,對節能高效、高精度等離子切割系統的需求不斷成長,促使製造商致力於研發能夠在保持卓越切割品質的同時,以更低功率位準運作的新型機器。這些技術能夠減少切割過程中的熱產生,最大限度地減少材料浪費,並防止熱致變形,從而帶來經濟和環境效益。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 8.114億美元 |

| 預測值 | 1.43兆美元 |

| 複合年成長率 | 5.9% |

2025年,空氣等離子切割機市場規模達到3.88億美元,預計2026年至2035年將以6.2%的複合年成長率成長。空氣等離子系統使用壓縮空氣作為等離子氣體,因此對中小企業而言經濟高效且便利。這些機器切割低碳鋼和其他常用金屬的效率極高,由於其維護需求低、易於安裝,與氧氣或氫氣等離子系統相比,在製造和輕工業應用中更受歡迎。

到 2025 年,直銷通路的市佔率將達到 64.4%,預計到 2035 年將以 5.2% 的複合年成長率成長。直接合作使製造商能夠提供客製化的切割解決方案、技術支援和及時的備件交付,從而加強客戶關係並提高營運效率。

2025年美國等離子切割機市場規模達1.389億美元,預計2026年至2035年將以3.5%的複合年成長率成長。美國先進的工業基礎、強大的製造業基礎設施以及對自動化技術的早期應用,推動了對數控高精度等離子切割機的強勁需求。汽車、航太和重型機械等關鍵產業對精密切割的需求,進一步促進了市場成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 數控技術和自動化技術的廣泛應用

- 節能型及高畫質技術

- 快速城市化和基礎設施項目

- 產業陷阱與挑戰

- 來自替代技術的激烈競爭

- 高昂的資本成本和推廣障礙

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 透過切割技術

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依切割技術分類,2022-2035年

- 空氣等離子切割機

- 氧等離子切割機

- 氮氣等離子切割機

- 氫等離子切割機

第6章:市場估算與預測:依營運模式分類,2022-2035年

- 自動的

- 半自動

- 手動的

第7章:市場估算與預測:依最終用途分類,2022-2035年

- 汽車

- 製造業

- 航太與國防

- 航運和海事

- 建築和基礎設施

- 其他

第8章:市場估算與預測:依配銷通路分類,2022-2035年

- 直銷

- 間接銷售

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- ACM Inc.

- Ador Welding Ltd.

- AJAN ELEKTRONIK

- C & G Systems

- ERMAKSAN

- ESAB Welding and Cutting Products

- DAIHEN Corporation

- Haco

- Hypertherm, Inc.

- Jinan Huaxia Machinery Equipment Co. Ltd.

- Kjellberg Finsterwalde Plasma und Maschinen GmbH

- Koike Aronson

- Komatsu cutting systems

- Lincoln Electric Holdings, Inc.

- Miller Electric Mfg

- Sturmer maschinen gmbh

- Victor Technologies

- Voortman Steel

The Global Plasma Cutting Machine Market was valued at USD 811.4 million in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 1.43 trillion by 2035.

The market is propelled by the rising adoption of CNC technologies and automation in plasma cutting systems. CNC integration allows manufacturers to produce high-precision components consistently, reducing human error and increasing overall production efficiency. Automation also supports the implementation of Industry 4.0 initiatives, including IoT-enabled monitoring, predictive maintenance, and seamless connectivity between manufacturing systems, enhancing productivity. Industries such as aerospace, automotive, and heavy engineering rely heavily on plasma cutting machines due to these capabilities. Additionally, the growing demand for energy-efficient and high-definition plasma systems is driving manufacturers to innovate machines that operate at lower power levels while maintaining superior cut quality. These technologies reduce heat generation during cutting, minimize material wastage, and prevent heat-induced distortion, offering both economic and environmental benefits.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $811.4 Million |

| Forecast Value | $1.43 Trillion |

| CAGR | 5.9% |

The air plasma cutting machines segment generated USD 388 million in 2025 and is expected to grow at a CAGR of 6.2% from 2026 to 2035. Air plasma systems use compressed air as the plasma gas, making them cost-effective and convenient for small and medium-sized enterprises. These machines are highly efficient for cutting mild steel and other widely used metals and are preferred in fabrication and light industrial applications due to their low maintenance requirements and ease of setup compared to oxygen or hydrogen plasma systems.

The direct sales channel held a 64.4% share in 2025 and is anticipated to grow at a CAGR of 5.2% through 2035. Direct engagement allows manufacturers to provide customized cutting solutions, technical support, and timely delivery of spare parts, strengthening customer relationships and improving operational efficiency.

U.S. Plasma Cutting Machine Market generated USD 138.9 million in 2025 and is expected to grow at a CAGR of 3.5% from 2026 to 2035. The country's advanced industrial base, strong manufacturing infrastructure, and early adoption of automation technologies drive high demand for CNC-controlled and high-definition plasma cutting machines. Key sectors such as automotive, aerospace, and heavy machinery require precision cutting, boosting market growth.

Major players operating in the Plasma Cutting Machine Market include Voortman Steel, Haco, ERMAKSAN, Lincoln Electric Holdings, Inc., Hypertherm, Inc., C & G Systems, Victor Technologies, Komatsu Cutting Systems, Miller Electric Mfg, DAIHEN Corporation, AJAN ELEKTRONIK, Sturmer Maschinen GmbH, Koike Aronson, Jinan Huaxia Machinery Equipment Co., Ltd., ACM Inc., Ador Welding Ltd., and ESAB Welding and Cutting Products. Companies in the Plasma Cutting Machine Market are employing multiple strategies to strengthen their market foothold. They are heavily investing in research and development to introduce high-definition, energy-efficient, and IoT-enabled plasma systems. Strategic collaborations with automotive, aerospace, and heavy engineering firms help expand customer reach and ensure product customization. Geographic expansion and the development of local service and support networks enhance accessibility for clients.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Cutting technology

- 2.2.3 Operation

- 2.2.4 End Use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Widespread adoption of CNC and automation

- 3.2.1.2 Energy-efficient models & high-definition technology

- 3.2.1.3 Rapid urbanization and infrastructure projects

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Intense competition from alternative technologies

- 3.2.2.2 High capital costs & adoption barriers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Cutting technology

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Cutting Technology, 2022 - 2035, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Air plasma cutting machines

- 5.3 Oxygen plasma cutting machines

- 5.4 Nitrogen plasma cutting machines

- 5.5 Hydrogen plasma cutting machine

Chapter 6 Market Estimates & Forecast, By Operation, 2022 - 2035, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Manufacturing

- 7.4 Aerospace and defense

- 7.5 Shipping and maritime

- 7.6 Construction and infrastructure

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ACM Inc.

- 10.2 Ador Welding Ltd.

- 10.3 AJAN ELEKTRONIK

- 10.4 C & G Systems

- 10.5 ERMAKSAN

- 10.6 ESAB Welding and Cutting Products

- 10.7 DAIHEN Corporation

- 10.8 Haco

- 10.9 Hypertherm, Inc.

- 10.10 Jinan Huaxia Machinery Equipment Co. Ltd.

- 10.11 Kjellberg Finsterwalde Plasma und Maschinen GmbH

- 10.12 Koike Aronson

- 10.13 Komatsu cutting systems

- 10.14 Lincoln Electric Holdings, Inc.

- 10.15 Miller Electric Mfg

- 10.16 Sturmer maschinen gmbh

- 10.17 Victor Technologies

- 10.18 Voortman Steel