|

市場調查報告書

商品編碼

1892848

冷鏈監測市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Cold Chain Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

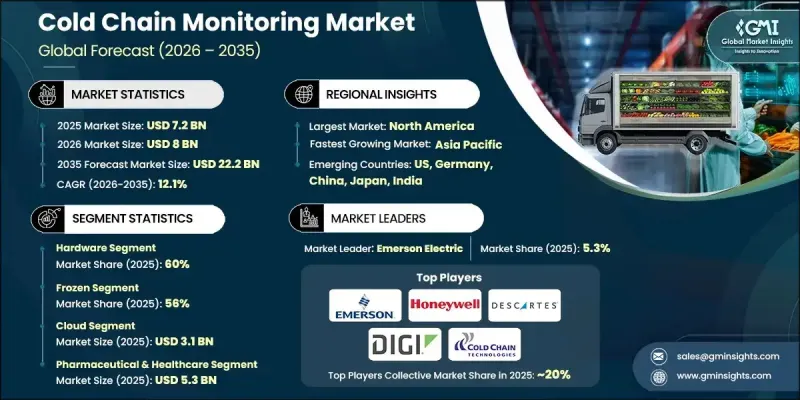

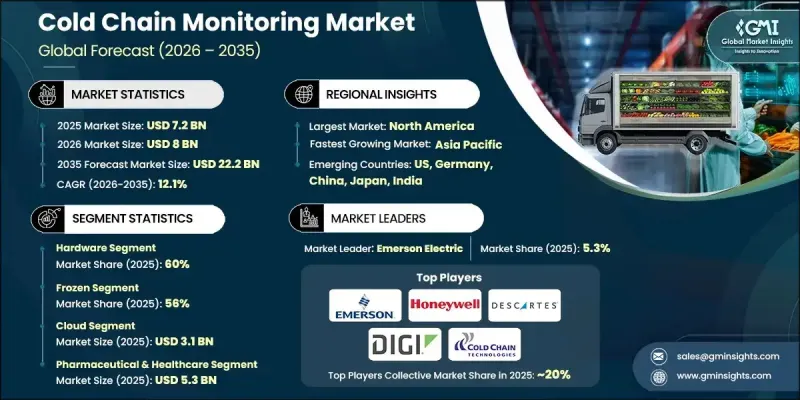

2025 年全球冷鏈監控市場價值為 72 億美元,預計到 2035 年將以 12.1% 的複合年成長率成長至 222 億美元。

易腐食品(包括新鮮農產品、肉類、海鮮、乳製品、冷凍食品和即食食品)的消費量成長,加劇了對整個供應鏈精準溫度控制的需求。隨著配送週期縮短和分銷網路不斷擴展,企業面臨越來越大的壓力,需要防止產品損壞並維持品質。如今,每批貨物的運輸都需要完全可追溯性並嚴格遵守溫度控制,尤其是在全球易腐品貿易不斷擴張的情況下。冷鏈監控已成為減少浪費、保持新鮮度以及滿足日益成長的安全性和一致性期望的關鍵。在製藥業,精準的溫度監管尤其重要,因為生物製劑、疫苗和特殊療法都依賴嚴格控制的溫度範圍。隨著溫度敏感型療法的日益普及,製造商和分銷商高度依賴能夠提供警報和可用於審計資料的即時、經過驗證的監控工具。在公共衛生緊急事件期間加速部署數位系統,進一步鞏固了即時冷鏈監管在製藥領域的優先地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 72億美元 |

| 預測值 | 222億美元 |

| 複合年成長率 | 12.1% |

2025年,硬體部分佔據了60%的市場佔有率,預計2026年至2035年將以12.4%的複合年成長率成長。冷鏈運作依賴大量的實體監控設備,包括溫度探頭、GPS單元、資料記錄器、濕度感測器、遠端資訊處理工具和門狀態偵測器,這些設備安裝在倉庫、冷藏運輸車輛、貨櫃和最後一公里配送設備中。由於每個托盤、每批貨物和每個存儲點都需要持續追蹤,硬體需求成長速度超過了軟體採用速度,從而確保了其市場領先地位。

冷凍食品市場在2025年佔據了56%的市場佔有率,預計到2035年將以12.4%的複合年成長率成長。包括某些藥品、生物製品和溫度敏感食品在內的冷凍產品必須儲存在嚴格控制的環境中。即使是最小的偏差也可能影響產品的安全性和有效性,因此企業需要在整個供應鏈中投資持續監控、高精度感測器和可靠的即時報告系統。

預計2025年,美國冷鏈監控市場規模將達23億美元。美國龐大的冷藏設施網路和溫控運輸系統促進了監控系統的廣泛應用。易腐食品分銷規模龐大,加上對新鮮農產品、包裝食品、冷凍食品、生物製品和先進藥品等產品的嚴格要求,更凸顯了即時可視性的重要性。產品種類繁多、運輸距離長以及零售商的高績效標準,持續推高了對精準冷鏈追蹤技術的需求。

活躍於全球冷鏈監控市場的公司包括Testo、Controlant、Cold Chain Technologies、Digi International、Sensitech、Zebra Technologies、Descartes Systems、Emerson Electric、Honeywell International和ORBCOMM。這些公司透過拓展硬體產品組合、提升感測器精度以及將先進的連接功能整合到產品線中來鞏固其市場地位。許多公司致力於開發即時平台,將溫度追蹤、地理定位和自動警報功能結合,以支援合規性並降低產品變質風險。與物流供應商和製藥廠商的策略合作有助於供應商將監控解決方案更深入地融入供應鏈。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 感測器和硬體製造商

- 連接和物聯網網路供應商

- 軟體/平台供應商

- 冷鏈包裝與保溫容器

- 冷凍設備製造商

- 冷庫營運商和倉庫基礎設施

- 成本結構

- 利潤率

- 每個階段的價值增加

- 影響供應鏈的因素

- 顛覆者

- 供應商格局

- 對力的影響

- 成長促進因素

- 雲端運算和超大規模擴展的快速成長

- 人工智慧、機器學習和高效能運算(HPC)的爆炸性成長

- 各行業資料產生量不斷增加

- 邊緣運算在低延遲應用中的成長

- 產業陷阱與挑戰

- 電力和散熱方面的限制制約了高密度伺服器部署。

- 能源成本上漲對總體擁有成本和伺服器更新決策帶來壓力。

- 供應鏈波動和半導體短缺導致伺服器出貨延遲。

- 市場機遇

- 加速採用人工智慧最佳化和GPU加速伺服器

- 邊緣運算的成長開啟了新的伺服器部署空間

- 過渡到液冷散熱會帶來硬體升級週期。

- ARM架構伺服器及其他架構的興起

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術趨勢與創新生態系統

- 目前技術

- 基於物聯網的感測器和無線環境感測器

- 溫度和濕度資料記錄儀

- 冷藏集裝箱/車輛的遠端資訊處理整合

- GPS定位/位置追蹤結合冷藏貨櫃監控

- 新興技術

- 預測分析/人工智慧和機器學習驅動的分析

- 數據驅動型決策平台

- 與更廣泛的供應鏈系統整合

- 邊緣運算/本地處理和混合架構

- 目前技術

- 專利分析

- 價格趨勢分析

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 風險分析與管理

- 營運風險評估

- 財務風險評估

- 技術與網路安全風險

- 風險緩解策略

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

- 投資報酬率和成本效益分析

- 功能和定價基準分析

- 顧客偏好/購買行為

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2022-2035年

- 硬體

- 感應器

- 射頻識別設備

- 車載資訊系統

- 網路裝置

- 其他

- 軟體

- 即時監控

- 分析與報告

- 服務

- 專業服務

- 託管服務

第6章:市場估算與預測:依溫度分類,2022-2035年

- 冷凍

- 冷藏

第7章:市場估算與預測:依部署方式分類,2022-2035年

- 雲

- 現場

- 混合

第8章:市場估算與預測:依物流業分類,2022-2035年

- 貯存

- 運輸

第9章:市場估算與預測:依最終用途分類,2022-2035年

- 醫藥與醫療保健

- 餐飲

- 物流與配送

- 化學

- 其他

第10章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 比荷盧經濟聯盟

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 泰國

- 印尼

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Global Leaders

- Sensitech (Carrier Global)

- Emerson Electric

- Honeywell International

- Descartes Systems

- Digi International

- Zebra Technologies

- Cold Chain Technologies (CCT)

- ORBCOMM

- Controlant

- Testo

- ELPRO-Buchs

- 區域冠軍

- DeltaTrak

- Monnit

- FreshLoc Technologies

- Samsara

- Tive

- Roambee

- Blulog (low-power NFC and wireless data loggers)

- OnAsset Intelligence (air cargo temperature & security tracking)

- Zest Labs

- TagBox

- 新興參與者

- SenseAnywhere

- Rotronic

- TempGenius

- Zhuhai Rayonics Technology

- Blulog

The Global Cold Chain Monitoring Market was valued at USD 7.2 billion in 2025 and is estimated to grow at a CAGR of 12.1% to reach USD 22.2 billion by 2035.

Rising consumption of perishable foods, including fresh produce, meat, seafood, dairy, frozen meals, and ready-to-eat items, has intensified the demand for precise temperature control throughout supply chains. As delivery cycles become shorter and distribution networks broaden, companies face growing pressure to prevent product damage and maintain quality. Every shipment now requires complete traceability and strict temperature adherence, especially as global trade in perishables expands. Cold-chain monitoring has become essential for reducing waste and preserving freshness while meeting heightened expectations for safety and consistency. The need for accurate temperature oversight is even more critical in the pharmaceutical sector, where biologics, vaccines, and specialized therapies depend on tightly regulated temperature ranges. With the increasing adoption of temperature-sensitive treatments, manufacturers and distributors rely heavily on real-time, validated monitoring tools that offer alerts and audit-ready data. The accelerated deployment of digital systems during public health emergencies has further cemented real-time cold-chain oversight as a priority within the pharmaceutical landscape.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.2 Billion |

| Forecast Value | $22.2 Billion |

| CAGR | 12.1% |

The hardware segment held a 60% share in 2025 and is expected to grow at a CAGR of 12.4% from 2026 to 2035. Cold-chain operations depend on large quantities of physical monitoring devices, temperature probes, GPS units, data loggers, humidity sensors, telematics tools, and door-status detectors installed across warehouses, refrigerated transport, containers, and last-mile equipment. Because every pallet, shipment, and storage point requires continuous tracking, hardware demand grows faster than software adoption, ensuring its leading market position.

The frozen segment accounted for a 56% share in 2025 and is projected to grow at a 12.4% CAGR through 2035. Products stored at frozen temperatures, including certain pharmaceuticals, biologics, and temperature-sensitive foods, must remain within tightly controlled environments. Even the smallest deviation can compromise safety or effectiveness, prompting companies to invest in continuous monitoring, high-accuracy sensors, and reliable real-time reporting throughout the supply chain.

U.S. Cold Chain Monitoring Market generated USD 2.3 billion in 2025. The country's extensive network of refrigerated storage facilities and temperature-controlled transportation promotes strong adoption of monitoring systems. The scale of perishable food distribution, alongside strict requirements for fresh produce, packaged foods, frozen items, biologics, and advanced pharmaceuticals, reinforces the need for real-time visibility. High product variety, long transport distances, and retailer performance standards consistently elevate demand for accurate cold-chain tracking technologies.

Companies active in the Global Cold Chain Monitoring Market include Testo, Controlant, Cold Chain Technologies, Digi International, Sensitech, Zebra Technologies, Descartes Systems, Emerson Electric, Honeywell International, and ORBCOMM. Companies competing in the Cold Chain Monitoring Market strengthen their position by expanding hardware portfolios, enhancing sensor accuracy, and integrating advanced connectivity features into their product lines. Many firms focus on developing real-time platforms that combine temperature tracking, geolocation, and automated alerts to support regulatory compliance and reduce spoilage risk. Strategic collaborations with logistics providers and pharmaceutical manufacturers help vendors embed monitoring solutions deeper within supply chains.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Temperature

- 2.2.4 Deployment

- 2.2.5 Logistics

- 2.2.6 End use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Sensor & hardware manufacturers

- 3.1.1.2 Connectivity & IoT network providers

- 3.1.1.3 Software / platform providers

- 3.1.1.4 Cold chain packaging & insulated containers

- 3.1.1.5 Refrigeration equipment manufacturers

- 3.1.1.6 Cold storage operators & warehouse infrastructure

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid growth of cloud computing & hyperscale expansion

- 3.2.1.2 Explosion of AI, machine learning & high-performance computing (HPC)

- 3.2.1.3 Increasing data generation across industries

- 3.2.1.4 Growth of edge computing for low-latency applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Power & cooling constraints limit high-density server deployments

- 3.2.2.2 Rising energy costs pressure TCO and server refresh decisions

- 3.2.2.3 Supply chain volatility and semiconductor shortages delay server shipments

- 3.2.3 Market opportunities

- 3.2.3.1 Accelerated adoption of AI-optimized and GPU-accelerated servers

- 3.2.3.2 Growth of edge computing opens new server deployment footprints

- 3.2.3.3 Transition to liquid cooling creates hardware upgrade cycles

- 3.2.3.4 Rise of ARM-based servers and alternative architectures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology trends & innovation ecosystem

- 3.7.1 Current technologies

- 3.7.1.1 IoT-based sensors & wireless environmental sensors

- 3.7.1.2 Temperature & humidity data loggers

- 3.7.1.3 Telematics integration for refrigerated containers / vehicles

- 3.7.1.4 GPS / location tracking combined with monitoring for refrigerated containers

- 3.7.2 Emerging technologies

- 3.7.2.1 Predictive analytics / AI and ML-driven analytics

- 3.7.2.2 Data-driven decision-making platforms

- 3.7.2.3 Integration with broader supply-chain systems

- 3.7.2.4 Edge computing / local processing & hybrid architectures

- 3.7.1 Current technologies

- 3.8 Patent analysis

- 3.9 Price trend analysis

- 3.9.1 By region

- 3.9.2 By products

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Risk analysis & management

- 3.12.1 Operational risk assessment

- 3.12.2 Financial risk evaluation

- 3.12.3 Technology & cybersecurity risks

- 3.12.4 Risk mitigation strategies

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Use cases

- 3.15 Best case scenario

- 3.16 ROI & Cost-Benefit Analysis

- 3.17 Feature & pricing benchmarking

- 3.18 Customer preference / buying behavior

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 RFID devices

- 5.2.3 Telematics

- 5.2.4 Networking devices

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Real-time monitoring

- 5.3.2 Analytics and reporting

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Temperature, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Frozen

- 6.3 Chilled

Chapter 7 Market Estimates & Forecast, By Deployment, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Logistics, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Storage

- 8.3 Transportation

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Pharmaceutical & healthcare

- 9.3 Food & beverage

- 9.4 Logistics & distribution

- 9.5 Chemical

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Thailand

- 10.4.7 Indonesia

- 10.4.8 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Leaders

- 11.1.1 Sensitech (Carrier Global)

- 11.1.2 Emerson Electric

- 11.1.3 Honeywell International

- 11.1.4 Descartes Systems

- 11.1.5 Digi International

- 11.1.6 Zebra Technologies

- 11.1.7 Cold Chain Technologies (CCT)

- 11.1.8 ORBCOMM

- 11.1.9 Controlant

- 11.1.10 Testo

- 11.1.11 ELPRO-Buchs

- 11.2 Regional Champions

- 11.2.1 DeltaTrak

- 11.2.2 Monnit

- 11.2.3 FreshLoc Technologies

- 11.2.4 Samsara

- 11.2.5 Tive

- 11.2.6 Roambee

- 11.2.7 Blulog (low-power NFC and wireless data loggers)

- 11.2.8 OnAsset Intelligence (air cargo temperature & security tracking)

- 11.2.9 Zest Labs

- 11.2.10 TagBox

- 11.3 Emerging Players

- 11.3.1 SenseAnywhere

- 11.3.2 Rotronic

- 11.3.3 TempGenius

- 11.3.4 Zhuhai Rayonics Technology

- 11.3.5 Blulog