|

市場調查報告書

商品編碼

1892846

食品磷酸鹽市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Food Phosphate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

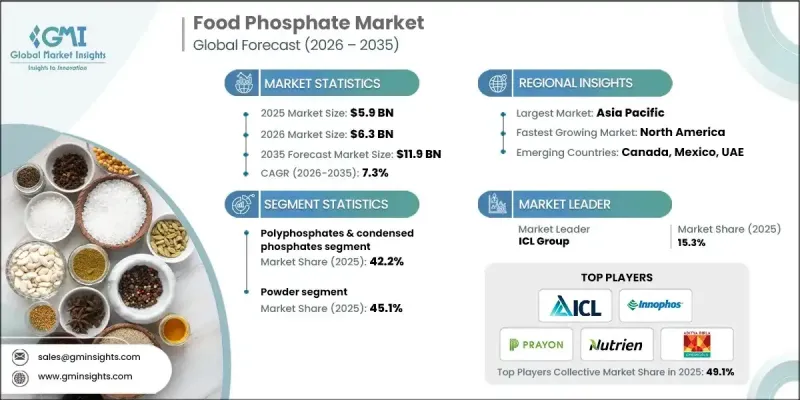

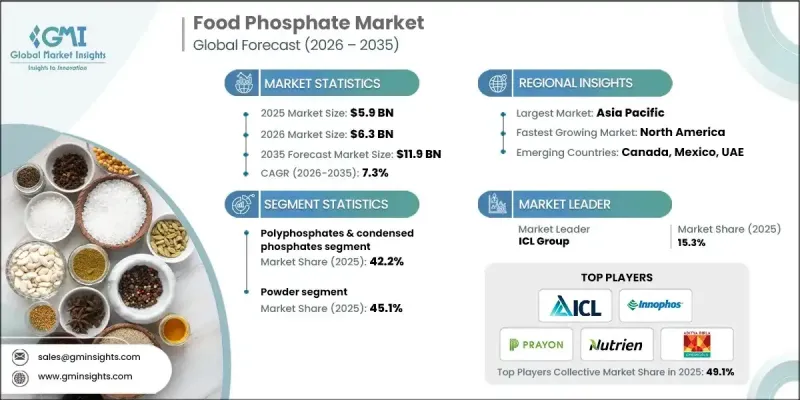

2025 年全球食品磷酸鹽市場價值為 59 億美元,預計到 2035 年將以 7.3% 的複合年成長率成長至 119 億美元。

市場成長得益於加工和包裝食品需求的持續成長,這些食品依賴功能性添加劑來維持品質、一致性和貨架穩定性。食品磷酸鹽,包括廣泛商業化的鈉基、鉀基和鈣基磷酸鹽,在改善質地、保持水分和支持大規模食品生產中的配方穩定性方面發揮關鍵作用。快速的城市化、飲食習慣的改變以及時間緊迫的生活方式持續推動著簡便食品消費的成長,從而增強了長期需求。亞太地區在全球市場銷售方面領先,這得益於人口成長、城市食品消費的擴大以及包裝食品形式的快速普及。北美市場成長速度更快,這主要得益於蛋白質加工和烘焙食品類別的強勁需求,以及先進的食品加工基礎設施。加工食品攝取量的增加、工業化食品生產以及持續的配方創新,共同為全球食品磷酸鹽產業的持續擴張創造了有利條件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 59億美元 |

| 預測值 | 119億美元 |

| 複合年成長率 | 7.3% |

2025 年,聚磷酸鹽和縮合磷酸鹽市佔率為 42.2%,預計到 2035 年將以 7.1% 的複合年成長率成長。它們的領先地位與其多功能性能有關,例如保水、成分穩定和提高產品一致性,這些特性支持其在各種食品加工應用中的廣泛應用。

由於粉狀食品磷酸鹽具有儲存穩定性好、易於操作以及與大批量生產流程相容等優點,預計到2025年,其市場佔有率將達到45.1%。粉狀食品磷酸鹽在多種食品配方中表現穩定,支撐了強勁的市場需求;同時,其他物理形態的粉狀食品磷酸鹽在需要控制溶解度的應用中也越來越受歡迎。

預計2026年至2035年,北美食品磷酸鹽市場將以7.2%的複合年成長率成長。環境高效生產方法的不斷進步以及與以永續發展為中心的製造實踐的日益契合,正在塑造區域需求模式。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 對加工食品和簡便食品的需求不斷成長

- 肉類和海鮮加工業的發展

- 烘焙和糖果業的擴張

- 產業陷阱與挑戰

- 對磷酸鹽添加劑的健康擔憂和負面看法

- 清潔標章運動與消費者偏好轉變

- 市場機遇

- 開發清潔標籤磷酸鹽溶液

- 注重健康的消費者的鈣基磷酸鹽替代品

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2022-2035年

- 正磷酸鹽

- 正磷酸鈉

- 磷酸鉀

- 正磷酸鈣

- 磷酸鎂

- 磷酸銨

- 多聚磷酸鹽和縮合磷酸鹽

- 焦磷酸鹽(二磷酸鹽)

- 三聚磷酸鹽

- 六偏磷酸鹽

- 三偏磷酸鹽

- 磷酸(食品級)

- 其他

第6章:市場估算與預測:依產品類型分類,2022-2035年

- 粉末

- 顆粒狀

- 液體和溶液

- 其他

第7章:市場估計與預測:依應用領域分類,2022-2035年

- 肉類和海鮮加工

- 新鮮及冷凍肉類

- 加工醃製肉類

- 家禽產品

- 海鮮及魚類產品

- 其他

- 麵包店

- 麵包和捲餅

- 蛋糕和糕點

- 餅乾和曲奇

- 泡打粉和混合粉

- 其他

- 乳製品

- 冰淇淋和冷凍甜點

- 加工起起司和起司醬

- 優格及發酵產品

- 其他

- 飲料

- 果汁和果漿

- 碳酸軟性飲料

- 運動飲料和能量飲料

- 咖啡伴侶和奶精

- 其他

- 加工食品及簡便食品

- 即食餐

- 湯和醬料

- 泡麵

- 其他

- 糖果

- 糖果和甜點

- 口香糖

- 其他

- 其他

第8章:市場估算與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Aditya Birla Chemicals

- FBC Industries, Inc

- Fosfa AS

- ICL Group

- Innophos, Inc

- Nippon Chemical Industrial Co., Ltd.

- Nutrien Ltd

- Prayon

- Sulux Phosphates

- TKI Hrastnik

- Xingfa Group

The Global Food Phosphate Market was valued at USD 5.9 billion in 2025 and is estimated to grow at a CAGR of 7.3% to reach USD 11.9 billion by 2035.

Market growth is supported by the steady rise in demand for processed and packaged food products that rely on functional additives to maintain quality, consistency, and shelf stability. Food phosphates, including widely commercialized sodium-, potassium-, and calcium-based variants, play a critical role in improving texture, maintaining moisture, and supporting formulation stability across large-scale food manufacturing. Rapid urbanization, changing dietary habits, and time-constrained lifestyles continue to increase the consumption of convenience foods, which strengthens long-term demand. Asia Pacific leads the global market in volume terms, supported by population growth, expanding urban food consumption, and the rapid penetration of packaged food formats. North America is showing faster expansion, driven by strong demand across protein processing and baked food categories, supported by advanced food processing infrastructure. The convergence of higher processed food intake, industrial-scale food production, and ongoing formulation innovation continues to create favorable conditions for the sustained expansion of the global food phosphate industry.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.9 Billion |

| Forecast Value | $11.9 Billion |

| CAGR | 7.3% |

The polyphosphates and condensed phosphates segment accounted for a 42.2% share in 2025 and is projected to grow at a CAGR of 7.1% through 2035. Their dominance is linked to multifunctional performance attributes such as moisture retention, ingredient stabilization, and improved product consistency, which support wide adoption across diverse food processing applications.

The powdered food phosphates segment held 45.1% share in 2025 due to their storage stability, ease of handling, and compatibility with high-volume manufacturing processes. Their consistent performance across multiple food formulations supports strong demand, while alternative physical forms continue to gain traction in applications requiring controlled solubility.

North America Food Phosphate Market is expected to grow at a CAGR of 7.2% from 2026 to 2035. Ongoing advancements in environmentally efficient production methods and increasing alignment with sustainability-focused manufacturing practices are shaping regional demand patterns.

Key companies active in the Global Food Phosphate Market include Prayon, Innophos, ICL Group, Nutrien Ltd, Aditya Birla Chemicals, Fosfa A.S, Nippon Chemical Industrial Co., Ltd., Xingfa Group, TKI Hrastnik, Sulux Phosphates, and FBC Industries, Inc. Companies operating in the Global Food Phosphate Market are strengthening their market position through capacity expansions, process optimization, and targeted investments in sustainable production technologies. Many players are focusing on improving product purity, functional performance, and formulation flexibility to align with evolving food manufacturing requirements. Strategic partnerships with food processors help secure long-term supply agreements and application-specific innovation. Geographic expansion into high-growth regions remains a priority to capture rising processed food demand. Additionally, companies are enhancing regulatory compliance capabilities and exploring alternative sourcing strategies to improve supply chain resilience and reinforce brand credibility in global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for processed & convenience foods

- 3.2.1.2 Growing meat & seafood processing industry

- 3.2.1.3 Expansion of bakery & confectionery sector

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Health concerns & negative perception of phosphate additives

- 3.2.2.2 Clean-label movement & consumer preference shift

- 3.2.3 Market opportunities

- 3.2.3.1 Development of clean-label phosphate solutions

- 3.2.3.2 Calcium-based phosphate alternatives for health-conscious consumers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Orthophosphates

- 5.2.1 Sodium orthophosphates

- 5.2.2 Potassium orthophosphates

- 5.2.3 Calcium orthophosphates

- 5.2.4 Magnesium phosphates

- 5.2.5 Ammonium phosphates

- 5.3 Polyphosphates & condensed phosphates

- 5.3.1 Pyrophosphates (diphosphates)

- 5.3.2 Tripolyphosphates

- 5.3.3 Hexametaphosphates

- 5.3.4 Trimetaphosphates

- 5.4 Phosphoric acid (food grade)

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Granular

- 6.4 Liquid & solution

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Meat & seafood processing

- 7.2.1 Fresh & frozen meat

- 7.2.2 Processed & cured meats

- 7.2.3 Poultry products

- 7.2.4 Seafood & fish products

- 7.2.5 Others

- 7.3 Bakery

- 7.3.1 Breads & rolls

- 7.3.2 Cakes & pastries

- 7.3.3 Biscuits & cookies

- 7.3.4 Baking powders & mixes

- 7.3.5 Others

- 7.4 Dairy

- 7.4.1 Ice cream & frozen desserts

- 7.4.2 Processed cheese & cheese spreads

- 7.4.3 Yogurt & cultured products

- 7.4.4 Others

- 7.5 Beverages

- 7.5.1 Fruit juices & nectars

- 7.5.2 Carbonated soft drinks

- 7.5.3 Sports & energy drinks

- 7.5.4 Coffee creamers & whiteners

- 7.5.5 Others

- 7.6 Processed & convenience foods

- 7.6.1 Ready meals

- 7.6.2 Soups & sauces

- 7.6.3 Instant noodles

- 7.6.4 Others

- 7.7 Confectionery

- 7.7.1 Candies & sweets

- 7.7.2 Chewing gum

- 7.7.3 Others

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Aditya Birla Chemicals

- 9.2 FBC Industries, Inc

- 9.3 Fosfa A.S

- 9.4 ICL Group

- 9.5 Innophos, Inc

- 9.6 Nippon Chemical Industrial Co., Ltd.

- 9.7 Nutrien Ltd

- 9.8 Prayon

- 9.9 Sulux Phosphates

- 9.10 TKI Hrastnik

- 9.11 Xingfa Group