|

市場調查報告書

商品編碼

1892825

步入式冷藏庫市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Walk-in Coolers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

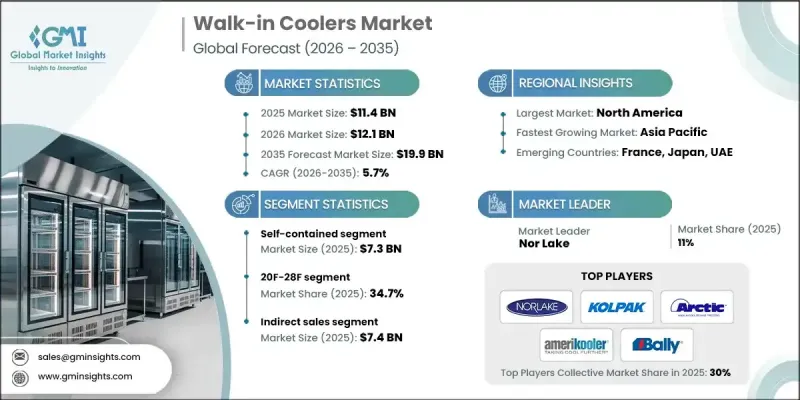

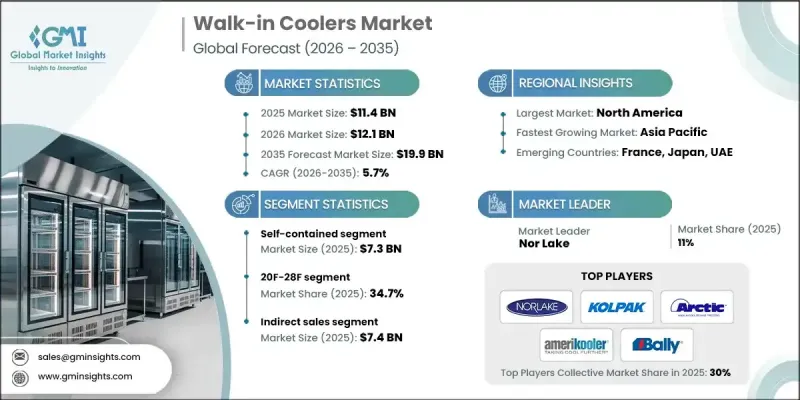

2025 年全球步入式冷藏庫市場價值為 114 億美元,預計到 2035 年將以 5.7% 的複合年成長率成長至 199 億美元。

對肉類、海鮮和乳製品等易腐食品的需求不斷成長,加上快餐店和雲端廚房數量的增加,推動了對可靠冷藏解決方案的需求。步入式冷藏庫透過控制溫度和實現精確的庫存追蹤,幫助經營者保障食品安全。這一趨勢在城市地區尤其顯著,較高的可支配收入和對即食食品的偏好,促使人們更多地選擇預製食品而非傳統的從零開始烹飪。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 114億美元 |

| 預測值 | 199億美元 |

| 複合年成長率 | 5.7% |

全球化的食品供應鏈也加劇了倉儲和配送的複雜性,凸顯了健全的冷鏈基礎設施的重要性。零售商、餐飲服務商和製造商都在投資先進的冷凍系統,以確保產品在長途運輸和多變的氣候條件下保持品質。環保意識的增強推動了對使用環保冷媒的節能型冷藏設備的需求,這為製造商提供了透過技術創新實現差異化競爭並滿足監管要求的途徑。

預計到2025年,-7°C至-2°C的溫度區間將佔據34.7%的市佔率。此溫度範圍是儲存肉類、海鮮、乳製品、冷凍食品和罐頭食品的理想溫度,能夠有效保持其品質和食用安全。專業零售商、肉店和餐廳都依賴此溫度範圍來符合食品安全標準,同時延長產品的保存期限。

到 2025 年,間接銷售部門創造了 74 億美元的收入。透過第三方分銷商或批發商進行銷售,製造商可以利用已建立的網路,擴大市場覆蓋範圍,並比單獨進行直接銷售更有效地進入多元化市場。

美國步入式冷藏庫市場佔79.6%的佔有率,預計2025年市場規模將達到31億美元。美國成熟的餐飲服務業、龐大的零售網路以及嚴格的衛生法規推動了對可靠且節能的冷凍設備的需求。雲端廚房的興起進一步提升了美國各地對高品質步入式冷藏庫和冷凍解決方案的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 食品飲料業的擴張

- 醫藥和醫療保健需求

- 都市化與零售業擴張

- 產業陷阱與挑戰

- 高初始投資

- 能源管理與營運成本壓力

- 機會

- 智慧互聯的冷卻解決方案

- 客製化和模組化設計

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2022-2035年

- 自給自足

- 遠端冷凝

- 多廳影院步入式通道

第6章:市場估算與預測:依溫度範圍分類,2022-2035年

- 華氏20 - 28華氏度

- 華氏28 - 32華氏度

- 32華氏度 - 35華氏度

- 36華氏度 - 40華氏度

第7章:市場估算與預測:依電力消耗量分類,2022-2035年

- 最高 1 千瓦時

- 2至3千瓦時

- 4至5度

- 超過 5 千瓦時

第8章:市場估算與預測:依儲存容量分類,2022-2035年

- 最多2噸

- 3至5噸

- 6至10噸

- 10噸以上

第9章:市場估價與預測:依窗簾類型分類,2022-2035年

- 條形簾

- 空氣幕

第10章:市場估計與預測:依應用領域分類,2022-2035年

- 餐飲

- 醫療保健設施

- 製藥

- 花的

- 零售

- 其他(農業、殯葬業等)

第11章:市場估價與預測:依配銷通路分類,2022-2035年

- 直銷

- 間接銷售

第12章:市場估算與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- ABN Refrigeration Manufacturing

- American Panel

- Amerikooler

- Arctic Walk-in Coolers & Walk-in Freezers

- Bally Refrigerated Boxes

- Canadian Curtis Refrigeration

- Everidge

- Hussmann

- Imperial Brown

- Kolpak

- KPS Global

- Master-Bilt

- Nor-Lake

- Thermo-Kool

- US Cooler

The Global Walk-in Coolers Market was valued at USD 11.4 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 19.9 billion by 2035.

Rising demand for perishable goods such as meat, seafood, and dairy, combined with the growing number of quick-service restaurants and cloud kitchens, is fueling the need for reliable cold storage solutions. Walk-in coolers help operators maintain food safety by controlling temperature and enabling accurate inventory tracking. This trend is particularly strong in urban areas, where higher disposable income and a preference for ready-to-eat meals are driving the adoption of pre-prepared foods over traditional cooking from scratch.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $11.4 Billion |

| Forecast Value | $19.9 Billion |

| CAGR | 5.7% |

Globalized food supply chains have also heightened the complexity of storage and distribution, increasing the importance of robust cold chain infrastructure. Retailers, foodservice operators, and manufacturers are investing in advanced refrigeration systems that preserve product quality during long-distance transportation and variable climate conditions. Environmental concerns are pushing demand for energy-efficient coolers that use eco-friendly refrigerants, offering manufacturers a way to differentiate themselves through technological innovation while meeting regulatory requirements.

The 20°F-28°F segment accounted for a 34.7% share in 2025. This temperature range is ideal for storing meat, seafood, dairy, frozen, and canned items, preserving their quality and safety for consumption. Specialty retailers, butcheries, and restaurants rely on this range to comply with food safety standards while extending the shelf life of their products.

The indirect sales segment generated USD 7.4 billion in 2025. Selling through third-party distributors or wholesalers allows manufacturers to leverage established networks, expand market reach, and access diverse markets more efficiently than direct sales alone.

U.S Walk-in Coolers Market held a 79.6% share, generating USD 3.1 billion in 2025. The country's mature foodservice industry, large retail network, and strict health regulations drive demand for reliable and energy-efficient refrigeration. The rise of cloud kitchens has further increased the need for quality walk-in coolers and refrigeration solutions across the U.S.

Key players in the Walk-in Coolers Market include Hussmann, KPS Global, Canadian Curtis Refrigeration, Master-Bilt, Thermo-Kool, U.S. Cooler, ABN Refrigeration Manufacturing, American Panel, Kolpak, Everidge, Imperial Brown, Bally Refrigerated Boxes, Arctic Walk-in Coolers & Walk-in Freezers, Nor-Lake, and Amerikooler. Companies in the walk-in cooler market are strengthening their presence through product innovation, focusing on energy-efficient designs and eco-friendly refrigerants that meet strict regulatory standards. Many are expanding their portfolios with modular and customizable cooler solutions to suit restaurants, retail chains, and cloud kitchens. Strategic partnerships with distributors and wholesalers help extend market reach and improve penetration in regional and urban centers. Companies are also investing in advanced temperature control and monitoring technologies, providing customers with smart, connected solutions that enhance operational efficiency and reduce food waste.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Temperature range

- 2.2.4 Power consumption

- 2.2.5 Storage capacity

- 2.2.6 Curtain type

- 2.2.7 Application

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of food & beverage industry

- 3.2.1.2 Pharmaceutical & healthcare needs

- 3.2.1.3 Urbanization & retail expansion

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Energy management & operational cost pressures

- 3.2.3 Opportunities

- 3.2.3.1 Smart & connected cooling solutions

- 3.2.3.2 Customization & modular designs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Self-contained

- 5.3 Remote condensing

- 5.4 Multiplex walk-ins

Chapter 6 Market Estimates and Forecast, By Temperature Range, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 20F - 28F

- 6.3 28F - 32F

- 6.4 32F - 35F

- 6.5 36F - 40F

Chapter 7 Market Estimates and Forecast, By Power Consumption, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 1 KWH

- 7.3 2 to 3 KWH

- 7.4 4 to 5 KWH

- 7.5 Above 5 KWH

Chapter 8 Market Estimates and Forecast, By Storage Capacity, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Up to 2 tons

- 8.3 3 to 5 tons

- 8.4 6 to 10 tons

- 8.5 Above 10 tons

Chapter 9 Market Estimates and Forecast, By Curtain Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Strip curtain

- 9.3 Air curtain

Chapter 10 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Food and beverage

- 10.3 Healthcare & medical facilities

- 10.4 Pharmaceuticals

- 10.5 Floral

- 10.6 Retail

- 10.7 Others (agriculture, mortuary, etc.)

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 ABN Refrigeration Manufacturing

- 13.2 American Panel

- 13.3 Amerikooler

- 13.4 Arctic Walk-in Coolers & Walk-in Freezers

- 13.5 Bally Refrigerated Boxes

- 13.6 Canadian Curtis Refrigeration

- 13.7 Everidge

- 13.8 Hussmann

- 13.9 Imperial Brown

- 13.10 Kolpak

- 13.11 KPS Global

- 13.12 Master-Bilt

- 13.13 Nor-Lake

- 13.14 Thermo-Kool

- 13.15 U.S. Cooler