|

市場調查報告書

商品編碼

1892823

被竊車輛找回市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Stolen Vehicle Recovery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

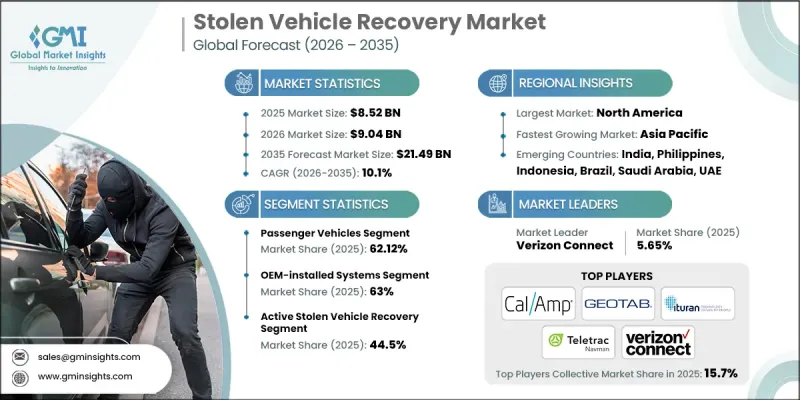

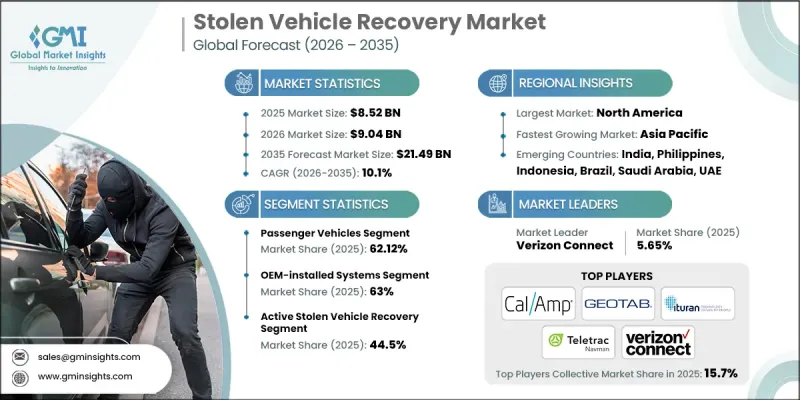

2025 年全球被盜車輛找回市場價值為 85.2 億美元,預計到 2035 年將以 10.1% 的複合年成長率成長至 214.9 億美元。

市場擴張的驅動力在於連網車輛架構、智慧車載資訊系統和嵌入式安全模組的快速普及,這些都正在重塑智慧車輛防盜(SVR)生態系統。現代SVR系統融合了全球導航衛星系統(GNSS)定位、蜂窩網路和物聯網(IoT)連接以及基於人工智慧的分析技術,能夠實現即時車輛追蹤、地理圍欄、遠端車輛鎖定和行為異常檢測。汽車製造商、保險公司和車隊營運商越來越依賴整合式SVR解決方案來減少竊盜損失、加快車輛找回速度並提升駕駛員安全。這些技術最大限度地減少了人工干預,支援持續的車輛監控,並加強了乘用車和商用車車隊的網路安全。策略投資、平台整合和跨產業合作正在重塑競爭格局。領先的車載資訊系統供應商正在部署高靈敏度GNSS模組、下一代物聯網調變解調器和基於雲端的指揮中心,而汽車供應商則專注於加密通訊、抗干擾感測器和可互通的API,以加速全球普及的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 85.2億美元 |

| 預測值 | 214.9億美元 |

| 複合年成長率 | 10.1% |

到 2025 年,乘用車市佔率將達到 62.12%,預計到 2035 年將以 9.8% 的複合年成長率成長。日益嚴重的車輛失竊問題、連網汽車的成長以及中等收入和高階車輛擁有量的增加,正在推動個人車輛採用 GPS 追蹤、地理圍欄和遠端鎖定等技術。

2025年, OEM配套)安裝系統市佔率達63%,預計2026年至2035年將以10.4%的複合年成長率成長。原廠預先安裝的車載資訊系統和連網汽車平台具有更高的可靠性、準確性和與車輛電子設備的整合度。 OEMOEM方案可透過製造商的連網汽車生態系統直接實現遠端防盜、地理圍籬、防篡改警報和自動防盜通知等功能,從而減少售後加裝的需求。

預計到2025年,美國被竊車輛追回市場將佔85%的市場佔有率,市場規模將達28.9億美元。推動市場成長的因素包括遠端資訊處理技術的普及、物聯網連接以及人工智慧分析的興起,這些技術有助於應對城市地區較高的車輛失竊率和複雜的犯罪網路。車隊營運商、保險公司和汽車製造商正擴大部署先進的車輛追回系統(SVR)平台,以減少經濟損失、加快車輛追回速度並提高駕駛員安全。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 車輛失竊率上升和複雜的汽車竊盜網路

- 技術創新不斷發展(GPS、物聯網、人工智慧/機器學習)

- 提高SVR安裝的保險激勵措施

- 車隊營運、叫車和物流業不斷發展

- 產業陷阱與挑戰

- SVR安裝和訂閱成本高昂

- 資料隱私和網路安全問題

- 市場機遇

- 隨著汽車保有量的成長,新興市場擴張勢頭強勁。

- 與智慧城市計畫和公共安全網路的整合

- 開發人工智慧驅動的預測分析和加值服務

- 原始設備製造商、保險公司和車隊管理公司之間的策略合作夥伴關係

- 成長促進因素

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 基於GPS的追蹤技術

- 射頻(RF)技術

- 混合技術系統

- 新興技術

- 地理圍籬和虛擬邊界技術

- 5G網路整合

- 物聯網 (IoT) 和低功耗廣域網路 (LPWAN) 技術

- 當前技術趨勢

- 專利分析

- 定價分析

- 按地區

- 透過訂閱和服務定價

- 成本細分分析

- 製造和組裝成本

- 軟體和平台開發成本

- 網路和連接成本

- 客戶獲取成本(CAC)

- 安裝和啟動費用

- 研發成本

- 永續性和環境影響分析

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 商業案例及投資報酬率分析

- 總擁有成本框架

- 投資報酬率計算方法

- 實施時間表和里程碑

- 風險評估與緩解策略

- 消費者行為與採納趨勢

- 採用生命週期分析

- 各細分市場技術採納曲線

- 區域採用模式

- 世代採納差異

- 季節性和時間性採用模式

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估價與預測:依車輛類型分類,2022-2035年

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第6章:市場估算與預測:依安裝量分類,2022-2035年

- OEM安裝的系統

- 售後市場

第7章:市場估計與預測:依技術分類,2022-2035年

- 基於GPS的追蹤系統

- 射頻(RF)系統

- 蜂窩和車載資訊服務平台

- 混合系統(GPS + RF)

- 其他

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 個人車輛所有者

- 車隊車主

- 保險公司

- 政府和執法部門

- 其他

第9章:市場估算與預測:依應用領域分類,2022-2035年

- 主動追回被盜車輛

- 車隊管理與安保

- 保險遠端資訊處理和UBI

- 汽車經銷商解決方案

- 資產和設備追蹤

- 其他

第10章:市場估價與預測:依服務模式分類,2022-2035年

- 硬體 + 訂閱

- 綜合服務計劃

- 一次性購買

- 企業/車隊許可

第11章:市場估計與預測:按地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 菲律賓

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- 全球參與者

- CalAmp

- General Motors

- Geotab

- Robert Bosch

- Spireon

- Verizon Communications

- Vodafone Automotive

- 區域玩家

- Ituran Location & Control

- MiX Telematics

- Netstar (Altron)

- Samsara

- Teletrac Navman

- TomTom International

- 新興參與者

- 3 Si Security Systems

- Ford Pro

- Lytx

- Matrack

- Powerfleet

- Quartix Technologies

- RecovR

- StarChase

- Telematica

- TRACKMATIC

- Trimble

- Zubie

The Global Stolen Vehicle Recovery Market was valued at USD 8.52 billion in 2025 and is estimated to grow at a CAGR of 10.1% to reach USD 21.49 billion by 2035.

The market expansion is driven by the rapid adoption of connected vehicle architectures, intelligent telematics, and embedded security modules, transforming the SVR ecosystem. Modern SVR systems combine GNSS positioning, cellular and IoT connectivity, and AI-based analytics, enabling live vehicle tracking, geofencing, remote immobilization, and behavioral anomaly detection. Automakers, insurers, and fleet operators increasingly rely on integrated SVR solutions to reduce theft losses, speed up recovery, and enhance driver safety. These technologies minimize manual intervention, support continuous vehicle monitoring, and strengthen cybersecurity across both passenger and commercial fleets. Strategic investments, platform consolidations, and cross-industry partnerships are reshaping the competitive landscape. Leading telematics providers are deploying high-sensitivity GNSS modules, next-generation IoT modems, and cloud-based command centers, while automotive suppliers are focusing on encrypted communications, anti-jamming sensors, and interoperable APIs to accelerate adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.52 Billion |

| Forecast Value | $21.49 Billion |

| CAGR | 10.1% |

The passenger vehicle segment held a 62.12% share in 2025 and is expected to grow at a CAGR of 9.8% through 2035. Rising vehicle theft concerns, the growth of connected cars, and the increase in mid-income and premium vehicle ownership are driving the adoption of GPS tracking, geofencing, and remote immobilization for personal vehicles.

The OEM-installed systems segment held a 63% share in 2025 and is projected to grow at a CAGR of 10.4% from 2026 to 2035. Factory-fitted telematics and connected-car platforms offer greater reliability, accuracy, and integration with vehicle electronics. OEM solutions enable features like remote immobilization, geofencing, tamper alerts, and automated theft notifications directly through the manufacturer's connected-car ecosystem, reducing the need for aftermarket installations.

United States Stolen Vehicle Recovery Market held an 85% share in 2025, generating USD 2.89 billion. Growth is fueled by rising telematics adoption, IoT connectivity, and AI-powered analytics, addressing higher vehicle theft rates in urban areas and complex criminal theft networks. Fleet operators, insurance companies, and OEMs are increasingly deploying advanced SVR platforms to mitigate financial losses, accelerate recovery, and improve driver safety.

Major players in the Global Stolen Vehicle Recovery Market include Geotab, CalAmp, Ituran Global, Netstar (Altron), Samsara, Spireon, Teletrac Navman, TomTom International, and Verizon Connect. Key strategies adopted by companies in the Stolen Vehicle Recovery Market include continuous R&D to enhance AI-driven analytics, GNSS accuracy, and IoT connectivity. Firms are focusing on integrating SVR solutions with OEM telematics platforms, fleet management systems, and insurance networks to offer value-added services. Expansion through strategic partnerships and acquisitions allows companies to extend their geographic presence and technological capabilities. Investment in cloud-based command centers, cybersecurity protocols, and anti-jamming technologies strengthens reliability and user trust. Additionally, companies are enhancing interoperability with cross-border tracking systems, offering scalable solutions for commercial fleets and high-value cargo, thereby consolidating their market position and improving customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Installation

- 2.2.4 Technology

- 2.2.5 End Use

- 2.2.6 Application

- 2.2.7 Service Model

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in vehicle theft rates and sophisticated auto-theft networks

- 3.2.1.2 Growing technological innovations (GPS, IoT, AI/ML)

- 3.2.1.3 Increase in insurance incentives for SVR installation

- 3.2.1.4 Growing fleet operations, ride-hailing, and logistics sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of SVR installation and subscription

- 3.2.2.2 Data privacy and cybersecurity concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets with growing vehicle ownership

- 3.2.3.2 Integration with smart-city initiatives and public-safety networks

- 3.2.3.3 Development of AI-powered predictive analytics and value-added services

- 3.2.3.4 Strategic partnerships among OEMs, insurers, and fleet managers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 GPS-based tracking technology

- 3.7.1.2 Radio frequency (RF) technology

- 3.7.1.3 Hybrid technology systems

- 3.7.2 Emerging technologies

- 3.7.2.1 Geofencing & virtual boundary technology

- 3.7.2.2 5g network integration

- 3.7.2.3 Internet of things (Iot) & LPWAN technologies

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.9 Pricing Analysis

- 3.9.1 By region

- 3.9.2 By subscription & service pricing

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing & assembly costs

- 3.10.2 Software & platform development costs

- 3.10.3 Network & connectivity costs

- 3.10.4 Customer acquisition costs (CAC)

- 3.10.5 Installation & activation costs

- 3.10.6 Research & development costs

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Business Case & ROI Analysis

- 3.12.1 Total cost of ownership framework

- 3.12.2 ROI calculation methodologies

- 3.12.3 Implementation timeline & milestones

- 3.12.4 Risk assessment & mitigation strategies

- 3.13 Consumer behavior & adoption trends

- 3.13.1 Adoption lifecycle analysis

- 3.13.2 Technology adoption curves by segment

- 3.13.3 Regional adoption patterns

- 3.13.4 Generational adoption differences

- 3.13.5 Seasonal & temporal adoption patterns

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Installation, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 OEM-installed systems

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 GPS-Based Tracking Systems

- 7.3 Radio Frequency (RF) Systems

- 7.4 Cellular & Telematics Platforms

- 7.5 Hybrid Systems (GPS + RF)

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Individual vehicle owners

- 8.3 Fleet owners

- 8.4 Insurance companies

- 8.5 Government & law enforcement

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Active Stolen Vehicle Recovery

- 9.3 Fleet Management & Security

- 9.4 Insurance Telematics & UBI

- 9.5 Automotive Dealer Solutions

- 9.6 Asset & Equipment Tracking

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Service Model, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Hardware + Subscription

- 10.3 Integrated Service Plans

- 10.4 One-Time Purchase

- 10.5 Enterprise/Fleet Licensing

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 CalAmp

- 12.1.2 General Motors

- 12.1.3 Geotab

- 12.1.4 Robert Bosch

- 12.1.5 Spireon

- 12.1.6 Verizon Communications

- 12.1.7 Vodafone Automotive

- 12.2 Regional Players

- 12.2.1 Ituran Location & Control

- 12.2.2 MiX Telematics

- 12.2.3 Netstar (Altron)

- 12.2.4 Samsara

- 12.2.5 Teletrac Navman

- 12.2.6 TomTom International

- 12.3 Emerging Players

- 12.3.1. 3 Si Security Systems

- 12.3.2 Ford Pro

- 12.3.3 Lytx

- 12.3.4 Matrack

- 12.3.5 Powerfleet

- 12.3.6 Quartix Technologies

- 12.3.7 RecovR

- 12.3.8 StarChase

- 12.3.9 Telematica

- 12.3.10 TRACKMATIC

- 12.3.11 Trimble

- 12.3.12 Zubie