|

市場調查報告書

商品編碼

1892819

前列腺癌診斷市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Prostate Cancer Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

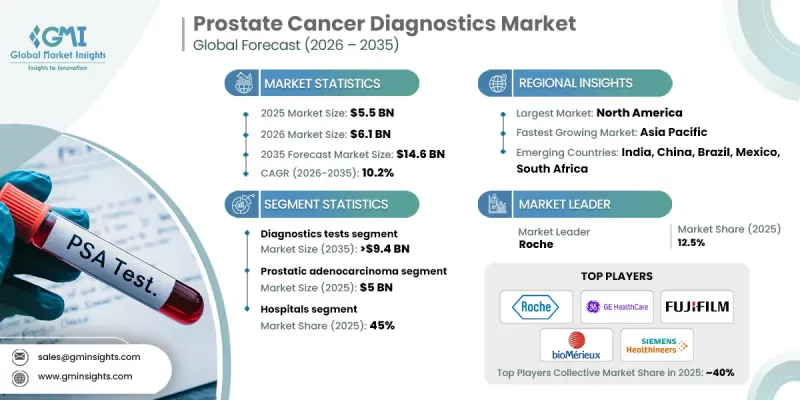

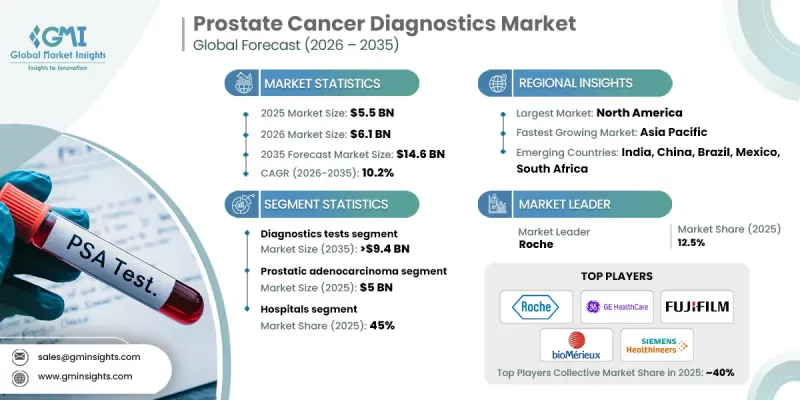

2025 年全球前列腺癌診斷市場價值為 55 億美元,預計到 2035 年將以 10.2% 的複合年成長率成長至 146 億美元。

這一成長得益於診斷技術的不斷進步、全球前列腺癌負擔的日益加重、公眾意識的不斷提高、篩檢計畫的不斷擴展,以及男性人口的快速老化。前列腺癌診斷是指用於檢測疾病、評估疾病進展和指導治療決策的一系列全面的臨床檢測和醫療程序。這些診斷方法包括血液檢測、先進的影像技術和組織分析方法,以支援疾病的準確識別和監測。近年來,諸如新一代定序、液基診斷方法、多參數影像和人工智慧輔助分析工具等技術的進步,顯著提高了診斷的精確度,同時減少了不必要的干涉。隨著診斷路徑向更精準、更微創的方向發展,以及對分子和基因組分析的日益依賴,整個行業持續受益,這些因素共同提高了早期檢出率,並改善了醫療機構的臨床決策。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 55億美元 |

| 預測值 | 146億美元 |

| 複合年成長率 | 10.2% |

到2025年,診斷測試領域將佔據63.6%的市場。這一領先地位反映了篩檢和基於生物標記的檢測方法的日益普及、人們對早期檢測的偏好不斷增強以及非侵入性診斷方法的廣泛接受。疾病盛行率的上升和患者意識的提高將繼續推動對可靠、準確的檢測解決方案的持續需求。

預計到2025年,醫院業務將佔前列腺癌診斷市場45%的佔有率,並在2025年至2035年間達到64億美元。醫院在前列腺癌診斷中仍然扮演著核心角色,因為它們在患者的初步評估、高級影像檢查和確診程序中發揮重要作用。整合的診斷能力支持在同一醫療機構內進行全面的疾病評估和分期。

預計到2025年,北美前列腺癌診斷市佔率將達到40.4%。該地區強勁的市場表現得益於高發病率、完善的篩檢體系和先進的醫療基礎設施。設備齊全的診斷機構和早期檢測措施持續推動該地區先進診斷技術的應用。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 攝護腺癌發生率不斷上升

- 影像和生物標記診斷技術的進步

- 提高公眾意識和篩檢力度

- 對微創診斷程序的需求日益成長

- 產業陷阱與挑戰

- 先進診斷方式成本高昂

- 低收入和中等收入地區的可及性有限

- 市場機遇

- 人工智慧診斷工具的擴展

- 個人化醫療的日益普及

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興技術

- 報銷方案

- 未來市場趨勢

- 價值鏈分析

- 波特的分析

- PESTEL 分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依測試類型分類,2022-2035年

- 診斷測試

- 攝護腺特異性抗原

- 攝護腺切片

- 分子/基因組檢測

- 其他診斷測試

- 影像檢查

- 經直腸超音波(TRUS)

- 磁振造影

- CT掃描

- 其他影像學檢查

第6章:市場估計與預測:依癌症類型分類,2022-2035年

- 攝護腺腺癌

- 小細胞癌

- 其他癌症類型

第7章:市場估算與預測:依最終用途分類,2022-2035年

- 醫院

- 診斷實驗室

- 癌症研究機構

- 其他最終用途

第8章:市場估算與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- Beckman Coulter

- Becton, Dickinson and Company

- bioMerieux

- FUJIFILM

- GE HealthCare

- Glycanostics

- HEALGEN

- KOELIS

- Metamark Genetics

- Myriad Genetics

- OPKO Health

- PHILIPS

- Proteomedix

- Roche

- SIEMENS Healthineers

- Veracyte

The Global Prostate Cancer Diagnostics Market was valued at USD 5.5 billion in 2025 and is estimated to grow at a CAGR of 10.2% to reach USD 14.6 billion by 2035.

This growth is driven by continuous progress in diagnostic technologies, the increasing global burden of prostate cancer, wider awareness initiatives, and expanding screening programs, along with a rapidly aging male population. Prostate cancer diagnostics refers to a comprehensive range of clinical tests and medical procedures used to detect the disease, assess its progression, and guide treatment decisions. These diagnostics include blood-based assessments, advanced imaging techniques, and tissue analysis methods that support accurate disease identification and monitoring. Recent technological advancements, such as next-generation sequencing, liquid-based diagnostic approaches, multiparametric imaging, and AI-supported analysis tools, have significantly enhanced diagnostic precision while reducing unnecessary interventions. The industry continues to benefit from a shift toward more accurate, less invasive diagnostic pathways and greater reliance on molecular and genomic profiling, which together are improving early detection rates and clinical decision-making across healthcare settings.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.5 Billion |

| Forecast Value | $14.6 Billion |

| CAGR | 10.2% |

The diagnostic tests segment held a 63.6% share in 2025. This leadership position reflects rising utilization of screening and biomarker-based tests, increased preference for early-stage detection, and broader acceptance of non-invasive diagnostic methods. Growing disease prevalence and improved patient awareness continue to drive consistent demand for reliable and accurate testing solutions.

The hospitals segment held a 45% share in 2025 and is expected to reach USD 6.4 billion during 2025-2035. Hospitals remain central to prostate cancer diagnosis due to their role in initial patient evaluation, advanced imaging, and confirmatory procedures. Integrated diagnostic capabilities support comprehensive disease assessment and staging within a single care setting.

North America Prostate Cancer Diagnostics Market held a 40.4% share in 2025. Strong regional performance is supported by high disease incidence, established screening practices, and advanced healthcare infrastructure. The presence of well-equipped diagnostic facilities and early detection initiatives continues to drive the adoption of advanced diagnostic technologies across the region.

Key companies operating in the Global Prostate Cancer Diagnostics Market include Roche, Abbott, Siemens Healthineers, GE HealthCare, PHILIPS, Myriad Genetics, Becton, Dickinson and Company, Beckman Coulter, bioMerieux, Veracyte, FUJIFILM, OPKO Health, Proteomedix, Glycanostics, Metamark Genetics, KOELIS, and HEALGEN. Companies in the Global Prostate Cancer Diagnostics Market implement focused strategies to strengthen their competitive positioning. Continuous investment in research and development supports the launch of more accurate and clinically validated diagnostic tools. Firms emphasize integration of molecular diagnostics, advanced imaging analytics, and AI-driven interpretation to enhance diagnostic confidence. Strategic collaborations with healthcare providers and research institutions accelerate technology adoption and clinical validation. Expansion into emerging markets supports long-term growth, while regulatory alignment ensures timely product approvals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Cancer type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of prostate cancer

- 3.2.1.2 Advancements in imaging and biomarker-based diagnostics

- 3.2.1.3 Surging awareness and screening initiatives

- 3.2.1.4 Growing demand for minimally invasive diagnostic procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced diagnostic modalities

- 3.2.2.2 Limited accessibility in low- and middle-income regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of AI-powered diagnostic tools

- 3.2.3.2 Growing adoption of personalized medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Future market trends

- 3.8 Value chain analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostics tests

- 5.2.1 PSA

- 5.2.2 Prostate biopsy

- 5.2.3 Molecular/ genomic test

- 5.2.4 Other diagnostics tests

- 5.3 Imaging tests

- 5.3.1 Transrectal Ultrasound (TRUS)

- 5.3.2 MRI

- 5.3.3 CT Scan

- 5.3.4 Other imaging tests

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Prostatic adenocarcinoma

- 6.3 Small cell carcinoma

- 6.4 Other cancer types

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Cancer research institutes

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Beckman Coulter

- 9.3 Becton, Dickinson and Company

- 9.4 bioMerieux

- 9.5 FUJIFILM

- 9.6 GE HealthCare

- 9.7 Glycanostics

- 9.8 HEALGEN

- 9.9 KOELIS

- 9.10 Metamark Genetics

- 9.11 Myriad Genetics

- 9.12 OPKO Health

- 9.13 PHILIPS

- 9.14 Proteomedix

- 9.15 Roche

- 9.16 SIEMENS Healthineers

- 9.17 Veracyte