|

市場調查報告書

商品編碼

1892816

充血性心臟衰竭藥物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Congestive Heart Failure Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

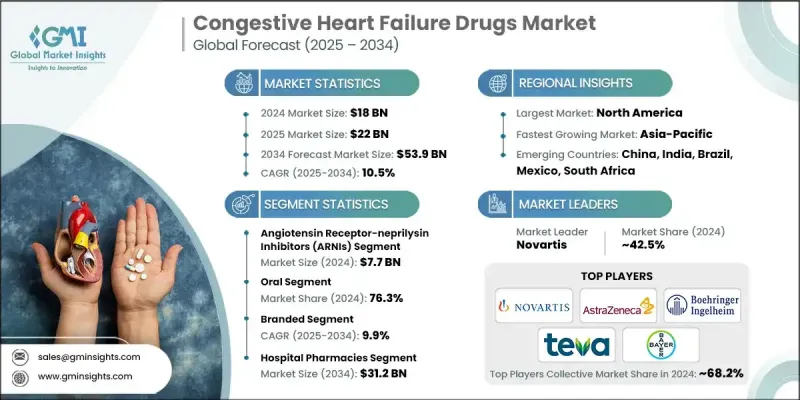

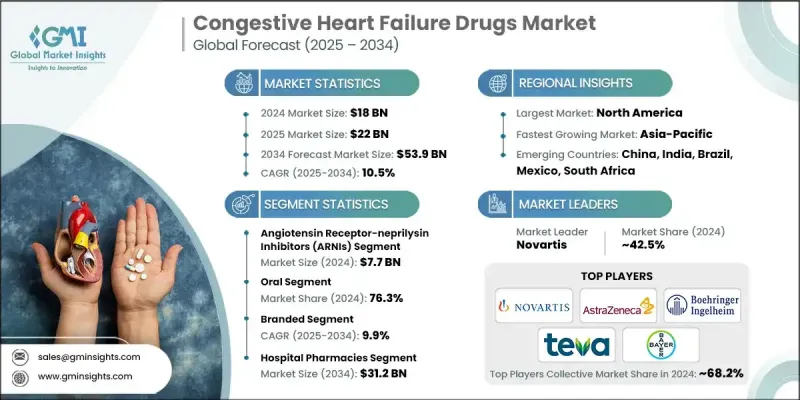

2024 年全球充血性心臟衰竭藥物市場價值為 180 億美元,預計到 2034 年將以 10.5% 的複合年成長率成長至 539 億美元。

市場成長主要受心臟衰竭盛行率上升、藥物研發進展以及指南指導的藥物治療推廣的推動。 SGLT2抑制劑和ARNI等新型藥物的日益普及,以及ACE抑制劑、BETA受體阻斷劑和利尿劑等成熟療法的應用,正在改善患者的生存預後並減少住院次數,從而擴大潛在患者群體。遠距醫療和遠距監測的日益普及,使得早期介入、更精準的治療方案最佳化和更好的長期依從性成為可能,進而提升了藥物在急性和慢性照護中的利用率。此外,製藥公司正大力推動在研藥物創新、聯合療法以及擴大適應症範圍(涵蓋更廣泛的心臟衰竭表現型)等方面的研發,這將進一步推動市場在預測期內持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 180億美元 |

| 預測值 | 539億美元 |

| 複合年成長率 | 10.5% |

充血性心臟衰竭藥物市場主要依給藥途徑分類,其中口服藥物在2024年佔76.3%的市佔率。口服療法因其便利性、易於自我給藥、給藥成本較低以及適合長期居家管理慢性心臟衰竭等優點而備受青睞。緩釋製劑、每日一次製劑和固定劑量複方製劑簡化了複雜的治療方案,提高了合併多種疾病患者的依從性和治療效果。此外,ACE抑制劑、BETA受體阻斷劑和SGLT2抑制劑等強效口服藥物的日益普及,進一步鞏固了該細分市場在門診和遠距醫療模式下的主導地位。

按配銷通路,醫院藥房在2024年創造了312億美元的收入,這主要得益於大量需要強化、標準化治療的急性失代償性心臟衰竭病例。這些場所需要管理複雜的靜脈注射正性肌力藥物、利尿劑以及血管緊張素受體-腦啡肽酶抑制劑(ARNI)和SGLT2抑制劑等先進療法,從而導致大量的藥物消耗,並使醫院藥房成為啟動和最佳化治療的關鍵節點。

2024 年,北美充血性心臟衰竭藥物市場佔 53.9% 的佔有率。這一主導地位得益於龐大的確診患者群體、創新療法的早期應用、強力的報銷框架以及強大的臨床研究基礎設施,這些都加速了指南的更新和新分子的應用。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 心臟衰竭盛行率上升

- 藥物研發進展

- 提高意識和篩檢

- 產業陷阱與挑戰

- 嚴格的法規核准

- 先進藥物價格昂貴

- 產業陷阱與挑戰

- 新藥類別的開發

- 遠距醫療和遠端監測在充血性心臟衰竭管理中的整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前技術趨勢

- 新興技術

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

第5章:市場估計與預測:依藥物類別分類,2021-2034年

- ACE抑制劑

- BETA受體阻斷劑

- 利尿劑

- 血管張力素II受體阻斷劑

- 鹽皮質激素受體拮抗劑(MRA)

- 血管張力素受體腦啡肽酶抑制劑 (ARNI)

- 正性肌力藥

- SGLT2抑制劑

- 其他藥物類別

第6章:市場估計與預測:依給藥途徑分類,2021-2034年

- 口服

- 腸外

第7章:市場估算與預測:依類型分類,2021-2034年

- 品牌

- 通用的

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Alnylam Pharmaceuticals

- Amgen

- AstraZeneca

- Bayer

- Boehringer Ingelheim International

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Otsuka Pharmaceutical

- Pfizer

- Sanofi

- Teva Pharmaceutical Industries

The Global Congestive Heart Failure Drugs Market was valued at USD 18 billion in 2024 and is estimated to grow at a CAGR of 10.5% to reach USD 53.9 billion by 2034.

Market growth is driven by the rising prevalence of heart failure, advances in drug development, and the expansion of guideline-directed medical therapy. Growing adoption of novel classes such as SGLT2 inhibitors and ARNIs, alongside established therapies like ACE inhibitors, beta-blockers, and diuretics, is improving survival outcomes and reducing hospitalizations, thereby expanding the addressable patient pool. Increasing integration of telemedicine and remote monitoring is enabling earlier intervention, tighter therapy optimization, and better long-term adherence, which in turn is boosting drug utilization across acute and chronic care settings. Pharmaceutical companies are also focusing heavily on pipeline innovation, combination therapies, and label expansions into broader heart failure phenotypes, further accelerating market momentum over the forecast horizon.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18 Billion |

| Forecast Value | $53.9 Billion |

| CAGR | 10.5% |

The Congestive Heart Failure Drugs Market is primarily segmented by route of administration, where the oral segment held 76.3% in 2024. Oral therapies are preferred due to their convenience, ease of self-administration, lower administration costs, and suitability for long-term, home-based management of chronic heart failure. Extended-release, once-daily, and fixed-dose combination formulations simplify complex regimens, improving adherence and outcomes for patients managing multiple comorbidities. In addition, the expanding availability of potent oral agents such as ACE inhibitors, beta-blockers, and SGLT2 inhibitors reinforces the dominance of this segment in both outpatient and telemedicine-enabled care models.

By distribution channel, the hospital pharmacies segment generated USD 31.2 billion in 2024, underpinned by the high burden of acute decompensated heart failure cases requiring intensive, protocol-driven therapy. These settings manage complex combinations of intravenous inotropes, diuretics, and advanced therapies like ARNIs and SGLT2 inhibitors, driving substantial drug consumption and positioning hospital pharmacies as a critical node in treatment initiation and optimization.

North America Congestive Heart Failure Drugs Market held a 53.9% share in 2024. This dominance is supported by a high diagnosed patient base, early adoption of innovative therapies, strong reimbursement frameworks, and robust clinical research infrastructure that accelerates guideline updates and uptake of new molecules.

Key companies operating in the Global Congestive Heart Failure Drugs Market include Novartis, AstraZeneca, Boehringer Ingelheim, Bayer, Teva Pharmaceutical, Pfizer, Sanofi, Johnson & Johnson, GlaxoSmithKline, Merck & Co., Merck KGaA, Lexicon Pharmaceuticals, Zensun Sci & Tech, Amgen, and AdvaCare Pharma, which collectively shape the competitive landscape through extensive portfolios, global commercial footprints, and active R&D strategies. In the Congestive Heart Failure Drugs Market, leading companies are adopting a mix of product innovation, lifecycle management, strategic collaborations, and geographic expansion to strengthen their market foothold. Many players are investing heavily in R&D for novel mechanisms of action, including SGLT2 inhibitors, ARNI-based combinations, vasodilators, and other advanced drug classes, while also pursuing label expansions into broader heart failure populations such as HFpEF and patients with comorbid diabetes or chronic kidney disease.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Route of administration trends

- 2.2.4 Type trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of heart failure

- 3.2.1.2 Advancements in drug development

- 3.2.1.3 Increasing awareness and screening

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approval

- 3.2.2.2 High cost of advanced medications

- 3.2.3 Industry pitfalls and challenges

- 3.2.3.1 Development of novel drug classes

- 3.2.3.2 Integration of telemedicine and remote monitoring for CHF management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 ACE inhibitors

- 5.3 Beta blockers

- 5.4 Diuretics

- 5.5 Angiotensin 2 receptor blockers

- 5.6 Mineralocorticoid receptor antagonists (MRAs)

- 5.7 Angiotensin receptor-neprilysin inhibitors (ARNIs)

- 5.8 Inotropes

- 5.9 SGLT2 inhibitors

- 5.10 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

Chapter 7 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alnylam Pharmaceuticals

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Bayer

- 10.5 Boehringer Ingelheim International

- 10.6 Bristol-Myers Squibb Company

- 10.7 Eli Lilly and Company

- 10.8 GlaxoSmithKline

- 10.9 Johnson & Johnson

- 10.10 Merck

- 10.11 Novartis

- 10.12 Otsuka Pharmaceutical

- 10.13 Pfizer

- 10.14 Sanofi

- 10.15 Teva Pharmaceutical Industries