|

市場調查報告書

商品編碼

1892808

眼科縫合線市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Ophthalmic Sutures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

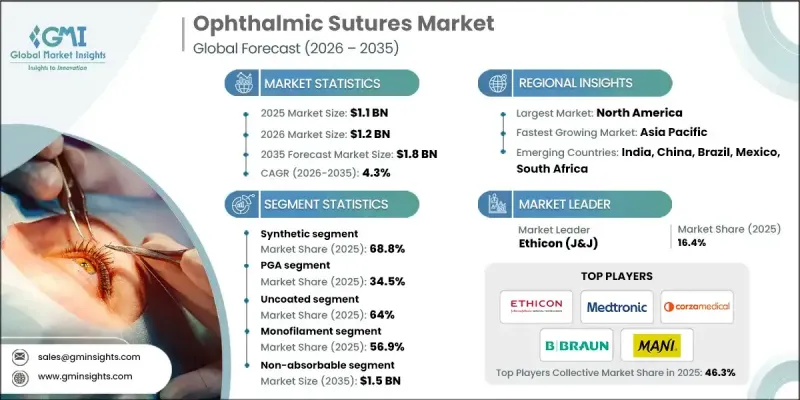

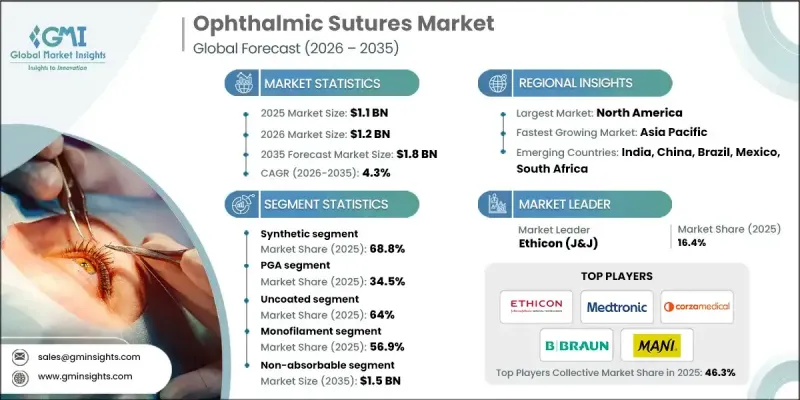

2025 年全球眼科縫合線市場價值為 11 億美元,預計到 2035 年將以 4.3% 的複合年成長率成長至 18 億美元。

眼科手術數量的增加、人口老化、技術創新、眼部疾病盛行率上升以及優質醫療保健服務的普及,共同推動了市場擴張。眼科縫合線為醫院、專科眼科診所和門診手術中心提供至關重要的手術解決方案,可改善患者預後,實現精準的傷口管理,並提高白內障、角膜、青光眼和視網膜手術的手術效率。這些縫合線,包括先進的可吸收和不可吸收縫合線,經過精心設計,具有優異的操作性能、最小的組織損傷和可靠的術後癒合,使眼科醫生能夠更精確、更安全地進行精細手術。顯微外科技術的進步以及門診和日間眼科手術的日益普及,增加了對能夠減少發炎、加速癒合並提供可預測恢復效果的縫合線的需求。新興經濟體醫療基礎設施的擴建和支出的成長也提高了患者接受矯正性眼科手術的機會,從而支撐了市場的持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 11億美元 |

| 預測值 | 18億美元 |

| 複合年成長率 | 4.3% |

到2025年,合成縫合線市佔率預計將達到68.8%,這主要得益於其高拉伸強度、可預測的吸收性和廣泛的臨床應用。合成縫合線由聚乳酸-羥基乙酸共聚物、聚乙醇酸和聚二氧雜環己酮等材料製成,具有組織反應性低、感染或發炎風險小等優點,因此非常適合用於精細的眼科手術。

由於其可生物分解性和優異的抗張強度,PGA(聚乙醇酸)縫合線預計在2025年將佔據34.5%的市場佔有率,價值達6.07億美元。 PGA縫合線可在體內逐漸分解,無需取出,從而減輕患者不適,減少復診次數,尤其有利於兒科和老年患者。

2025年,北美眼科縫合線市佔率預計將達到38.1%,這主要得益於先進的醫療基礎設施、高昂的醫療支出以及眼部疾病盛行率的不斷上升。該地區擁有龐大的醫院、門診手術中心和專科眼科診所網路,進行大量的白內障、青光眼和視網膜手術,從而確保了對眼科縫合線的持續需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 眼疾發生率不斷上升

- 技術進步

- 糖尿病盛行率上升導致眼部疾病

- 有利的政府舉措

- 微創手術的需求和偏好激增

- 產業陷阱與挑戰

- 眼科手術後併發症

- 缺乏技術嫻熟的眼科醫生

- 市場機遇

- 特種和高階縫合線的使用率不斷提高

- 隨著眼科醫療基礎設施的改善,新興市場將迎來擴張。

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術進步

- 當前技術趨勢

- 精密設計的縫合針組合

- 預裝式即用縫合線包

- 微創顯微外科縫合技術

- 新興技術

- 生物可吸收塗層縫合線

- 先進聚合物和複合材料

- 智慧手術工具與機器人輔助縫合

- 當前技術趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 數位手術規劃與人工智慧輔助顯微手術的融合

- 生物工程及藥物洗脫縫合線的研發

- 隨著眼科基礎設施的不斷完善,新興市場將迎來擴張。

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2022-2035年

- 自然的

- 合成的

第6章:市場估算與預測:依材料分類,2022-2035年

- PGA

- 尼龍

- 絲綢

- 聚丙烯

- 其他材料

第7章:市場估算與預測:依塗料產業分類,2022-2035年

- 塗層

- 未塗層

第8章:市場估算與預測:依材料結構分類,2022-2035年

- 單絲

- 多股/編織

第9章:市場估計與預測:依吸收量分類,2022-2035年

- 可吸收

- 不可吸收

第10章:市場估計與預測:依應用領域分類,2022-2035年

- 白內障手術

- 角膜移植手術

- 青光眼手術

- 玻璃體切除術

- 眼部整形手術

- 其他應用

第11章:市場估計與預測:依最終用途分類,2022-2035年

- 醫院

- 門診手術中心

- 其他最終用途

第12章:市場估算與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- Alcon

- Assut Medical

- Aurolab

- Accutome

- B Braun

- Corza Medical

- DemeTECH

- Ethicon

- FCI Ophthalmics

- Geuder AG

- Mani

- Medtronic

- Teleflex Incorporated

- Unilene

The Global Ophthalmic Sutures Market was valued at USD 1.1 billion in 2025 and is estimated to grow at a CAGR of 4.3% to reach USD 1.8 billion by 2035.

Market expansion is driven by the rising number of ophthalmic surgeries, an aging population, technological innovations, and increased prevalence of eye disorders, alongside broader access to quality healthcare. Ophthalmic sutures provide crucial surgical solutions to hospitals, specialty eye clinics, and ambulatory surgical centers, enhancing patient outcomes, precise wound management, and surgical efficiency in cataract, corneal, glaucoma, and retinal procedures. These sutures, including advanced absorbable and non-absorbable options, are engineered for superior handling, minimal tissue trauma, and reliable postoperative healing, enabling ophthalmologists to perform delicate surgeries with greater precision and safety. Advancements in microsurgical techniques and the growing trend toward outpatient and ambulatory ophthalmic procedures have increased demand for sutures that reduce inflammation, accelerate healing, and provide predictable recovery outcomes. Expanding healthcare infrastructure and rising expenditure in emerging economies are also improving patient access to corrective eye surgeries, supporting consistent market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.1 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 4.3% |

The synthetic segment held a 68.8% share in 2025, driven by high tensile strength, predictable absorption, and widespread clinical adoption. Synthetic sutures, composed of materials like polyglactin, polyglycolic acid, and polydioxanone, offer reduced tissue reactivity and minimal risk of infection or inflammation, making them highly suitable for delicate eye surgeries.

The PGA segment held a 34.5% share in 2025, valued at USD 607 million, due to its biodegradable properties and excellent tensile strength. PGA sutures degrade gradually in the body, eliminating the need for removal, reducing patient discomfort, and minimizing follow-up visits, particularly benefiting pediatric and geriatric patients.

North America Ophthalmic Sutures Market held a 38.1% share in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, and growing prevalence of eye disorders. The region's extensive network of hospitals, ambulatory surgical centers, and specialty eye clinics performing a high volume of cataract, glaucoma, and retinal procedures ensures sustained demand for ophthalmic sutures.

Key players in the Global Ophthalmic Sutures Market include Teleflex Incorporated, Assut Medical, Aurolab, Ethicon, Alcon, Corza Medical, Accutome, Mani, DemeTECH, FCI Ophthalmics, Geuder AG, Medtronic, B Braun, and Unilene. Companies in the Ophthalmic Sutures Market are strengthening their position through continuous product innovation, developing sutures with improved handling, biodegradability, and tensile strength. Strategic partnerships with hospitals, clinics, and distributors enable wider reach and faster adoption of new solutions. Expanding global footprints and entering emerging markets allow manufacturers to capture rising demand in underserved regions. Investment in R&D, clinical training programs, and after-sales support enhances brand loyalty, while regulatory compliance and quality certifications build trust among healthcare providers. Marketing initiatives, educational outreach, and digital engagement strategies further solidify their market presence and competitiveness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Material trends

- 2.2.4 Coating trends

- 2.2.5 Material structure trends

- 2.2.6 Absorption trends

- 2.2.7 Application trends

- 2.2.8 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of eye diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising prevalence of diabetes leading to ophthalmic disorders

- 3.2.1.4 Favorable government initiatives

- 3.2.1.5 Surging demand and preference for minimally invasive surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Postoperative complications associated with ophthalmic procedures

- 3.2.2.2 Lack of skilled ophthalmologist

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of specialty and premium sutures

- 3.2.3.2 Expansion in emerging markets with improving eye care infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.1.1 Precision-engineered suture-needle combinations

- 3.5.1.2 Preloaded and ready-to-use suture kits

- 3.5.1.3 Minimally invasive microsurgical suturing techniques

- 3.5.2 Emerging technologies

- 3.5.2.1 Bio-absorbable and coated sutures

- 3.5.2.2 Advanced polymer and composite materials

- 3.5.2.3 Smart surgical tools and robotic-assisted suturing

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Integration of digital surgical planning and AI-assisted microsurgery

- 3.9.2 Development of bioengineered and drug-eluting sutures

- 3.9.3 Expansion in emerging markets with advancing ophthalmic infrastructure

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Natural

- 5.3 Synthetic

Chapter 6 Market Estimates and Forecast, By Material, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 PGA

- 6.3 Nylon

- 6.4 Silk

- 6.5 Polypropylene

- 6.6 Other materials

Chapter 7 Market Estimates and Forecast, By Coating, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Coated

- 7.3 Uncoated

Chapter 8 Market Estimates and Forecast, By Material Structure, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Monofilament

- 8.3 Multifilament/Braided

Chapter 9 Market Estimates and Forecast, By Absorption, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 Absorbable

- 9.3 Non-absorbable

Chapter 10 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 10.1 Key trends

- 10.2 Cataract surgery

- 10.3 Corneal transplantation surgery

- 10.4 Glaucoma surgery

- 10.5 Vitrectomy

- 10.6 Oculoplastic surgery

- 10.7 Other applications

Chapter 11 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 11.1 Key trends

- 11.2 Hospitals

- 11.3 Ambulatory surgical centers

- 11.4 Other End use

Chapter 12 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Alcon

- 13.2 Assut Medical

- 13.3 Aurolab

- 13.4 Accutome

- 13.5 B Braun

- 13.6 Corza Medical

- 13.7 DemeTECH

- 13.8 Ethicon

- 13.9 FCI Ophthalmics

- 13.10 Geuder AG

- 13.11 Mani

- 13.12 Medtronic

- 13.13 Teleflex Incorporated

- 13.14 Unilene