|

市場調查報告書

商品編碼

1892805

美容醫學市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Aesthetic Medicine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

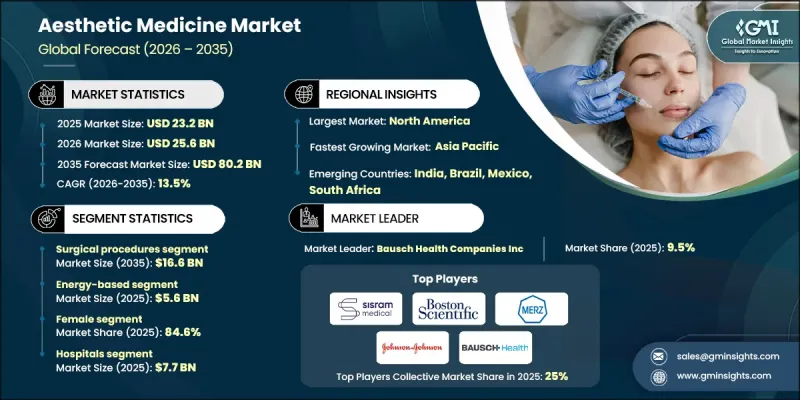

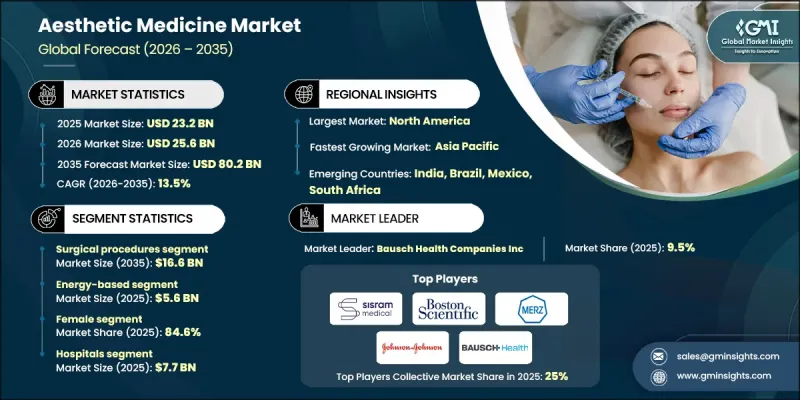

2025年全球美容醫學市場價值為232億美元,預計到2035年將以13.5%的複合年成長率成長至802億美元。

市場快速擴張的促進因素包括消費者對美容治療意識的提高、醫療美容設備技術的不斷創新、肥胖率的上升以及對非侵入性療法的日益青睞。美容醫學專注於透過微創或非手術干預來改善外貌,解決皺紋、色素沉著、膚質、毛髮再生和體型雕塑等問題。肥胖症的日益普遍已成為推動市場發展的重要因素,因為人們尋求超越傳統減肥方法的塑形和改善體型的方案。由於肥胖會影響健康和自尊,抽脂、腹部整形、體型雕塑和非侵入性減脂等治療的需求正在激增。該領域結合了外科和非手術技術,旨在改善皮膚鬆弛、橘皮組織、疤痕、多餘脂肪、多餘毛髮和色素沉著等問題,從而提升外觀和自信心。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 232億美元 |

| 預測值 | 802億美元 |

| 複合年成長率 | 13.5% |

2025年,外科手術市場規模達47億美元,預計2035年將達166億美元。這些手術為臉部年輕化、身體塑形、隆乳和隆鼻等問題提供全面的解決方案,為尋求顯著改善外觀的患者帶來持久而顯著的效果。

預計到2025年,能量型美容市場規模將達56億美元。這類解決方案提供精準、非侵入性或微創的治療,且恢復期極短。能量型設備利用雷射、射頻、超音波和強烈脈衝光(IPL)等先進技術,可解決多種美容問題,包括皮膚再生、除毛、紋身去除和塑形。

預計到2024年,北美美容醫學市場將佔據39.5%的佔有率。該地區的成長得益於消費者意識的提高、先進技術的廣泛應用以及文化上對外觀的重視。龐大的消費群體對美容手術有著濃厚的興趣,這推動了對外科手術和非手術療法的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 提高人們對美容手術的認知

- 與醫療美容設備相關的技術進步

- 肥胖症盛行率不斷上升

- 非侵入性手術的普及率不斷提高

- 產業陷阱與挑戰

- 美容手術費用高昂

- 缺乏報銷機制和嚴格的監管環境

- 市場機遇

- 人工智慧與數位科技的融合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 供應鏈分析

- 報銷方案

- 2025年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2022-2035年

- 外科手術

- 非手術治療

第6章:市場估算與預測:依產品分類,2022-2035年

- 基於能源

- 雷射美容設備

- 以射頻為基礎(RF)的美容設備

- 以光線為基礎的美容設備

- 超音波美容設備

- 其他能源產品

- 非能源型

- 肉毒桿菌毒素

- 皮膚填充劑

- 植入物

- 臉部植入

- 隆乳

- 其他植入物

- 其他非能源類產品

第7章:市場估計與預測:依性別分類,2022-2035年

- 男性

- 18歲及以下

- 19-34歲

- 35-50歲

- 51-64歲

- 65歲以上

- 女性

- 18歲及以下

- 19-34歲

- 35-50歲

- 51-64歲

- 65歲以上

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 醫院

- 門診手術中心

- 美容中心及醫療水療中心

- 皮膚科診所

- 首頁設定

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Apax Partners

- Boston Scientific Corporation

- 博士倫健康公司

- El.En. SpA

- GC Aesthetics plc

- Huadong Medicine Co., Ltd

- Johnson & Johnson

- Merz Pharma

- Sciton, Inc.

- SharpLight Technologies Inc

- Sisram Medical Ltd

- Vitruvian Partners LLP

The Global Aesthetic Medicine Market was valued at USD 23.2 billion in 2025 and is estimated to grow at a CAGR of 13.5% to reach USD 80.2 billion by 2035.

The market's rapid expansion is fueled by increasing consumer awareness of aesthetic treatments, continuous technological innovations in medical aesthetic devices, rising obesity rates, and a growing preference for non-invasive procedures. Aesthetic medicine focuses on enhancing physical appearance through minimally invasive or non-surgical interventions, addressing concerns such as wrinkles, pigmentation, skin texture, hair restoration, and body contouring. The growing prevalence of obesity has become a significant driver, as individuals seek solutions to reshape and refine their bodies beyond traditional weight-loss methods. With obesity affecting both health and self-esteem, demand for treatments like liposuction, tummy tucks, body contouring, and non-invasive fat reduction is surging. The field combines surgical and non-surgical techniques to correct skin laxity, cellulite, scars, excess fat, unwanted hair, and hyperpigmentation, aiming to improve both appearance and confidence.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $23.2 Billion |

| Forecast Value | $80.2 Billion |

| CAGR | 13.5% |

The surgical procedures segment reached USD 4.7 billion in 2025 and is projected to reach USD 16.6 billion by 2035. These procedures provide comprehensive solutions for concerns including facial rejuvenation, body contouring, breast augmentation, and rhinoplasty, offering long-lasting and transformative results for patients seeking significant changes in appearance.

The energy-based segment accounted for USD 5.6 billion in 2025. These solutions offer precise, non-invasive or minimally invasive treatments with minimal downtime. Utilizing advanced technologies such as lasers, radiofrequency, ultrasound, and intense pulsed light (IPL), energy-based devices address a variety of cosmetic concerns, including skin rejuvenation, hair removal, tattoo removal, and body contouring.

North America Aesthetic Medicine Market held a 39.5% share in 2024. Growth in the region is supported by heightened consumer awareness, widespread adoption of advanced technologies, and a cultural emphasis on physical appearance. A large population with significant interest in cosmetic procedures is driving demand for both surgical and non-surgical interventions.

Key players operating in the Global Aesthetic Medicine Market include Johnson & Johnson, Boston Scientific Corporation, Huadong Medicine Co., Ltd, GC Aesthetics plc, Apax Partners, SharpLight Technologies Inc., Sisram Medical Ltd, Bausch Health Companies Inc., Merz Pharma, Vitruvian Partners LLP, and El.En. S.p.A. Companies in the Global Aesthetic Medicine Market are strengthening their presence by investing in research and development to create innovative, minimally invasive devices with higher efficacy and lower recovery times. Strategic partnerships and collaborations with distributors and healthcare providers are enhancing market reach and patient access. Firms are also focusing on expanding into emerging regions, offering training programs for clinicians, and integrating digital solutions such as AI-assisted treatment planning. Sustainability initiatives, personalized treatment options, and product diversification are being used to differentiate offerings and build long-term brand loyalty, while targeted marketing campaigns raise consumer awareness and drive adoption of advanced aesthetic procedures.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Product trends

- 2.2.4 Gender trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness regarding aesthetic procedures

- 3.2.1.2 Technological advancements associated with medical aesthetic devices

- 3.2.1.3 Rising prevalence of obesity

- 3.2.1.4 Increasing adoption of non-invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with aesthetic procedures

- 3.2.2.2 Lack of reimbursement and stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and digital technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2025

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical procedures

- 5.3 Non-surgical procedures

Chapter 6 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Energy-based

- 6.2.1 Laser-based aesthetic device

- 6.2.2 Radiofrequency (RF)-based aesthetic device

- 6.2.3 Light-based aesthetic device

- 6.2.4 Ultrasound aesthetic device

- 6.2.5 Other energy-based products

- 6.3 Non-energy-based

- 6.3.1 Botulinum toxin

- 6.3.2 Dermal fillers

- 6.3.3 Implants

- 6.3.3.1 Facial implants

- 6.3.3.2 Breast implants

- 6.3.3.3 Other implants

- 6.3.4 Other non-energy-based products

Chapter 7 Market Estimates and Forecast, By Gender, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Male

- 7.2.1 18 years and below

- 7.2.2 19-34 years

- 7.2.3 35-50 years

- 7.2.4 51-64 years

- 7.2.5 65 years and above

- 7.3 Female

- 7.3.1 18 years and below

- 7.3.2 19-34 years

- 7.3.3 35-50 years

- 7.3.4 51-64 years

- 7.3.5 65 years and above

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Beauty centers and medical spas

- 8.5 Dermatology clinics

- 8.6 Home settings

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Apax Partners

- 10.2 Boston Scientific Corporation

- 10.3 Bausch Health Companies Inc.

- 10.4 El.En. S.p.A

- 10.5 GC Aesthetics plc

- 10.6 Huadong Medicine Co., Ltd

- 10.7 Johnson & Johnson

- 10.8 Merz Pharma

- 10.9 Sciton, Inc.

- 10.10 SharpLight Technologies Inc

- 10.11 Sisram Medical Ltd

- 10.12 Vitruvian Partners LLP