|

市場調查報告書

商品編碼

1892795

醫療器材分銷服務市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Medical Device Distribution Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

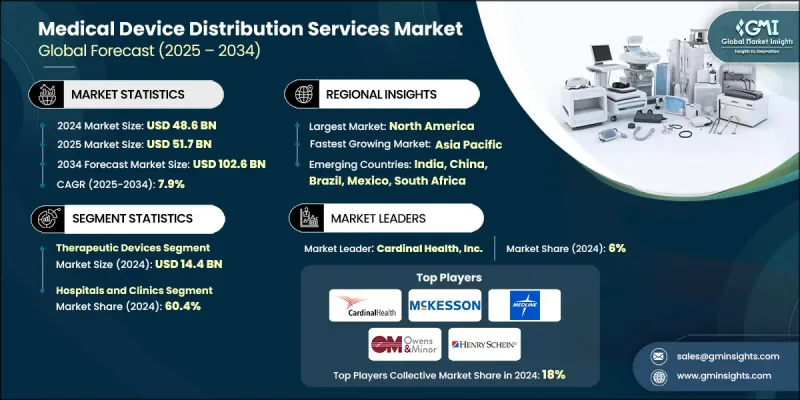

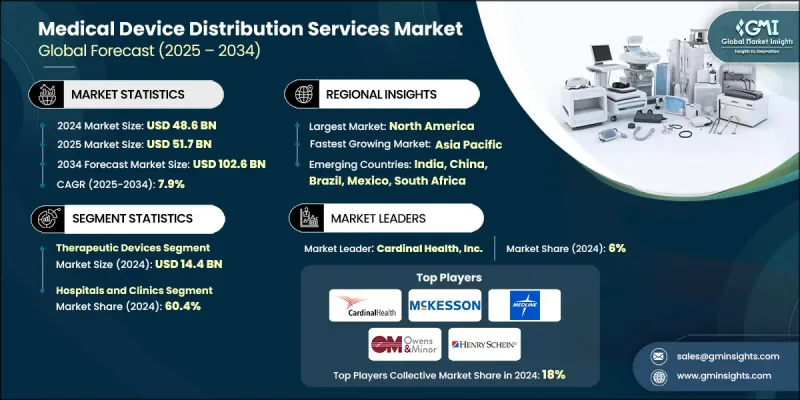

2024 年全球醫療器材分銷服務市場價值為 486 億美元,預計到 2034 年將以 7.9% 的複合年成長率成長至 1026 億美元。

慢性病盛行率上升、家庭醫療保健和遠端監測解決方案的快速普及以及對數位化供應鏈能力的大量投資是推動這一成長的主要因素。經銷商日益成為醫療保健系統的策略合作夥伴,不僅提供物流服務,還提供安裝、校準、培訓、冷鏈管理和UDI可追溯性等加值服務,從而加速從商品運輸到整合式臨床供應解決方案的轉變。同時,醫院龐大的採購量和集團採購組織(GPO)的運作模式也增加了對先進分銷服務的需求,這些服務能夠減少缺貨、縮短交貨時間並確保跨多個司法管轄區的合規性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 486億美元 |

| 預測值 | 1026億美元 |

| 複合年成長率 | 7.9% |

依產品類型分類,治療器材領域在2024年以144億美元的市場規模領跑,反映出市場對輸液幫浦、呼吸器材、心血管支架、人工植入物、透析系統和其他關鍵治療技術的強勁需求。治療器械通常需要特殊處理、冷鍊或條件敏感型物流以及售後支援(安裝、維修、員工培訓),這提高了分銷商的利潤率,並鞏固了與醫院和診所的長期合作關係。

從終端用戶角度來看,醫院和診所預計在2024年將佔據60.4%的市場佔有率,這主要歸因於其廣泛的設備需求、集中採購流程以及為應對急診和外科手術而需要維持較高的內部庫存。醫院傾向於選擇包含物流、安裝和售後支援的捆綁式服務,這凸顯了能夠確保產品可追溯性、快速回應維修和合規性報告的分銷合作夥伴的戰略重要性。

2024年,北美醫療器材分銷服務市佔率達到39.2%,反映了該地區成熟的醫療保健基礎設施、高手術量以及對數位化物流技術(物聯網、人工智慧、區塊鏈等可追溯性技術)的早期應用。美國市場動態,包括龐大的醫院網路、集中式集團採購組織(GPO)合約以及完善的家庭醫療保健報銷體系,都為分銷商提供了更高的利潤空間,並促使其投資於先進的冷鍊和自動化補貨系統。此外,北美在供應鏈韌性、分銷中心技術現代化以及諸如UDI等監管框架方面的大量公共和私人資金投入,進一步鞏固了其領先地位,這些監管框架激勵著可追溯、品質保證的分銷模式。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 慢性病盛行率不斷上升

- 研究投資激增和醫療器材核准數量成長

- 家庭醫療保健和遠端監測的需求不斷成長

- 醫療器材技術的進步

- 產業陷阱與挑戰

- 需要高額的初始資本支出

- 嚴格的監理合規性

- 市場機遇

- 線上分銷服務和數位訂購系統的成長

- 加強公私合作以強化供應鏈

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 供應鏈分析

- 報銷方案

- 2024年定價分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 診斷設備

- 治療設備

- 病患監護設備

- 家用醫療保健設備

- 其他產品類型

第6章:市場估算與預測:依最終用途分類,2021-2034年

- 醫院和診所

- 診斷中心

- 門診手術中心(ASC)

- 長期照護機構

- 家庭護理機構

第7章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Alfresa Holdings Corporation

- Avantor, Inc.

- Bunzl plc

- CAN-med Healthcare

- Cardinal Health, Inc.

- Henry Schein, Inc.

- KEBOMED Europe AG

- McKesson Corporation

- Meditek Systems Pvt. Ltd.

- Medline Industries, LP.

- Owens & Minor, Inc.

- 帕特森公司

- Soquelec Ltd.

- Southmedic Inc.

- The Stevens Company Limited

The Global Medical Device Distribution Services Market was valued at USD 48.6 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 102.6 billion by 2034.

The expansion is driven by rising chronic disease prevalence, rapid adoption of home-healthcare and remote monitoring solutions, and significant investments in digital supply-chain capabilities. Distributors are increasingly positioned as strategic partners to healthcare systems, providing not just logistics but value-added services such as installation, calibration, training, cold-chain management, and UDI traceability, which is accelerating the shift from commodity shipping to integrated clinical supply solutions. Simultaneously, hospitals' large procurement volumes and Group Purchasing Organization (GPO) dynamics are increasing demand for sophisticated distribution services that reduce stockouts, shorten lead times, and ensure regulatory compliance across multiple jurisdictions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48.6 Billion |

| Forecast Value | $102.6 Billion |

| CAGR | 7.9% |

By product type, the therapeutic devices segment led the market in 2024 with USD 14.4 billion, reflecting strong demand for infusion pumps, respiratory devices, cardiovascular stents, prosthetic implants, dialysis systems, and other treatment-critical technologies. Therapeutic devices typically require specialized handling, cold-chain or condition-sensitive logistics, and after-sales support (installation, servicing, staff training), which amplifies distributor margins and cements long-term partnerships with hospitals and clinics.

On an end-use basis, the hospitals and clinics segment held 60.4% share in 2024, owing to their broad device requirements, centralized procurement processes, and need to maintain high in-house inventories for emergency and surgical care. Hospitals' preference for bundled service offerings combining logistics, installation, and post-sale support heightens the strategic importance of distribution partners who can guarantee traceability, rapid response repair, and compliance reporting.

North America Medical Device Distribution Services Market held 39.2% share in 2024, reflecting the region's mature healthcare infrastructure, high procedural volumes, and early adoption of digital logistics technologies (IoT, AI, blockchain for traceability). The U.S. market dynamics, including large hospital networks, centralized GPO contracting, and strong home-healthcare reimbursement systems, support higher distributor margins and investment in advanced cold-chain and automated replenishment systems. North America's leadership is further reinforced by substantial private and public funding for supply-chain resilience, technology modernization in distribution centers, and regulatory frameworks such as UDI that incentivize traceable, quality-assured distribution models.

Key players shaping the Global Medical Device Distribution Services Market include Cardinal Health, Inc.; McKesson Corporation; Medline Inc.; Owens & Minor, Inc.; Henry Schein, Inc.; Patterson Companies, Inc.; Bunzl plc; Avantor, Inc.; Alfresa Holdings Corporation; CAN-med Healthcare; KEBOMED Europe AG; Meditek Systems Pvt. Ltd.; Soquelec Ltd.; Southmedic Inc.; and The Stevens Company Limited. These companies are competing on breadth of coverage, cold-chain and compliance capabilities, digital ordering platforms, and value-added clinical services. Market leaders are investing in smart warehouses, temperature-validated storage, last-mile home care delivery capabilities, and partnerships with OEMs and telehealth providers to capture higher margin service revenues and lock in long-term procurement agreements. Companies in the medical device distribution services market are strengthening footprints through vertical integration, digital platform investments, and strategic partnerships with hospitals, GPOs, and device OEMs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic diseases

- 3.2.1.2 Surge in investments for research purpose and growth in medical device approvals

- 3.2.1.3 Rising demand for home healthcare and remote monitoring

- 3.2.1.4 Advancements in medical device technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Requirement for high initial capital expenditure

- 3.2.2.2 Presence of stringent regulatory compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in online distribution services and digital ordering system

- 3.2.3.2 Increasing public private partnership to strengthen supply chain

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic devices

- 5.3 Therapeutic devices

- 5.4 Patient monitoring devices

- 5.5 Home healthcare devices

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Diagnostic centers

- 6.4 Ambulatory surgical centers (ASCs)

- 6.5 Long-term care facilities

- 6.6 Homecare settings

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alfresa Holdings Corporation

- 8.2 Avantor, Inc.

- 8.3 Bunzl plc

- 8.4 CAN-med Healthcare

- 8.5 Cardinal Health, Inc.

- 8.6 Henry Schein, Inc.

- 8.7 KEBOMED Europe AG

- 8.8 McKesson Corporation

- 8.9 Meditek Systems Pvt. Ltd.

- 8.10 Medline Industries, LP.

- 8.11 Owens & Minor, Inc.

- 8.12 Patterson Companies, Inc.

- 8.13 Soquelec Ltd.

- 8.14 Southmedic Inc.

- 8.15 The Stevens Company Limited