|

市場調查報告書

商品編碼

1892791

非織物磨料市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Non-woven Abrasives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

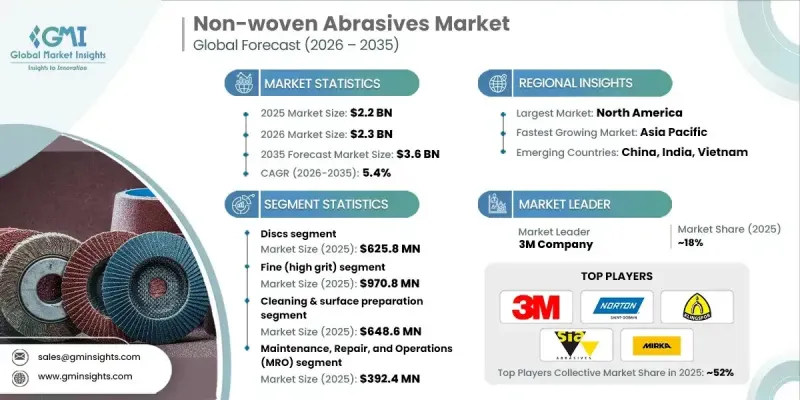

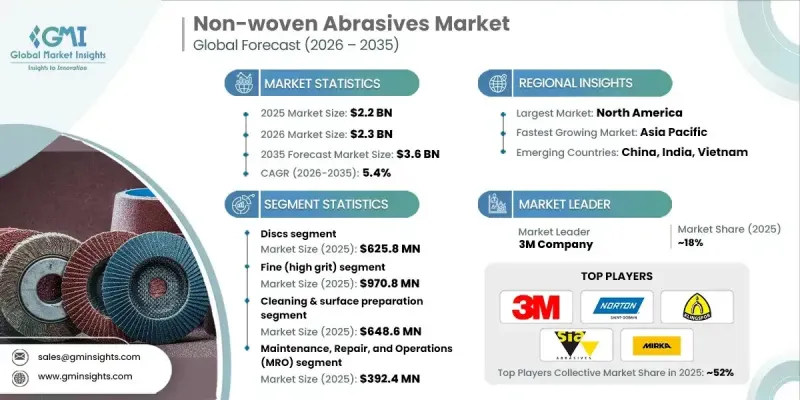

2025年全球非織物磨料市場價值為22億美元,預計到2035年將以5.4%的複合年成長率成長至36億美元。

非織物磨料是一種工程化的3D產品,它將合成纖維、黏合樹脂和磨料礦物結合成開放式網狀結構,確保在工業和消費應用中實現一致的精加工性能。這些產品採用尼龍、聚酯或合成纖維基體,其中嵌入氧化鋁、碳化矽或陶瓷磨料顆粒,並透過樹脂系統黏合,從而確保礦物均勻分佈和可控的切削作用。產品系列包括手墊、砂帶、砂碟、砂片、砂捲、砂輪、砂刷和特殊規格,粒度範圍從粗粒(40-80目)到超細粒(600目以上)。精密製造程序,包括纖維網成型、樹脂浸漬、礦物塗層、固化和加工,確保了產品的密度、貼合性和承載能力的一致性。合成纖維工程、礦物技術和黏合化學的進步提高了產品的貼合性和表面接觸性,從而能夠在複雜幾何形狀和曲面上實現卓越的精加工效果。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 22億美元 |

| 預測值 | 36億美元 |

| 複合年成長率 | 5.4% |

預計到2025年,砂輪片市場規模將達到6.258億美元,其需求將持續旺盛,這主要得益於砂輪片的多功能性、與各種電動工具的兼容性以及能夠貼合曲面等優點。砂輪片有多種直徑、粒度等級和安裝方式可供選擇,廣泛應用於製造和維護作業中的金屬加工、鋁材處理和複合材料加工等領域。

2025年,精細(高目數)磨料市場規模預計將達到9.708億美元,主要得益於其在表面拋光、美學精加工和精密製造領域的重要性。高目數產品佔據了近45%的市場佔有率,能夠以最小的表面損傷實現可控的材料去除,從而支持汽車修補、不銹鋼拋光和裝飾性表面處理等應用。目數從180到600+的產品可確保在注重品質的工廠中,為清漆調色、鍍鉻和鏡面拋光等工序提供有效的精加工效果。

預計2025年,美國非織物磨料市場規模將達5.515億美元。該市場成長的主要驅動力來自美國成熟的汽車和航太產業、先進的金屬加工和製造業。自動化製造、表面處理和維護作業對精密精加工的重視,以及專業級產品的廣泛應用,進一步強化了市場需求。 3M、聖戈班和PFERD等主要製造商在美國設有生產基地和廣泛的分銷網路,而電動汽車製造領域不斷湧現的新需求,也進一步推動了對專為鋁和複合材料設計的專用磨料的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2022-2035年

- 手墊

- 腰帶

- 光碟

- 片材和卷材

- 車輪

- 畫筆

- 特種磨料

第6章:市場估算與預測:依磨料等級分類,2022-2035年

- 粗粒(低粒度)

- 中等(中等粒度)

- 細(高粒度)

第7章:市場估計與預測:依應用領域分類,2022-2035年

- 清潔和表面處理

- 去毛邊和倒圓邊

- 表面處理與融合

- 打磨和成型

- 精加工和拋光

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 家庭

- 維護、修理和營運 (MRO)

- 海洋

- 金工

- 汽車

- 航太

- 木工

- 建造

- 電子

- 其他

第9章:市場估算與預測:依配銷通路分類,2022-2035年

- 直銷

- 線上零售商

- 五金店

- 工業用品商店

- 其他

第10章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第11章:公司簡介

- 3M Company

- Saint-Gobain Abrasives / Norton

- Klingspor Abrasives

- Sia Abrasives Industries AG

- Mirka Ltd.

- Carborundum Universal Limited (CUMI)

- PFERD Inc. / PFERD GmbH & Co. KG

- Osborn International / Osborn LLC

- DEWALT (Stanley Black & Decker)

- Hermes Abrasives (Hermes Schleifmittel GmbH)

- Weiler Abrasives

- RHODIUS Abrasives

- Nihon Kenshi Co., Ltd.

- Walter Surface Technologies

- ARC Abrasives, Inc.

The Global Non-woven Abrasives Market was valued at USD 2.2 billion in 2025 and is estimated to grow at a CAGR of 5.4% to reach USD 3.6 billion by 2035.

Non-woven abrasives are engineered, three-dimensional products created by combining synthetic fibers, bonding resins, and abrasive minerals into open-web structures that ensure consistent finishing performance across industrial and consumer applications. These products use nylon, polyester, or synthetic fiber matrices embedded with aluminum oxide, silicon carbide, or ceramic abrasive grains, bonded with resin systems to guarantee uniform mineral distribution and controlled cutting action. The portfolio includes hand pads, belts, discs, sheets, rolls, wheels, brushes, and specialty formats, with grit grades ranging from coarse (40-80) to ultra-fine (600+). Precision manufacturing processes, including fiber web formation, resin saturation, mineral coating, curing, and converting, deliver consistent density, conformability, and load resistance. Advancements in synthetic fiber engineering, mineral technology, and bonding chemistries have improved conformability and surface contact, enabling superior finishing on complex geometries and contoured surfaces.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 5.4% |

The discs segment generated USD 625.8 million in 2025, maintaining demand due to their versatility, compatibility with various power tools, and ability to conform to curved surfaces. Available in multiple diameters, grit grades, and mounting types, discs are widely used in metalworking, aluminum preparation, and composite processing across manufacturing and maintenance operations.

The fine (high grit) abrasives segment reached USD 970.8 million in 2025, driven by their importance in surface polishing, aesthetic finishing, and precision manufacturing. Representing nearly 45% of the market value, high-grit products enable controlled material removal with minimal surface damage, supporting applications in automotive refinishing, stainless steel polishing, and decorative surface treatments. Grit equivalents from 180 to 600+ ensure effective finishing for clearcoat blending, chrome finishing, and mirror-polish operations in quality-driven facilities.

U.S. Non-woven Abrasives Market reached USD 551.5 million in 2025. Growth is driven by the country's established automotive and aerospace industries, advanced metalworking, and fabrication sectors. Emphasis on precision finishing for automated manufacturing, surface preparation, and maintenance operations, combined with robust professional-grade product adoption, strengthens market demand. Major manufacturers such as 3M, Saint-Gobain, and PFERD maintain production facilities and extensive distribution networks in the U.S., while emerging requirements in electric vehicle manufacturing further boost demand for specialized abrasives designed for aluminum and composite materials.

Key players in the Global Non-woven Abrasives Market include Saint-Gobain Abrasives / Norton, 3M Company, PFERD Inc., Klingspor Abrasives, Sia Abrasives Industries AG, Mirka Ltd., Osborn International / Osborn LLC, DEWALT (Stanley Black & Decker), Hermes Abrasives, Weiler Abrasives, RHODIUS Abrasives, Nihon Kenshi Co., Ltd., Walter Surface Technologies, Carborundum Universal Limited (CUMI), and ARC Abrasives, Inc. Companies in the Non-woven Abrasives Market strengthen their market presence by investing in R&D to develop advanced fiber matrices, engineered abrasive minerals, and innovative bonding chemistries. They focus on expanding product portfolios to cater to diverse industrial applications while enhancing grit uniformity and conformability. Strategic collaborations with OEMs, industrial distributors, and specialty manufacturers enable broader market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 Abrasive Grade

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Distribution Channel

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Hand pads

- 5.3 Belts

- 5.4 Discs

- 5.5 Sheets & rolls

- 5.6 Wheels

- 5.7 Brushes

- 5.8 Specialty abrasives

Chapter 6 Market Estimates and Forecast, By Abrasive Grade, 2022-2035 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Coarse (low grit)

- 6.3 Medium (medium grit)

- 6.4 Fine (high grit)

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Cleaning & surface preparation

- 7.3 Deburring & edge rounding

- 7.4 Surface conditioning & blending

- 7.5 Sanding & shaping

- 7.6 Finishing & polishing

Chapter 8 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Household

- 8.3 Maintenance, repair, and operations (MRO)

- 8.4 Marine

- 8.5 Metalworking

- 8.6 Automotive

- 8.7 Aerospace

- 8.8 Woodworking

- 8.9 Construction

- 8.10 Electronics

- 8.11 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Online retailers

- 9.4 Hardware stores

- 9.5 Industrial supply stores

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 3M Company

- 11.2 Saint-Gobain Abrasives / Norton

- 11.3 Klingspor Abrasives

- 11.4 Sia Abrasives Industries AG

- 11.5 Mirka Ltd.

- 11.6 Carborundum Universal Limited (CUMI)

- 11.7 PFERD Inc. / PFERD GmbH & Co. KG

- 11.8 Osborn International / Osborn LLC

- 11.9 DEWALT (Stanley Black & Decker)

- 11.10 Hermes Abrasives (Hermes Schleifmittel GmbH)

- 11.11 Weiler Abrasives

- 11.12 RHODIUS Abrasives

- 11.13 Nihon Kenshi Co., Ltd.

- 11.14 Walter Surface Technologies

- 11.15 ARC Abrasives, Inc.