|

市場調查報告書

商品編碼

1892787

眼科抗VEGF療法市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Ophthalmic Anti-VEGF Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

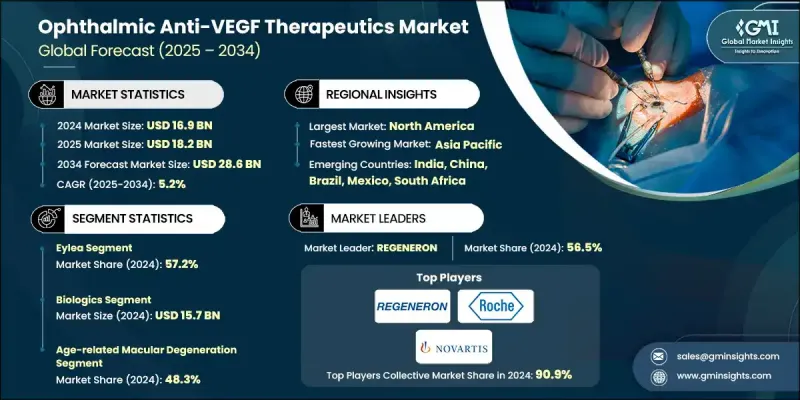

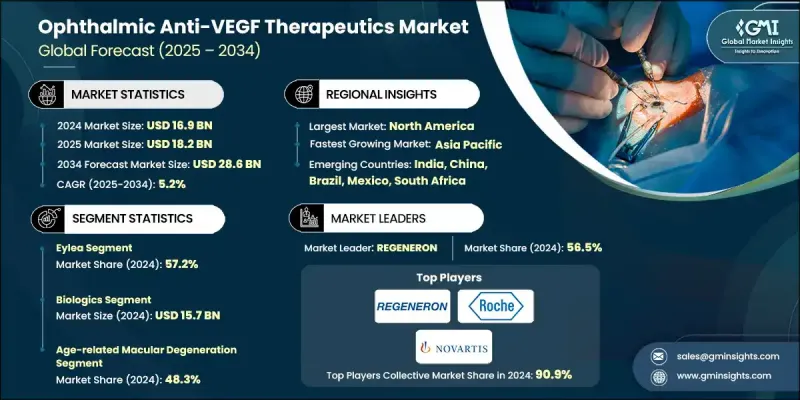

2024 年全球眼科抗 VEGF 治療市值為 169 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長至 286 億美元。

視網膜疾病的增加、全球糖尿病盛行率的上升、人口老化的持續加劇以及專業眼科機構的快速發展推動了市場擴張。抗VEGF藥物透過阻斷VEGF活性發揮作用,VEGF活性會導致視網膜異常血管形成,因此這類療法對於治療老年黃斑部病變(AMD)、糖尿病黃斑水腫(DME)和視網膜靜脈阻塞(RVO)等疾病至關重要。糖尿病視網膜病變、糖尿病相關性黃斑部併發症和老年視力退化病例的不斷增加,持續擴大了治療範圍。同時,持續的研究工作正在研發出具有更長效期、更高安全性和多通路靶向能力的改良分子。這些創新正在重塑治療模式,拓展一線治療方案的選擇,最佳化轉換策略,並支持更長的給藥間隔。隨著治療領域的多元化,高階藥物類別憑藉其卓越的臨床療效以及在老化和糖尿病人群中的持續需求,仍然保持著商業可行性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 169億美元 |

| 預測值 | 286億美元 |

| 複合年成長率 | 5.2% |

2024年,Eylea市佔率達到57.2%,這得益於其強勁的臨床療效、可靠的安全性以及高劑量配方帶來的更長給藥週期。全球糖尿病患者人數的快速成長進一步推動了Eylea在糖尿病視網膜疾病領域的廣泛應用,持續的長期使用和高年度治療量也促進了該藥物的長期應用。

2024年,年齡相關性黃斑部病變(AMD)市場佔全球市場佔有率的48.3%,預計到2034年將達到132億美元。由於AMD主要影響老年人,老年人口快速成長的市場對AMD的治療需求持續上升。抗VEGF療法仍是AMD治療的基石,因此在全球老化人口中,AMD治療市場持續成長。

2024年,北美眼科抗VEGF療法市佔率達到64.8%,這主要得益於該地區龐大的AMD、DME和糖尿病視網膜病變患者族群。該地區擁有完善的臨床基礎設施、豐富的專家資源以及高效的供應和管理系統,這些優勢有助於患者堅持治療。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 眼疾發生率不斷上升

- 人口老化加劇

- 藥物研發中的技術進步

- 人們對及時治療眼科疾病的意識日益增強。

- 產業陷阱與挑戰

- 治療費用高昂

- 副作用和安全問題

- 市場機遇

- 生物相似藥和低成本替代藥物擴大了患者的可及性。

- 隨著醫療保健覆蓋範圍的擴大,業務拓展至新興市場。

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 管道分析

- 2024年定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依抗 VEGF 療法分類,2021-2034 年

- 艾莉婭

- 瓦比斯莫

- 盧森蒂斯

- 其他抗 VEGF 療法

第6章:市場估算與預測:依藥物類型分類,2021-2034年

- 生物製劑

- 生物相似藥

第7章:市場估算與預測:依指示劑分類,2021-2034年

- 老年性黃斑部病變

- 糖尿病視網膜病變

- 黃斑水腫

- 視網膜靜脈阻塞

- 近視性脈絡膜新生血管

第8章:市場估算與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AMGEN

- Astellas

- Biocon Biologics

- Biogen

- CELLTRION

- Intas Pharmaceuticals

- KANGHONG PHARMACEUTICALS

- LUPIN

- NOVARTIS

- REGENERON

- Reliance Life Sciences

- Roche

- SANDOZ

- STADA

- teva

The Global Ophthalmic Anti-VEGF Therapeutics Market was valued at USD 16.9 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 28.6 billion by 2034.

Market expansion is driven by the rise in retinal disorders, the global increase in diabetes, continued population aging, and the rapid establishment of specialized ophthalmic facilities. Anti-VEGF drugs work by blocking VEGF activity, which contributes to abnormal blood vessel formation in the retina, making these therapies essential for conditions such as age-related macular degeneration (AMD), diabetic macular edema (DME), and retinal vein occlusion (RVO). Increasing cases of diabetic retinopathy, diabetes-related macular complications, and age-related visual degeneration continue to widen the treatment pool. At the same time, continual research efforts are delivering improved molecules with longer durability, enhanced safety, and multi-pathway targeting capabilities. These innovations are reshaping treatment patterns by expanding options for first-line therapies, optimizing switching strategies, and supporting longer dosing intervals. As the therapeutic landscape diversifies, premium drug categories remain commercially viable due to clinical performance and sustained demand across aging and diabetic populations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.9 Billion |

| Forecast Value | $28.6 Billion |

| CAGR | 5.2% |

The Eylea segment held a 57.2% share in 2024, supported by strong clinical outcomes, reliable safety, and longer dosing cycles enabled by its higher-dose formulation. Its broad adoption in diabetic retinal diseases is reinforced by the fast-growing global diabetic population, which consistently drives long-term utilization and high annual treatment volumes.

The age-related macular degeneration segment accounted for a 48.3% share in 2024 and is expected to reach USD 13.2 billion through 2034. As AMD primarily affects older adults, markets with rapidly expanding senior populations continue to see rising therapy demand. Anti-VEGF treatment remains the cornerstone of AMD care, resulting in steady growth across aging demographics worldwide.

North America Ophthalmic Anti-VEGF Therapeutics Market held a 64.8% share in 2024, supported by a large patient base with AMD, DME, and diabetic retinopathy. The region benefits from robust clinical infrastructure, extensive specialist availability, and highly efficient supply and administration systems that facilitate ongoing treatment adherence.

Major companies participating in the Global Ophthalmic Anti-VEGF Therapeutics Market include AMGEN, Astellas, Biocon Biologics, Biogen, CELLTRION, Intas Pharmaceuticals, KANGHONG PHARMACEUTICALS, LUPIN, NOVARTIS, REGENERON, Reliance Life Sciences, Roche, SANDOZ, STADA, and Teva. Companies operating in the Ophthalmic Anti-VEGF Therapeutics Market are adopting several strategic approaches to strengthen their position. Many are investing heavily in next-generation molecules with extended durability to reduce injection burden and improve patient outcomes. Firms are expanding clinical trials across multiple retinal conditions to broaden therapeutic indications and secure a larger market share. Partnerships, co-development agreements, and biosimilar expansion strategies are helping companies reach new geographies and diversify product portfolios. Manufacturers are also prioritizing real-world evidence programs to reinforce clinical value and support reimbursement negotiations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Anti-VEGF therapies trends

- 2.2.3 Drug type trends

- 2.2.4 Indication trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye diseases

- 3.2.1.2 Rise in aging population

- 3.2.1.3 Technological advancements in drug development

- 3.2.1.4 Growing awareness towards timely treatment of ophthalmic disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Side effects and safety concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Biosimilars and lower-cost alternatives expanding access

- 3.2.3.2 Expansion into emerging markets with growing healthcare access

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Pricing analysis, 2024

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Anti-VEGF Therapies, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Eylea

- 5.3 Vabysmo

- 5.4 Lucentis

- 5.5 Other anti-VEGF therapies

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Biologics

- 6.3 Biosimilars

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Age-related macular degeneration

- 7.3 Diabetic retinopathy

- 7.4 Macular edema

- 7.5 Retinal vein occlusion

- 7.6 Myopic choroidal neovascularization

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AMGEN

- 9.2 Astellas

- 9.3 Biocon Biologics

- 9.4 Biogen

- 9.5 CELLTRION

- 9.6 Intas Pharmaceuticals

- 9.7 KANGHONG PHARMACEUTICALS

- 9.8 LUPIN

- 9.9 NOVARTIS

- 9.10 REGENERON

- 9.11 Reliance Life Sciences

- 9.12 Roche

- 9.13 SANDOZ

- 9.14 STADA

- 9.15 teva