|

市場調查報告書

商品編碼

1892786

開源情報(OSINT)市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Open-Source Intelligence (OSINT) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

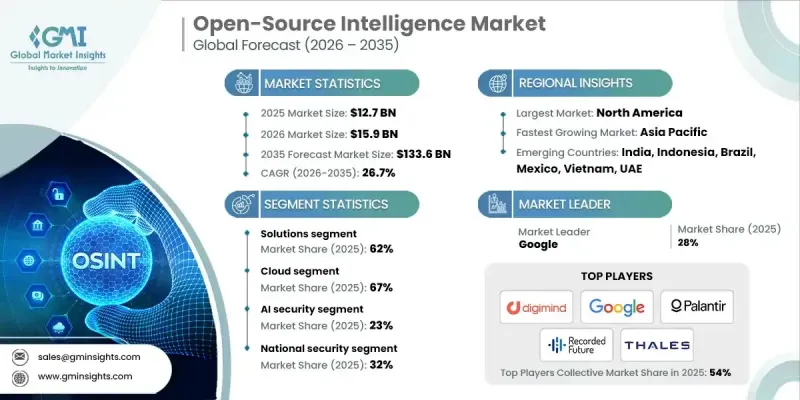

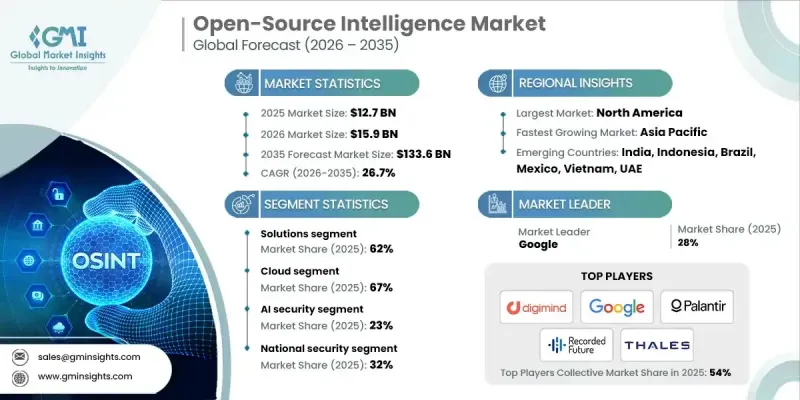

2025 年全球開源情報 (OSINT) 市場價值為 127 億美元,預計到 2035 年將以 26.7% 的複合年成長率成長至 1336 億美元。

網路威脅(包括勒索軟體、詐欺和資料外洩)的日益頻繁和複雜化,正促使各組織採用開源情報(OSINT)解決方案,以實現即時威脅偵測和風險緩解。 2024年企業網路遭受的網路攻擊激增,促使企業廣泛採用開源情報平台,以增強威脅情報並提供預警系統。企業正在利用來自社群媒體、部落格、新聞入口網站、物聯網設備和網路論壇的日益成長的公開資料,以獲取可操作的洞察。人工智慧、機器學習、自然語言處理和巨量資料分析等領域的技術進步,實現了資料收集的自動化,提高了預測性威脅偵測能力,並增強了分析能力。一些開源情報平台現在整合了由人工智慧驅動的商業智慧解決方案,使商業組織和政府機構能夠快速存取準確的資料、情報和可操作的洞察,從而支援決策和安全營運。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 127億美元 |

| 預測值 | 1336億美元 |

| 複合年成長率 | 26.7% |

解決方案業務部門佔據62%的市場佔有率,預計2025年將創造79.2億美元的收入。該板塊涵蓋軟體平台、資料收集工具、分析應用以及完全整合的智慧套件,旨在支援端到端的開源情報(OSINT)行動,包括資料收集、分析、監控和分發。雲端架構和行動導向的API優先整合等創新預計將持續推動成長。

到2025年,雲端部署市場佔有率將達到67%,預計到2035年將以27.3%的複合年成長率成長。基於雲端的開源情報(OSINT)平台提供訂閱定價、彈性擴展、快速部署、持續更新和多租戶高效性等優勢。這些優勢使全球各地的分散式團隊無需維護本地基礎設施即可存取先進的情報工具。採用公共雲端還使中型組織能夠實施開源情報解決方案,促進協作,並在全面的安全營運中與其他雲端服務無縫整合。

預計到2025年,美國開源情報(OSINT)市場規模將達到30.6億美元。聯邦政府的支出、雄厚的國防預算、金融和科技業的大型企業以及完善的供應商生態系統,共同支撐著該市場的成熟。聯邦機構和商業安全團隊高度依賴可擴展的威脅情報平台、連結分析和暗網監控來增強安全態勢和提升營運效率。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 網路威脅與安全問題日益加劇

- 數位足跡和資料可用性不斷成長

- 監理合規與風險管理

- 技術進步

- 產業陷阱與挑戰

- 資料隱私和監管限制

- 複雜性及對專業人才的需求

- 市場機遇

- 新興市場和中小企業

- 拓展至非傳統領域

- 高級分析服務

- 與安全生態系統整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- CISA(網路安全與基礎設施安全局)

- 個人資訊保護與電子文件法(PIPEDA)

- 歐洲

- 聯邦資料保護法 (BDSG)

- 隱私代碼(Codice in materia di protezione dei dati individuali)

- 國家網路安全局(ANSSI)指令

- 2018年資料保護法

- 亞太地區

- 個人資訊保護法 (PIPL)

- 2023年數位個人資料保護法

- PIPA(個人資訊保護法)

- 1979年電信(截取與存取)法

- 拉丁美洲

- LGPD(Lei Geral de Protecao de Dados)

- 國家個人資料保護局法規

- 聯邦法律關於保護私人持有的個人數據

- 中東和非洲

- 個人資料保護法 (PDPL)

- 反網路犯罪法

- 電子通訊和交易法

- 北美洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 定價分析

- 依產品

- 按地區

- 成本細分分析

- 供應商成本結構

- 成本構成要素的實施

- 持續營運成本

- 間接客戶成本

- 專利分析

- 案例研究

- 政府網路安全機構

- 全球銀行詐欺偵測與合規監控

- 零售及消費品牌聲譽及仿冒品追蹤

- 電信公司地緣政治與基礎設施情報

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 未來展望與機遇

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2022-2035年

- 解決方案/平台

- 開源情報分析平台

- 社群媒體情報工具

- 地理空間工具

- 文字探勘引擎

- 服務

- 專業服務

- 諮詢

- 部署與整合

- 支援與維護

- 託管服務

- 專業服務

第6章:市場估算與預測:依證券類型分類,2022-2035年

- 人類智慧

- 內容智慧

- 巨量資料安全

- 人工智慧安全

- 數據分析

- 暗網分析

- 鏈路/網路分析

第7章:市場估算與預測:依部署模式分類,2022-2035年

- 雲

- 現場

第8章:市場估算與預測:依應用領域分類,2022-2035年

- 國家安全

- 軍事與國防

- 私部門

- 公部門

- 其他

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 波蘭

- 羅馬尼亞

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球公司

- Accenture

- Babel Street

- Cellebrite

- IBM

- Maltego Technologies

- Microsoft

- NICE

- Palantir Technologies

- Recorded Future

- SAIL Labs

- Thales

- 區域玩家

- BAE Systems Applied Intelligence

- Ciqurix Intelligence

- CybelAngel

- DarkOwl

- Digimind (Onclusive)

- OpenText

- Social Links

- ThreatQuotient

- Verint Systems

- ZeroFox

- 新興玩家

- Dataminr

- Fivecast

- Hetz

- Hypersight

- Kharon

- Skopenow

The Global Open-Source Intelligence (OSINT) Market was valued at USD 12.7 billion in 2025 and is estimated to grow at a CAGR of 26.7% to reach USD 133.6 billion by 2035.

The rising frequency and complexity of cyber threats, including ransomware, fraud, and data breaches, are driving organizations to adopt OSINT solutions for real-time threat detection and risk mitigation. The spike in cyber-attacks across enterprise networks in 2024 prompted significant adoption of OSINT platforms to enhance threat intelligence and provide early warning systems. Businesses are leveraging the increasing volume of publicly available data from social media, blogs, news portals, IoT devices, and web forums to gain actionable insights. Technological advancements in artificial intelligence, machine learning, natural language processing, and big data analytics have automated data collection, improved predictive threat detection, and strengthened analysis. Some OSINT platforms now integrate AI-driven business intelligence solutions, allowing both commercial organizations and government agencies to rapidly access accurate data, intelligence, and actionable insights for decision-making and security operations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.7 Billion |

| Forecast Value | $133.6 Billion |

| CAGR | 26.7% |

The solutions segment held a 62% share, generating USD 7.92 billion in 2025. This segment includes software platforms, data collection tools, analytical applications, and fully integrated intelligence suites that facilitate end-to-end OSINT operations, covering data acquisition, analysis, monitoring, and dissemination. Innovations such as cloud-based architectures and API-first integration for mobile access are expected to continue fueling growth.

The cloud deployment segment accounted for a 67% share in 2025 and is projected to grow at a CAGR of 27.3% through 2035. Cloud-based OSINT platforms offer subscription pricing, elastic scalability, rapid deployment, continuous updates, and multi-tenant efficiency. These advantages allow distributed teams worldwide to access advanced intelligence tools without maintaining on-premises infrastructure. Public cloud adoption also enables mid-sized organizations to implement OSINT solutions, promote collaboration, and integrate seamlessly with other cloud services within comprehensive security operations.

U.S. Open-Source Intelligence (OSINT) Market reached USD 3.06 billion in 2025. The market's maturity is supported by federal government spending, robust defense budgets, large corporations in the finance and technology sectors, and a well-established vendor ecosystem. Federal agencies and commercial security teams heavily rely on scalable threat intelligence platforms, link analysis, and dark web monitoring to strengthen security posture and operational efficiency.

Key players in the Global Open-Source Intelligence (OSINT) Market include Google, Palantir Technologies, Digimind (Onclusive), Cellebrite, Babelstreet, Maltego Technologies, Recorded Future, Thales, NICE, Sail Labs (Hensoldt), and CybelAngel. Companies in the Global Open-Source Intelligence (OSINT) Market are strengthening their foothold by investing in AI and ML-driven analytics, cloud-enabled deployment, and mobile-friendly solutions. Strategic partnerships with government agencies and enterprises help expand adoption and credibility. Firms are also focusing on API-first integrations to ensure interoperability with existing security infrastructures, while enhancing platform scalability and user experience. Regular updates, threat intelligence enrichment, and tailored industry solutions further differentiate offerings, allowing vendors to capture emerging opportunities in both commercial and public sector segments while maintaining long-term market leadership.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment mode

- 2.2.4 Security

- 2.2.5 Application

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cyber threats & security concerns

- 3.2.1.2 Growing digital footprint & data availability

- 3.2.1.3 Regulatory compliance & risk management

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy & regulatory restrictions

- 3.2.2.2 Complexity & skilled resource requirement

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets & SMEs

- 3.2.3.2 Expansion into non-traditional sectors

- 3.2.3.3 Advanced analytics services

- 3.2.3.4 Integration with security ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 CISA (Cybersecurity & Infrastructure Security Agency)

- 3.4.1.2 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 3.4.2 Europe

- 3.4.2.1 BDSG (Federal Data Protection Act)

- 3.4.2.2 Privacy Code (Codice in materia di protezione dei dati personali)

- 3.4.2.3 National Cybersecurity Agency (ANSSI) directives

- 3.4.2.4 Data Protection Act 2018

- 3.4.3 Asia Pacific

- 3.4.3.1 PIPL (Personal Information Protection Law)

- 3.4.3.2 Digital Personal Data Protection Act 2023

- 3.4.3.3 PIPA (Personal Information Protection Act)

- 3.4.3.4 Telecommunications (Interception and Access) Act 1979

- 3.4.4 Latin America

- 3.4.4.1 LGPD (Lei Geral de Protecao de Dados)

- 3.4.4.2 National Directorate for Personal Data Protection regulations

- 3.4.4.3 Federal Law on the Protection of Personal Data Held by Private Parties

- 3.4.5 Middle East & Africa

- 3.4.5.1 PDPL (Personal Data Protection Law)

- 3.4.5.2 Anti-Cyber Crime Law

- 3.4.5.3 Electronic Communications and Transactions Act

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Cost breakdown analysis

- 3.9.1 Vendor cost structure

- 3.9.2 Implementation of cost components

- 3.9.3 Ongoing operational costs

- 3.9.4 Indirect customer costs

- 3.10 Patent analysis

- 3.11 Case studies

- 3.11.1 Government cyber agency

- 3.11.2 Global bank fraud detection & compliance monitoring

- 3.11.3 Retail & consumer brand reputation and counterfeit product tracking

- 3.11.4 Telecom company geopolitical & infrastructure intelligence

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook and opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Solutions/Platforms

- 5.2.1 OSINT analytics platforms

- 5.2.2 Social media intelligence tools

- 5.2.3 Geospatial tools

- 5.2.4 Text-mining engines

- 5.3 Services

- 5.3.1 Professional services

- 5.3.1.1 Consulting

- 5.3.1.2 Deployment & integration

- 5.3.1.3 Support & maintenance

- 5.3.2 Managed services

- 5.3.1 Professional services

Chapter 6 Market Estimates & Forecast, By Security, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 Human intelligence

- 6.3 Content intelligence

- 6.4 Big data security

- 6.5 AI security

- 6.6 Data analytics

- 6.7 Dark web analysis

- 6.8 Link/network analysis

Chapter 7 Market Estimates & Forecast, By Deployment mode, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premises

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 National security

- 8.3 Military & defense

- 8.4 Private sector

- 8.5 Public sector

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.3.8 Poland

- 9.3.9 Romania

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 Accenture

- 10.1.2 Babel Street

- 10.1.3 Cellebrite

- 10.1.4 Google

- 10.1.5 IBM

- 10.1.6 Maltego Technologies

- 10.1.7 Microsoft

- 10.1.8 NICE

- 10.1.9 Palantir Technologies

- 10.1.10 Recorded Future

- 10.1.11 SAIL Labs

- 10.1.12 Thales

- 10.2 Regional players

- 10.2.1 BAE Systems Applied Intelligence

- 10.2.2 Ciqurix Intelligence

- 10.2.3 CybelAngel

- 10.2.4 DarkOwl

- 10.2.5 Digimind (Onclusive)

- 10.2.6 OpenText

- 10.2.7 Social Links

- 10.2.8 ThreatQuotient

- 10.2.9 Verint Systems

- 10.2.10 ZeroFox

- 10.3 Emerging players

- 10.3.1 Dataminr

- 10.3.2 Fivecast

- 10.3.3 Hetz

- 10.3.4 Hypersight

- 10.3.5 Kharon

- 10.3.6 Skopenow