|

市場調查報告書

商品編碼

1892778

自動化細胞計數器市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Automated Cell Counter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

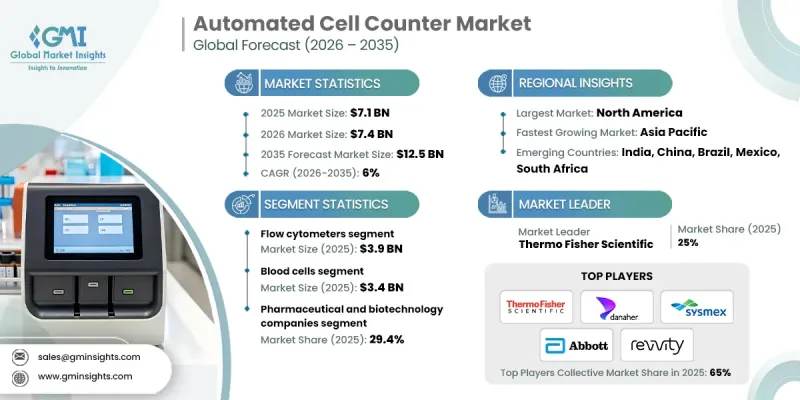

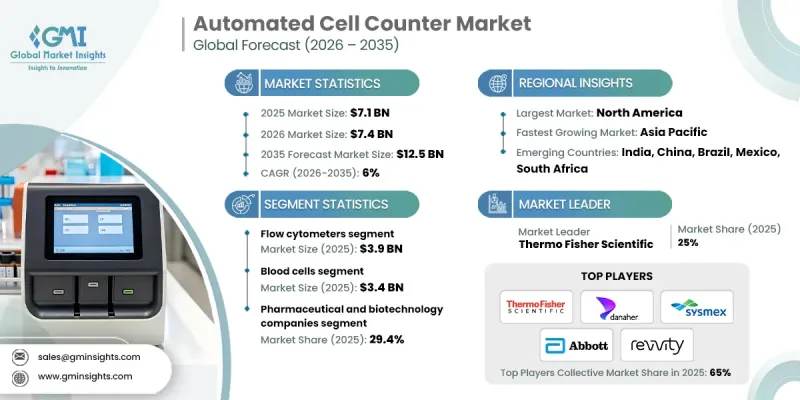

2025 年全球自動細胞計數器市場價值為 71 億美元,預計到 2035 年將以 6% 的複合年成長率成長至 125 億美元。

市場擴張的促進因素包括長期疾病和傳染性疾病發病率的上升、全球研究投入的增加以及自動化細胞分析解決方案技術的持續進步。隨著醫療保健系統日益重視早期診斷、精準醫療和大規模篩檢,對快速、準確的細胞分析的需求持續成長。自動化細胞計數器支援高通量工作流程,同時最大限度地減少人為操作的差異,從而提高了診斷、臨床和研究環境中的可靠性。對效率、可重複性和資料準確性的日益重視,進一步推動了全球實驗室對這些系統的採用。由於這些系統能夠大規模地提供一致的結果,因此它們正成為現代醫療保健和生命科學研究不可或缺的一部分,既支持常規檢測,也支持前沿科學研究。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 71億美元 |

| 預測值 | 125億美元 |

| 複合年成長率 | 6% |

流式細胞儀市場預計在2025年將創造39億美元的收入,佔市場佔有率的55%。流式細胞儀技術能夠同時評估多種細胞特徵,從而快速分析大量細胞群。其高速處理和多參數評估能力使其成為臨床診斷和科研實驗室中先進細胞測量應用的核心工具。

預計2025年,血液細胞分析市場規模將達34億美元。血液細胞檢測仍然是最常用的診斷程序之一,為疾病檢測、治療監測和臨床研究提供支援。自動化系統能夠提高檢測準確性和縮短週轉時間,同時減輕醫療機構的營運負擔。

預計到2024年,製藥和生技公司將佔據29.4%的市場。這些公司依賴自動化細胞計數器來支援藥物研發、生物製劑生產和品質保證流程。對生物製劑和個人化療法的日益重視,持續推高了對精準且可擴展的細胞計數技術的需求。

2024年,北美自動化細胞數市場佔據38%的佔有率。強大的醫療基礎設施、先進的實驗室能力以及對精準診斷工具日益成長的需求,支撐著該地區自動化細胞計數技術的持續普及。對效率和數據驅動型醫療的重視,也進一步加速了自動化解決方案的應用。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 慢性病和傳染病症率不斷上升

- 全球研發支出不斷增加

- 自動化細胞計數產業的技術進步

- 幹細胞和再生醫學的擴展

- 產業陷阱與挑戰

- 自動細胞計數設備成本高昂

- 缺乏熟練勞動力

- 市場機遇

- 細胞治療生產規模擴大

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 2024年定價分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2022-2035年

- 流式細胞儀

- 基於螢光影像的細胞計數器

- 庫爾特計數器

第6章:市場估算與預測:依應用領域分類,2022-2035年

- 血球

- 細胞系

- 微生物細胞

- 其他應用

第7章:市場估算與預測:依最終用途分類,2022-2035年

- 製藥和生物技術公司

- 醫院

- 診斷實驗室

- 研究機構

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Thermo Fisher Scientific

- PerkinElmer

- Bio-Rad Laboratories

- Abbott Laboratories

- Sysmex Corporation

- NanoEnTek

- F. Hoffmann-La Roche Ltd

- Danaher (Beckman Coulter Inc. and Radiometer)

- Agilent Technologies

- Merck KGaA

- ChemoMetec A/S

- Logos Biosystems

- Nexcelom Bioscience (Revvity)

- DeNovix

- Curiosis

The Global Automated Cell Counter Market was valued at USD 7.1 billion in 2025 and is estimated to grow at a CAGR of 6% to reach USD 12.5 billion by 2035.

Market expansion is driven by the rising incidence of long-term and infectious health conditions, increasing global investment in research activities, and continuous technological progress within automated cell analysis solutions. As healthcare systems emphasize early diagnosis, precision medicine, and large-scale screening initiatives, demand for fast and accurate cell analysis continues to increase. Automated cell counters support high-throughput workflows while minimizing manual variability, which enhances reliability across diagnostic, clinical, and research environments. Growing emphasis on efficiency, reproducibility, and data accuracy is reinforcing their adoption across laboratories worldwide. These systems are becoming integral to modern healthcare and life science research due to their ability to deliver consistent results at scale, supporting both routine testing and advanced scientific studies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.1 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 6% |

The flow cytometry segment generated USD 3.9 billion in 2025 and accounted for 55% share. Flow cytometry technology enables rapid analysis of large cell populations by evaluating multiple cellular characteristics simultaneously. Its high-speed processing and multi-parameter assessment capabilities make it a core tool in advanced cell measurement applications across clinical diagnostics and research laboratories.

The blood cell analysis segment was valued at USD 3.4 billion in 2025. Blood cell measurement remains one of the most frequently performed diagnostic procedures, supporting disease detection, treatment monitoring, and clinical research. Automated systems improve accuracy and turnaround time while reducing operational burden across healthcare facilities.

The pharmaceutical and biotechnology companies held a 29.4% share in 2024. These organizations rely on automated cell counters to support drug development, biologics manufacturing, and quality assurance processes. Increasing focus on biologics and individualized therapies continues to elevate demand for precise and scalable cell counting technologies.

North America Automated Cell Counter Market held a 38% share in 2024. Strong healthcare infrastructure, advanced laboratory capabilities, and growing demand for accurate diagnostic tools support sustained adoption across the region. Emphasis on efficiency and data-driven care continues to accelerate the use of automated solutions.

Key companies active in the Global Automated Cell Counter Market include Thermo Fisher Scientific, Sysmex Corporation, Abbott Laboratories, Bio-Rad Laboratories, Danaher, Merck KGaA, Agilent Technologies, PerkinElmer, F. Hoffmann-La Roche Ltd, NanoEnTek, ChemoMetec A/S, Logos Biosystems, Nexcelom Bioscience (Revvity), DeNovix, and Curiosis. Companies in the Global Automated Cell Counter Market implement strategic initiatives to strengthen their competitive position. Continuous investment in research and product innovation enables the development of faster, more accurate, and user-friendly systems. Firms expand their portfolios to address diverse application needs across diagnostics, research, and bioprocessing. Strategic partnerships and acquisitions help broaden geographic presence and technical capabilities. Companies also focus on automation, software integration, and data analytics to enhance system value.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic and infectious diseases

- 3.2.1.2 Increasing research and development expenditure worldwide

- 3.2.1.3 Technological advancements in automated cell counter industry

- 3.2.1.4 Expansion of stem cell and regenerative medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of automated cell counter devices

- 3.2.2.2 Lack of skilled workforce

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in cell therapy manufacturing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Flow cytometers

- 5.3 Fluorescence image-based cell counter

- 5.4 Coulter counter

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Blood cells

- 6.3 Cell lines

- 6.4 Microbial cells

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical & biotechnology companies

- 7.3 Hospitals

- 7.4 Diagnostic laboratories

- 7.5 Research institutes

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Thermo Fisher Scientific

- 9.2 PerkinElmer

- 9.3 Bio-Rad Laboratories

- 9.4 Abbott Laboratories

- 9.5 Sysmex Corporation

- 9.6 NanoEnTek

- 9.7 F. Hoffmann-La Roche Ltd

- 9.8 Danaher (Beckman Coulter Inc. and Radiometer)

- 9.9 Agilent Technologies

- 9.10 Merck KGaA

- 9.11 ChemoMetec A/S

- 9.12 Logos Biosystems

- 9.13 Nexcelom Bioscience (Revvity)

- 9.14 DeNovix

- 9.15 Curiosis