|

市場調查報告書

商品編碼

1892776

白油市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)White Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

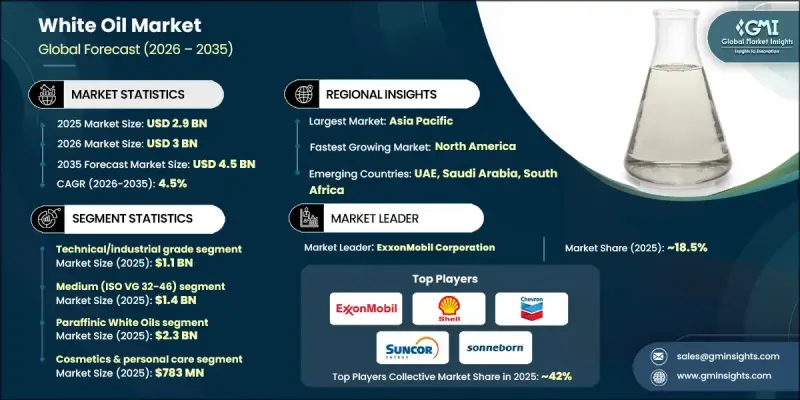

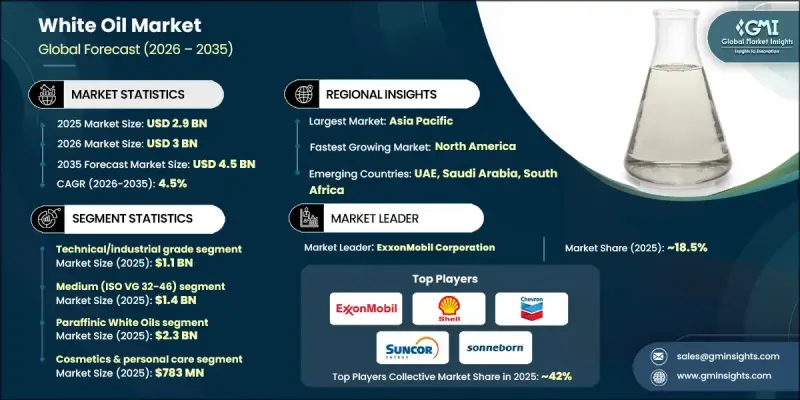

2025 年全球白油市場價值 29 億美元,預計到 2035 年將以 4.5% 的複合年成長率成長至 45 億美元。

白油是高度精煉的礦物油,無色、無味、無臭,具有卓越的化學穩定性和無毒特性。這些特性使其成為安全性和法規遵循要求極高的各行業敏感應用的理想選擇。白油經過先進的加氫和精煉工藝,去除芳香族化合物、硫和氮雜質,從而獲得不同純度和黏度等級的產品。這些油品廣泛應用於製藥、化妝品、食品加工和工業製造等領域,在這些領域,穩定的品質至關重要。近年來,加氫處理和催化脫蠟技術的進步使得生產超純油成為可能,這些超純油具有更高的氧化穩定性、更長的保存期限,並符合國際標準。此外,合成和生物基替代品的開發在滿足永續發展需求的同時,也確保了關鍵應用所需的性能標準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 29億美元 |

| 預測值 | 45億美元 |

| 複合年成長率 | 4.5% |

預計到2025年,技術級和工業級白油市場規模將達11億美元。由於其在塑膠加工、聚合物生產、黏合劑和其他工業應用領域的多功能性和成本效益,該市場需求保持穩定。煉油技術的不斷改進以及新興經濟體製造業的擴張,進一步推動了這些等級產品的需求。

預計到2025年,中等黏度等級(ISO VG 32-46)潤滑油市場規模將達到14億美元。這些等級潤滑油性能均衡、適應性強,且能服務包括塑膠和工業製造在內的眾多產業,因此備受青睞。這些等級的潤滑油佔白油總消費量的近48%,反映了其在科技和消費領域的廣泛應用。

2025年,美國白油市場規模預計將達到6.38億美元,主要得益於強勁的製藥生產、先進的化妝品生產以及嚴格的食品安全法規。美國對高純度油脂的需求主要來自製藥、個人護理產品、食品級應用以及工業聚合物加工等領域。領先的製藥和化妝品公司以及完善的食品加工基礎設施,確保了符合FDA及其他監管標準的USP級和食品級白油的持續需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品等級

- 未來市場趨勢

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品等級分類,2022-2035年

- 技術/工業級

- 食品級

- 藥用/USP級

- 化妝品級

第6章:市場估算與預測:依黏度分類,2022-2035年

- 光線(ISO VG 7-15)

- 中等 (ISO VG 32-46)

- 高黏度(ISO VG 68-100+)

第7章:市場估計與預測:依基礎油類型分類,2022-2035年

- 石蠟白油

- 環烷白油

第8章:市場估算與預測:依應用領域分類,2022-2035年

- 藥物應用

- 化妝品及個人護理

- 塑膠和聚合物

- 食品加工

- 黏合劑和密封劑

- 紡織品和皮革

- 農業應用

- 金屬加工及工業

- 動物營養與獸醫

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Chevron Corporation

- Petro-Canada/Suncor Energy

- Sonneborn LLC

- H&R Group (Hansen & Rosenthal KG)

- FUCHS Petrolub SE

- APAR Industries Limited

- Savita Oil Technologies Ltd.

- Panama Petrochem Ltd.

- Raj Petro Specialities Pvt. Ltd.

- Lodha Petro

- SEOJIN Chemical Co., Ltd.

- JX Nippon Oil & Energy Corporation

The Global White Oil Market was valued at USD 2.9 billion in 2025 and is estimated to grow at a CAGR of 4.5% to reach USD 4.5 billion by 2035.

White oils are highly refined mineral oils that are colorless, odorless, and tasteless, offering exceptional chemical stability and non-toxic properties. These characteristics make them ideal for sensitive applications across industries where safety and regulatory compliance are crucial. White oils undergo advanced hydrogenation and refining processes to remove aromatic compounds, sulfur, and nitrogen impurities, resulting in products with varying purity levels and viscosity grades. The oils find applications in pharmaceuticals, cosmetics, food processing, and industrial manufacturing, where consistent quality is essential. Recent technological advancements in hydrotreatment and catalytic dewaxing have enabled the production of ultra-pure oils with improved oxidation stability, longer shelf life, and compliance with international standards. Additionally, the development of synthetic and bio-based alternatives is addressing sustainability demands while maintaining performance standards required for critical uses.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.9 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 4.5% |

The technical and industrial-grade white oils segment generated USD 1.1 billion in 2025. This segment maintains steady demand due to its versatility and cost-effectiveness in plastics processing, polymer production, adhesives, and other industrial applications. Continuous improvements in refining techniques and the expansion of manufacturing in emerging economies are further driving demand for these grades.

The medium viscosity grades (ISO VG 32-46) segment reached USD 1.4 billion in 2025. Their balanced performance, adaptability, and ability to serve a wide range of industries, including plastics and industrial manufacturing, make them highly preferred. These grades account for nearly 48% of total white oil consumption, reflecting broad applicability across technical and consumer applications.

U.S. White Oil Market accounted for USD 638 million in 2025, supported by robust pharmaceutical manufacturing, advanced cosmetics production, and stringent food safety regulations. The country's demand is fueled by the need for high-purity oils in pharmaceuticals, personal care products, food-grade applications, and industrial polymer processing. The presence of leading pharmaceutical and cosmetics companies, along with sophisticated food processing infrastructure, ensures continued demand for USP-grade and food-grade white oils that comply with FDA and regulatory standards.

Key players operating in the Global White Oil Market include ExxonMobil Corporation, Royal Dutch Shell plc, Chevron Corporation, Petro-Canada/Suncor Energy, Sonneborn LLC, H&R Group (Hansen & Rosenthal KG), FUCHS Petrolub SE, APAR Industries Limited, Savita Oil Technologies Ltd., Panama Petrochem Ltd., Raj Petro Specialities Pvt. Ltd., Lodha Petro, SEOJIN Chemical Co., Ltd., and JX Nippon Oil & Energy Corporation. Companies in the Global White Oil Market strengthen their market presence through a combination of strategies. They invest heavily in research and development to enhance refining technologies, produce ultra-pure and specialty viscosity grades, and innovate synthetic and bio-based alternatives. Strategic partnerships, mergers, and acquisitions expand geographic reach and distribution networks. Firms also focus on regulatory compliance and product standardization to ensure global acceptance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product Grade

- 2.2.2 Viscosity

- 2.2.3 Base Oil Type

- 2.2.4 Application

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product grade

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Technical/industrial grade

- 5.3 Food grade

- 5.4 Pharmaceutical/USP grade

- 5.5 Cosmetic grade

Chapter 6 Market Estimates and Forecast, By Viscosity, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Light (ISO VG 7-15)

- 6.3 Medium (ISO VG 32-46)

- 6.4 Heavy (ISO VG 68-100+)

Chapter 7 Market Estimates and Forecast, By Base Oil Type, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Paraffinic white oils

- 7.3 Naphthenic white oils

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical applications

- 8.3 Cosmetics & personal care

- 8.4 Plastics & polymers

- 8.5 Food processing

- 8.6 Adhesives & sealants

- 8.7 Textiles & leather

- 8.8 Agricultural applications

- 8.9 Metalworking & industrial

- 8.10 Animal nutrition & veterinary

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 ExxonMobil Corporation

- 10.2 Royal Dutch Shell plc

- 10.3 Chevron Corporation

- 10.4 Petro-Canada/Suncor Energy

- 10.5 Sonneborn LLC

- 10.6 H&R Group (Hansen & Rosenthal KG)

- 10.7 FUCHS Petrolub SE

- 10.8 APAR Industries Limited

- 10.9 Savita Oil Technologies Ltd.

- 10.10 Panama Petrochem Ltd.

- 10.11 Raj Petro Specialities Pvt. Ltd.

- 10.12 Lodha Petro

- 10.13 SEOJIN Chemical Co., Ltd.

- 10.14 JX Nippon Oil & Energy Corporation