|

市場調查報告書

商品編碼

1892775

泌尿科補充劑市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Urology Supplements Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

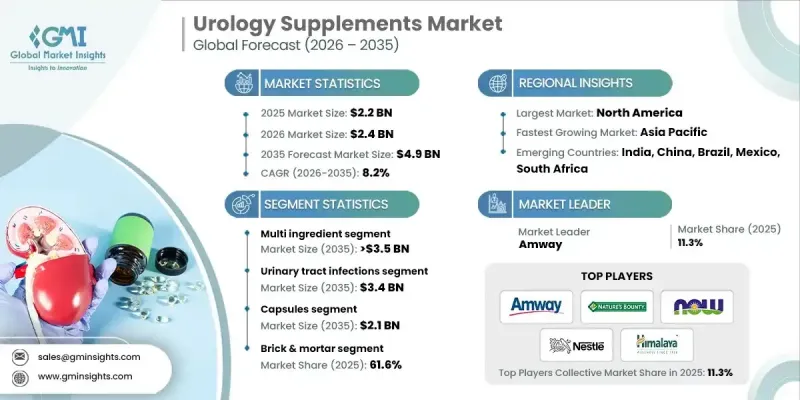

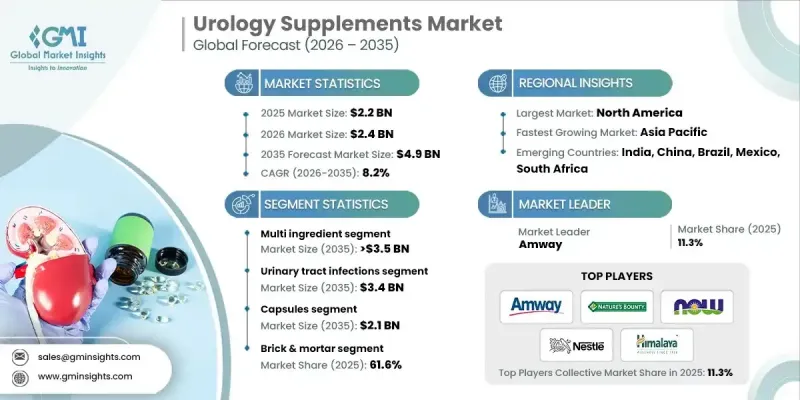

2025 年全球泌尿科補充劑市場價值為 22 億美元,預計到 2035 年將以 8.2% 的複合年成長率成長至 49 億美元。

市場成長得益於泌尿系統疾病負擔的加重、人們對前列腺健康的日益關注以及消費者對積極自我保健的日益重視。數位零售平台的普及和消費者對天然配方產品的強烈偏好進一步強化了市場需求。消費者越來越傾向於尋求以科學為基礎的非藥物解決方案,以支持泌尿系統功能、攝護腺健康、腎臟功能以及整體泌尿系統平衡。感染率的上升、人口老化加劇以及人們向預防性和自我管理型醫療保健的轉變,持續擴大潛在消費群。業界領導者憑藉先進的配方技術、經驗證的植物科學以及涵蓋實體零售、線上平台和專業服務管道的多元化分銷策略展開競爭。持續的創新和不斷加強的消費者教育措施正在增強消費者對泌尿系統膳食補充劑的信心,並支持市場的持續發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 22億美元 |

| 預測值 | 49億美元 |

| 複合年成長率 | 8.2% |

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 泌尿系統疾病發生率不斷上升

- 產品配方和輸送系統的進步

- 越來越重視預防性醫療保健

- 產業陷阱與挑戰

- 潛在的相互作用和副作用

- 市場機遇

- 對個人化營養解決方案的需求不斷成長

- 新興市場滲透率不斷提高

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術進步

- 當前技術趨勢

- 先進的吸收和生物利用度技術

- 用於泌尿系統健康的新型草藥和功能性成分

- 人工智慧輔助的個人化劑量和補充劑指導

- 新興技術

- 機器學習在多成分配方最佳化的應用

- 與穿戴式和遠端健康監測設備的整合

- 智慧封裝與控釋遞送系統

- 當前技術趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 基於基因和生活方式資料的個人化營養解決方案

- 經實證醫學驗證、臨床測試的泌尿科補充劑組合

- 以數位優先的平台,結合人工智慧推薦和全球電子商務覆蓋範圍

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2022-2035年

- 多重成分

- 單一成分

第6章:市場估算與預測:依應用領域分類,2022-2035年

- 泌尿道感染

- 攝護腺健康

- 腎臟健康

- 膀胱健康

第7章:市場估價與預測:依配方分類,2022-2035年

- 膠囊

- 軟膠囊

- 片劑

- 粉末

- 其他配方

第8章:市場估算與預測:依配銷通路分類,2022-2035年

- 傳統實體店

- 電子商務

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Amway

- Better Being

- Biotexlife

- dsm-firmenich

- Himalaya Wellness

- Himalayan Organics

- Natrol

- Nature's Bounty

- Nestle

- NOW Foods

- Puritan's Pride

- Solaray

- Szio+

- Theralogix

- ZAHLER

The Global Urology Supplements Market was valued at USD 2.2 billion in 2025 and is estimated to grow at a CAGR of 8.2% to reach USD 4.9 billion by 2035.

Market growth is supported by the rising burden of urinary health disorders, growing concern around prostate wellness, and increasing consumer focus on proactive self-care routines. Wider access to digital retail platforms and a strong preference for naturally derived formulations further reinforce demand. Consumers are increasingly seeking science-backed, non-pharmaceutical solutions that support urinary tract function, prostate health, kidney performance, and overall urological balance. Rising infection rates, a growing aging population, and the shift toward preventive and self-managed healthcare continue to expand the addressable consumer base. Leading industry participants compete through advanced formulation expertise, validated botanical science, and diversified distribution strategies spanning physical retail, online platforms, and practitioner-focused channels. Continuous innovation and growing consumer education initiatives are strengthening confidence in urology-focused dietary supplementation and supporting sustained market development.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 8.2% |

Key manufacturers emphasize high-grade ingredient sourcing, sustained research investment, and transparent consumer communication to reinforce credibility and product effectiveness. Strategic advancements centered on optimized nutrient combinations, clinically aligned formulations, and evidence-supported performance benchmarks are raising quality standards across the market and improving long-term urinary wellness outcomes.

The multi-ingredient formulations segment accounted for a 70.4% share in 2025. This leadership position reflects increasing consumer preference for all-in-one products designed to address multiple urological health needs in a single regimen. These formulations integrate diverse functional components to deliver enhanced convenience, broader health coverage, and improved perceived effectiveness, which continues to support segment growth.

The urinary tract health segment held a 67.8% share in 2025 and is projected to reach USD 3.4 billion during 2026-2035, attributed to widespread prevalence across age groups and heightened awareness of preventive nutritional approaches that support long-term urinary function and reduce recurrence risks.

North America Urology Supplements Market held a 40.2% share in 2025. Strong consumer awareness, well-established healthcare infrastructure, and rising incidence of urological conditions have fueled demand for supportive supplementation. Ongoing advances in formulation technologies and increased availability of clinically positioned products continue to accelerate regional adoption.

Prominent companies operating in the Global Urology Supplements Market include NOW Foods, Himalaya Wellness, Nestle, Natrol, Amway, Better Being, dsm-firmenich, Theralogix, Puritan's Pride, Himalayan Organics, Nature's Bounty, Solgaray, Biotexlife, ZAHLER, and Szio+. Companies in the Global Urology Supplements Market adopt targeted strategies to strengthen their competitive positioning and expand market share. Product differentiation through clinically aligned formulations and premium ingredient sourcing remains a central focus. Manufacturers invest heavily in research to support efficacy claims and meet evolving regulatory expectations. Expansion across omnichannel distribution models enables brands to reach both direct consumers and healthcare-influenced buyers. Strategic acquisitions and partnerships support portfolio diversification and geographic reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Application trends

- 2.2.4 Formulation trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of urological disorders

- 3.2.1.2 Advancements in product formulations and delivery systems

- 3.2.1.3 Increasing emphasis on preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Potential interactions and side effects

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding demand for personalized nutrition solutions

- 3.2.3.2 Rising penetration across emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.1.1 Advanced absorption and bioavailability technologies

- 3.5.1.2 Novel herbal and functional ingredients for urinary health

- 3.5.1.3 AI-assisted personalized dosing and supplement guidance

- 3.5.2 Emerging technologies

- 3.5.2.1 Machine learning for multi-ingredient formulation optimization

- 3.5.2.2 Integration with wearable and remote health monitoring devices

- 3.5.2.3 Smart encapsulation and controlled-release delivery systems

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Tailored nutrition solutions based on genetic and lifestyle data

- 3.9.2 Evidence-backed, clinically tested urology supplement combinations

- 3.9.3 Digital-first platforms combining AI recommendations with global e-commerce reach

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Multi ingredient

- 5.3 Single ingredient

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Urinary tract infections

- 6.3 Prostate health

- 6.4 Kidney health

- 6.5 Bladder health

Chapter 7 Market Estimates and Forecast, By Formulation, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Capsules

- 7.3 Softgels

- 7.4 Tablets

- 7.5 Powder

- 7.6 Other formulations

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Brick & mortar

- 8.3 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amway

- 10.2 Better Being

- 10.3 Biotexlife

- 10.4 dsm-firmenich

- 10.5 Himalaya Wellness

- 10.6 Himalayan Organics

- 10.7 Natrol

- 10.8 Nature's Bounty

- 10.9 Nestle

- 10.10 NOW Foods

- 10.11 Puritan's Pride

- 10.12 Solaray

- 10.13 Szio+

- 10.14 Theralogix

- 10.15 ZAHLER