|

市場調查報告書

商品編碼

1892774

噴砂機市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Sand Blasting Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

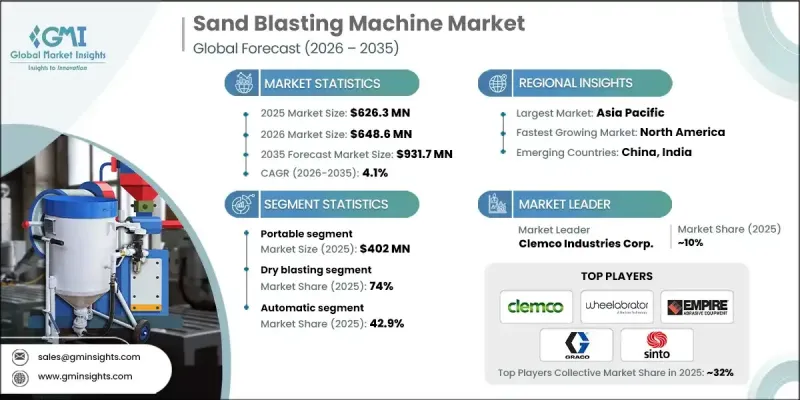

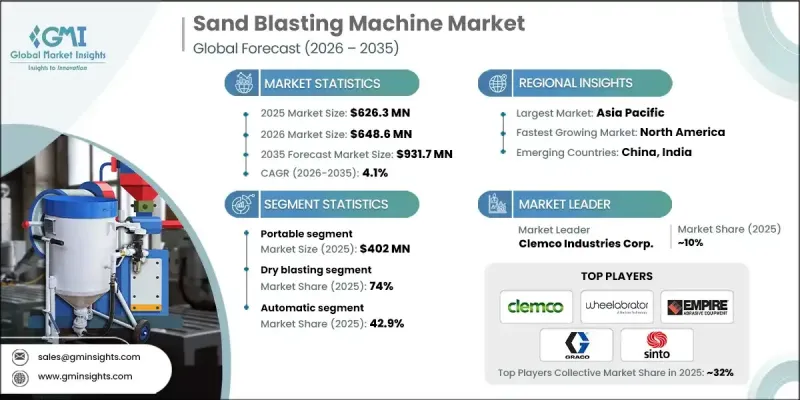

2025 年全球噴砂機市場價值為 6.263 億美元,預計到 2035 年將以 4.1% 的複合年成長率成長至 9.317 億美元。

市場成長的驅動力在於對大型基礎設施建設(包括新建和改造項目)日益成長的需求。噴砂機在混凝土、鋼材和管道的塗裝或噴漆前進行預處理和清潔至關重要,因此在建築和工業領域不可或缺。發展中國家大力投資城市化和工業化,為設備供應商創造了巨大的機會。此外,對維護、翻新和防腐處理的需求不斷成長,也推動了對高效噴砂解決方案的需求。自動化和機器人系統因其能夠提高精度、提升生產效率並確保工人安全而日益普及。整合物聯網和智慧監控系統的機器能夠實現即時效能追蹤和預測性維護,從而提高營運效率並降低長期成本。這些創新正在重塑各行業進行表面處理的方式,將耐用性與技術進步完美融合。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 6.263億美元 |

| 預測值 | 9.317億美元 |

| 複合年成長率 | 4.1% |

2025年,攜帶式噴砂機市場規模達到4.02億美元,預計2026年至2035年將以3.7%的複合年成長率成長。攜帶式噴砂機具有更高的移動性,操作人員可以有效率地在多個作業現場移動和使用設備。這種彈性在作業地點頻繁變更的產業中尤其重要,並能確保作業不間斷地進行。

2025年,自動噴砂機市佔率為42.9%,預計2026年至2035年將以4.3%的複合年成長率成長。這些機器旨在以高速噴射磨料,以清潔、平滑或準備表面,廣泛應用於製造業、建築業和汽車行業,用於除鏽、表面處理和油漆剝離等任務。

預計2025年,北美噴砂機市場規模將達到1.431億美元。先進製造業、航太和汽車業對高精度和高效率的需求是推動市場成長的主要動力。對自動化、安全合規性和環保設計的重視,促使消費者採用配備可程式控制、整合除塵系統和節能技術的噴砂機。此外,永續發展法規也影響消費者的購買決策,推動了環保磨料的應用。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 工業自動化和效率需求

- 基礎建設開發和建設熱潮

- 嚴格的品質和安全標準

- 陷阱與挑戰

- 較高的初始投資和維護成本

- 環境和監管方面的挑戰

- 機會:

- 環保與先進技術的融合

- 新興市場和售後服務

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼 - 84243000)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2022-2035年

- 便攜的

- 文具

第6章:市場估算與預測:依爆破類型分類,2022-2035年

- 乾式噴砂

- 濕式噴砂

第7章:市場估計與預測:依控制系統分類,2022-2035年

- 自動的

- 半自動

- 手動的

第8章:市場估算與預測:依產能分類,2022-2035年

- 不足1000公升

- 1000升至2000公升

- 2000升至3000公升

- 超過 3,000 公升

第9章:市場估算與預測:依最終用途分類,2022-2035年

- 汽車

- 建造

- 海洋

- 石油和天然氣

- 石油化工

- 其他

第10章:市場估價與預測:依配銷通路分類,2022-2035年

- 直銷

- 間接銷售

第11章:市場估計與預測:按地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Abrasive Blasting Service & Supplies Pty Ltd (ABSS)

- Airblast BV

- Burwell Technologies

- Clemco Industries Corp.

- Empire Abrasive Equipment

- Graco Inc.

- Guyson Corporation

- Kramer Industries Inc.

- Laempe Mossner Sinto GmbH

- Midwest Finishing Systems, Inc.

- Norton Sandblasting Equipment

- Sinto Group

- Torbo Engineering Keizers GmbH

- Trinco Trinity Tool Co.

- Wheelabrator Group

The Global Sand Blasting Machine Market was valued at USD 626.3 million in 2025 and is estimated to grow at a CAGR of 4.1% to reach USD 931.7 million by 2035.

Market growth is being driven by the rising demand for large-scale infrastructure development, including new construction and renovation projects. Sand blasting machines are essential for preparing and cleaning concrete, steel, and pipelines before coating or painting, making them indispensable across construction and industrial sectors. Developing nations investing heavily in urbanization and industrialization are creating significant opportunities for equipment suppliers. Additionally, the increasing need for maintenance, refurbishment, and anti-corrosion treatments is pushing demand for efficient blasting solutions. Automation and robotic systems are gaining popularity due to their ability to enhance precision, boost productivity, and ensure worker safety. Machines integrated with IoT and smart monitoring systems allow real-time performance tracking and predictive maintenance, increasing operational efficiency and lowering long-term costs. These innovations are reshaping the way industries approach surface preparation, blending durability with technological advancement.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $626.3 Million |

| Forecast Value | $931.7 Million |

| CAGR | 4.1% |

The portable segment accounted for USD 402 million in 2025 and is expected to grow at a CAGR of 3.7% from 2026 to 2035. Portable sand blasting machines offer enhanced mobility, allowing operators to move and utilize the equipment across multiple job sites efficiently. This flexibility is particularly useful in industries where work locations frequently change, ensuring uninterrupted operations.

The automatic sand blasting machines segment held a 42.9% share in 2025 and is projected to grow at a CAGR of 4.3% from 2026 to 2035. These machines are designed to propel abrasive materials at high velocity to clean, smooth, or prepare surfaces and are widely used in manufacturing, construction, and automotive sectors for tasks such as rust removal, surface finishing, and paint stripping.

North America Sand Blasting Machine Market accounted for USD 143.1 million in 2025. The market is propelled by advanced manufacturing, aerospace, and automotive industries that demand high precision and efficiency. Emphasis on automation, safety compliance, and eco-friendly designs is encouraging the adoption of machines with programmable controls, integrated dust collection, and energy-efficient technologies. Sustainability regulations further shape purchasing decisions, promoting environmentally responsible abrasive materials.

Key players in the Global Sand Blasting Machine Market include Abrasive Blasting Service & Supplies Pty Ltd (ABSS), Airblast B.V., Burwell Technologies, Clemco Industries Corp., Empire Abrasive Equipment, Graco Inc., Guyson Corporation, Kramer Industries Inc., Laempe Mossner Sinto GmbH, Midwest Finishing Systems, Inc., Norton Sandblasting Equipment, Sinto Group, Torbo Engineering Keizers GmbH, Trinco Trinity Tool Co., and Wheelabrator Group. Companies in the Global Sand Blasting Machine Market are strengthening their presence through a combination of innovation and strategic expansion. They are investing in automated and robotic systems to meet growing demands for precision and safety. Partnerships with construction and industrial contractors help expand market reach, while enhanced after-sales support and maintenance services improve customer loyalty. Regional expansion in emerging markets with rising infrastructure projects ensures new growth opportunities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Blasting type

- 2.2.4 Control systems

- 2.2.5 Capacity

- 2.2.6 End use

- 2.2.7 Distribution channels

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial automation and efficiency needs

- 3.2.1.2 Infrastructure development and construction boom

- 3.2.1.3 Stringent quality and safety standards

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Environmental and regulatory challenges

- 3.2.3 Opportunities:

- 3.2.3.1 Eco-friendly and advanced technology integration

- 3.2.3.2 Emerging markets and after-sales services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 84243000)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Portable

- 5.3 Stationary

Chapter 6 Market Estimates & Forecast, By Blasting Type, 2022 - 2035, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Dry blasting

- 6.3 Wet blasting

Chapter 7 Market Estimates & Forecast, By Control Systems, 2022 - 2035, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates & Forecast, By Capacity, 2022 - 2035, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Less than 1,000 L

- 8.3 1,000L to 2,000L

- 8.4 2,000L to 3,000L

- 8.5 Above 3,000 L

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Construction

- 9.4 Marine

- 9.5 Oil & gas

- 9.6 Petrochemicals

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Abrasive Blasting Service & Supplies Pty Ltd (ABSS)

- 12.2 Airblast B.V.

- 12.3 Burwell Technologies

- 12.4 Clemco Industries Corp.

- 12.5 Empire Abrasive Equipment

- 12.6 Graco Inc.

- 12.7 Guyson Corporation

- 12.8 Kramer Industries Inc.

- 12.9 Laempe Mossner Sinto GmbH

- 12.10 Midwest Finishing Systems, Inc.

- 12.11 Norton Sandblasting Equipment

- 12.12 Sinto Group

- 12.13 Torbo Engineering Keizers GmbH

- 12.14 Trinco Trinity Tool Co.

- 12.15 Wheelabrator Group