|

市場調查報告書

商品編碼

1892772

紫外線消毒系統市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)UV Disinfection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

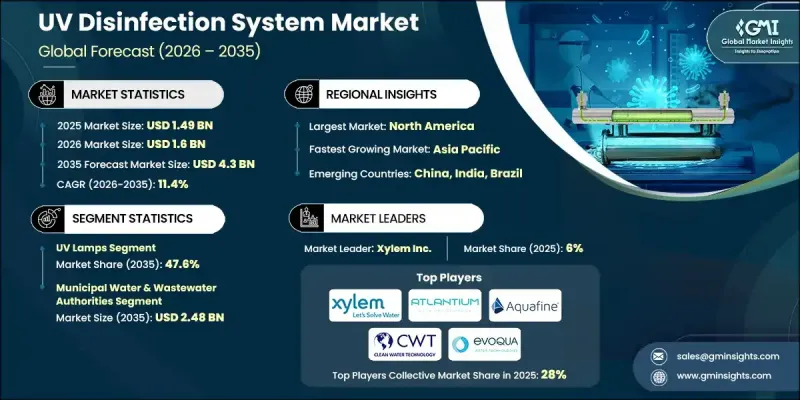

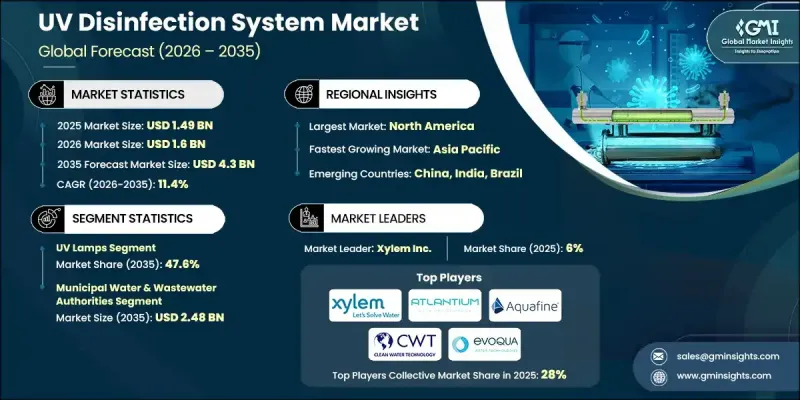

2025 年全球紫外線消毒系統市值為 14.9 億美元,預計到 2035 年將以 11.4% 的複合年成長率成長至 43 億美元。

對水質日益嚴格的監管壓力正在推動這一領域的擴張,尤其是在水和廢水處理領域。世界各國政府和監管機構正在實施更嚴格的標準,以確保更安全的飲用水和更清潔的廢水排放,從而鼓勵採用高效的消毒技術。紫外線消毒系統因其無需使用化學物質即可去活化多種病原體的能力而日益受到青睞。例如,美國環保署的《地表水處理規則》、歐盟的《飲用水指令》以及加拿大、澳洲和日本等國的類似法規,都要求飲用水和處理後的廢水中病原體去除率更高。紫外線系統能夠有效殺死細菌、病毒和原生動物,並滿足這些監管要求。全球日益嚴格的水質管理趨勢,以及傳統氯化消毒方式的轉變,為紫外線消毒解決方案在市政和工業應用領域創造了巨大的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 14.9億美元 |

| 預測值 | 43億美元 |

| 複合年成長率 | 11.4% |

到 2035 年,紫外線燈市場將以 11.8% 的複合年成長率成長。紫外線燈的強勁普及得益於其作為重要替換組件的作用,以及 UV-C LED 技術的日益融合,這提高了系統性能並拓寬了應用範圍。

市政供水和污水處理部門佔據 54% 的市場佔有率,預計到 2025 年將創造 8.095 億美元的收入。該部門引領市場,因為嚴格的法規推動了化學系統的替代,以及需要對耐氯微生物進行大規模處理。

美國紫外線消毒系統市場佔 84.5% 的市場佔有率,2025 年市場規模達到 4.626 億美元,預計到 2035 年將以 12.3% 的複合年成長率成長。市場擴張得益於系統升級的持續投資、高昂的勞動力成本促使自動化紫外線系統的發展,以及先進的 UV-C LED 技術在商業和市政應用中被廣泛用於水和空氣消毒。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 政府對水質製定了嚴格的法規。

- 無化學消毒的需求日益成長

- 水/污水基礎設施投資不斷成長

- 產業陷阱與挑戰

- 高額初始資本投入(CapEx)

- UV-C LED效率的技術局限性

- 機會

- 紫外線在空氣和表面消毒的應用

- 無汞UV-C LED技術的進步

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依組件分類,2022-2035年

- 紫外線燈

- 鎮流器/驅動器

- 石英套管

- 控制系統

- 其他

第6章:市場估算與預測:依流量分類,2022-2035年

- 小型(1000立方米/天)

- 中(1,000 - 50,000 立方米/天)

- 大型(>50,000立方米/天)

第7章:市場估計與預測:依技術分類,2022-2035年

- 低壓紫外線

- 中壓紫外線

- 脈衝紫外線

- 紫外線LED

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 市政供水和污水處理機構

- 工業製造商

- 商業設施(例如,飯店、購物中心)

- 住宅/終端消費

第9章:市場估算與預測:依配銷通路分類

- 直銷

- 間接銷售

第10章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Advanced UV Inc.

- Alfa Laval

- Atlantic Ultraviolet Corporation

- Atlantium Technologies Ltd.

- Aquafine Corporation

- Clean Water Technology

- Evoqua Water Technologies

- ERMA FIRST ESK Engineering SA

- Heraeus Noblelight

- Industrie De Nora SPA

- LIT UV Technologies

- Pentair (Aquionics)

- Severn Trent Services

- Trojan Technologies Group

- Xylem Inc.

The Global UV Disinfection System Market was valued at USD 1.49 billion in 2025 and is estimated to grow at a CAGR of 11.4% to reach USD 4.3 billion by 2035.

Rising regulatory pressure on water quality is driving this expansion, especially in the water and wastewater treatment sectors. Governments and regulatory bodies worldwide are implementing stricter standards to ensure safer drinking water and cleaner wastewater discharge, encouraging the adoption of efficient disinfection technologies. UV disinfection systems are increasingly preferred for their ability to inactivate a wide range of pathogens without using chemicals. Regulations such as the EPA's Surface Water Treatment Rule in the US, European Drinking Water Directives, and similar mandates in countries like Canada, Australia, and Japan require higher pathogen reduction in both drinking water and treated wastewater. UV systems effectively eliminate bacteria, viruses, and protozoa, meeting these regulatory demands. The global trend toward stricter water quality management, alongside the shift from traditional chlorination, is creating significant opportunities for UV disinfection solutions in both municipal and industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.49 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 11.4% |

The UV lamps segment will grow at a CAGR of 11.8% through 2035. Their strong adoption is driven by their role as essential replacement components and the rising integration of UV-C LED technology, which improves system performance and broadens applicability.

The municipal water and wastewater authorities segment held a 54% share, generating USD 809.5 million in 2025. This segment leads the market due to stringent regulations driving the replacement of chemical-based systems and the need for large-scale treatment against chlorine-resistant microorganisms.

United States UV Disinfection System Market held 84.5% share, generating USD 462.6 million in 2025 and is expected to grow at a CAGR of 12.3% through 2035. Market expansion is supported by continuous investment in system upgrades, high labor costs favoring automated UV systems, and widespread adoption of advanced UV-C LED technologies for both water and air disinfection in commercial and municipal applications.

Major players in the Global UV Disinfection System Market include Pentair (Aquionics), Atlantic Ultraviolet Corporation, Heraeus Noblelight, Industrie De Nora SPA, LIT UV Technologies, Severn Trent Services, Evoqua Water Technologies, Advanced UV Inc., Alfa Laval, Aquafine Corporation, ERMA FIRST ESK Engineering SA, Atlantium Technologies Ltd., Clean Water Technology, and Trojan Technologies Group. Companies in the Global UV Disinfection System Market are strengthening their foothold by investing in innovative UV-C LED technology to enhance efficiency and extend lifespan. They are expanding service networks and offering turnkey solutions to improve client adoption and reliability. Strategic partnerships with municipalities and industrial clients help ensure long-term contracts and recurring revenue streams. Additionally, firms are focusing on research and development to introduce energy-efficient, low-maintenance systems that meet evolving regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Flow Rate

- 2.2.4 Technology

- 2.2.5 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent Government Regulations on Water Quality

- 3.2.1.2 Growing Demand for Chemical-Free Disinfection

- 3.2.1.3 Rising Investments in Water/Wastewater Infrastructure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Capital Investment (CapEx)

- 3.2.2.2 Technical Limitations in UV-C LED Efficiency

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of UV in Air & Surface Disinfection

- 3.2.3.2 Advancements in Mercury-Free UV-C LED Technology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Components, 2022 - 2035, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 UV lamps

- 5.3 Ballasts/drivers

- 5.4 Quartz sleeves

- 5.5 Control systems

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Flow Rate, 2022 - 2035, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Small (1,000 m3/day)

- 6.3 Medium (1,000 - 50,000 m3/day)

- 6.4 Large (>50,000 m3/day)

Chapter 7 Market Estimates and Forecast, By Technology, 2022 - 2035, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Low-pressure UV

- 7.3 Medium pressure UV

- 7.4 Pulsed UV

- 7.5 UV LED

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Municipal water & wastewater authorities

- 8.3 Industrial manufacturers

- 8.4 Commercial facilities (e.g., Hotels, Malls)

- 8.5 Residential/point-of-use

Chapter 9 Market Estimates & Forecast, By Distribution Channel, (USD Million) (Thousand units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Advanced UV Inc.

- 11.2 Alfa Laval

- 11.3 Atlantic Ultraviolet Corporation

- 11.4 Atlantium Technologies Ltd.

- 11.5 Aquafine Corporation

- 11.6 Clean Water Technology

- 11.7 Evoqua Water Technologies

- 11.8 ERMA FIRST ESK Engineering SA

- 11.9 Heraeus Noblelight

- 11.10 Industrie De Nora SPA

- 11.11 LIT UV Technologies

- 11.12 Pentair (Aquionics)

- 11.13 Severn Trent Services

- 11.14 Trojan Technologies Group

- 11.15 Xylem Inc.