|

市場調查報告書

商品編碼

1892770

心臟心律不整監測設備市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Cardiac Arrhythmia Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

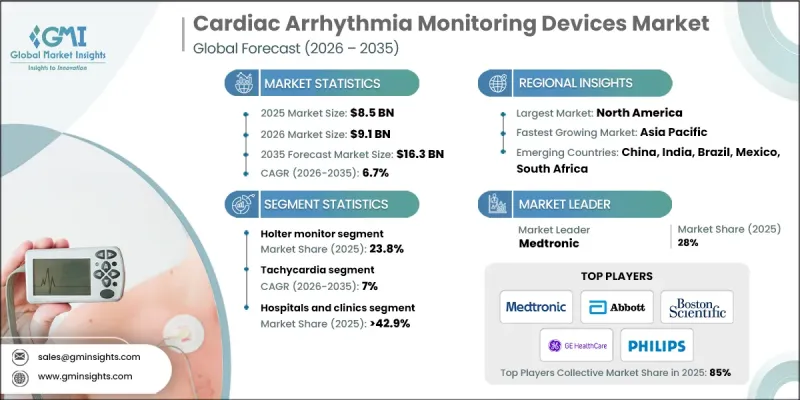

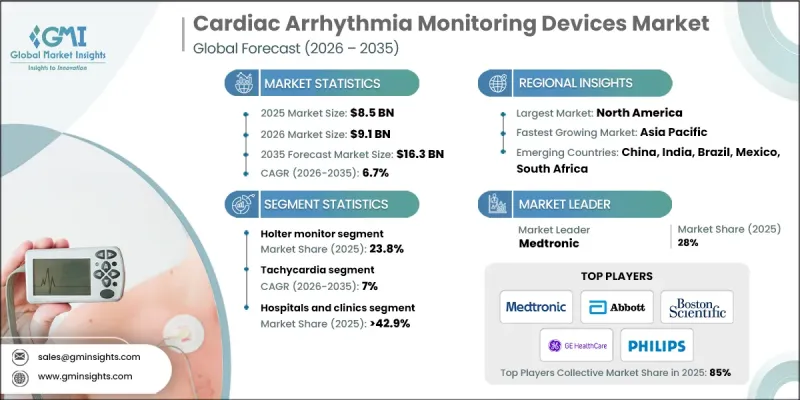

2025 年全球心臟心律不整監測設備市場價值為 85 億美元,預計到 2035 年將以 6.7% 的複合年成長率成長至 163 億美元。

市場成長的驅動力來自心血管疾病盛行率的上升以及對早期檢測和持續心律監測日益成長的重視。隨著人口老化和慢性心臟病負擔的加重,這些設備已成為改善患者預後和預防住院治療的重要工具。心律不整監測解決方案透過實現即時監測、及時介入和個人化治療策略,正在重塑心臟護理。與行動應用程式、雲端平台和遠距醫療系統的整合,使臨床醫生能夠更有效地管理慢性疾病。這些設備對於心律不整高風險患者尤其重要,它們能夠提供準確的診斷並輔助治療決策,最終降低與心臟疾病相關的死亡率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 85億美元 |

| 預測值 | 163億美元 |

| 複合年成長率 | 6.7% |

預計2025年,動態心電圖監測儀市佔率將達到23.8%。動態心電圖監測儀長期以來一直用於在日常活動中持續監測心電圖,幫助臨床醫生發現標準心電圖檢查可能無法檢測到的心律不整。無線連接、緊湊型設計和基於雲端的資料共享等創新技術提高了患者的便利性和可及性,推動了該細分市場的成長。

預計2025年至2035年間,心動過速監測設備市場將以7%的複合年成長率成長。該市場涵蓋房性心動過速和室性心動過速監測設備。先進疾病監測解決方案的日益普及推動了市場需求,尤其是在老年人群和存在生活方式相關風險因素的人群中,房顫和室性心動過速的病例不斷增加。持續監測對於預防中風或心臟驟停等併發症至關重要。

預計2025年,美國心臟心律不整監測設備市場規模將達30億美元。美國仍然是全球最先進、最成熟的市場之一,這得益於其強大的醫療基礎設施、廣泛的保險覆蓋以及對心血管疾病管理的重視。美國在數位化醫療應用方面的領先地位,包括遠距醫療、遠距患者監測和整合式醫療模式,加速了心律不整監測設備在臨床和居家護理環境中的應用。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 全球心血管疾病盛行率不斷上升,心臟健康支出也不斷增加。

- 技術進步和創新心臟節律監測設備的引入

- 行動和遙測式心臟監視器的應用日益普及

- 老年人口基數不斷擴大,加上肥胖症盛行率日益上升。

- 產業陷阱與挑戰

- 缺乏熟練專業人員

- 植入式和先進監測設備成本高昂

- 市場機遇

- 將心臟監測設備與數位健康生態系統整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 專利分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依設備類型分類,2021-2034年

- 動態心電圖監測

- 事件記錄器

- 移動心臟遙測

- 植入式心臟監測器

- 心電圖(ECG)監視器

- 其他設備

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 心跳過速

- 房性心搏過速

- 室性心搏過速

- 心搏過緩

- 早搏

- 其他應用

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 醫院和診所

- 診斷中心

- 門診手術中心

- 家庭護理機構

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- AliveCor

- Applied Cardiac Systems

- Baxter International

- Biotronik

- Biotricity

- Boston Scientific

- FUKUDA DENSHI

- GE Healthcare

- iRhythm Technologies

- Koninklijke Philips

- Medtronic

- Mindray

- Nihon Kohden

- Spacelabs Healthcare

The Global Cardiac Arrhythmia Monitoring Devices Market was valued at USD 8.5 billion in 2025 and is estimated to grow at a CAGR of 6.7% to reach USD 16.3 billion by 2035.

The market is driven by the rising prevalence of cardiovascular disorders and a growing emphasis on early detection and continuous heart rhythm monitoring. With aging populations and the increasing burden of chronic cardiac conditions, these devices have become essential tools for improving patient outcomes and preventing hospitalizations. Cardiac arrhythmia monitoring solutions are reshaping cardiac care by enabling real-time monitoring, timely interventions, and personalized treatment strategies. Integration with mobile apps, cloud platforms, and telehealth systems allows clinicians to manage chronic conditions more effectively. These devices are especially important for patients at higher risk of arrhythmias, providing accurate diagnosis and aiding in treatment decisions, ultimately reducing mortality rates associated with cardiac disorders.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.5 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 6.7% |

The Holter monitor segment held a 23.8% share in 2025. Holter monitors have long been used for continuous ECG tracking during daily activities, helping clinicians detect arrhythmias that might not appear in standard ECG tests. Innovations such as wireless connectivity, compact designs, and cloud-based data sharing have improved patient convenience and accessibility, driving growth in this segment.

The tachycardia segment is expected to grow at a CAGR of 7% during 2025-2035. This segment includes atrial tachycardia and ventricular tachycardia monitoring devices. Rising adoption of advanced disease monitoring solutions is fueling demand, particularly due to increasing cases of atrial fibrillation and ventricular tachycardia among elderly populations and individuals with lifestyle-related risk factors. Continuous monitoring is critical for preventing complications such as stroke or sudden cardiac arrest.

U.S. Cardiac Arrhythmia Monitoring Devices Market was valued at USD 3 billion in 2025. The country remains one of the most advanced and mature markets, driven by strong healthcare infrastructure, extensive insurance coverage, and a focus on cardiovascular disease management. Leadership in digital health adoption, including telehealth, remote patient monitoring, and integrated care models, has accelerated the use of arrhythmia monitoring devices in clinical and home-care settings.

Key players in the Global Cardiac Arrhythmia Monitoring Devices Market include AliveCor, Biotricity, FUKUDA DENSHI, Boston Scientific, Medtronic, Applied Cardiac Systems, Nihon Kohden, Spacelabs Healthcare, Abbott Laboratories, GE Healthcare, Biotronik, Koninklijke Philips, Baxter International, iRhythm Technologies, and Mindray. Companies are strengthening their Cardiac Arrhythmia Monitoring Devices Market presence by investing in advanced technology integration, such as wireless connectivity, AI-assisted analytics, and cloud-based monitoring solutions. Strategic collaborations with healthcare providers and telehealth platforms expand market reach and ensure device adoption in both hospital and home settings. Continuous R&D for compact, user-friendly, and highly accurate devices enhances competitiveness. Firms are also focusing on regulatory compliance and certification to facilitate global market entry, while digital marketing and patient education campaigns help drive awareness and adoption of arrhythmia monitoring solutions worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Device trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of cardiovascular diseases and expenditure on cardiac health globally

- 3.2.1.2 Technological advancements and introduction of innovative devices for cardiac rhythm monitoring

- 3.2.1.3 Increasing adoption of mobile and telemetry cardiac monitors

- 3.2.1.4 Expanding geriatric population base coupled with growing prevalence of obesity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 High cost of implantable and advanced monitoring devices

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of cardiac monitoring devices with digital health ecosystems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Holter monitor

- 5.3 Event recorder

- 5.4 Mobile cardiac telemetry

- 5.5 Implantable cardiac monitor

- 5.6 Electrocardiogram (ECG) monitor

- 5.7 Other devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tachycardia

- 6.2.1 Atrial tachycardia

- 6.2.2 Ventricular tachycardia

- 6.3 Bradycardia

- 6.4 Premature contraction

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Diagnostic centers

- 7.4 Ambulatory surgical centers

- 7.5 Homecare settings

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AliveCor

- 9.3 Applied Cardiac Systems

- 9.4 Baxter International

- 9.5 Biotronik

- 9.6 Biotricity

- 9.7 Boston Scientific

- 9.8 FUKUDA DENSHI

- 9.9 GE Healthcare

- 9.10 iRhythm Technologies

- 9.11 Koninklijke Philips

- 9.12 Medtronic

- 9.13 Mindray

- 9.14 Nihon Kohden

- 9.15 Spacelabs Healthcare