|

市場調查報告書

商品編碼

1892767

基於感測器的礦業分選機市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Sensor Based Sorting Machines for Mining Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

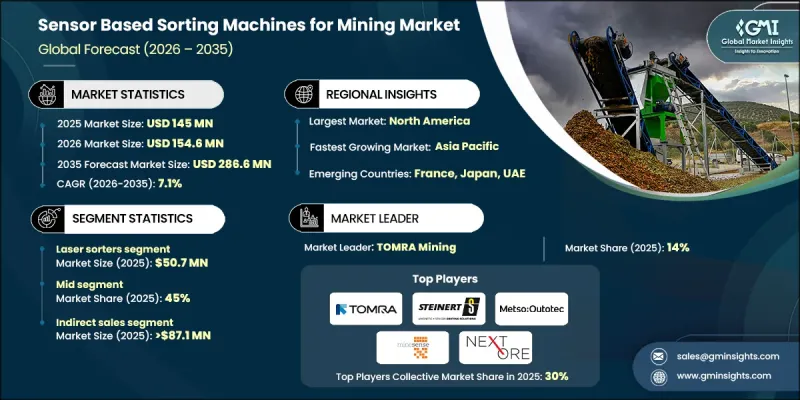

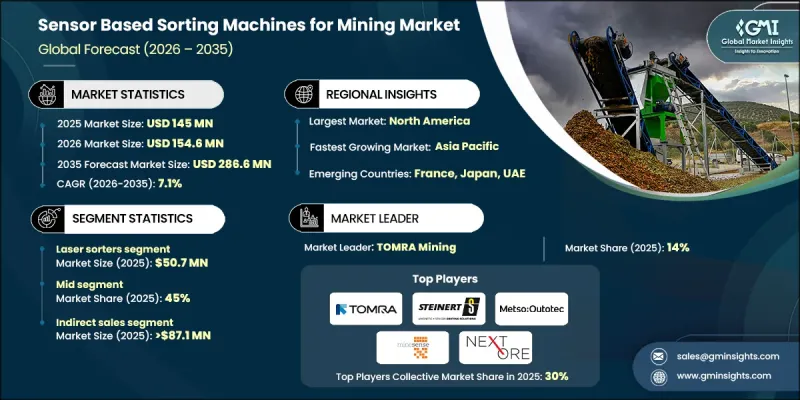

2025 年全球礦業用感測器分類機市場價值為 1.45 億美元,預計到 2035 年將以 7.1% 的複合年成長率成長至 2.866 億美元。

市場成長的驅動力來自全球對基本金屬、貴金屬和工業礦物日益成長的需求,而基礎設施擴張、城市發展加速以及持續的能源轉型則為其提供了支持。這些結構性轉變增加了對銅、鎳等材料的需求,進而推高了整體採礦量。隨著生產規模的擴大,礦業公司面臨提高效率和控制廢料所產生的壓力。基於感測器的分選技術能夠實現早期礦石預濃縮,使營運商能夠在下游加工之前分離出有價值的材料。這提高了回收率,並透過降低能源和水的消耗來減少對環境的影響。隨著採礦活動擴大轉向低品位礦床和地理位置偏遠的地區,傳統的選礦方法變得越來越複雜和昂貴。感測器驅動的分選技術能夠實現選擇性加工,最大限度地減少不必要的物料移動,並減輕選礦作業的負荷。這些系統在提高整體生產率的同時,也符合更嚴格的永續發展目標,使基於感測器的分選技術成為現代礦業營運的核心技術,專注於效率、成本控制和環境責任。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 1.45億美元 |

| 預測值 | 2.866億美元 |

| 複合年成長率 | 7.1% |

預計2025年,雷射分選設備市場規模將達5,070萬美元。這些系統採用先進的雷射感測技術,利用礦石顆粒的表面和成分特徵進行評估。透過分析礦物的紋理、反射率和元素組成,雷射分選比基於密度或顏色的分選方法具有更高的選擇性。這種分析能力是透過雷射誘導擊穿光譜法實現的,該方法利用高能量脈衝產生可測量的光譜,從而精確識別礦物特性。

到2025年,中等產能系統市佔率將達到45%。這些設備的處理能力通常在每小時150至350噸之間,介於小型模組化裝置和大型工業裝置之間。它們通常用於初級或二級預濃縮,旨在保持穩定的處理量,同時不影響下游迴路。使用這些設備有助於在研磨前去除廢料,減少試劑消耗,並穩定進料波動。

美國礦業感測器分選機市場佔據75.6%的市場佔有率,預計2025年市場規模將達到1.096億美元。強勁的採礦活動、先進的營運基礎設施以及對生產力最佳化的重視,共同支撐了其市場領先地位。美國礦業營運商已廣泛採用感測器技術,以提高資源利用率並最大限度地減少對環境的影響。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 採礦活動日益增多

- 營運成本節約

- 關鍵礦產的需求

- 產業陷阱與挑戰

- 高昂的前期成本

- 整合複雜度

- 機會

- 自動化與人工智慧整合

- 客製化感測器解決方案

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 透過作業系統

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術分類,2022-2035年

- 雷射分類機

- X光透射

- 基於顏色

- 近紅外線

- LIBS技術

- 其他(X光螢光光譜法、渦流光譜法)

第6章:市場估計與預測:依產能分類,2022-2035年

- 低(低於150噸/小時)

- 中型(150-350噸/小時)

- 高(超過350噸/小時)

第7章:市場估計與預測:依應用領域分類,2022-2035年

- 金屬

- 非金屬

第8章:市場估算與預測:依配銷通路分類,2022-2035年

- 直銷

- 間接銷售

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Binder+Co

- Buhler Group

- Comex

- Eriez Manufacturing

- FLSmidth

- HPY Sorting Technology

- Metso

- MineSense Technologies

- NextOre

- Pellenc ST

- REDWAVE

- Scantech

- Sesotec

- STEINERT

- TOMRA Systems

The Global Sensor Based Sorting Machines for Mining Market was valued at USD 145 million in 2025 and is estimated to grow at a CAGR of 7.1% to reach USD 286.6 million by 2035.

Market growth is driven by rising global demand for base metals, precious metals, and industrial minerals, supported by infrastructure expansion, accelerating urban development, and the ongoing energy transition. These structural shifts are increasing the need for materials such as copper and nickel, which in turn is raising overall mining volumes. As production scales up, mining operators are under pressure to improve efficiency while controlling waste generation. Sensor-based sorting enables early-stage ore pre-concentration, allowing operators to separate valuable material before downstream processing. This improves recovery rates and reduces environmental impact by lowering energy and water consumption. As mining activity increasingly shifts toward lower-grade deposits and geographically remote locations, conventional beneficiation methods are becoming more complex and costly. Sensor-driven sorting technologies allow selective processing that minimizes unnecessary material movement and reduces the load on milling operations. These systems support higher overall productivity while aligning with stricter sustainability targets, positioning sensor-based sorting as a core technology in modern mining operations focused on efficiency, cost control, and environmental responsibility.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $145 Million |

| Forecast Value | $286.6 Million |

| CAGR | 7.1% |

The laser sorter segment generated USD 50.7 million in 2025. These systems rely on advanced laser-based sensing to evaluate ore particles using surface and compositional characteristics. By analyzing mineral texture, reflectivity, and elemental composition, laser sorting delivers higher selectivity than density- or color-based methods. This analytical capability is achieved through laser-induced breakdown spectroscopy, where high-energy pulses create measurable spectra used to identify mineral properties with precision.

The mid-capacity systems segment accounted for a 45% share in 2025. These machines typically process between 150 and 350 tons per hour, placing them between small modular units and full-scale industrial installations. They are commonly deployed for primary or secondary pre-concentration and are designed to maintain consistent throughput without disrupting downstream circuits. Their use supports waste removal before grinding, reduces reagent consumption, and stabilizes feed variability.

US Sensor Based Sorting Machines for Mining Market held 75.6% share and generated USD 109.6 million in 2025. Strong mining activity, advanced operational infrastructure, and a focus on productivity optimization support market leadership. Mining operators in the country have widely adopted sensor-based technologies to improve resource utilization while minimizing environmental impact.

Key companies active in the Global Sensor Based Sorting Machines for Mining Market include TOMRA Systems, Metso, STEINERT, REDWAVE, FLSmidth, Buhler Group, Sesotec, Binder+Co AG, Eriez Manufacturing, NextOre, MineSense Technologies, Scantech, HPY Sorting Technology, Comex, and Pellenc ST. Companies operating in the Sensor Based Sorting Machines for Mining Market are reinforcing their competitive position through continuous technology development, strategic collaborations, and expanded global presence. Manufacturers are investing in advanced sensing capabilities, artificial intelligence integration, and data analytics to improve sorting accuracy and throughput. Partnerships with mining operators enable customized solutions that align with specific ore characteristics and operational requirements. Many players focus on modular system designs that allow flexible deployment and scalability across mine sizes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing mining activities

- 3.2.1.2 Operational cost savings

- 3.2.1.3 Demand for critical minerals

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront costs

- 3.2.2.2 Integration complexity

- 3.2.3 Opportunities

- 3.2.3.1 Automation & AI integration

- 3.2.3.2 Customized sensor solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By operating system

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2022 - 2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Laser sorters

- 5.3 X-Ray transmission

- 5.4 Color based

- 5.5 Near infrared

- 5.6 LIBS technology

- 5.7 Others (XRF, eddy current)

Chapter 6 Market Estimates and Forecast, By Capacity, 2022 - 2035 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Low (less than 150 tons/hr.)

- 6.3 Mid (150-350 tons/hr.)

- 6.4 High (more than 350 tons/hr.)

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Metallic

- 7.3 Nonmetallic

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Binder+Co

- 10.2 Buhler Group

- 10.3 Comex

- 10.4 Eriez Manufacturing

- 10.5 FLSmidth

- 10.6 HPY Sorting Technology

- 10.7 Metso

- 10.8 MineSense Technologies

- 10.9 NextOre

- 10.10 Pellenc ST

- 10.11 REDWAVE

- 10.12 Scantech

- 10.13 Sesotec

- 10.14 STEINERT

- 10.15 TOMRA Systems