|

市場調查報告書

商品編碼

1892762

邊緣運算市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Edge Computing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

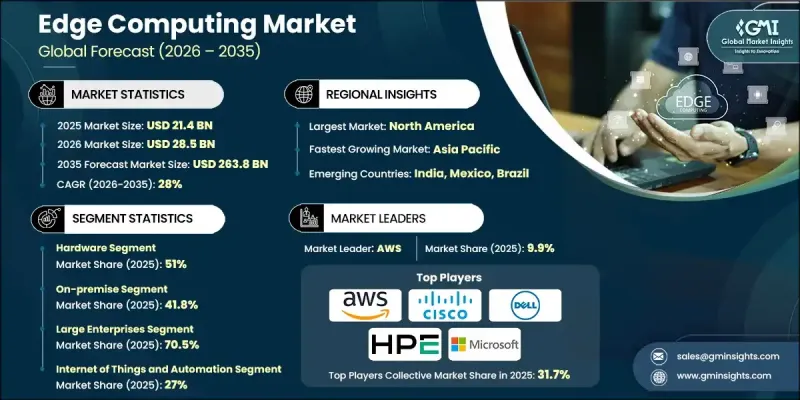

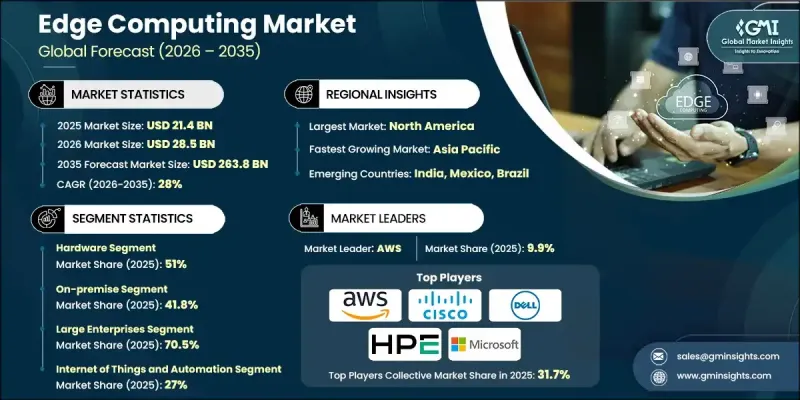

2025 年全球邊緣運算市場價值為 214 億美元,預計到 2035 年將以 28% 的複合年成長率成長至 2,638 億美元。

企業正日益從集中式IT基礎設施轉向分散式處理模式,這使得邊緣運算對於設備級即時資料處理至關重要。產業分析師預測,到2025年,全球將產生近180 ZB的新資料,這將推動對本地化運算的需求,而非僅依賴遠端雲端或資料中心資源。邊緣運算正幫助製造業和工業自動化等行業實現更高的營運視覺性、預測性維護和更少的停機時間。電信業者正在快速擴展多接入邊緣運算(MEC)基礎設施,以滿足日益成長的高速資料和視訊流量需求,而工業企業則持續投資於物聯網設施,以最佳化分散式網路中的生產和營運效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 214億美元 |

| 預測值 | 2638億美元 |

| 複合年成長率 | 28% |

到2025年,硬體領域將佔據51%的市場佔有率,預計到2035年將以26.5%的複合年成長率成長。預計到2030年,全球連網設備數量將達到290億,這將推動終端用戶對處理器、儲存模組和網路硬體的需求。此外,由於邊緣網路對即時分析、編排系統和網路安全工具的需求不斷成長,軟體平台也將快速擴張。

到 2025 年,本地部署部分佔 41.8% 的佔有率,並且從 2026 年到 2035 年將以 24.3% 的複合年成長率成長,因為各行業擴大採用本地化基礎設施,利用工業物聯網、生產線最佳化和即時資產監控。

美國邊緣運算市場佔據87%的佔有率,預計到2025年將創造70億美元的市場規模。美國5G服務的擴展正在推動交通運輸、製造業、醫療保健和公共安全等各行業採用邊緣運算技術。企業正擴大部署預測性維護、自動化和資產監控技術,以提高營運效率並減少停機時間。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 即時資料處理技術的日益普及

- 工業物聯網的擴展

- 多接入邊緣部署的成長

- 基於分析的工作負載增加

- 產業陷阱與挑戰

- 高昂的基礎設施和整合成本

- 各供應商之間的標準化程度有限

- 市場機遇

- 智慧城市專案成長

- 私人企業網路的擴展

- 邊緣人工智慧的進步

- 成長潛力分析

- 監管環境

- 北美洲

- 美國聯邦通訊委員會(FCC)指南

- 美國國家標準與技術研究院 (NIST) 網路安全框架

- 資料隱私和保護法規

- 歐洲

- 歐盟資料保護法規

- 邊緣系統的 GDPR 合規性

- 歐盟人工智慧法案

- 網路安全法

- 歐盟數位服務法規

- 亞太地區

- 中國網路安全法

- 個人資訊保護法(PIPL)

- 資料安全法

- 印度資訊科技法和數位規則

- 日本個人資訊保護法(APPI)

- 拉丁美洲

- 巴西通用資料保護法(LGPD)

- 阿根廷個人資料保護法

- 墨西哥聯邦個人資料保護法

- 中東和非洲

- 阿拉伯聯合大公國資料保護法

- 沙烏地阿拉伯國家網路安全局規章

- 南非個人資訊保護法(POPIA)

- 北美洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 定價分析

- 按地區

- 依產品

- 成本細分分析

- 硬體和邊緣設備成本

- 軟體和平台授權費用

- 營運和維護成本

- 監理合規和安全成本

- 連接性和能源成本

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

- 投資和融資環境

- 邊緣運算領域的創投與私募股權趨勢

- 政府對邊緣部署的撥款和激勵措施

- 按地區和行業分類的投資熱點

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2022-2035年

- 硬體

- 邊緣伺服器

- 網路裝置

- 儲存裝置

- 軟體

- 邊緣運算平台

- 應用軟體

- 服務

- 專業服務

- 託管服務

第6章:市場估算與預測:依部署方式分類,2022-2035年

- 本地部署

- 基於雲端的

- 混合

第7章:市場估算與預測:依組織規模分類,2022-2035年

- 大型企業

- 中小企業

第8章:市場估算與預測:依應用領域分類,2022-2035年

- 工業物聯網與自動化

- 智慧城市

- 視訊監控與分析

- 內容散佈

- 擴增實境(AR)和虛擬實境(VR)

- 自動駕駛和連網汽車

- 遠端監控

- 智慧零售

- 遠距醫療與醫療保健優勢

- 其他

第9章:市場估算與預測:依最終用途分類,2022-2035年

- 金融服務業

- 能源與公用事業

- 電信與資訊技術

- 衛生保健

- 零售與電子商務

- 媒體與娛樂

- 政府和公共部門

- 汽車

- 製造業

- 農業

- 其他

第10章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第11章:公司簡介

- 全球參與者

- AWS

- Cisco

- Dell

- Google Cloud

- HPE

- IBM

- Intel

- Microsoft

- NVIDIA

- Oracle

- 區域玩家

- Atos

- Fujitsu

- Huawei

- NEC

- ZTE

- 新興參與者/顛覆者

- Avassa

- ClearBlade

- Edge Impulse

- Hailo

- Vapor IO

- ZEDEDA

The Global Edge Computing Market was valued at USD 21.4 billion in 2025 and is estimated to grow at a CAGR of 28% to reach USD 263.8 billion by 2035.

Businesses are increasingly shifting from centralized IT infrastructures to distributed processing models, making edge computing essential for real-time data processing at the device level. Industry analysts project that nearly 180 ZB of new data will be generated worldwide by 2025, driving the need for localized computing rather than relying solely on distant cloud or data center resources. Edge computing is enabling industries such as manufacturing and industrial automation to achieve enhanced operational visibility, predictive maintenance, and reduced downtime. Telecommunications providers are rapidly expanding Multi-Access Edge Computing (MEC) infrastructure to support rising demands for high-speed data and video traffic, while industrial organizations continue to invest in IoT-enabled facilities to optimize production and operational efficiency across distributed networks.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $21.4 Billion |

| Forecast Value | $263.8 Billion |

| CAGR | 28% |

In 2025, the hardware segment held a 51% share and is expected to grow at a CAGR of 26.5% through 2035. The rising number of connected devices, projected to reach 29 billion globally by 2030, is driving demand for processing units, storage modules, and network hardware at the point of use. Software platforms are also set to expand rapidly due to the growing need for real-time analytics, orchestration systems, and cybersecurity tools across edge networks.

The on-premises segment accounted for a 41.8% share in 2025 and is growing at a CAGR of 24.3% from 2026 to 2035, as localized infrastructure adoption increases across industries, leveraging IIoT, production line optimization, and real-time asset monitoring.

United States Edge Computing Market held an 87% share, generating USD 7 billion in 2025. The expansion of 5G services in the US is driving edge compute adoption across sectors such as transportation, manufacturing, healthcare, and public safety. Companies are increasingly implementing predictive maintenance, automation, and asset monitoring technologies to improve operational efficiency and reduce downtime.

Key players operating in the Global Edge Computing Market include Intel, IBM, Dell, HPE, Microsoft, Cisco, AWS, Oracle, NVIDIA, and Google Cloud. Companies in the Global Edge Computing Market are strengthening their position by investing heavily in R&D to develop high-performance hardware, secure software platforms, and integrated edge-to-cloud solutions. Strategic partnerships and collaborations with telecom providers and industrial IoT vendors allow them to expand deployment networks and reach diverse verticals. Firms offer managed services, low-latency computing solutions, and scalable-edge infrastructure to attract enterprise clients. Additionally, innovation in AI-driven analytics, real-time monitoring, and orchestration platforms enables companies to differentiate themselves and create long-term customer loyalty while addressing increasing demand for localized computing solutions across multiple industries.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment

- 2.2.4 Organization Size

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising adoption of real time data processing

- 3.2.1.3 Expansion of industrial Internet of Things

- 3.2.1.4 Growth in multi-access edge deployments

- 3.2.1.5 Increase in analytics-based workloads

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure and integration costs

- 3.2.2.2 Limited standardization across vendors

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in smart city projects

- 3.2.3.2 Expansion of private enterprise networks

- 3.2.3.3 Advancement in artificial intelligence at the edge

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 Federal communications commission (FCC) guidelines

- 3.4.1.2 National institute of standards and technology (NIST) cybersecurity framework

- 3.4.1.3 Data privacy and protection regulations

- 3.4.2 Europe

- 3.4.2.1 EU data protection regulations

- 3.4.2.2 GDPR compliance for edge systems

- 3.4.2.3 EU AI act

- 3.4.2.4 Cybersecurity act

- 3.4.2.5 EU digital services regulations

- 3.4.3 Asia Pacific

- 3.4.3.1 China cybersecurity law

- 3.4.3.2 Personal information protection law (PIPL)

- 3.4.3.3 Data security law

- 3.4.3.4 India IT act and digital rules

- 3.4.3.5 Japan act on the protection of personal information (APPI)

- 3.4.4 Latin America

- 3.4.4.1 Brazil general data protection law (LGPD)

- 3.4.4.2 Argentina personal data protection act

- 3.4.4.3 Mexico federal law on protection of personal data

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE data protection law

- 3.4.5.2 Saudi national cybersecurity authority regulations

- 3.4.5.3 South Africa protection of personal information act (POPIA)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.9.1 Hardware and edge device costs

- 3.9.2 Software and platform licensing costs

- 3.9.3 Operational and maintenance costs

- 3.9.4 Regulatory compliance and security costs

- 3.9.5 Connectivity and energy costs

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use cases

- 3.13 Best case scenarios

- 3.14 Investment and funding landscape

- 3.14.1 Venture capital and private equity trends in edge computing

- 3.14.2 Government grants and incentives for edge deployments

- 3.14.3 Investment hotspots by region and sector

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 2035 (USD Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Edge Servers

- 5.2.2 Networking Equipment

- 5.2.3 Storage Devices

- 5.3 Software

- 5.3.1 Edge Computing Platform

- 5.3.2 Application Software

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment, 2022 - 2035 (USD Mn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Organization Size, 2022 - 2035 (USD Mn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 Small & Medium Enterprises (SMEs)

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 (USD Mn)

- 8.1 Key trends

- 8.2 Industrial IoT & Automation

- 8.3 Smart Cities

- 8.4 Video Surveillance & Analytics

- 8.5 Content Delivery

- 8.6 Augmented Reality (AR) & Virtual Reality (VR)

- 8.7 Autonomous & Connected Vehicles

- 8.8 Remote Monitoring

- 8.9 Smart Retail

- 8.10 Telemedicine & Healthcare Edge

- 8.11 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 (USD Mn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Energy & Utilities

- 9.4 Telecommunication & IT

- 9.5 Healthcare

- 9.6 Retail & E-commerce

- 9.7 Media & Entertainment

- 9.8 Government & Public Sector

- 9.9 Automotive

- 9.10 Manufacturing

- 9.11 Agriculture

- 9.12 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Netherlands

- 10.3.9 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 AWS

- 11.1.2 Cisco

- 11.1.3 Dell

- 11.1.4 Google Cloud

- 11.1.5 HPE

- 11.1.6 IBM

- 11.1.7 Intel

- 11.1.8 Microsoft

- 11.1.9 NVIDIA

- 11.1.10 Oracle

- 11.2 Regional Players

- 11.2.1 Atos

- 11.2.2 Fujitsu

- 11.2.3 Huawei

- 11.2.4 NEC

- 11.2.5 ZTE

- 11.3 Emerging Players / Disruptors

- 11.3.1 Avassa

- 11.3.2 ClearBlade

- 11.3.3 Edge Impulse

- 11.3.4 Hailo

- 11.3.5 Vapor IO

- 11.3.6 ZEDEDA