|

市場調查報告書

商品編碼

1892756

聚丙烯無規共聚物市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Polypropylene Random Copolymer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

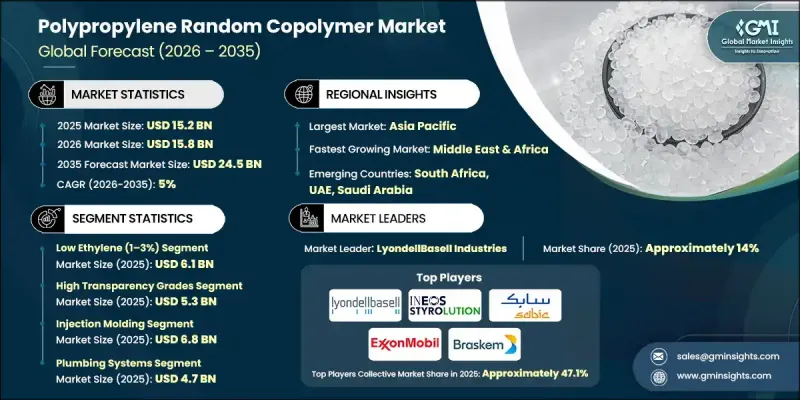

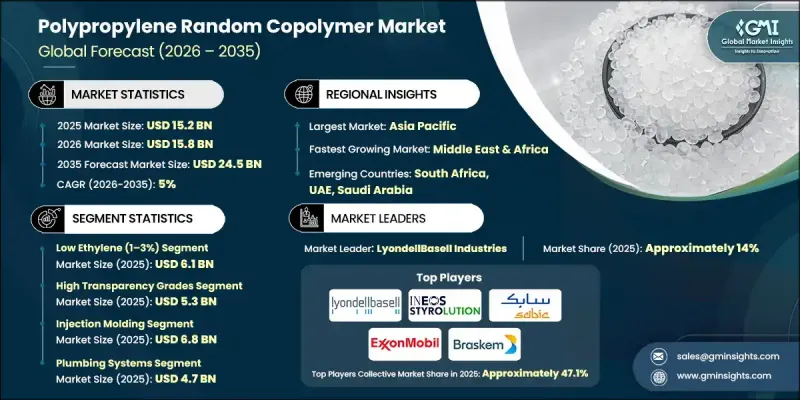

2025年全球聚丙烯無規共聚物市場價值為152億美元,預計2035年將以5%的複合年成長率成長至245億美元。

全球建築活動的強勁成長支撐了市場擴張,這主要得益於加速的城市發展和大型基礎設施項目,尤其是在亞太和拉丁美洲地區。聚丙烯無規共聚物因其耐久性、耐腐蝕性和長使用壽命而備受青睞,使其非常適合現代建築的需求。其低維護成本的特性進一步鞏固了其在長期建築應用中的地位。同時,食品和消費品包裝行業需求的成長也推動了市場發展,因為該材料具有更高的透明度、衝擊強度和熱穩定性。對產品安全性和品質日益重視,促使製造商轉向多功能聚合物解決方案。醫療和製藥行業也為市場成長做出了貢獻,因為聚丙烯無規共聚物因其耐化學性、與滅菌製程的兼容性以及適用於精密應用而備受青睞。這些終端用戶產業共同建構了一個穩定且多元化的需求基礎,持續支撐著市場的穩定成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 152億美元 |

| 預測值 | 245億美元 |

| 複合年成長率 | 5% |

2025年,高透明度等級鋼材市場規模達53億美元,預計2026年至2035年將以5.3%的複合年成長率成長。這些等級鋼材擴大應用於對視覺清晰度和美觀性要求極高的應用領域,而抗衝擊改性鋼材則在需要更高韌性和耐久性的應用中不斷擴大其市場佔有率。

2025 年,管道系統市場規模達到 47 億美元,佔市場佔有率的 30.7%,預計到 2035 年將以 4.8% 的複合年成長率成長。住宅和商業建築對持久耐用、耐腐蝕管道的持續需求,以及醫療組件對化學穩定性和消毒相容性的穩定應用,都推動了管道系統的普及。

2025年北美無規聚丙烯共聚物市場規模預估為27億美元,並在預測期內維持強勁成長。該地區的需求成長得益於持續的基礎設施升級、工業管道領域應用的日益廣泛、醫療和食品級應用領域的成長,以及對可回收和環保材料的日益重視。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依乙烯含量分類,2022-2035年

- 低乙烯含量(1-3%)

- 中等乙烯(4-5%)

- 高乙烯含量(6-7%)

第6章:市場估算與預測:依等級分類,2022-2035年

- 高透明度等級

- 食品包裝

- 醫療器材

- 抗衝擊改質等級

- 水管

- 汽車零件

- 紫外線穩定等級

- 室外管道

- 農業應用

- 其他

第7章:市場估算與預測:依加工形式分類,2022-2035年

- 射出成型

- 擠壓

- 吹塑成型

第8章:市場估算與預測:依應用領域分類,2022-2035年

- 管道系統

- 熱水管道

- 冷水管

- 醫療應用

- 注射器

- 無菌容器

- 食品包裝

- 透明容器

- 瓶蓋和封口

- 工業部件

- 化學品儲罐

- 配件

- 其他

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- LyondellBasell Industries

- INEOS Styrolution

- SABIC

- ExxonMobil Chemical

- Braskem SA

- Formosa Plastics Corporation

- TotalEnergies

- Repsol

- Chevron Phillips Chemical

- Reliance Industries Limited

- Aquatherm GmbH

- Wefatherm GmbH

- Georg Fischer Piping Systems

- Uponor

- Astral Poly Technik Ltd.

The Global Polypropylene Random Copolymer Market was valued at USD 15.2 billion in 2025 and is estimated to grow at a CAGR of 5% to reach USD 24.5 billion by 2035.

Market expansion is supported by strong growth in global construction activity, driven by accelerating urban development and large-scale infrastructure projects, particularly across Asia-Pacific and Latin America. Polypropylene random copolymer continues to gain preference due to its durability, corrosion resistance, and long service life, making it well-suited for modern building requirements. Its low-maintenance profile further strengthens adoption across long-term construction applications. At the same time, rising demand from the food and consumer packaging sector is supporting market momentum, as the material offers improved clarity, impact strength, and thermal stability. Growing emphasis on product safety and quality has encouraged manufacturers to shift toward versatile polymer solutions. The medical and pharmaceutical industries are also contributing to growth, as polypropylene random copolymer is valued for its chemical resistance, compatibility with sterilization processes, and suitability for precision applications. Together, these end-use industries are creating a stable and diversified demand base that continues to support steady market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15.2 Billion |

| Forecast Value | $24.5 Billion |

| CAGR | 5% |

The high-transparency grades segment generated USD 5.3 billion in 2025 and is projected to grow at a CAGR of 5.3% from 2026 to 2035. These grades are increasingly adopted in applications where visual clarity and aesthetic quality are critical, while impact-modified variants are expanding their presence in uses requiring enhanced toughness and durability.

The plumbing systems segment accounted for USD 4.7 billion in 2025, representing a 30.7% market share, and is expected to grow at a CAGR of 4.8% through 2035. Sustained demand for long-lasting, corrosion-resistant piping in residential and commercial construction continues to drive adoption, alongside steady usage in medical components that require chemical stability and sterilization compatibility.

North America Polypropylene Random Copolymer Market was valued at USD 2.7 billion in 2025 and is expected to witness attractive growth during the forecast period. Demand in the region is supported by ongoing infrastructure upgrades, increasing adoption in industrial piping, rising use in medical and food-grade applications, and growing focus on recyclable and environmentally responsible materials.

Key companies operating in the Polypropylene Random Copolymer Market include SABIC, LyondellBasell Industries, Braskem S.A., ExxonMobil Chemical, INEOS Styrolution, and other established global producers. Companies in the Polypropylene Random Copolymer Market are strengthening their market position through capacity expansions, product grade differentiation, and investments in advanced polymer technologies. Many players are focusing on developing high-performance and specialty grades to meet evolving requirements in construction, packaging, and medical applications. Strategic partnerships with downstream manufacturers help secure long-term demand and application-specific innovation. Geographic expansion into high-growth regions supports volume growth, while sustainability initiatives, including recyclable and low-impact polymer solutions, enhance brand value.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Ethylene Content

- 2.2.3 Grade

- 2.2.4 Processing Form

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Ethylene Content, 2022- 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Low Ethylene (1-3%)

- 5.3 Medium Ethylene (4-5%)

- 5.4 High Ethylene (6-7%)

Chapter 6 Market Estimates and Forecast, By Grade, 2022 - 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 High Transparency Grades

- 6.2.1 Food packaging

- 6.2.2 Medical devices

- 6.3 Impact-Modified Grades

- 6.3.1 Plumbing pipes

- 6.3.2 Automotive parts

- 6.4 UV-Stabilized Grades

- 6.4.1 Outdoor piping

- 6.4.2 Agricultural applications

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Processing Form, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Injection Molding

- 7.3 Extrusion

- 7.4 Blow Molding

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Plumbing Systems

- 8.2.1 Hot water pipes

- 8.2.2 Cold water pipes

- 8.3 Medical Applications

- 8.3.1 Syringes

- 8.3.2 Sterile containers

- 8.4 Food Packaging

- 8.4.1 Transparent containers

- 8.4.2 Caps & closures

- 8.5 Industrial Components

- 8.5.1 Chemical tanks

- 8.5.2 Fittings

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 LyondellBasell Industries

- 10.2 INEOS Styrolution

- 10.3 SABIC

- 10.4 ExxonMobil Chemical

- 10.5 Braskem S.A.

- 10.6 Formosa Plastics Corporation

- 10.7 TotalEnergies

- 10.8 Repsol

- 10.9 Chevron Phillips Chemical

- 10.10 Reliance Industries Limited

- 10.11 Aquatherm GmbH

- 10.12 Wefatherm GmbH

- 10.13 Georg Fischer Piping Systems

- 10.14 Uponor

- 10.15 Astral Poly Technik Ltd.