|

市場調查報告書

商品編碼

1892747

腹腔鏡器材市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Laparoscopic Instruments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

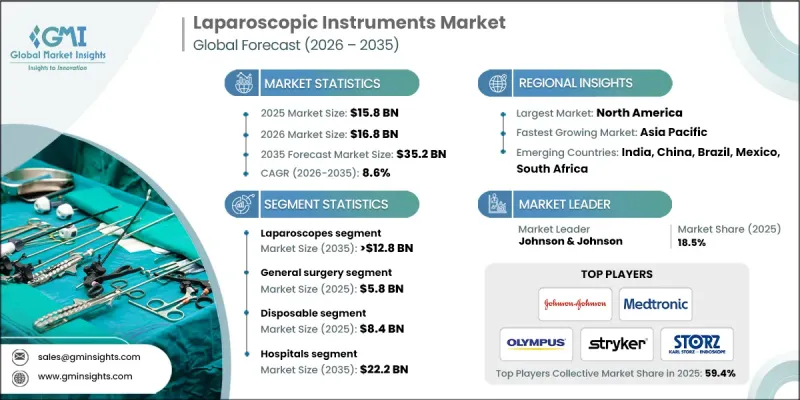

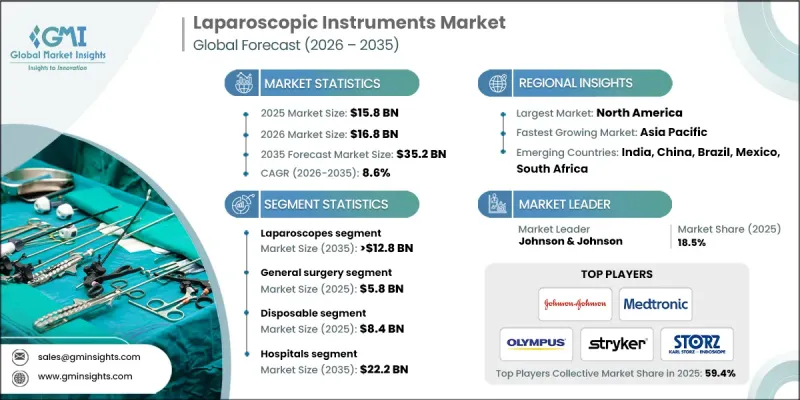

2025 年全球腹腔鏡器械市場價值為 158 億美元,預計到 2035 年將以 8.6% 的複合年成長率成長至 352 億美元。

微創手術的日益普及、需要手術干預的慢性疾病盛行率的上升以及腹腔鏡設備的持續技術進步推動了市場成長。腹腔鏡器械是專為透過腹部小切口進行的手術而設計的專用外科工具,包括套管針、抓鉗、剪刀、分離器和能量型器械。這些器械能夠實現精準的內部操作,增強視野和手術操作的便利性,同時減少病患創傷、縮短恢復時間並降低併發症風險。肥胖症、胃腸道疾病、泌尿系統疾病和大腸直腸疾病病例的增加,推動了依賴腹腔鏡手術的手術量成長。諸如可彎曲器材、高畫質和3D/4K視覺化系統、能量型技術和無線攝影機等創新技術,正在提高手術的精確度和人體工學性能。此外,人工智慧輔助影像和機器人輔助腹腔鏡手術也進一步促進了先進設備在全球手術室的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 158億美元 |

| 預測值 | 352億美元 |

| 複合年成長率 | 8.6% |

2025年,能量器材市場規模達到34億美元,預計2026年至2035年將以8.8%的複合年成長率成長。隨著外科醫師越來越依賴精準的組織封閉和切割技術來提高手術效率,這類器械的需求量也隨之成長。先進的超音波和雙極系統應用日益廣泛,縮短了手術時間,同時提高了病患安全性,這些都為該市場的發展帶來了正面影響。

2025年,一般外科手術市場規模達到58億美元,預計2035年將以8.9%的複合年成長率成長。疝氣修補術、闌尾切除術和膽囊切除術等領域的高手術量持續推動對腹腔鏡器械的持續需求。視覺化技術、人體工學設計和可彎曲器械的進步使腹腔鏡手術更加安全高效,促使醫院投資升級設備。

預計到2025年,美國腹腔鏡器械市場規模將達63億美元。微創手術在北美地區的普及主要得益於其能改善病患預後、縮短住院時間並減少併發症。擁有先進手術室的醫院和門診手術中心正在採用高階腹腔鏡系統,包括能量器械、抓鉗和視覺化工具。對機器人輔助平台、整合手術室和先進成像系統的投資也持續推動該地區的市場成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 胃腸道和婦科疾病發生率不斷上升

- 人們越來越傾向選擇微創手術

- 腹腔鏡設備的技術進步

- 機器人輔助腹腔鏡手術的擴展

- 產業陷阱與挑戰

- 先進腹腔鏡器械價格昂貴

- 設備故障或併發症的風險

- 市場機遇

- 新興市場日益普及

- 對可重複使用和永續儀器的需求日益成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興技術

- 報銷方案

- 消費者洞察

- 未來市場趨勢

- 價值鏈分析

- 波特的分析

- PESTEL 分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2022-2035年

- 腹腔鏡

- 視訊腹腔鏡

- 纖維腹腔鏡

- 能源設備

- 閉合裝置

- 充氣機

- 手持樂器

- 存取裝置

- 吸力系統

- 腹腔鏡配件

第6章:市場估算與預測:依應用領域分類,2022-2035年

- 一般外科

- 婦科手術

- 泌尿外科手術

- 減重手術

- 大腸直腸手術

- 小兒外科手術

- 其他應用

第7章:市場估算與預測:依用途分類,2022-2035年

- 一次性的

- 可重複使用的

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 醫院

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- B. BRAUN

- Boston Scientific

- CONMED

- COOK Medical

- FUJIFILM

- Intuitive Surgical

- Johnson & Johnson

- KARL STORZ

- Medtronic

- Microline Surgical

- OLYMPUS

- Richard Wolf

- Smith & Nephew

- Stryker

- VICTOR MEDICAL

The Global Laparoscopic Instruments Market was valued at USD 15.8 billion in 2025 and is estimated to grow at a CAGR of 8.6% to reach USD 35.2 billion by 2035.

Market growth is fueled by the increasing adoption of minimally invasive surgeries, the rising prevalence of chronic conditions requiring surgical intervention, and ongoing technological advancements in laparoscopic equipment. Laparoscopic instruments are specialized surgical tools designed for procedures conducted through small abdominal incisions, including trocars, graspers, scissors, dissectors, and energy-based devices. These instruments enable precise internal manipulation, enhancing visualization and access while reducing patient trauma, recovery time, and complication risks. Rising cases of obesity, gastrointestinal, urological, and colorectal disorders are driving higher surgical volumes that rely on laparoscopy. Innovations such as articulating instruments, high-definition and 3D/4K visualization systems, energy-based technologies, and wireless cameras are improving surgical accuracy and ergonomics. Additionally, AI-assisted imaging and robotic-assisted laparoscopy are further supporting the adoption of advanced devices in operating rooms worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15.8 Billion |

| Forecast Value | $35.2 Billion |

| CAGR | 8.6% |

The energy devices segment generated USD 3.4 billion in 2025 and is projected to grow at a CAGR of 8.8% from 2026 to 2035. These instruments are in high demand as surgeons increasingly rely on precise tissue sealing and cutting technologies to improve procedural efficiency. The segment benefits from the growing adoption of advanced ultrasonic and bipolar systems that reduce operation times while enhancing patient safety.

The general surgery segment accounted for USD 5.8 billion in 2025 and is expected to grow at a CAGR of 8.9% through 2035. High procedural volumes in areas such as hernia repair, appendectomy, and cholecystectomy continue to drive recurring demand for laparoscopic instruments. Advancements in visualization technologies, ergonomic designs, and articulating tools make laparoscopic procedures safer and more efficient, prompting hospitals to invest in upgraded equipment.

U.S. Laparoscopic Instruments Market was valued at USD 6.3 billion in 2025. The popularity of minimally invasive procedures in North America is driven by improved patient outcomes, shorter hospital stays, and reduced complications. Hospitals and ambulatory surgical centers with advanced operating rooms are adopting high-end laparoscopic systems, including energy devices, graspers, and visualization tools. Investments in robotic-assisted platforms, integrated operating rooms, and advanced imaging systems continue to propel market growth in the region.

Key players in the Laparoscopic Instruments Market include B. BRAUN, Boston Scientific, Medtronic, KARL STORZ, FUJIFILM, Johnson & Johnson, Intuitive Surgical, Smith & Nephew, CONMED, COOK Medical, OLYMPUS, Richard Wolf, Microline Surgical, Stryker, and VICTOR MEDICAL. Companies in the Laparoscopic Instruments Market are employing multiple strategies to strengthen their position and expand their market presence. They are investing heavily in research and development to create next-generation devices, including AI-enabled and robotic-assisted instruments, to improve surgical outcomes. Strategic partnerships, mergers, and acquisitions allow firms to broaden their product portfolios and expand geographically. Companies are also focusing on advanced visualization systems, energy-based technologies, and ergonomic instrument designs to enhance operational efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 Usage trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of gastrointestinal and gynecological disorders

- 3.2.1.2 Growing preference for minimally invasive surgeries

- 3.2.1.3 Technological advancements in laparoscopic devices

- 3.2.1.4 Expansion of robotic-assisted laparoscopy

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced laparoscopic instruments

- 3.2.2.2 Risk of equipment failure or complications

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption in emerging markets

- 3.2.3.2 Increasing demand for reusable and sustainable instruments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Consumer insights

- 3.8 Future market trends

- 3.9 Value chain analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Laparoscopes

- 5.2.1 Video laparoscopes

- 5.2.2 Fiber laparoscopes

- 5.3 Energy devices

- 5.4 Closure devices

- 5.5 Insufflators

- 5.6 Hand instruments

- 5.7 Access devices

- 5.8 Suction systems

- 5.9 Laparoscopic accessories

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Gynecological surgery

- 6.4 Urological surgery

- 6.5 Bariatric surgery

- 6.6 Colorectal surgery

- 6.7 Pediatric surgery

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By Usage, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Disposable

- 7.3 Reusable

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 B. BRAUN

- 10.2 Boston Scientific

- 10.3 CONMED

- 10.4 COOK Medical

- 10.5 FUJIFILM

- 10.6 Intuitive Surgical

- 10.7 Johnson & Johnson

- 10.8 KARL STORZ

- 10.9 Medtronic

- 10.10 Microline Surgical

- 10.11 OLYMPUS

- 10.12 Richard Wolf

- 10.13 Smith & Nephew

- 10.14 Stryker

- 10.15 VICTOR MEDICAL