|

市場調查報告書

商品編碼

1892710

汽車共享平台技術市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Car-Sharing Platform Technologies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

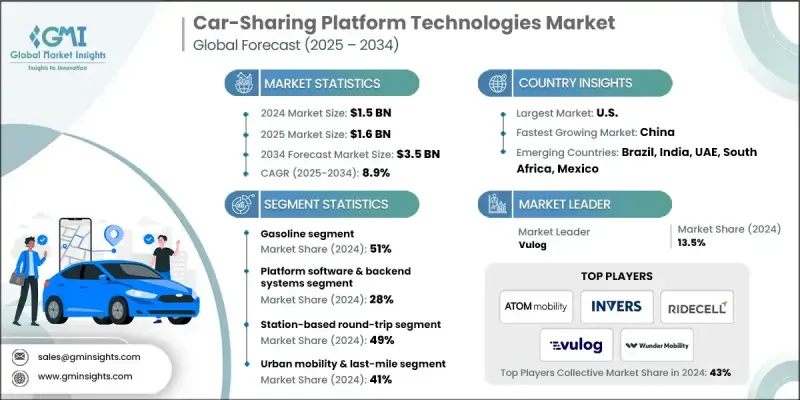

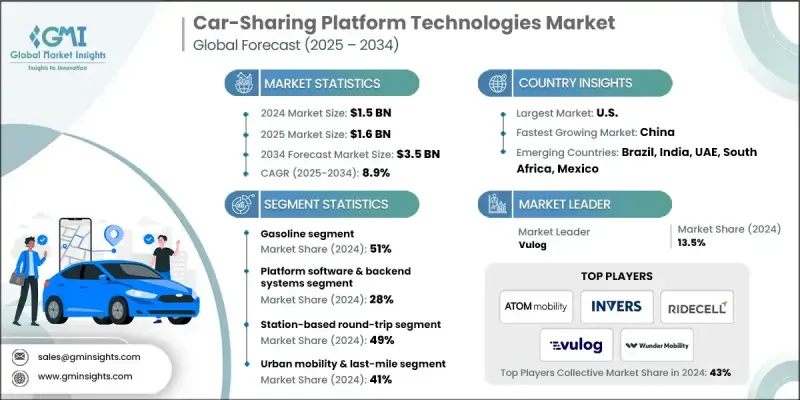

2024 年全球汽車共享平台技術市場價值為 15 億美元,預計到 2034 年將以 8.9% 的複合年成長率成長至 35 億美元。

城市密度不斷上升,以及人們對更便利的交通模式的需求日益成長,推動了共享出行的發展。這種交通模式旨在減少擁擠街道上的私家車數量,同時提供更便利的旅行體驗。隨著城市努力應對交通堵塞、停車需求激增以及出行偏好的轉變,消費者正逐漸轉向由數位生態系統支援的共享車隊。從遠端資訊處理和連網車輛系統到人工智慧驅動的車隊管理,現代平台技術正在改善營運商維護車輛、監控使用情況和降低營運成本的方式。數據驅動的洞察支持車輛重新定位、動態定價和高效調度,最終提高車隊可用性並減少停機時間。隨著共享出行的發展,訂閱和按次付費模式吸引了那些優先考慮靈活性而非所有權的用戶。流暢的行動應用程式、整合支付和社交驗證功能進一步降低了用戶接受共享出行的門檻。年輕用戶更喜歡便捷的按需出行,並且擴大依賴共享出行進行日常出行和非高峰時段出行,這增強了城市和郊區對共享出行的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 35億美元 |

| 複合年成長率 | 8.9% |

2024年,汽油車市佔率達到51%,預計2025年至2034年將以8%的複合年成長率成長。由於汽油動力車隊擁有可靠的續航里程和快速的加油能力,因此需求仍然旺盛,尤其適用於充電網路覆蓋有限的地區。平台技術透過即時車輛監控、燃油效率分析和智慧路線規劃,提升了汽油動力車隊的性能,延長了車隊的使用壽命,同時降低了營運成本。

平台軟體和後端系統細分市場在2024年佔據28%的市場佔有率,預計到2034年將以9.8%的複合年成長率成長。營運商越來越依賴自動化軟體堆疊來處理車隊調度、門禁控制、路線規劃和駕駛員身份驗證。這些系統顯著減少了人工操作,提高了準確性,並支援更高的車隊利用率。即時分析也使得預測性地平衡車輛配置成為可能,並在競爭激烈的市場中保持一致的服務水準。

美國汽車共享平台技術市場佔據86%的市場佔有率,預計2024年將創造5.074億美元的市場規模。人口高度集中、停車位有限以及交通成本不斷上漲,促使美國主要都會區對靈活的出行方式需求日益成長。汽車共享技術提供了一種靈活、經濟高效的選擇,符合永續發展目標以及人們對車輛所有權態度的轉變。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 都市化及朝向共享出行方式的轉變

- 互聯汽車技術的發展

- 電動車共享車隊的普及率不斷提高

- 多模式交通生態系的整合

- 產業陷阱與挑戰

- 高昂的部署和整合成本

- 監理合規的複雜性

- 故意破壞、濫用和資產損壞風險

- 低利用率下獲利能力低

- 市場機遇

- 拓展新興智慧城市市場

- 電動車與脫碳政策

- 企業流動性計劃

- MaaS 和 API 貨幣化

- 成長促進因素

- 成長潛力分析

- 主要市場趨勢和顛覆性因素

- 未來市場趨勢

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 即時車隊管理平台

- 連網車輛遠端資訊處理

- 基於行動裝置的預訂和存取系統

- 整合支付和計費解決方案

- 新興技術

- 人工智慧驅動的車隊最佳化和預測性維護

- 自動駕駛車輛整合

- 基於區塊鏈的智慧合約

- 支援5G的車聯網(V2X)通訊

- 目前技術

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 市場吸引力分析

- 按技術類型分類的市場吸引力

- 商業模式的市場吸引力

- 按地區分類的市場吸引力

- 市場飽和指數

- 採納障礙熱圖

- 成本分析與獲利能力洞察

- 總擁有成本 (TCO) 分析

- 投資報酬率(ROI)分析

- 成本結構細分

- 獲利能力模型與單位經濟效益

- 成本降低策略和最佳實踐

- 產業基準和關鍵績效指標

- 營運績效指標

- 使用者體驗指標

- 財務績效指標

- 技術性能指標

- 戰略框架與決策工具

- 技術選擇框架

- 自建、購買或合作決策框架

- 市場進入策略框架

- 規模化與成長策略框架

- 數位轉型路線圖

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依技術分類,2021-2034年

- 平台軟體和後端系統

- 行動和用戶介面應用程式

- 車載資訊系統和物聯網硬體

- 車輛出入控制系統

- 支付和帳單系統

- 車隊營運與最佳化系統

- 其他

第6章:市場估算與預測:以推進方式分類,2021-2034年

- 汽油

- 柴油引擎

- 純電動車

- 插電式混合動力汽車

- 戊型肝炎病毒

第7章:市場估計與預測:依營運模式分類,2021-2034年

- 車站往返

- 車站單行道

- 居家區域汽車共享

- 自由浮動單向

- 點對點

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 城市交通與最後一公里

- MaaS平台整合

- 企業車隊管理

- 其他

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 汽車共享營運商

- 汽車原廠設備製造商

- 公共交通管理部門

- 技術平台提供商和整合商

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球參與者

- ATOM

- Getaround

- INVERS

- Ridecell

- Smartcar

- Turo

- Unbound

- Vulog

- Wunder

- Zipcar

- 區域玩家

- Car2 Go

- DriveNow

- Modo

- GoGet

- Car Club

- GreenMobility

- Sixt Share

- ShareNow

- BlueIndy

- Communauto

- Convadis

- Fluctuo

- 新興參與者

- BluSmart

- Zuch

- Koenigsegg

- P2 P CarShare

- Ubeeqo

- DriveMyCar

- RidePark

- Karhoo

The Global Car-Sharing Platform Technologies Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 3.5 billion by 2034.

Growth is fueled by rising urban density and the increasing need for transportation models that provide greater convenience without adding more personal vehicles to crowded streets. With cities managing congestion, soaring parking demand, and shifting mobility preferences, consumers are gravitating toward shared fleets supported by digital ecosystems. Modern platform technologies ranging from telematics and connected vehicle systems to AI-powered fleet management are improving how operators maintain vehicles, monitor usage, and reduce operating costs. Data-driven insights support vehicle repositioning, dynamic pricing, and efficient dispatching, ultimately boosting fleet availability and reducing downtime. As shared mobility evolves, subscription-based and pay-per-use options appeal to users who prioritize flexibility over ownership. Seamless mobile applications, integrated payments, and social validation features further reduce adoption barriers. Younger users prefer convenient, on-demand transportation and are increasingly relying on shared mobility for both routine and off-peak travel, strengthening demand across urban and suburban areas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 8.9% |

The gasoline vehicle segment held a 51% share in 2024 and is anticipated to grow at a CAGR of 8% from 2025 to 2034. Gasoline-powered fleets remain in demand due to dependable driving range and fast refueling, making them suitable for regions where charging networks are still limited. Platform technologies improve their performance through real-time vehicle monitoring, fuel-efficiency analytics, and intelligent routing that extends fleet life while lowering operational expenses.

The platform software and backend systems segment held a 28% share in 2024 and is expected to grow at a CAGR of 9.8% through 2034. Operators increasingly rely on automated software stacks that handle fleet dispatch, access control, routing, and driver verification. These systems significantly reduce manual labor, enhance accuracy, and support higher fleet utilization. Real-time analytics also make it possible to balance vehicles predictively and maintain consistent service levels across competitive markets.

U.S Car-Sharing Platform Technologies Market held an 86% share, generating USD 507.4 million in 2024. High population concentration, limited parking, and rising traffic costs are contributing to the demand for flexible transportation alternatives across major US metropolitan areas. Car-sharing technologies offer adaptable, cost-efficient options that align with sustainability goals and changing attitudes toward vehicle ownership.

Major companies in the Global Car-Sharing Platform Technologies Market include ATOM, Convadis, Fluctuo, INVERS, Karhoo, Ridecell, Smartcar, Unbound, Vulog, and Wunder. Companies in the Car-Sharing Platform Technologies Market are reinforcing their market presence by investing heavily in integrated mobility software, enhanced telematics, and scalable backend systems. Many firms focus on expanding real-time analytics capabilities to improve vehicle repositioning, optimize asset performance, and strengthen pricing strategies. Partnerships with automakers, urban mobility planners, and payment providers help broaden platform reach and support seamless service delivery. Providers are also adding modular and customizable software features to accommodate diverse fleet models and city regulations. Continuous upgrades to app interfaces, in-app payments, and user verification tools strengthen customer experience and retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Propulsion

- 2.2.4 Operational model

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & shift toward shared mobility

- 3.2.1.2 Growth in connected vehicle technologies

- 3.2.1.3 Rising adoption of EV-based shared fleets

- 3.2.1.4 Integration of multimodal mobility ecosystems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High deployment & integration costs

- 3.2.2.2 Regulatory compliance complexities

- 3.2.2.3 Vandalism, misuse & asset damage risks

- 3.2.2.4 Low profitability at low utilization

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging smart-city markets

- 3.2.3.2 EV and decarbonization mandates

- 3.2.3.3 Corporate mobility programs

- 3.2.3.4 MaaS and API monetization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current Technologies

- 3.9.1.1 Real-time fleet management platforms

- 3.9.1.2 Connected vehicle telematics

- 3.9.1.3 Mobile-based booking & access systems

- 3.9.1.4 Integrated payment & billing solutions

- 3.9.2 Emerging Technologies

- 3.9.2.1 AI-powered fleet optimization & predictive maintenance

- 3.9.2.2 autonomous vehicle integration

- 3.9.2.3 blockchain-based smart contracts

- 3.9.2.4 5g-enabled vehicle-to-everything (V2X) communication

- 3.9.1 Current Technologies

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Market attractiveness analysis

- 3.13.1 Market attractiveness by technology type

- 3.13.2 Market attractiveness by business model

- 3.13.3 Market attractiveness by region

- 3.13.4 Market saturation index

- 3.13.5 Adoption barriers heatmap

- 3.14 Cost analysis & profitability insights

- 3.14.1 Total cost of ownership (tco) analysis

- 3.14.2 Return on investment (roi) analysis

- 3.14.3 Cost structure breakdown

- 3.14.4 Profitability models & unit economics

- 3.14.5 Cost reduction strategies & best practices

- 3.15 Industry benchmarks & key performance indicators

- 3.15.1 Operational performance metrics

- 3.15.2 User experience metrics

- 3.15.3 Financial performance indicators

- 3.15.4 Technology performance metrics

- 3.16 Strategy frameworks & decision tools

- 3.16.1 Technology selection framework

- 3.16.2 Build vs. Buy vs. Partner decision framework

- 3.16.3 Market entry strategy framework

- 3.16.4 Scaling & growth strategy framework

- 3.16.5 Digital transformation roadmap

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Platform software & backend systems

- 5.3 Mobile & user interface applications

- 5.4 Telematics & IoT hardware

- 5.5 Vehicle access control systems

- 5.6 Payment & billing systems

- 5.7 Fleet operations & optimization systems

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 BEV

- 6.5 PHEV

- 6.6 HEV

Chapter 7 Market Estimates & Forecast, By Operational Model, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Station-based round-trip

- 7.3 Station-based one-way

- 7.4 Home-zone car-sharing

- 7.5 Free-floating one-way

- 7.6 Peer-to-peer

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Urban mobility & last-mile

- 8.3 MaaS platform integration

- 8.4 Corporate fleet management

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Car-sharing operators

- 9.3 Automotive OEMs

- 9.4 Public transport authorities

- 9.5 Technology platform providers & integrators

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 ATOM

- 11.1.2 Getaround

- 11.1.3 INVERS

- 11.1.4 Ridecell

- 11.1.5 Smartcar

- 11.1.6 Turo

- 11.1.7 Unbound

- 11.1.8 Vulog

- 11.1.9 Wunder

- 11.1.10 Zipcar

- 11.2 Regional players

- 11.2.1. Car2 Go

- 11.2.2 DriveNow

- 11.2.3 Modo

- 11.2.4 GoGet

- 11.2.5 Car Club

- 11.2.6 GreenMobility

- 11.2.7 Sixt Share

- 11.2.8 ShareNow

- 11.2.9 BlueIndy

- 11.2.10 Communauto

- 11.2.11 Convadis

- 11.2.12 Fluctuo

- 11.3 Emerging Players

- 11.3.1 BluSmart

- 11.3.2 Zuch

- 11.3.3 Koenigsegg

- 11.3.4. P2 P CarShare

- 11.3.5 Ubeeqo

- 11.3.6 DriveMyCar

- 11.3.7 RidePark

- 11.3.8 Karhoo