|

市場調查報告書

商品編碼

1892708

飛機熱交換器市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Aircraft Heat Exchanger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

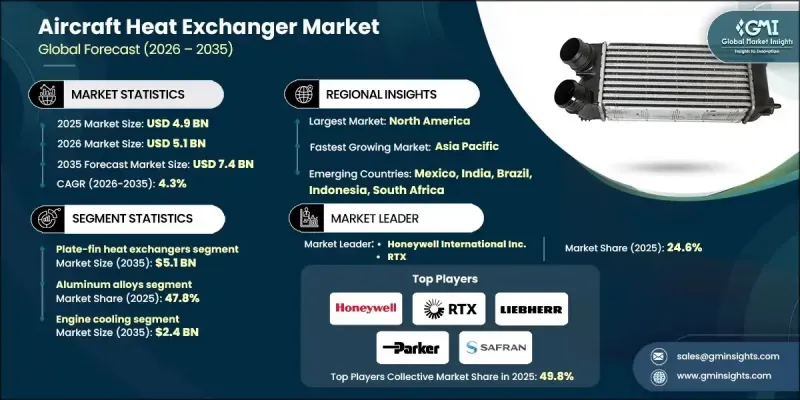

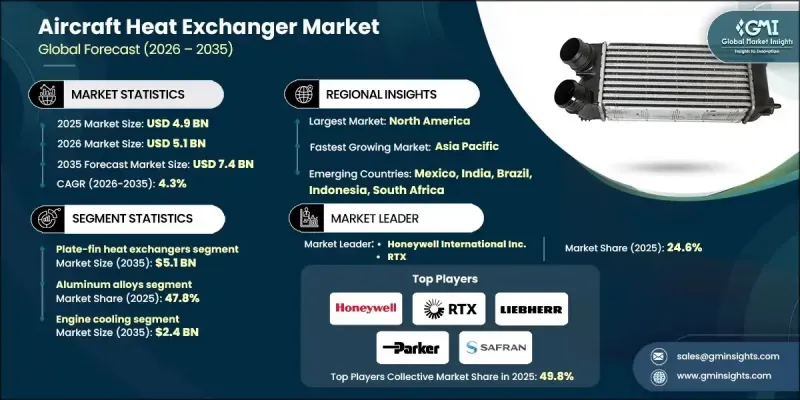

2025 年全球飛機熱交換器市場價值為 49 億美元,預計到 2035 年將以 4.3% 的複合年成長率成長至 74 億美元。

市場成長的驅動力來自不斷成長的航空客運量、對燃油效率日益重視、先進空中交通的興起以及無人機和軍用飛機應用的日益廣泛。不斷成長的客運需求促使航空公司提升飛機的性能、效率和永續性,進而推動了熱交換器的應用。電動和氫電推進系統推動了對輕量化、高性能熱解決方案的需求,這些解決方案能夠處理先進動力系統產生的大量熱量。熱交換器在維持所有飛機系統(尤其是新一代電動和混合動力平台)的最佳運作性能方面發揮著至關重要的作用,滿足了低排放航空和永續飛行計劃的要求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 49億美元 |

| 預測值 | 74億美元 |

| 複合年成長率 | 4.3% |

預計到2035年,板翅式熱交換器市場規模將達51億美元。其結構緊湊、熱效率高,且適用於先進輕型飛機設計,這些優勢加速了其應用普及。市場成長主要得益於與現代引擎、無人機和電動飛機的整合,這些設備需要在狹小空間內實現高效散熱。

到2025年,鋁合金市佔率將達到47.8%。鋁合金製成的熱交換器因其優異的強度重量比、易製造性和成本效益而備受青睞。航空公司擴大在窄體客機、寬體客機和無人機平台上使用這些材料,以減輕重量並提高燃油效率。預計製造商將專注於高強度、導熱性良好的鋁合金,以支援下一代飛機的設計。

預計2025年,美國飛機熱交換器市場規模將達16億美元。該地區的成長主要得益於機隊現代化、商業和支線航空運輸量的擴張,以及混合動力和無人機平台的日益普及。各公司正致力於研發用於下一代飛機的模組化、熱最佳化熱交換器,同時投資支援無人機和支線航空發展的技術。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 航空客運量不斷成長

- 對燃油效率的需求不斷成長

- 先進空中交通和電氣化推進技術的發展

- 模組化和整合式熱管理架構

- 無人機和軍用飛機應用的興起

- 產業陷阱與挑戰

- 製造流程複雜,認證要求高

- 飛機設計中的重量和空間限制

- 市場機遇

- 積層製造技術在複雜幾何形狀熱交換器製造上的應用

- 整合智慧嵌入式感測器進行即時熱監測

- 無人機、中空長航時/高空長航時無人機以及國防平台的發展需要先進的冷卻技術

- 下一代輕量材料的開發

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 新興商業模式

- 合規要求

- 供應鏈韌性

- 地緣政治分析

- 勞動力分析

- 數位轉型

- 併購和策略夥伴關係格局

- 風險評估與管理

- 主要合約授予情況(2022-2025 年)

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 對主要參與者進行競爭基準分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 按地區分類的市場滲透率

- 競爭定位矩陣

- 領導人

- 挑戰者

- 追蹤者

- 小眾玩家

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年主要發展動態

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估算與預測:依熱交換器類型分類,2022-2035年

- 板翅式熱交換器

- 管翅式熱交換器

第6章:市場估算與預測:依材料類型分類,2022-2035年

- 鋁合金

- 不銹鋼

- 鈦

- 銅

- 其他

第7章:市場估價與預測:依冷卻介質分類,2022-2035年

- 空對空

- 空液

- 液對液

- 液氣

第8章:市場估算與預測:依應用領域分類,2022-2035年

- 引擎冷卻

- 艙室暖氣和冷氣 (ECS)

- 航空電子設備冷卻

- 液壓冷卻

- 燃料暖氣和冷氣

- 其他

第9章:市場估算與預測:依飛機類型分類,2022-2035年

- 商用飛機

- 窄體飛機

- 寬體飛機

- 支線噴射機

- 軍用機

- 戰鬥機

- 運輸機

- 公務航空

- 通用航空

- 直升機和旋翼機

第10章:市場估計與預測:依最終用途分類,2022-2035年

- OEM (生產線適配)

- 售後市場(MRO)

第11章:市場估計與預測:按地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- 全球關鍵參與者

- Honeywell International Inc.

- RTX

- Liebherr Group

- Parker Hannifin Corp

- 區域關鍵參與者

- 北美洲

- 3D Systems, Inc

- AMETEK Inc.

- Boyd Corporation

- 歐洲

- Safran SA

- Meggitt PLC

- Triumph Group

- 亞太地區

- JAMCO Corporation

- HS-Nauka

- TAT Technologies Ltd

- 北美洲

- 小眾玩家/顛覆者

- Conflux Technology

- Essex Industries, Inc.

- ETP Thermal Dynamics

- THERMOVAC AEROSPACE

- Wall Colmonoy

The Global Aircraft Heat Exchanger Market was valued at USD 4.9 billion in 2025 and is estimated to grow at a CAGR of 4.3% to reach USD 7.4 billion by 2035.

Market growth is propelled by rising air passenger traffic, increasing focus on fuel efficiency, the emergence of advanced air mobility, and the growing applications of UAVs and military aircraft. Rising passenger demand is creating pressure on airlines to improve aircraft performance, efficiency, and sustainability, which in turn fuels the adoption of heat exchangers. Electric and hydrogen-electric propulsion systems are driving the need for lightweight, high-performance thermal solutions that can manage substantial heat from advanced powertrains. Heat exchangers play a critical role in maintaining optimal operational performance across all aircraft systems, particularly in new-generation electric and hybrid-electric platforms, meeting the expectations of low-emission aviation and sustainable flight initiatives.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.9 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 4.3% |

The plate-fin heat exchangers segment is expected to reach USD 5.1 billion by 2035. Their compact form, high thermal efficiency, and suitability for advanced and lightweight aircraft designs have accelerated adoption. Growth is largely driven by integration with modern engines, UAVs, and electric aircraft, which require efficient heat dissipation within confined spaces.

The aluminum alloys segment held 47.8% share in 2025. Heat exchangers made from aluminum alloys are favored for their superior strength-to-weight ratio, manufacturability, and cost-effectiveness. Airlines increasingly rely on these materials across narrow-body, wide-body, and UAV platforms to reduce weight and enhance fuel efficiency. Manufacturers are expected to focus on high-strength, thermally conductive aluminum grades to support next-generation aircraft designs.

U.S. Aircraft Heat Exchanger Market generated USD 1.6 billion in 2025. Growth in this region is driven by fleet modernization, expanding commercial and regional air traffic, and rising adoption of hybrid-electric and UAV platforms. Companies are concentrating on modular, thermally optimized heat exchangers for next-generation aircraft while investing in technology to support UAVs and regional aviation expansion.

Key players operating in the Global Aircraft Heat Exchanger Market include 3D Systems, Inc., AMETEK Inc., Boyd Corporation, Conflux Technology, Essex Industries, Inc., ETP Thermal Dynamics, Honeywell International Inc., HS-Nauka, JAMCO Corporation, Liebherr Group, and Meggitt PLC. Companies in the Global Aircraft Heat Exchanger Market strengthen their position by focusing on research and development to design high-efficiency, lightweight, and thermally optimized solutions for next-generation aircraft. They are investing in advanced manufacturing techniques such as 3D printing to produce complex geometries with enhanced heat transfer efficiency. Strategic collaborations with aviation OEMs and defense contractors expand market reach and support co-development of electric and hybrid propulsion systems. Firms also emphasize modular product designs for faster integration and cost-effective maintenance, while targeting regional markets with growing air traffic and UAV adoption to secure long-term contracts and boost market presence globally.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Heat exchanger type trends

- 2.2.2 Material type trends

- 2.2.3 Cooling medium trends

- 2.2.4 Application trends

- 2.2.5 Aircraft type trends

- 2.2.6 End use trends

- 2.2.7 Regional trends

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising air passenger traffic

- 3.2.1.2 Rising demand for fuel efficiency

- 3.2.1.3 Growth of advanced air mobility & electrified propulsion

- 3.2.1.4 Modular & integrated thermal management architectures

- 3.2.1.5 Rise of UAVs & military aircraft applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing complexity and certification requirements

- 3.2.2.2 Weight and space constraints in aircraft design

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of additive manufacturing for complex heat exchanger geometries

- 3.2.3.2 Integration of smart and embedded sensors for real-time thermal monitoring

- 3.2.3.3 Expansion in UAV, MALE/HALE, and defense platforms requiring advanced cooling

- 3.2.3.4 Development of next-generation lightweight materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Supply chain resilience

- 3.11 Geopolitical analysis

- 3.12 Workforce analysis

- 3.13 Digital transformation

- 3.14 Mergers, acquisitions, and strategic partnerships landscape

- 3.15 Risk assessment and management

- 3.16 Major contract awards (2022-2025)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Heat Exchanger Type, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 Plate-fin heat exchangers

- 5.3 Tube-fin heat exchangers

Chapter 6 Market Estimates and Forecast, By Material Type, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Aluminum alloys

- 6.3 Stainless steel

- 6.4 Titanium

- 6.5 Copper

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Cooling Medium, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 Air-to-air

- 7.3 Air-to-liquid

- 7.4 Liquid-to-liquid

- 7.5 Liquid-to-air

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Engine cooling

- 8.3 Cabin heating & cooling (ECS)

- 8.4 Avionics cooling

- 8.5 Hydraulic cooling

- 8.6 Fuel heating & cooling

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Aircraft Type, 2022 - 2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 Commercial aircraft

- 9.2.1 Narrow-body aircraft

- 9.2.2 Wide-body aircraft

- 9.2.3 Regional jets

- 9.3 Military aircraft

- 9.3.1 Fighter jets

- 9.3.2 Transport aircraft

- 9.4 Business aviation

- 9.5 General aviation

- 9.6 Helicopters & rotorcraft

Chapter 10 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million & Units)

- 10.1 Key trends

- 10.2 OEM (Line-Fit)

- 10.3 Aftermarket (MRO)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Key Players

- 12.1.1 Honeywell International Inc.

- 12.1.2 RTX

- 12.1.3 Liebherr Group

- 12.1.4 Parker Hannifin Corp

- 12.2 Regional Key Players

- 12.2.1 North America

- 12.2.1.1 3D Systems, Inc

- 12.2.1.2 AMETEK Inc.

- 12.2.1.3 Boyd Corporation

- 12.2.2 Europe

- 12.2.2.1 Safran S.A

- 12.2.2.2 Meggitt PLC

- 12.2.2.3 Triumph Group

- 12.2.3 APAC

- 12.2.3.1 JAMCO Corporation

- 12.2.3.2 HS-Nauka

- 12.2.3.3 TAT Technologies Ltd

- 12.2.1 North America

- 12.3 Niche Players / Disruptors

- 12.3.1 Conflux Technology

- 12.3.2 Essex Industries, Inc.

- 12.3.3 ETP Thermal Dynamics

- 12.3.4 THERMOVAC AEROSPACE

- 12.3.5 Wall Colmonoy