|

市場調查報告書

商品編碼

1892701

無線電動汽車電池監測市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Wireless EV Battery Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

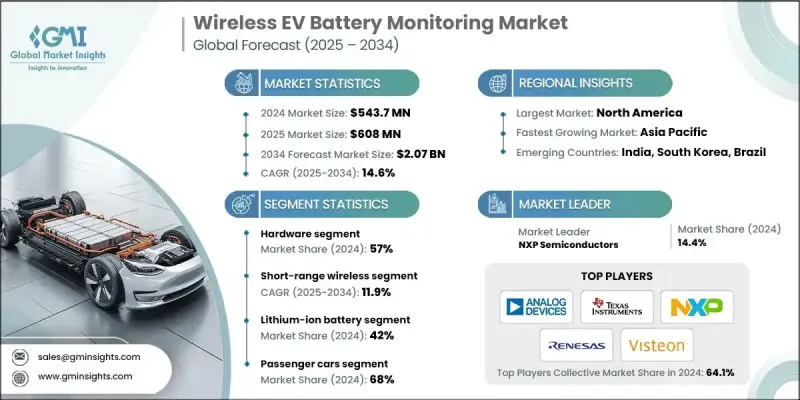

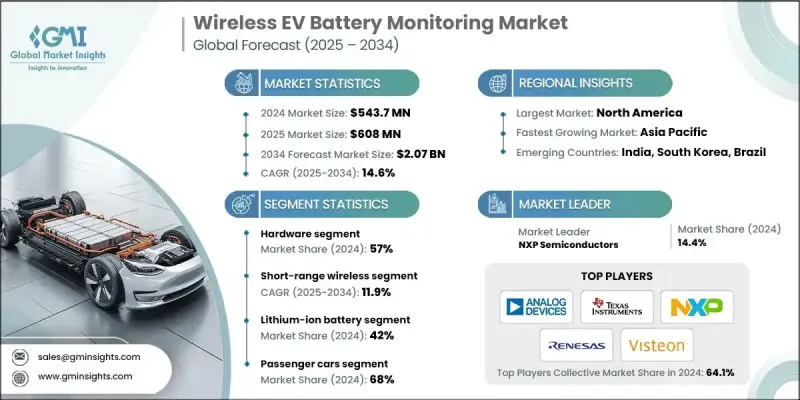

2024 年全球無線電動汽車電池監控市場價值為 5.437 億美元,預計到 2034 年將以 14.6% 的複合年成長率成長至 20.7 億美元。

汽車產業正不斷重新設計電動車平台,以減輕重量、提高能量密度並實現模組化電池配置。無線電池監控無需繁重的佈線,加快了組裝速度,並支援靈活的模組化架構,使其成為下一代電動車平台的首選解決方案。軟體定義車輛需要更深入的資料視覺性、安全的雲端連接和空中升級功能。無線電池管理系統 (BMS) 提供豐富的遙測和預測分析支持,從而實現高級安全建模和高效的能源管理。轉型為資料驅動架構的原始設備製造商 (OEM) 發現,無線監控符合其策略目標。此外,對用於電網、家庭和工業儲能應用的二手電動車電池進行監控也日益重要。無線解決方案降低了整合複雜性,最大限度地降低了成本,並滿足了車隊和個人消費者對適應性儲能監控、智慧充電解決方案和最佳化能源輸送日益成長的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.437億美元 |

| 預測值 | 20.7億美元 |

| 複合年成長率 | 14.6% |

到 2024 年,硬體領域將佔據 57% 的市場。電池電氣化程度的提高和高容量電池組複雜性的增加,推動了對能夠承受惡劣汽車環境的堅固耐用的感測器節點、閘道器模組、天線和處理單元的需求。

預計到2034年,短距離無線通訊市場將以11.9%的複合年成長率成長。藍牙、低功耗藍牙(BLE)和其他低功耗短距離協定對於電池組內部通訊仍然至關重要,它們能夠提供穩定的資料傳輸、低能耗以及與模組化設計的兼容性。這些技術能夠有效應對電磁干擾、電池單元數量增加以及嚴格的安全標準等挑戰。

美國無線電動汽車電池監控市場佔75.8%的市場佔有率,預計2024年市場規模將達到1.426億美元。強而有力的聯邦和州政府措施正在加速電動車的普及,相關計畫為電動車購買和充電基礎設施建設提供激勵措施。降低電池成本和加快充電速度的政策目標進一步推動了對先進監控技術的需求。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 加速全球電動車普及

- 電池安全與監測的監管要求

- 降低成本勢在必行

- 重量和體積最佳化

- 熱失控安全隱患

- 產業陷阱與挑戰

- 高昂的初始實施成本與研發投資

- 缺乏標準化和互通性

- 市場機遇

- 用於更高效熱失控檢測的多模態感測器融合

- 具有能量收集功能的能量自主無線節點

- 人工智慧驅動的預測性維護與預判

- 區塊鏈助力電池安全護照及追溯

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 市場定價策略與經濟學

- 定價模式比較(資本支出與營運支出、訂閱與永久授權)

- 成本加成定價策略與價值定價策略

- 批量折扣和階梯定價結構

- 區域定價差異和在地化因素

- 按客戶細分市場進行的單位經濟效益和利潤率分析

- 投資報酬率 (ROI) 和投資回收期計算

- 捆綁銷售和交叉銷售機會

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 碳足跡評估

- 循環經濟一體化

- 電子垃圾管理要求

- 綠色製造計劃

- 系統架構分析

- 電池監控要求

- 透過化學方法

- 透過申請

- 電池外形尺寸及監控方面的意義

- 電池衰減機制及監測意義

- 熱管理與無線監控整合

- 生產製造與品質管制注意事項

- 電池製造中的無線BMS整合

- 線上測試與調試

- 製造良率和缺陷檢測

- 可擴展性和自動化

- 總擁有成本(TCO)模型

- 前期成本構成

- 製造成本節約

- 營運成本節約

- 生命週期末期價值

- 總擁有成本損益平衡分析

- 互通性和標準化格局

- 通訊協定標準

- BMS 資料標準

- 功能安全標準

- 網路安全標準

- 產業合作計劃

- 區域監理協調工作

- 資料管理與分析框架

- 數據採集與預處理

- 邊緣運算架構與雲端處理架構

- 電池狀態估價演算法

- 異常檢測與診斷

- 預測性維護與車隊分析

- 數位孿生實施

- 測試與驗證規程

- 無線鏈路效能測試

- 環境測試

- 電磁干擾/電磁相容性測試

- 功能安全測試

- 網路安全測試

- 加速壽命試驗

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 硬體

- 軟體

- 服務

第6章:市場估算與預測:依通訊技術分類,2021-2034年

- 短距離無線(藍牙)

- 遠端/低功耗廣域網

- 專有射頻協定棧

- 混合架構

第7章:市場估計與預測:依電池化學類型分類,2021-2034年

- 鋰離子電池

- 鉛酸電池

- 鎳氫電池

- 固態電池

- 其他

第8章:市場估算與預測:依車輛類型分類,2021-2034年

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型

- 中型

- 重負

第9章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 馬來西亞

- 泰國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Analog Devices (ADI)

- Texas Instruments (TI)

- NXP Semiconductors

- Infineon Technologies

- Renesas Electronics

- STMicroelectronics

- Dukosi

- Cavli Wireless

- u-blox

- Quectel Wireless Solutions

- Robert Bosch

- Continental

- Denso

- Hitachi Astemo

- Marelli

- LG Innotek

- Visteon

- ABB E-mobility

- BP Pulse

- Siemens eMobility

- 區域玩家

- Sunwoda EVB

- EVE Energy

- Ficosa

- Sensata Technologies

- Hyundai Mobis

- 新興參與者

- Dragonfly Energy

- WeaveGrid

- Twaice

- VoltaIQ

- Ampeco

The Global Wireless EV Battery Monitoring Market was valued at USD 543.7 million in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 2.07 billion by 2034.

The automotive sector is increasingly redesigning electric vehicle platforms to reduce weight, improve energy density, and allow modular battery configurations. Wireless battery monitoring eliminates heavy wiring, speeds up assembly, and supports flexible, modular architecture, making it a preferred solution for next-generation EV platforms. Software-defined vehicles demand deeper data visibility, secure cloud connectivity, and over-the-air update capabilities. Wireless BMS systems offer rich telemetry and predictive analytics support, enabling advanced safety modeling and efficient energy management. OEMs transitioning to data-driven architectures find wireless monitoring aligned with their strategic goals. Additionally, monitoring second-life EV batteries for grid, home, and industrial storage applications is gaining importance. Wireless solutions reduce integration complexity, minimize costs, and meet the growing demand for adaptable energy storage monitoring, smart charging solutions, and optimized energy delivery for fleets and individual consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $543.7 Million |

| Forecast Value | $2.07 Billion |

| CAGR | 14.6% |

The hardware segment held 57% share in 2024. Rising battery electrification and the growing complexity of high-capacity packs are driving demand for robust sensor nodes, gateway modules, antennas, and processing units capable of withstanding harsh automotive environments.

The short-range wireless segment is expected to grow at a CAGR of 11.9% through 2034. Bluetooth, BLE, and other low-power short-range protocols remain vital for internal battery-pack communications, offering stable data transfer, low energy consumption, and compatibility with modular designs. These technologies address challenges such as electromagnetic interference, increasing cell counts, and stringent safety standards.

U.S. Wireless EV Battery Monitoring Market held a 75.8% share, generating USD 142.6 million in 2024. Strong federal and state initiatives are accelerating EV adoption, with programs providing incentives for EV purchases and charging infrastructure deployment. Policy targets lower battery costs and faster charging further drive demand for advanced monitoring technologies.

Key players operating in the Global Wireless EV Battery Monitoring Market include Analog Devices, Texas Instruments, LG Innotek, Marelli, NXP Semiconductors, Renesas, Visteon, ABB E-mobility, BP Pulse, and Siemens eMobility. Companies in the Wireless EV Battery Monitoring Market are strengthening their position by investing in R&D to develop advanced sensor nodes, gateway modules, and antenna systems that can handle high-capacity EV batteries. Many firms focus on short-range wireless protocols and IoT-enabled solutions to improve modularity, data accuracy, and energy efficiency. Strategic collaborations with OEMs, fleet operators, and energy providers help expand deployment and secure long-term contracts. Cloud integration and predictive analytics capabilities are being enhanced to support software-defined vehicles and over-the-air updates.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Communication technology

- 2.2.4 Battery chemistry

- 2.2.5 Vehicle

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Accelerating Global EV Adoption

- 3.2.1.2 Regulatory Mandates for Battery Safety & Monitoring

- 3.2.1.3 Cost Reduction Imperatives

- 3.2.1.4 Weight & Volume Optimization

- 3.2.1.5 Thermal Runaway Safety Concerns

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Implementation Costs & R&D Investment

- 3.2.2.2 Lack of Standardization & Interoperability

- 3.2.3 Market opportunities

- 3.2.3.1 Multi-Modal Sensor Fusion for Superior Thermal Runaway Detection

- 3.2.3.2 Energy-Autonomous Wireless Nodes with Energy Harvesting

- 3.2.3.3 AI-Driven Predictive Maintenance & Prognostics

- 3.2.3.4 Blockchain for Secure Battery Passport & Traceability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.8.3 Market Pricing Strategy & Economics

- 3.8.3.1 Pricing models comparison (capex vs. opex, subscription vs. perpetual)

- 3.8.3.2 Cost-plus and value-based pricing strategies

- 3.8.3.3 Volume discounts and tiered pricing structures

- 3.8.3.4 Regional pricing variations and localization factors

- 3.8.3.5 Unit economics and margin analysis by customer segment

- 3.8.3.6 Return on Investment (ROI) and payback period calculations

- 3.8.3.7 Bundling and cross-selling opportunities

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.9.4 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability & environmental aspects

- 3.11.1 Carbon Footprint Assessment

- 3.11.2 Circular Economy Integration

- 3.11.3 E-Waste Management Requirements

- 3.11.4 Green Manufacturing Initiatives

- 3.12 System Architecture Analysis

- 3.13 Battery Monitoring Requirements

- 3.13.1 By chemistry

- 3.13.2 By application

- 3.14 Battery Form Factor & Monitoring Implications

- 3.15 Battery Degradation Mechanisms & Monitoring Implications

- 3.16 Thermal Management Integration with Wireless Monitoring

- 3.17 Manufacturing & Quality Control Considerations

- 3.17.1 Wireless BMS Integration in Battery Manufacturing

- 3.17.2 In-Line Testing & Commissioning

- 3.17.3 Manufacturing Yield & Defect Detection

- 3.17.4 Scalability & Automation

- 3.18 Total Cost of Ownership (TCO) Models

- 3.18.1 Upfront Cost Components

- 3.18.2 Manufacturing Cost Savings

- 3.18.3 Operational Cost Savings

- 3.18.4 End-of-Life Value

- 3.18.5 TCO Breakeven Analysis

- 3.19 Interoperability & Standardization Landscape

- 3.19.1 Communication Protocol Standards

- 3.19.2 BMS Data Standards

- 3.19.3 Functional Safety Standards

- 3.19.4 Cybersecurity Standards

- 3.19.5 Industry Collaboration Initiatives

- 3.19.6 Regional Regulatory Harmonization Efforts

- 3.20 Data Management & Analytics Frameworks

- 3.20.1 Data Acquisition & Preprocessing

- 3.20.2 Edge vs Cloud Processing Architecture

- 3.20.3 Battery State Estimation Algorithms

- 3.20.4 Anomaly Detection & Diagnostics

- 3.20.5 Predictive Maintenance & Fleet Analytics

- 3.20.6 Digital Twin Implementation

- 3.21 Testing & Validation Protocols

- 3.21.1 Wireless Link Performance Testing

- 3.21.2 Environmental Testing

- 3.21.3 EMI/EMC Testing

- 3.21.4 Functional Safety Testing

- 3.21.5 Cybersecurity Testing

- 3.21.6 Accelerated Life Testing

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Communication technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Short-range wireless (Bluetooth)

- 6.3 Long-range / LPWAN

- 6.4 Proprietary RF stacks

- 6.5 Hybrid architecture

Chapter 7 Market Estimates & Forecast, By Battery Chemistry, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Lithium-ion battery

- 7.3 Lead-acid battery

- 7.4 Nickel-metal hydride battery

- 7.5 Solid-state battery

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial Vehicles

- 8.3.1 Light duty

- 8.3.2 Medium duty

- 8.3.3 Heavy-duty

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Analog Devices (ADI)

- 10.1.2 Texas Instruments (TI)

- 10.1.3 NXP Semiconductors

- 10.1.4 Infineon Technologies

- 10.1.5 Renesas Electronics

- 10.1.6 STMicroelectronics

- 10.1.7 Dukosi

- 10.1.8 Cavli Wireless

- 10.1.9 u-blox

- 10.1.10 Quectel Wireless Solutions

- 10.1.11 Robert Bosch

- 10.1.12 Continental

- 10.1.13 Denso

- 10.1.14 Hitachi Astemo

- 10.1.15 Marelli

- 10.1.16 LG Innotek

- 10.1.17 Visteon

- 10.1.18 ABB E-mobility

- 10.1.19 BP Pulse

- 10.1.20 Siemens eMobility

- 10.2 Regional Players

- 10.2.1 Sunwoda EVB

- 10.2.2 EVE Energy

- 10.2.3 Ficosa

- 10.2.4 Sensata Technologies

- 10.2.5 Hyundai Mobis

- 10.3 Emerging Players

- 10.3.1 Dragonfly Energy

- 10.3.2 WeaveGrid

- 10.3.3 Twaice

- 10.3.4 VoltaIQ

- 10.3.5 Ampeco