|

市場調查報告書

商品編碼

1892699

植入式藥物輸送幫浦市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Implantable Drug Delivery Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

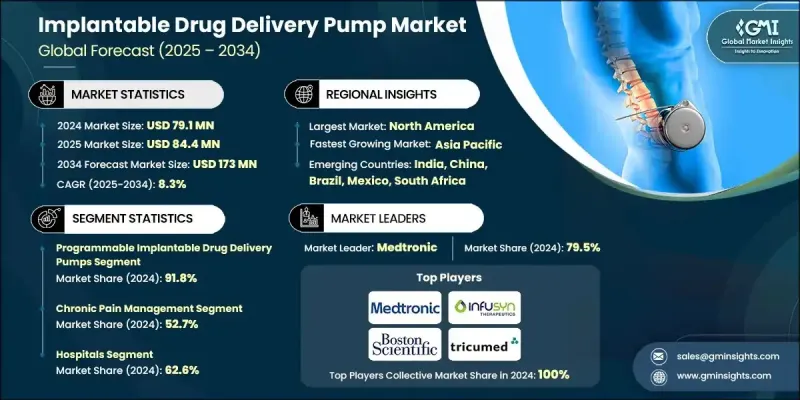

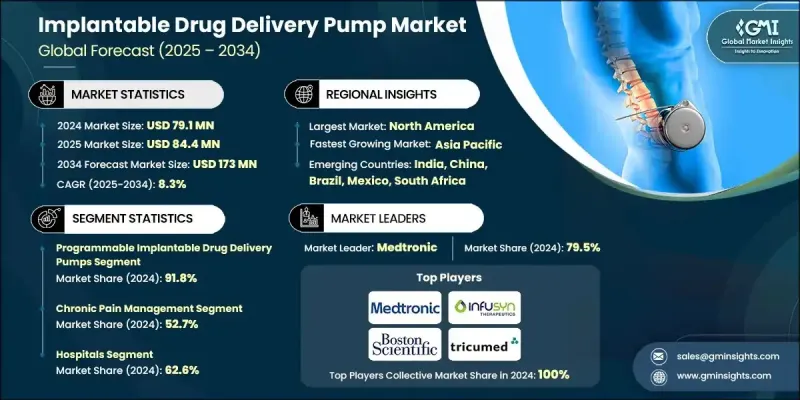

2024 年全球植入式藥物輸送幫浦市值為 7,910 萬美元,預計到 2034 年將以 8.3% 的複合年成長率成長至 1.73 億美元。

慢性疼痛、痙攣和其他長期疾病的日益普遍,推動了對先進植入式幫浦的需求,這些幫浦能夠確保藥物的可控和持續輸送。醫院、專科診所和門診手術中心正擴大採用這些系統,以改善患者預後、更有效地管理慢性疾病並提高營運效率。市面上提供可編程和恆速泵,可提供精準的標靶治療,減少全身副作用並提高患者依從性。包括小型化幫浦設計、生物相容性3D列印組件、無線遙測和遠端病患監測在內的技術進步,正在提升設備的功能性、安全性和便利性,加速臨床應用,並促進其在全球慢性疾病管理中的更廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7910萬美元 |

| 預測值 | 1.73億美元 |

| 複合年成長率 | 8.3% |

2024年,可程式植入式藥物輸注幫浦市佔率達91.8%。這類幫浦因其能夠提供個人化、精準且可控的藥物輸注而備受青睞。臨床醫生可以根據患者的反應、疾病進展和治療需求調整劑量,從而在改善療效的同時最大限度地減少不良反應。這種靈活性使得可程式泵成為需要持續、精準給藥的慢性病治療的關鍵。

2024 年,慢性疼痛管理領域佔市場佔有率的 52.7%,預計在 2025 年至 2034 年間將達到 8,790 萬美元。神經性疼痛、肌肉骨骼疼痛和術後疼痛病例的增加推動了需求,因為植入式幫浦可以直接有效地輸送鎮痛藥,與口服或全身性治療相比,可確保快速起效並提高治療效果。

2024年,北美植入式藥物輸送幫浦市佔率預計將達到61.8%,主要得益於先進的醫療基礎設施、完善的健保報銷系統以及對創新醫療技術的早期應用。該地區慢性病高發以及微創療法日益受到青睞,推動了醫院和專科診所對藥物輸送泵的採用。美國FDA和加拿大衛生部推出的有利監管政策也進一步促進了藥物輸送泵的快速商業化和創新。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 慢性疼痛、痙攣和癌症的盛行率不斷上升

- 標靶和可控藥物傳遞的優勢

- 泵浦設計方面的技術進步

- 人們越來越傾向選擇微創療法

- 產業陷阱與挑戰

- 高昂的設備和植入成本

- 設備故障和感染的風險

- 市場機遇

- 物聯網與遠端監控的整合

- 對個人化醫療的需求日益成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術進步

- 當前技術趨勢

- 微型植入式幫浦

- 可編程且對病人友善的輸液系統

- 微創植入技術

- 新興技術

- 配備人工智慧加藥演算法的智慧泵

- 無線連接和遠端監控

- 整合安全和警報系統

- 當前技術趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 人工智慧、數位醫療和互聯輸液系統的整合

- 聯合藥物-器械療法的開發

- 隨著新興市場醫療基礎設施的改善,其成長勢頭強勁。

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 可編程植入式藥物輸送泵

- 恆速(固定流量)植入式泵

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 慢性疼痛管理

- 痙攣管理

- 腫瘤/化療

- 其他慢性疾病

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 醫院

- 門診手術中心

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 排

第9章:公司簡介

- Boston Scientific (Integra Oncology)

- Infusyn Therapeutics

- Medtronic

- Tricumed Medizintechnik

The Global Implantable Drug Delivery Pump Market was valued at USD 79.1 million in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 173 million by 2034.

The rising prevalence of chronic pain, spasticity, and other long-term disorders is driving demand for advanced implantable pumps that ensure controlled and sustained drug delivery. Hospitals, specialty clinics, and ambulatory surgical centers are increasingly adopting these systems to enhance patient outcomes, manage chronic conditions more effectively, and improve operational efficiency. The market offers programmable and constant-rate pumps that provide precise, targeted therapy, reducing systemic side effects and improving adherence. Technological advancements, including miniaturized pump designs, biocompatible 3D-printed components, wireless telemetry, and remote patient monitoring, are enhancing device functionality, safety, and convenience, accelerating clinical adoption and encouraging broader use in chronic disease management globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $79.1 Million |

| Forecast Value | $173 Million |

| CAGR | 8.3% |

The programmable implantable drug delivery pumps segment held 91.8% share in 2024. These pumps are favored due to their ability to provide personalized, precise, and controlled drug administration. Clinicians can adjust dosages based on patient response, disease progression, and therapy needs, improving outcomes while minimizing adverse effects. This flexibility makes programmable pumps essential for chronic conditions requiring ongoing, precise medication delivery.

The chronic pain management segment accounted for a 52.7% share in 2024 and is expected to reach USD 87.9 million during 2025-2034. Rising cases of neuropathic, musculoskeletal, and post-surgical pain are fueling demand, as implantable pumps deliver analgesics directly and efficiently, ensuring rapid onset and enhanced therapeutic efficacy compared to oral or systemic treatments.

North America Implantable Drug Delivery Pump Market held a 61.8% share in 2024, supported by advanced healthcare infrastructure, strong reimbursement systems, and early adoption of innovative medical technologies. The high prevalence of chronic diseases in the region and the growing preference for minimally invasive therapies are driving pump adoption in hospitals and specialty clinics. Favorable regulatory pathways by the U.S. FDA and Health Canada further encourage rapid commercialization and innovation.

Major players operating in the Global Implantable Drug Delivery Pump Market include Medtronic, Infusyn Therapeutics, Boston Scientific (Integra Oncology), and Tricumed Medizintechnik. Companies in the implantable drug delivery pump market are focusing on strategies such as investing heavily in R&D to develop miniaturized, programmable, and remote-monitoring-enabled pumps. Strategic partnerships with hospitals, specialty clinics, and research institutions help expand their distribution networks and clinical adoption. Firms are also emphasizing global market expansion, enhancing regulatory compliance, and implementing targeted marketing strategies to raise awareness among clinicians and patients. Product differentiation through advanced telemetry, wireless communication, and customizable therapy options ensures competitive advantage, while ongoing innovation and service support strengthen brand loyalty and penetration in chronic disease management segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic pain, spasticity, and cancer

- 3.2.1.2 Advantages of targeted and controlled drug delivery

- 3.2.1.3 Technological advancements in pump design

- 3.2.1.4 Growing preference for minimally invasive therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High device and implantation cost

- 3.2.2.2 Risk of device malfunction and infection

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of IoT and remote monitoring

- 3.2.3.2 Rising demand for personalized medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancemnets

- 3.5.1 Current technological trends

- 3.5.1.1 Miniaturized implantable pumps

- 3.5.1.2 Programmable and patient-friendly infusion systems

- 3.5.1.3 Minimally invasive implantation techniques

- 3.5.2 Emerging technologies

- 3.5.2.1 Smart pumps with AI-based dosing algorithms

- 3.5.2.2 Wireless connectivity and remote monitoring

- 3.5.2.3 Integrated safety and alert systems

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Integration of AI, digital health, and connected infusion systems

- 3.9.2 Development of combination drug-device therapies

- 3.9.3 Growth in emerging markets with improving healthcare infrastructure

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Programmable implantable drug delivery pumps

- 5.3 Constant-rate (Fixed-flow) implantable pumps

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chronic pain management

- 6.3 Spasticity management

- 6.4 Oncology/Chemotherapy

- 6.5 Other chronic conditions

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 RoW

Chapter 9 Company Profiles

- 9.1 Boston Scientific (Integra Oncology)

- 9.2 Infusyn Therapeutics

- 9.3 Medtronic

- 9.4 Tricumed Medizintechnik