|

市場調查報告書

商品編碼

1892687

異質整合技術市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Heterogeneous Integration Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

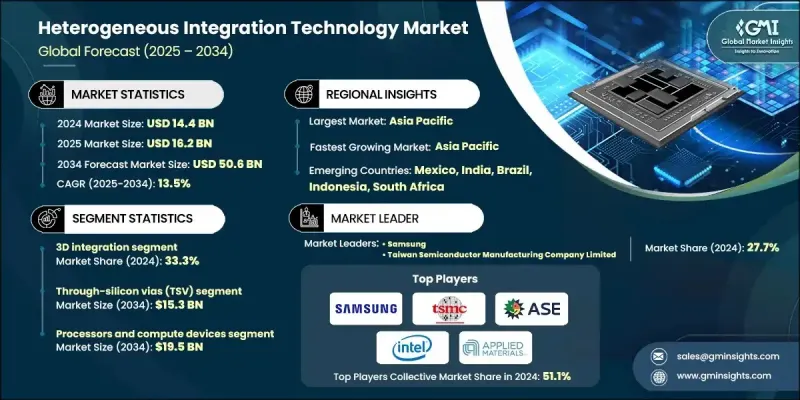

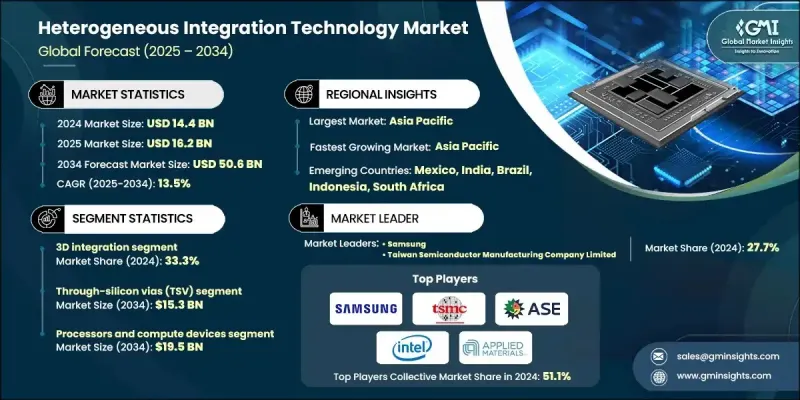

2024 年全球異質整合技術市場價值為 144 億美元,預計到 2034 年將以 13.5% 的複合年成長率成長至 506 億美元。

隨著各行業採用先進的封裝解決方案、人工智慧系統、邊緣運算平台和下一代無線連接技術,市場成長正在加速。對高效能運算架構日益成長的依賴,推動了對能夠提供高頻寬和低延遲的緊湊型、高能效多晶片系統的需求。隨著人工智慧驅動的工作負載在互聯設備、企業網路和雲端基礎架構中不斷擴展,異質整合正變得日益重要。物聯網應用在工業自動化、消費生態系統和智慧基礎設施中的快速普及,進一步提升了在更小的空間內實現高密度、多功能整合的需求。隨著晶片設計功耗的不斷增加,該產業在熱管理、中介層材料和封裝架構方面也取得了顯著的創新。高效的散熱和功耗最佳化對於先進的加速器和多晶片模組保持最佳可靠性和性能至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 144億美元 |

| 預測值 | 506億美元 |

| 複合年成長率 | 13.5% |

2024年,3D整合領域佔據了33.3%的市場。隨著對更高頻寬、更低延遲和垂直整合多晶片架構的需求不斷成長,該領域的成長勢頭也持續強勁。隨著記憶體、運算處理器和加速器擴大堆疊在一起,開發者被鼓勵推進晶片組標準,建立更廣泛的設計庫,並擴展合作開發生態系統。

預計到2034年,矽通孔(TSV)市場規模將達153億美元。由於垂直整合儲存結構和高密度互連的廣泛應用,TSV的採用率正在上升。這項技術對於需要低延遲訊號傳輸的垂直系統架構仍然至關重要。為了最大限度地提高可擴展性,製造商正致力於降低缺陷率、提高耐久性並最佳化中間通孔和後通孔的製造流程。

2024年,北美異質整合技術市佔率達到17.9%,預計到2034年將以13.3%的複合年成長率成長。人工智慧、物聯網和先進連接技術推動了系統設計需求,緊湊型多晶片配置的廣泛應用也成為推動該地區市場成長的主要動力。此外,該地區在半導體設計、封裝創新和基於晶片的整合研究方面的領先地位,也持續推動技術進步。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 為支援高效能運算,對先進封裝的需求不斷成長

- 人工智慧、機器學習和邊緣運算工作負載的日益普及

- 5G/6G基礎設施的擴展及相關半導體需求

- 物聯網設備的激增需要高效、緊湊的整合

- 對資料中心和雲端基礎設施的投資不斷增加

- 產業陷阱與挑戰

- 製造流程複雜度高,整合面臨許多挑戰

- 先進多晶片封裝的生產成本較高

- 市場機遇

- 開發標準化的晶片市場,實現跨廠商整合

- 先進基板和中介層製造能力的成長

- 擴展3D封裝工具、EDA平台和協同設計軟體解決方案

- 採用異質整合技術開發專業化、小批量客製化應用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 新興商業模式

- 合規要求

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 對主要參與者進行競爭基準分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 按地區分類的市場滲透率

- 競爭定位矩陣

- 領導人

- 挑戰者

- 追蹤者

- 小眾玩家

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年主要發展動態

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估算與預測:依整合類型分類,2021-2034年

- 2.5D 整合

- 3D整合

- 扇出式包裝

- 基於晶片的整合

- 其他

第6章:市場估算與預測:依互連技術分類,2021-2034年

- 矽通孔(TSV)

- 微凸塊互連

- 重新分配層(RDL)

- 混合鍵結(銅-銅鍵結)

- 其他

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 3D儲存解決方案

- 高頻寬記憶體(HBM)

- 寬 I/O 內存

- 3D NAND快閃記憶體

- 處理器和計算設備

- CPU

- GPU

- 人工智慧加速器

- FPGA

- CMOS影像感測器

- MEMS元件

- 慣性感測器

- 壓力感測器

- 麥克風

- 其他

- 射頻和通訊設備

- 其他

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 整合裝置製造商(IDM)

- 鑄造廠

- OSAT(外包半導體組裝和測試)

- 無晶圓廠半導體公司

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球關鍵參與者

- Samsung

- Taiwan Semiconductor Manufacturing Company Limited

- Intel

- Applied Materials, Inc.

- ASE Technology Holding

- 區域關鍵參與者

- 北美洲

- Advanced Micro Devices (AMD)

- Broadcom Inc

- Lam Research Corporation

- 歐洲

- EV Group (EVG)

- Indium Corporation

- Micron Technology Inc.

- 亞太地區

- Amkor Technology

- JCET Group

- United Microelectronics Corporation (UMC)

- 北美洲

- 小眾玩家/顛覆者

- NHanced Semiconductors

- Atomica Corp

- Powertech Technology Inc.

- Siliconware Precision Industries Co., Ltd.

- Silicon Box Pte Ltd

The Global Heterogeneous Integration Technology Market was valued at USD 14.4 billion in 2024 and is estimated to grow at a CAGR of 13.5% to reach USD 50.6 billion by 2034.

Market growth is accelerating as industries adopt advanced packaging solutions, AI-enabled systems, edge computing platforms, and next-generation wireless connectivity. Increasing reliance on high-performance compute architectures is pushing demand for compact, energy-efficient multi-die systems capable of delivering high bandwidth and low latency. As AI-driven workloads scale across connected devices, enterprise networks, and cloud infrastructure, heterogeneous integration is gaining strategic importance. The rapid spread of IoT applications across industrial automation, consumer ecosystems, and smart infrastructure is further elevating the need for dense, multifunctional integration within reduced footprints. The sector is also witnessing strong innovation in thermal management, interposer materials, and packaging architectures as chip designs grow more power-intensive. Efficient heat dissipation and power optimization have become essential for advanced accelerators and multi-chip modules to maintain peak reliability and performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $50.6 Billion |

| CAGR | 13.5% |

The 3D integration segment held a 33.3% share in 2024. Its momentum continues to grow alongside demand for higher bandwidth, reduced latency, and vertically integrated multi-die architectures. As memory, compute processors, and accelerators are increasingly stacked, developers are encouraged to advance chiplet standards, build broader design libraries, and expand cooperative development ecosystems.

The through-silicon vias segment is expected to reach USD 15.3 billion by 2034. TSV adoption is rising due to greater use of vertically integrated memory structures and high-density interconnects. The technology remains fundamental to vertical system architectures that require low-latency signal transmission. To maximize scalability, producers are working to reduce defect levels, enhance durability, and optimize via-middle and via-last fabrication techniques.

North America Heterogeneous Integration Technology Market held 17.9% share in 2024 and is forecasted to grow at a CAGR of 13.3% through 2034. Strong adoption of compact multi-die configurations is propelling regional growth as AI, IoT, and advanced connectivity drive system design requirements. The region's leadership in semiconductor design, packaging innovation, and chiplet-based integration research continues to encourage technological advancement.

Key companies participating in the Heterogeneous Integration Technology Market include Applied Materials, Inc., Samsung, Intel, EV Group (EVG), Atomica Corp, ASE Technology Holding, Amkor Technology, Indium Corporation, NHanced Semiconductors, and Taiwan Semiconductor Manufacturing Company Limited. Companies in the Heterogeneous Integration Technology Market are advancing their competitive positions through multiple strategic initiatives. Many are scaling R&D investments to enhance chiplet architectures, packaging density, and advanced thermal solutions. Firms are also adopting collaborative development models that align interface standards and accelerate ecosystem interoperability. Several players are expanding manufacturing capacity to support high-volume 3D integration and TSV processes, while others are investing in materials innovation to improve conductivity, reduce power loss, and strengthen structural reliability. Strategic alliances with semiconductor designers and system integrators help broaden product adoption across AI, edge computing, and data-centric applications.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Integration type trends

- 2.2.2 Interconnect Technology trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced packaging to support high-performance computing

- 3.2.1.2 Growing adoption of AI, machine learning, and edge computing workloads

- 3.2.1.3 Expansion of 5G/6G infrastructure and related semiconductor requirements

- 3.2.1.4 Proliferation of IoT devices requiring efficient, compact integration

- 3.2.1.5 Rising investment in data centers and cloud infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing complexity and integration challenges

- 3.2.2.2 Elevated production costs for advanced multi-die packaging

- 3.2.3 Market opportunities

- 3.2.3.1 Development of standardized chiplet marketplaces enabling cross-vendor integration

- 3.2.3.2 Growth in advanced substrate and interposer manufacturing capacity

- 3.2.3.3 Expansion of 3D packaging tools, EDA platforms, and co-design software solutions

- 3.2.3.4 Adoption of heterogeneous integration for specialized, low-volume custom applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Integration Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 2.5D integration

- 5.3 3D integration

- 5.4 Fan-out packaging

- 5.5 Chiplet-based integration

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Interconnect Technology, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Through-silicon vias (TSV)

- 6.3 Micro-bump interconnects

- 6.4 Redistribution layers (RDL)

- 6.5 Hybrid bonding (Cu-Cu Bonding)

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 3D Memory solutions

- 7.2.1 High bandwidth memory (HBM)

- 7.2.2 Wide I/O memory

- 7.2.3 3D NAND flash memory

- 7.3 Processors & compute devices

- 7.3.1 CPUs

- 7.3.2 GPUs

- 7.3.3 AI accelerators

- 7.3.4 FPGAs

- 7.4 CMOS image sensors

- 7.5 MEMS devices

- 7.5.1 Inertial sensors

- 7.5.2 Pressure sensors

- 7.5.3 Microphones

- 7.5.4 Others

- 7.6 RF & communication devices

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Integrated device manufacturers (IDMs)

- 8.3 Foundries

- 8.4 OSATs (outsourced semiconductor assembly & test)

- 8.5 Fabless semiconductor companies

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Samsung

- 10.1.2 Taiwan Semiconductor Manufacturing Company Limited

- 10.1.3 Intel

- 10.1.4 Applied Materials, Inc.

- 10.1.5 ASE Technology Holding

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Advanced Micro Devices (AMD)

- 10.2.1.2 Broadcom Inc

- 10.2.1.3 Lam Research Corporation

- 10.2.2 Europe

- 10.2.2.1 EV Group (EVG)

- 10.2.2.2 Indium Corporation

- 10.2.2.3 Micron Technology Inc.

- 10.2.3 APAC

- 10.2.3.1 Amkor Technology

- 10.2.3.2 JCET Group

- 10.2.3.3 United Microelectronics Corporation (UMC)

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 NHanced Semiconductors

- 10.3.2 Atomica Corp

- 10.3.3 Powertech Technology Inc.

- 10.3.4 Siliconware Precision Industries Co., Ltd.

- 10.3.5 Silicon Box Pte Ltd