|

市場調查報告書

商品編碼

1892681

車輛預測性維護市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Predictive Maintenance for Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

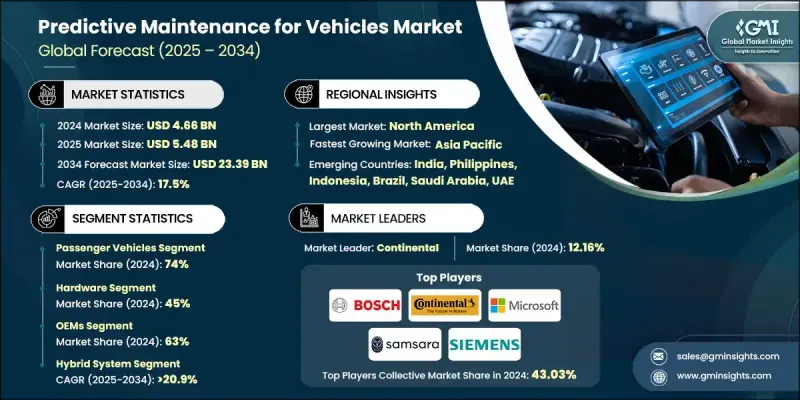

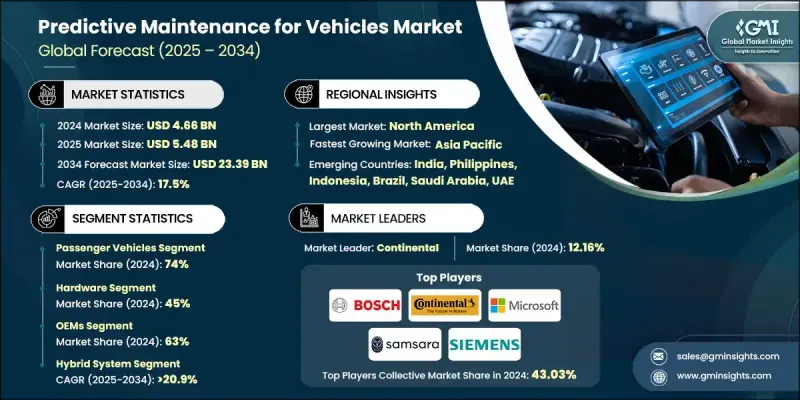

2024 年全球車輛預測性維護市場價值為 46.6 億美元,預計到 2034 年將以 17.5% 的複合年成長率成長至 233.9 億美元。

汽車和車隊生態系統的快速數位化正在改變車輛的監控、維護和保養方式。預測性維護解決方案利用遠端資訊處理、物聯網感測器、車載診斷、人工智慧/機器學習分析和雲端運算,實現車輛健康狀況的即時監控、早期故障檢測以及對引擎、電池、煞車、輪胎和電力電子設備的剩餘使用壽命 (RUL) 預測。隨著車輛向軟體定義架構演進,數據驅動的維護正在取代商用車隊、乘用車和電動車中傳統的被動式和定期保養。新冠疫情加速了遠端診斷、空中升級和數位化車隊健康平台的普及。供應鏈中斷以及最大限度地延長車輛正常運行時間和使用壽命的需求進一步推高了相關需求。人工智慧模型分析遠端資訊處理、故障碼、振動、溫度和歷史維修資料,從而預測故障的發生,使車隊營運商和原始設備製造商 (OEM) 能夠減少停機時間、最佳化維護計劃並確保安全。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 46.6億美元 |

| 預測值 | 233.9億美元 |

| 複合年成長率 | 17.5% |

2024年,乘用車細分市場佔據74%的市場佔有率,預計到2034年將以17%的複合年成長率成長。該細分市場之所以佔據領先地位,主要得益於全球乘用車保有量的龐大、互聯汽車技術的廣泛應用,以及消費者對可靠性、安全性和更低維護成本日益成長的需求。現代乘用車擴大配備遠端資訊處理控制單元、人工智慧診斷工具和車載感測器,用於監測引擎、電池和煞車系統的健康狀況,從而推動了預測性維護的普及。

2024年,硬體部分佔據了45%的市場佔有率,預計到2034年將以16.8%的複合年成長率成長。硬體,包括感測器、遠端資訊處理設備、OBD-II閘道器和物聯網模組,對於收集引擎性能、煞車系統、電池健康狀況、振動和溫度等即時資料至關重要。這些數據是人工智慧和機器學習模型準確預測故障的基礎。乘用車和商用車都高度依賴可靠的硬體來確保持續監控並防止非計劃性停機。

美國車輛預測性維護市場佔86%的市場佔有率,預計2024年市場規模將達到14.6億美元。美國市場受益於先進的互聯車隊生態系統、廣泛的遠端資訊處理技術應用以及人工智慧驅動的分析。包括物流、最後一公里配送、叫車和租賃業者在內的商業車隊高度依賴預測性維護平台。投資於雲端分析、即時診斷和基於人工智慧的維護解決方案的公司已將預測性維護打造成為交通運輸產業的核心營運工具。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 車輛複雜性和感測器化程度不斷提高

- 監管機構對安全和排放合規性施加壓力

- 維護和維修成本不斷上漲

- 擴展遠端資訊處理和 5G 連接

- 產業陷阱與挑戰

- 高昂的整合成本和傳統車隊的限制

- 對OEM診斷資料的存取權限受限

- 市場機遇

- 電動汽車電池的預測性維護

- 以車隊為中心的AI診斷平台

- 車輛零件的數位孿生建模

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 洛杉磯

- MEA

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利分析

- 價格趨勢

- 按地區

- 按組件

- 成本細分分析

- 永續性和環境影響分析

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 數位轉型經濟學與總擁有成本分析

- 總擁有成本 (TCO) 框架

- 投資報酬率計算方法

- 數位轉型成熟度模型

- 技術整合和平台互通性標準

- 資料交換標準和協議

- API及整合框架

- 雲端平台整合

- 企業系統整合

- 互通性挑戰與解決方案

- 新興用例

- 飛行器的預測性維護

- 自動駕駛車輛車隊管理

- 共享出行與微出行

- 最後一公里配送機器人

- 監理演變

- 美國國家公路交通安全管理局自動駕駛汽車分步計畫的影響

- 全球標準協調

- 網路安全監理收緊

- 資料主權要求

- 商業模式創新

- 預測性維護即服務

- 按使用量付費和基於結果的定價

- 數據貨幣化策略

- 生態系平台模型

- 投資熱點

- 電動汽車電池健康監測

- 自動駕駛車輛感知器診斷

- 非公路及工程機械

- 新興市場基礎設施

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估價與預測:依車輛類型分類,2021-2034年

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第6章:市場估計與預測:依技術分類,2021-2034年

- 物聯網與車載資訊服務

- 人工智慧(AI)

- 機器學習(ML)

- 邊緣運算

- 雲端運算

- 巨量資料分析

- 其他

第7章:市場估計與預測:依組件分類,2021-2034年

- 硬體

- 軟體

- 服務

第8章:市場估算與預測:依維護類型分類,2021-2034年

- 基於狀態的維護

- 預測性診斷

- 遠端監控

- 即時故障檢測

- 其他

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 原始設備製造商

- 售後市場

第10章:市場估算與預測:依部署模式分類,2021-2034年

- 本地部署

- 基於雲端的

- 混合

第11章:市場估計與預測:按地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 菲律賓

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- OEMs & Tier-1 Suppliers

- BMW

- Bosch

- Continental

- Mercedes-Benz

- Volkswagen

- Volvo

- ZF Friedrichshafen

- Telematics & Technology Leaders

- Geotab

- IBM

- Microsoft

- PTC

- Samsara

- Siemens

- Solera

- Thermo King

- Trimble

- Verizon Connect

- 區域玩家

- Amerit Fleet Solutions

- Bendix Commercial Vehicle Systems

- Fleetworthy Solutions

- PrePass Safety Alliance

- 新興參與者

- Adesso

- CDK Global

- Simply Fleet

The Global Predictive Maintenance for Vehicles Market was valued at USD 4.66 billion in 2024 and is estimated to grow at a CAGR of 17.5% to reach USD 23.39 billion by 2034.

The rapid digitalization of the automotive and fleet ecosystem is transforming how vehicles are monitored, maintained, and serviced. Predictive maintenance solutions leverage telematics, IoT sensors, onboard diagnostics, AI/ML analytics, and cloud computing to enable real-time vehicle health monitoring, early fault detection, and remaining-useful-life (RUL) predictions for engines, batteries, brakes, tires, and power electronics. As vehicles evolve toward software-defined architectures, data-driven maintenance is replacing traditional reactive and scheduled servicing across commercial fleets, passenger vehicles, and EVs. The COVID-19 pandemic accelerated the adoption of remote diagnostics, over-the-air updates, and digital fleet-health platforms. Supply chain disruptions and the need to maximize uptime and vehicle lifespan further increased demand. AI models analyze telematics, fault codes, vibration, temperature, and historical repair data to forecast failures before they occur, allowing fleet operators and OEMs to reduce downtime, optimize maintenance schedules, and ensure safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.66 Billion |

| Forecast Value | $23.39 Billion |

| CAGR | 17.5% |

The passenger vehicle segment held a 74% share in 2024 and is expected to grow at a CAGR of 17% through 2034. This segment leads due to the sheer size of the global passenger vehicle fleet, widespread adoption of connected-car technologies, and growing consumer demand for reliability, safety, and lower maintenance costs. Modern passenger vehicles are increasingly equipped with telematics control units, AI-powered diagnostic tools, and onboard sensors to monitor engine, battery, and braking system health, boosting the adoption of predictive maintenance.

The hardware segment held a 45% share in 2024 and is projected to grow at a CAGR of 16.8% through 2034. Hardware, including sensors, telematics devices, OBD-II gateways, and IoT modules, is essential for collecting real-time data on engine performance, braking systems, battery health, vibration, and temperature. These inputs form the foundation for AI and machine learning models to forecast failures accurately. Both passenger and commercial vehicles rely heavily on robust hardware to ensure continuous monitoring and prevent unplanned downtime.

U.S. Predictive Maintenance for Vehicles Market held 86% share, generating USD 1.46 billion in 2024. The U.S. market benefits from advanced connected-fleet ecosystems, widespread telematics adoption, and AI-driven analytics. Commercial fleets, including logistics, last-mile delivery, ride-hailing, and rental operators, rely heavily on predictive maintenance platforms. Companies investing in cloud analytics, real-time diagnostics, and AI-based maintenance solutions have made predictive maintenance a central operational tool in the transportation industry.

Major players in the Global Predictive Maintenance for Vehicles Market include Bosch, Continental, GE, Geotab, IBM, Microsoft, PTC, Samsara, Siemens, and Trimble. Companies in the Predictive Maintenance for Vehicles Market are expanding their footprint by investing in advanced AI and machine learning models to enhance predictive accuracy for vehicle components. Strategic partnerships with OEMs, fleet operators, and telematics providers help increase solution adoption and long-term service contracts. Cloud integration and real-time analytics platforms are being developed to improve remote diagnostics and over-the-air updates. Firms are also focusing on robust hardware development, including IoT sensors, telematics modules, and OBD-II devices, to ensure reliable data capture in harsh automotive environments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Technology

- 2.2.4 Component

- 2.2.5 Maintenance

- 2.2.6 Deployment mode

- 2.2.7 End Use

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing vehicle complexity & sensorization

- 3.2.1.2 Regulatory pressure for safety & emissions compliance

- 3.2.1.3 Rising maintenance & repair costs

- 3.2.1.4 Expansion of telematics & 5G connectivity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High integration costs & legacy fleet limitations

- 3.2.2.2 Restricted access to OEM diagnostic data

- 3.2.3 Market opportunities

- 3.2.3.1 Predictive maintenance for EV batteries

- 3.2.3.2 Fleet-centric AI diagnostic platforms

- 3.2.3.3 Digital twin modeling for vehicle components

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LA

- 3.4.5 MEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Digital transformation economics & TCO analysis

- 3.13.1 Total cost of ownership (TCO) framework

- 3.13.2 ROI calculation methodologies

- 3.13.3 Digital transformation maturity model

- 3.14 Technology integration & platform interoperability standards

- 3.14.1 Data exchange standards & protocols

- 3.14.2 API & integration frameworks

- 3.14.3 Cloud platform integration

- 3.14.4 Enterprise system integration

- 3.14.5 Interoperability challenges & solutions

- 3.15 Emerging use cases

- 3.15.1 Predictive maintenance for flying vehicles

- 3.15.2 Autonomous vehicle fleet management

- 3.15.3 Shared mobility & micromobility

- 3.15.4 Last-mile delivery robots

- 3.16 Regulatory evolution

- 3.16.1 NHTSA AV step program impact

- 3.16.2 Global harmonization of standards

- 3.16.3 Cybersecurity regulation tightening

- 3.16.4 Data sovereignty requirements

- 3.17 Business model innovation

- 3.17.1 Predictive maintenance-as-a-service

- 3.17.2 Pay-per-use & outcome-based pricing

- 3.17.3 Data monetization strategies

- 3.17.4 Ecosystem platform models

- 3.18 Investment hotspots

- 3.18.1 Ev battery health monitoring

- 3.18.2 Autonomous vehicle sensor diagnostics

- 3.18.3 Off-highway & construction equipment

- 3.18.4 Emerging markets infrastructure

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 IoT & telematics

- 6.3 Artificial intelligence (AI)

- 6.4 Machine learning (ML)

- 6.5 Edge computing

- 6.6 Cloud computing

- 6.7 Big data analytics

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Hardware

- 7.3 Software

- 7.4 Services

Chapter 8 Market Estimates & Forecast, By Maintenance, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Condition-based maintenance

- 8.3 Predictive diagnostics

- 8.4 Remote monitoring

- 8.5 Real-time fault detection

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Deployment mode, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 On-Premise

- 10.3 Cloud-Based

- 10.4 Hybrid

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 OEMs & Tier-1 Suppliers

- 12.1.1 BMW

- 12.1.2 Bosch

- 12.1.3 Continental

- 12.1.4 Mercedes-Benz

- 12.1.5 Volkswagen

- 12.1.6 Volvo

- 12.1.7 ZF Friedrichshafen

- 12.2 Telematics & Technology Leaders

- 12.2.1 Geotab

- 12.2.2 IBM

- 12.2.3 Microsoft

- 12.2.4 PTC

- 12.2.5 Samsara

- 12.2.6 Siemens

- 12.2.7 Solera

- 12.2.8 Thermo King

- 12.2.9 Trimble

- 12.2.10 Verizon Connect

- 12.3 Regional Players

- 12.3.1 Amerit Fleet Solutions

- 12.3.2 Bendix Commercial Vehicle Systems

- 12.3.3 Fleetworthy Solutions

- 12.3.4 PrePass Safety Alliance

- 12.4 Emerging Players

- 12.4.1 Adesso

- 12.4.2 CDK Global

- 12.4.3 Simply Fleet