|

市場調查報告書

商品編碼

1892666

固態電池電解液市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Solid State Battery Electrolyte Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

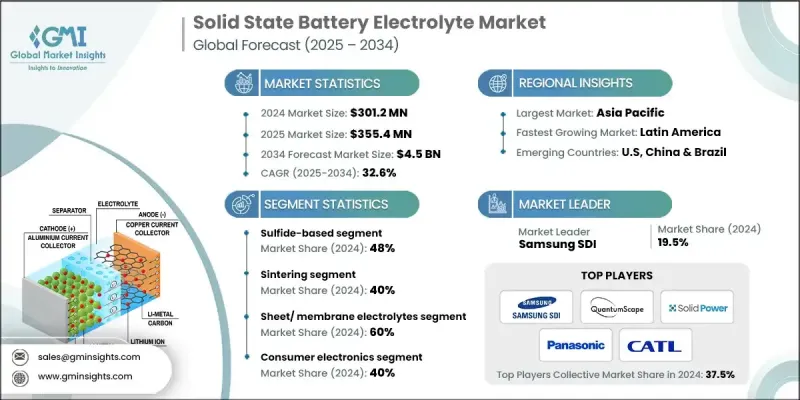

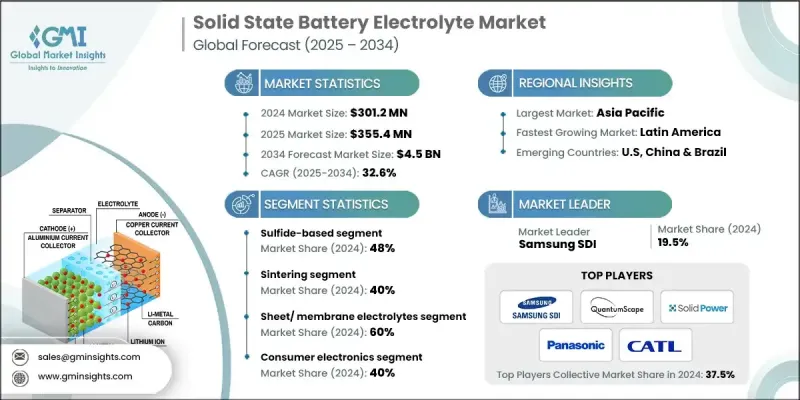

2024 年全球固態電池電解液市值為 3.012 億美元,預計到 2034 年將以 32.6% 的複合年成長率成長至 45 億美元。

預計亞太地區將實現最快成長,其中中國在硫化物和聚合物電解質領域的投資處於領先地位,北美和歐洲緊隨其後。拉丁美洲和中東及非洲地區也展現出強勁潛力,這得益於豐富的鋰資源、電動車的日益普及以及國內可再生能源計劃的推進,這些因素將推動新增產能。技術進步、大規模電池製造以及監管支援正在加速固態電解質在全球的應用。計算篩選和機器學習正被用來發現具有高離子電導率和增強電化學穩定性的材料。界面工程、晶界最佳化以及鋰金屬負極的保護塗層等創新技術正在提升安全性、循環壽命和能量密度,使其在電動車、消費性電子產品和儲能系統等領域得到更廣泛的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.012億美元 |

| 預測值 | 45億美元 |

| 複合年成長率 | 32.6% |

2024年,氧化物電解質市場規模達8,430萬美元。這些材料具有優異的機械強度、電化學穩定性和與鋰金屬負極的兼容性,使其成為汽車和消費性電子產品的理想選擇。然而,其較高的燒結溫度和固有的脆性使其製造過程較為複雜。

由於薄膜電解質具有輕質結構、高體積能量密度和均勻的離子傳輸等優點,預計到2024年,其市場規模將達到6,020萬美元。這些薄膜通常採用物理氣相沉積(PVD)或原子層沉積(ALD)技術製備,以獲得無缺陷的均勻薄膜,但規模化生產成本高且極具挑戰性。

預計2024年,北美固態電池電解液市場將佔30%的佔有率。該地區的成長得益於電動車普及率的提高、儲能需求的增加以及消費性電子產品應用的普及。美國市場受惠於政府支持的專案和資金支持,以及QuantumScape、Solid Power和Factorial Energy等公司的投資。加拿大則透過與公共研究機構和大學合作建立原型規模的生產設施,為市場發展做出貢獻。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 全球汽車原始設備製造商正在加速採用固態電池

- 不可燃固態電解質可提高安全性並降低熱風險

- 鋰金屬負極可實現更高的能量密度和更長的電動車續航里程。

- 產業陷阱與挑戰

- 固-固界面電阻限制了功率密度和循環性能

- 從實驗室到GWh量產的製造規模化仍然十分複雜。

- 市場機遇

- 儲能系統需求成長推動了固定式固態應用的發展。

- 消費性電子產品的微型化創造了高價值、緊湊型電池應用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)

(註:貿易統計僅針對重點國家提供)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依材料類型分類,2021-2034年

- 氧化物基固體電解質

- 石榴石型(LLZO)

- NASICON 型(LATP、LAGP)

- 鈣鈦礦型(LLTO)

- LiPON(磷氧氮化鋰)

- 硫化物基固態電解質

- 銀硫鐵礦族 (Li6PS5X)

- LGPS系列(Li10GeP2S12及其衍生產品)

- 硫代-LISICON(Li3PS4、Li4-xGe1-xPxS4)

- 聚合物基固態電解質

- 聚環氧乙烷(PEO)

- PC(聚碳酸酯)和 PAN(聚丙烯腈)

- 複合聚合物電解質(CPEs)

- 混合電解質(聚合物+無機物)

- 鹵化物基固體電解質

- 氯化物基(Li3YCl6、Li3InCl6、Li2ZrCl6)

- 溴化物基(Li3YBr6)

- 混合鹵化物體系(Li3Y(Br3Cl3))

第6章:市場估算與預測:依製造流程分類,2021-2034年

- 物理氣相沉積(PVD)和原子層沉積(ALD)

- 膠帶成型和網版印刷

- 燒結和熱壓

- 傳統燒結

- 熱壓

- 放電等離子燒結(SPS)

- 冷燒結

- 溶液澆鑄和聚合物加工

第7章:市場估計與預測:依外型尺寸分類,2021-2034年

- 薄膜電解質(<10 μm)

- 片狀/膜狀電解質(10-100 μm)

- 塊狀/顆粒狀電解質(>100 μm)

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 電動車

- 消費性電子產品

- 儲能系統

- 醫療器材

- 航太與國防

第9章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Ampcera Inc.

- Blue Solutions SAS

- Contemporary Amperex Technology Co., Limited (CATL)

- Idemitsu Kosan Co., Ltd.

- Ionic Materials Inc.

- Murata Manufacturing Co., Ltd.

- Panasonic Holdings Corporation

- QuantumScape Corporation

- SAMSUNG SDI

- Solid Power Inc.

The Global Solid State Battery Electrolyte Market was valued at USD 301.2 million in 2024 and is estimated to grow at a CAGR of 32.6% to reach USD 4.5 billion by 2034.

The Asia-Pacific region is expected to see the fastest growth, with China leading investments in sulfide and polymer electrolytes, followed by notable activity in North America and Europe. Latin America and the Middle East & Africa also show strong potential due to abundant lithium resources, rising electric vehicle adoption, and domestic renewable energy initiatives, which will drive new production capacity. Technological advancements, large-scale battery manufacturing, and regulatory support are accelerating the adoption of solid-state electrolytes worldwide. Computational screening and machine learning are being leveraged to discover materials with high ionic conductivity and enhanced electrochemical stability. Innovations such as interface engineering, grain boundary optimization, and protective coatings for lithium metal anodes are improving safety, cycle life, and energy density, enabling broader applications in electric vehicles, consumer electronics, and energy storage systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $301.2 Million |

| Forecast Value | $4.5 Billion |

| CAGR | 32.6% |

In 2024, the oxide electrolytes segment accounted for USD 84.3 million. These materials offer exceptional mechanical strength, electrochemical stability, and compatibility with lithium metal anodes, making them ideal for automotive and consumer electronics applications. However, high sintering temperatures and inherent brittleness make their manufacturing complex.

The thin-film electrolytes segment was valued at USD 60.2 million in 2024 owing to their lightweight structure, high volumetric energy density, and uniform ion transport. These films are produced through physical vapor deposition (PVD) or atomic layer deposition (ALD) to achieve defect-free, homogeneous layers, though scaling production is costly and challenging.

North America Solid State Battery Electrolyte Market accounted for a 30% share in 2024. Growth in the region is supported by rising electric vehicle adoption, energy storage demand, and consumer electronics applications. The U.S. market benefits from government-backed programs and funding initiatives, alongside investments from companies such as QuantumScape, Solid Power, and Factorial Energy. Canada contributes through collaborative prototype-scale production facilities involving public research institutions and universities.

Key players in the Global Solid State Battery Electrolyte Market include CATL (Contemporary Amperex Technology Co., Limited), Panasonic Holdings Corporation, QuantumScape Corporation, Solid Power Inc., SAMSUNG SDI, Ampcera Inc., Blue Solutions SAS, Idemitsu Kosan Co., Ltd., Ionic Materials Inc., and Murata Manufacturing Co., Ltd. Companies in the Solid State Battery Electrolyte Market strengthen their presence through strategic R&D investments to enhance ionic conductivity, electrochemical stability, and compatibility with lithium metal anodes. They are forming partnerships with automakers, consumer electronics manufacturers, and energy storage providers to accelerate adoption. Additionally, firms focus on scaling production capabilities, pilot programs, and supply chain optimization while leveraging government incentives and funding initiatives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Manufacturing Process

- 2.2.4 Form Factor

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Automotive OEMs accelerating adoption of solid-state batteries globally

- 3.2.1.2 Non-flammable solid electrolytes enhance safety and reduce thermal risks

- 3.2.1.3 Lithium metal anodes enable higher energy density and extended EV range

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Solid-solid interface resistance limits power density and cycling performance

- 3.2.2.2 Manufacturing scale-up from lab to GWh production remains complex

- 3.2.3 Market opportunities

- 3.2.3.1 Energy storage systems demand growth drives stationary solid-state applications

- 3.2.3.2 Consumer electronics miniaturization creates high-value, compact battery applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oxide-Based Solid Electrolytes

- 5.2.1 Garnet-type (LLZO)

- 5.2.2 NASICON-type (LATP, LAGP)

- 5.2.3 Perovskite-type (LLTO)

- 5.2.4 LiPON (Lithium Phosphorus Oxynitride)

- 5.3 Sulfide-Based Solid Electrolytes

- 5.3.1 Argyrodite Family (Li6PS5X)

- 5.3.2 LGPS Family (Li10GeP2S12 & Derivatives)

- 5.3.3 Thio-LISICON (Li3PS4, Li4-xGe1-xPxS4)

- 5.4 Polymer-Based Solid Electrolytes

- 5.4.1 PEO (Polyethylene Oxide)

- 5.4.2 PC (Polycarbonate) & PAN (Polyacrylonitrile)

- 5.4.3 Composite Polymer Electrolytes (CPEs)

- 5.4.4 Hybrid Electrolytes (Polymer + Inorganic)

- 5.5 Halide-Based Solid Electrolytes

- 5.5.1 Chloride-based (Li3YCl6, Li3InCl6, Li2ZrCl6)

- 5.5.2 Bromide-based (Li3YBr6)

- 5.5.3 Mixed Halide Systems (Li3Y(Br3Cl3))

Chapter 6 Market Estimates and Forecast, By Manufacturing Process, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Physical Vapor Deposition (PVD) & Atomic Layer Deposition (ALD)

- 6.3 Tape casting & screen printing

- 6.4 Sintering & hot pressing

- 6.4.1 Conventional sintering

- 6.4.2 Hot pressing

- 6.4.3 Spark Plasma Sintering (SPS)

- 6.4.4 Cold sintering

- 6.5 Solution casting & polymer processing

Chapter 7 Market Estimates and Forecast, By Form Factor, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Thin-film electrolytes (<10 μm)

- 7.3 Sheet/membrane electrolytes (10-100 μm)

- 7.4 Bulk/pellet electrolytes (>100 μm)

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electric vehicles

- 8.3 Consumer electronics

- 8.4 Energy storage systems

- 8.5 Medical devices

- 8.6 Aerospace & defense

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Ampcera Inc.

- 10.2 Blue Solutions SAS

- 10.3 Contemporary Amperex Technology Co., Limited (CATL)

- 10.4 Idemitsu Kosan Co., Ltd.

- 10.5 Ionic Materials Inc.

- 10.6 Murata Manufacturing Co., Ltd.

- 10.7 Panasonic Holdings Corporation

- 10.8 QuantumScape Corporation

- 10.9 SAMSUNG SDI

- 10.10 Solid Power Inc.